Budget 2018 was one of give and take – but it was more take than give, especially for the common man. This article talks about Income Tax for FY 2018-19 or AY 2019-20.

Table of Contents

Overview of Income Tax For FY 2018-19 or AY 2019-20

On Mar 14 2018, the Lok Sabha passed The Budget without any debate the Finance Bill 2018. The two bills(Finance Bill 2018 and the Appropriation Bill to approve spending for the next financial year ) were sent to the Rajya Sabha, but because they are money bills, they would be considered passed if the upper house does not return them within 14 days.

These changes are going to bring little cheer to salaried individuals earning less than 10 lakh in a year, but for people earning a salary of more than 10 lakh annually, it is going to increase their tax outgo. For those with salary

- between 10 lakhs to 50 lakhs, Tax is raised from 1,17,000 to 1,15,875 so more tax of 1,125.

- between 50 lakhs to 1 crore, Tax is raised from 14,87,063 to 5,01,500 so more tax of 14,437.

- between 1 crore to 2 crore, Tax is raised from 33,31,406 to 33,63,750 so more tax of 29,644.

- At 2 crore , Tax is raised from 68,84,906 to 69,51,750 so more tax of 66,844.

If taxpayers – individual or corporate – forget to file their income tax returns by the due date, they will not be allowed to claim tax breaks on investments, children’s school fees and medical insurance premiums under the grab-all Section 80. So you will no longer be eligible for tax breaks under sections 80C, 80D (mediclaim), 80TTA (savings bank interest), 80G which covers donations, etc if you miss the filing deadline. All these come under Chapter VI of the Income Tax Act. The proposal says

“It is proposed to substitute the said section so as to provide that in computing the total income of an assessee of the previous year relevant to the assessment year commencing on or after the 1st day of April, 2018, deduction under any other provisions of Chapter VIA under the heading “C. – Deductions in respect of certain incomes” shall be allowed only if the return is filed within the due date specified under sub-section (1) of section 139. This amendment will take effect from 1st April 2018, and will, accordingly, apply in relation to the FY 2018-19 or assessment year 2019-2020 and subsequent years.

No change in income tax slabs for individuals. The slabs are given later in the article

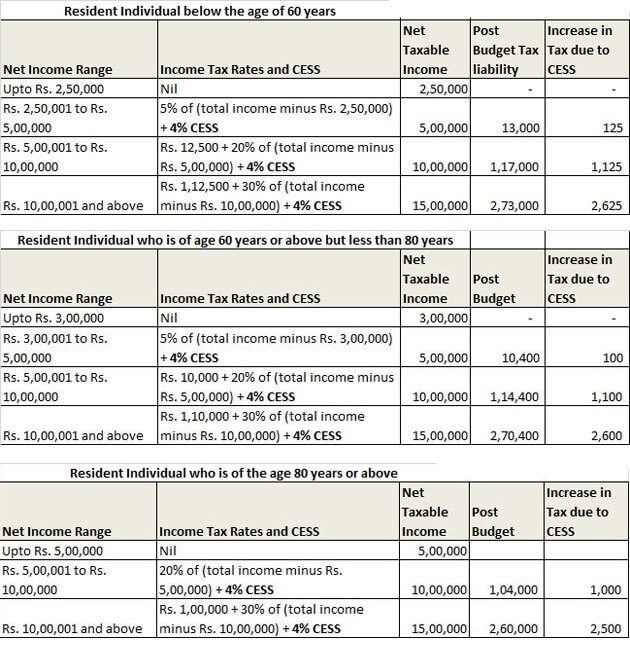

Cess on income tax hiked to 4%

The existing 3% education cess will be replaced by a 4% Health and Education Cess to be levied on the tax payable.This will enable us to collect an estimated additional amount of Rs 11,000 crore. Budget 2018 has proposed to hike the cess on income tax from 3% to 4% thereby increasing the tax payable by all categories of taxpayers. Due to this change,

- the tax liability for highest tax bracket (assuming Rs 15 lakh income) goes up by Rs 2,625.

