In our earlier article Income Tax for Beginner we discussed what is income tax, different kinds of income, tax slabs, how is tax calculation done, what is salary income, how tax is deducted from salary every month,how one can reduce the tax . This is second part of Income tax for beginners. In this we shall talk about Form 16, verifying TDS, Form 26AS and filing income tax returns, documents required, what happens after filing the returns.

Table of Contents

Overview of Salary Income and TDS

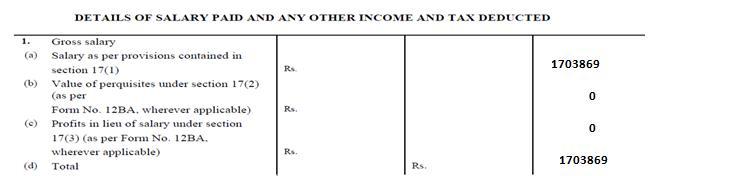

Whatever is received by an employee from an employer in cash, kind or as a facility (perquisite) is considered as Salary. Our article Salary, Net Salary, Gross Salary, Cost to Company: What is the difference explains it in detail. The salary consists of

- Basic Salary,

- Allowance such as Dearness Allowance(DA), House Rent Allowance (HRA) etc. Allowance can be fully taxable, partly or non-taxable.

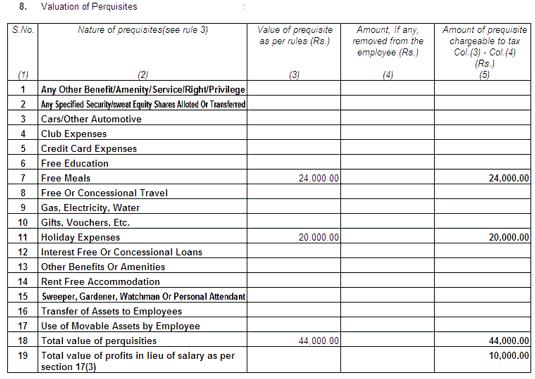

- Perquisite: Is any benefit or amenity granted or provided free of cost or at a concessional rate such as Rent free unfurnished house, Motor car facility, Interest Subsidy on Loan, Reimbursement of medical bills, Benefits derived by employee stock option, and so on.

Income earned by doing a job with employer-employee option comes under the category of Income From Salary. As mentioned earlier income tax is taxed based on the total income earned. Paying tax at end of the year in one shot is difficult. So as per Income tax law some tax is deducted by the employer from the salary every month(if income is taxable i.e above 2 lakhs for FY 2012-13 AY 2013014), called as Tax deducted at source or TDS. TDS can be adjusted against tax due. To save tax employer asks for employee’s tax saving investments in beginning of financial year (Apr) and proof by mid-February. EPF, if deducted by the employer, is also part of tax saving options.

What is proof of deduction of TDS from Salary?

For income from Salary employer gives Form 16, and Form 12BA to the employee after the financial year (usually by mid-May) . These are used by the employee as a reference as well as proof while filing Income Tax Returns. The Form furnishes various details such as Salary Income components of the Employee, Tax Deducted at Source (TDS) by the Employer, and Tax paid by the Employer to the Income Tax Department. Our article Understanding Form 16: Part I, Understanding Form 16: Chapter VI-A Deductions, Understanding Form 16: Tax on income, covers it in detail.

Form 12BA is a statement showing particulars of perquisites, other fringe benefits or amenities and profits in lieu of salary with value thereof. Our article Understanding Form 12BA covers it in detail.

Even if no taxes have been deducted from salary, is there any need for my employer to issue Form-16 to me?

Form-16 is a certificate of TDS and in your case, it will not apply. However, your employer must issue a salary statement or pay-slip.

If I worked with different employers during the financial year?

If you have worked with different employers during the financial year (from 1 Apr to 31 Mar ) then each of them is required to deduct tax and issue Form 16 and Form 12BA.

Most employers would be computing employees’ tax liability after taking into consideration the basic exemption limit ( in the financial year 2018-2019 or assessment year 2019-2020 it is Rs 2.5 lakh) and also the exemption availed under Section 80C. So there is a possibility that your previous employer and the present employer may give you these exemptions for the same financial year. It is possible that none of them deducts any tax from salary. But if the amounts are clubbed your income exceeds the minimum exemption limit. Then you would have to pay self-assessment tax.