- For middle-income taxpayers (between Rs 5 lakh and Rs 10 lakh) the tax liability increases by Rs 1,125 and

- for lowest tax brackets (Rs 2.5 lakhs to Rs 5 lakhs) by Rs 125.

Read Our article Tax: What are Cess and Surcharge? to learn more about how many Cess you pay and how it is used. For example, you pay Education Cess, Swatch Bharat Cess, Krishi Kalyan Cess.

Standard deduction reintroduced

Budget 2018 has provided a standard deduction of Rs 40,000 from salary income to employees. The standard deduction is essentially a flat amount subtracted from the salary income before calculation of taxable income. The standard deduction was a part of the Income-tax Act until former finance minister, P. Chidambaram, withdrew it in the Union budget of 2005-06.

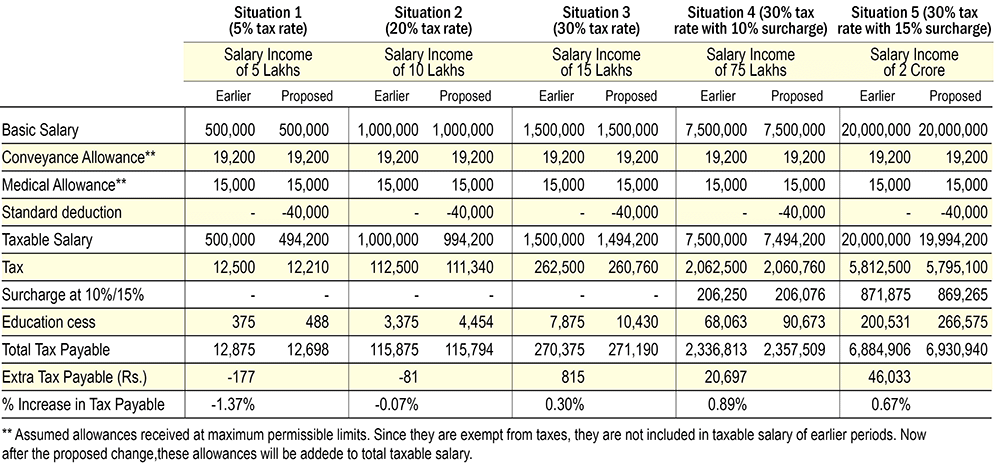

Budget 2018 provide a standard deduction of Rs 40,000 from salary income to employees, it also proposes to take away existing annual transport allowance of Rs 19,200 and Rs 15,000 medical reimbursement. Prima facie income exempted from tax after setting off the gain and loss is Rs 5,800 only. The tax saved for each employee on this income would depend on the tax slab that income falls into. Consequently, individuals with income above Rs 5 lakh would end up shelling out more tax after taking into account the standard deduction, the removal of the allowances and the increase in cess. The Table below shows the effect of Removal of Medical Reimbursement and Transport Allowance, the addition of Standard deduction and application of cess.

Women joining the workforce for the first time will have to contribute only 8% instead of 12% or 10% as the case may be, for the first three years. The proposed move will enhance their take-home pay. Further, for new employees coming under the ambit of EPFO would be provided 12 percent contribution from the government.

Government to roll out I-T e-assessment, cut person-to-person contact

The government has proposed to amend the Income-Tax Act to reduce interface between the I-T department and taxpayers by widening the scope of e-assessment for greater efficiency and transparency.

The government had introduced e-assessment in 2016 on a pilot basis and extended it to 102 cities in 2017 with the aim to cut down the interface between the I-T department and the taxpayers.

Table below shows Income Tax changes for FY 2018-19 due to Standard Deduction, Medical Reimbursement, Cess

Investments in Stocks, Mutual Funds and Budget 2018

The FM in his Budget 2018 speech proposed to re-introduce long-term capital gains (LTCG) tax on gains arising from the transfer of listed equity shares exceeding Rs 1 Lakh at 10 percent, without allowing any indexation benefit. However, all gains up to January 31, 2018 will be exempt.

Currently, long-term capital gains from the sale of equity shares and equity-oriented mutual funds on which securities transaction tax (STT) has been charged on sell transactions are completely exempt from tax. This means that any gains from sale of equity shares or mutual funds held for more than a year are not subject to any kind of tax whatsoever.

Let’s say you held a stock since 10 April 2015 till now with a purchase price of Rs. 100.

Let’s say it was at Rs. 500 as on Jan 31, 2018.

You sell it on April 1, 2018 at Rs. 600.

It’s long-term held, since you have owned it for over 3 years.

Your capital gains are Rs. 100. Why

The purchase price is the HIGHER of

a) your purchase price, or

b) the price on Jan 31, 2018.

In this case, it’s the higher of 100 and 500, which is 500. So the gain is sale minus purchase = 600 minus 500 which is 100.

Read our article Budget:2018 Long Term Capital Gain on Stocks & Equity Mutual Funds with Calculator for how Long Term Capital Gain on Stock will work now, What is Grandfathering? Play with the calculator.

Dividend distribution tax is levied on equity-oriented mutual funds at the rate of 10% percent, to provide a level field across growth oriented and dividend distributing schemes. This reduces the investor’s in-hand return.

Hence, the growth option could be more suitable and to meet regular income needs, the Systematic Withdrawal Plan (SWP) option may have to be used by investors.

Senior Citizen and Budget 2018

Section 80D, Medical Insurance, limit hiked to Rs 50,000 for senior citizens

The limit of deduction under section 80D, medical insurance, for senior citizens has been hiked from Rs 30,000 to Rs 50,000.

Exemption of interest income on deposits for senior citizens

It has been proposed to hike the exemption on the interest income on bank and post office deposits for senior citizens from Rs. 10,000 to Rs. 50,000. This is for all FDs and RDs.

Hike PMVVY limit to Rs 15 lakh

More good news for senior citizens. The FM has proposed to increase the investment limit the pension scheme, Pradhanmantri Vaya Vandana Yojana (PMVVY), to Rs 15 lakh from the present Rs 7.5 lakh.

Income Tax Slabs for FY 2018-19 AY 2019-20

Income Tax Slab and the effect of the increase in cess is shown in the table below.

I had Invested Rs 25000/- in Tata Capital Financial Services NCD on 06.03.2014 under cumulative option. Every financial year I gets interest certificate for the accrued interest about Rs. 3565/-. This interest I am not getting in my bank account but it is accumulated in my Tata NCD account as I have opted for cumulative option. This Rs 3565/- I had showed as an Income in my Income tax return in each last four financial year till date. Now this NCD is matured an I got Rs. 41175/- on 05.03.2019. My initial investment was Rs 25000/- and received Rs 41175/-. Thus from 06.03.2014 to 05.03.2019 for five years I got interest of Rs 16175/-. (41175 – 25000 = 16175) During previous four years I have showed interest income Rs. 3565/- every year in my income tax return. Thus 3565 X 4 = 14260 Total interest I got is 16175 Therefore 16175 – 14260 = 1915. What I understand is that I have to show interest income of Rs 1915 in this financial year 2018-19 income tax return. Is am I right ? Then which interest income I have to show in my this year income tax return for F.Y.2018-19 (A.Y.2019-20) Please advise. I am very much confused. Being a technocrat, account is not my cup of tea, so I request you to please respond.

Read more at: https://www.caclubindia.com/experts/tax-2731384.asp

“In the above page you have written in red ink This will apply from 1st april 2018 ie in the assessment year 2018 -2019

What i feel is that it should be either FY 2018-19 or assessment year 2019-20

I think this is a mistake & needs correction

Your site is very good & informative I like it

Thanks for the observation and encouraging words.

Corrected the mistake.

If you have any feedback on how to make the site better or kind of articles we can write please do share.

sir , I do have a NRO account deposited Rs 400,000 in FD NRO account made a deposit on 30/01/2017 to 30/01/2018 ,renewed again for one more year.

My bank statement is confusing can you please clarify me.

29 jan 2018 credit int -28,322/- on this amount TDS 8,497/- cess deduction 255/- this is fine.

But again on 31 March 2018 i see credit of 1373/-

and Tax deduction of Rs1333/- and cess deduction of Rs40/- i mean total amount which was credited was debited can you explain me why same amount was debited .

Thanks and regards.

Please clarify the following:

1) Under what head of income I should declare the annuity received from the superannuation fund (contribution made by my employer) which is maintained by LIC?

2) In case it is treated as Salary, whose name I should mentioned against the Employer details?

3) Under what head I should declare the pension I receive under Employees Pension Scheme 1995 which is paid by the Employees Provident Fund Organisation?

4) Same clarification as point No. 2 above

5) Under what head I should declare the annuity received from LIC in respect of my Jeevan Suraksha policy which was covered under 80CC earlier?

6) Under what head of Income I should declare the amount received from LIC against my investment in Varishth Pension Beema Yojana

Your guidance would be helpful to not only me but to all who have similar situations in their income tax return.

Regards

A.S.Ganesan

@TeamBemoneyaware.com

Dear team,

In the initial part of the above article, you have mentioned that taxpayers would not be allowed to claim various deductions such as eligible investments u/s 80C, mediclaim u/s 80D, savings account interest u/s 80TTA and donations u/s 80G, in case the IT return is filed late i.e. after due date referred to in section 139(1).

In this regard, I would humbly like to clarify that the amendment seeks to limit the dis-allowability to only those deductions as are covered under Chapter VI-A under the heading “C.—Deductions in respect of certain incomes” and not other headings of Chapter VI-A of the Income Tax Act, 1961 like

‘A-General’,

‘B-Deductions in respect of certain payments’, (wherein major deductions including 80C, 80CCC, 80CCB, 80D, 80DD/B, 80E, etc are covered)

‘CA.-Deductions in respect of other incomes’ (wherein savings account interest u/s 80TTA is covered).

Heading “C.—Deductions in respect of certain incomes” of Chapter VI-A normally covers various profit linked deductions and provisions relating to tax holidays such as section 80IA, 80IAB, 80IAC, 80IBA, 80JJAA, 80QQB and host of other sections generally relating to profit or income linked deductions.

What the amendment has exactly done is that it has merely expanded the scope of not allowing deductions within the same heading of Chapter VI-A [ i.e. earlier deduction u/s 80-IA, 80-IAB, 80-IB, 80-IC, 80-ID & 80-IE -deductions under these 6 sections were not allowed which has now been extended to all the section covered under heading “C.—Deductions in respect of certain incomes” under chapter VI-A

Thus, in my view, taxpayers filing late return will only suffer non-allowability of profit linked deductions like 80IA, 80IB, 80IAB, 80IBA, etc covered under heading ‘C- Deductions in respect of certain incomes’ whereas allowability of deductions covered under heading ‘B-Deductions in respect of certain payments’ ( like 80C, 80CCC, 80CCB, 80D, 80DD/B, 80E, etc) of Chapter VI-A will not be impacted.

Nice job

Good info

This “Table below shows Income Tax changes for FY 2018-19 due to Standard Deduction, Medical Reimbursement, Cess” is excellent. Thanks for sharing it.

Thanks a lot Sir.

It is a pleasure and very encouraging to get such comments.

The dividend of shares in the hands of the investors will be tax free as earlier. (The dividend distribution tax was being paid by the companies u/s 115O before disbursement of dividends to the shareholders). I think it is tax free as earlier?

Dividend income, from equity shares of an Indian company, is exempt from tax in India.

Investors who bank on dividends from equity mutual funds to generate periodic income would be hit by the new budget proposal to tax dividends on equity mutual funds schemes

If you have invested in a mutual fund scheme under the dividend option, you don’t have to pay any tax on dividends as they are exempt from income tax in the hands of the investor in both equity and a debt schemes.

However, from now, mutual fund houses will have to pay a Dividend Distribution Tax of 10 per cent on dividends declared under equity schemes. As said earlier, they already pay a DDT of 28.84 per cent on dividends declared under debt schemes.

Sure, DDT is paid by the mutual funds and not by investors. However, investors would be impacted as the company pays the tax out of the declared profits and it will debt the dividends to that extent.