Making a job switch in the middle of the year involves making sure that the deductions and exemptions regarding tax liability are made only once. When a new employee joins the company, he is required to give the particulars of income from his earlier employment by filling Form 12B. It is different from Form 12BA issued by employer for showing perquisites. Our article Changing Jobs:Take Care Of Bank Account,Tax Liability covers it in detail.

TDS and Form 26AS

How can I verify TDS deducted?

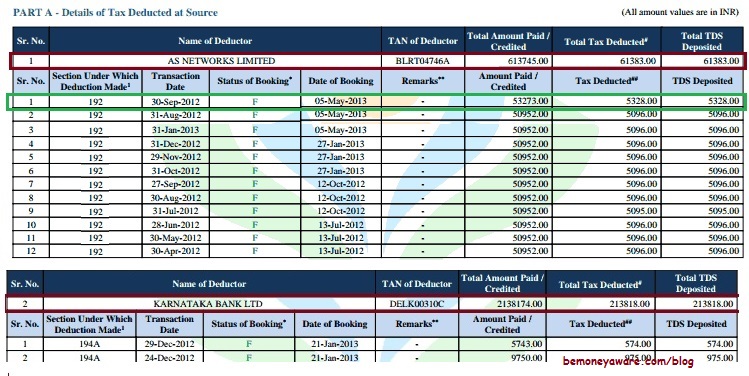

If you have a PAN card(which you should) then you can verify that TDS is deducted from your salary and paid to the government by checking Form 26AS. Income Tax Department facilitates a PAN holder to view its Tax Credit Statement (Form 26AS) online. Form 26AS contains

- Details of tax deducted on behalf of the taxpayer by deductors, Part A & A1 of Form 26AS.

- Details of tax collected on behalf of the taxpayer by collectors. Part B of Form 26AS

- Advance tax/self-assessment tax/regular assessment tax, etc. deposited by the taxpayers (PAN holders), Part C of Form 26AS

- Details of the paid refund received during the financial year, Part D of Form 26AS

- Details of the High-value Transactions in respect of shares, mutual fund etc. Also called as Details of AIR((Annual Information Return) transactions, Part E of Form 26AS.

The Tax Credit Statement (Form 26AS) are generated wherein valid PAN has been reported in the TDS statements. It is a form issued under Rule 31AB.

- From FY 2005-06(AY 2006-07) to 31st Oct 2012 one can view the Form through TIN-NSDL website.

- From FY 2008-2009 (AY 2009-10) one can also view the Form through TRACES website

How can I view Form 26AS?

Various ways in which you can view Form 26AS are as follows:

- View Tax Credit from incometaxindiaefiling.gov.in

- Taxpayers who are registered at the portal incometaxindiaefiling.gov.in for e-filing of income tax returns can view 26AS by clicking on ‘View Tax Credit Statement (From 26AS)’ in “My Account”. The facility is available free of cost. Earlier it used to TIN-NSDL website, now it takes to TRACES.

- View Tax Credit (Form 26AS) through banks using net banking facility

- The facility is available to a PAN holder having a net banking account with any of authorized banks. View of Tax Credit Statement (Form 26AS) is available only if the PAN is mapped to that particular account. The facility is available for free of cost.

- Banks Site showing tax credit through TRACES (Earlier it was taking to TIN-NSDL site) ex State Bank of India, HDFC Bank Limited

- Through TRACES website after registration. New registrations can be done at TRACES site.

Check Form 26AS and verify that TDS deducted has been attributed to you. If not please get it rectified by following your Finance department/Deductor as Income Tax Department validates your TDS, tax due etc based on information in Form 26AS.

Any other tax that I need to pay or account for other than TDS on salary?

Other than Taxes deducted at source (TDS) on your salary income you may need to pay Advance Tax and Self Assessment Tax.

Advance tax is the income tax that is payable if your tax due after deducting TDS exceeds Rs 10,000 and should be paid in the same year in which income is received. Below are the dates and percentages of when the advance tax is to be paid. If advance tax is due to you and you don’t pay it’s okay. You need to pay interest(under section 234A, 234B, 234C) while filing returns Our article Advance Tax:Details-What, How, Why covers it in detail.

From FY 2016-17 For both individual and corporate taxpayers, the dates for Advance Tax are

| Due Date | Advance Tax Payable |

|---|---|

| On or before 15th June | 15% of advance tax |

| On or before 15th September | 45% of advance tax |

| On or before 15th December | 75% of advance tax |

| On or before 15th March | 100% of advance tax |

Note: If you are a beginner, salaried employee (with few investments) then you might not be liable to pay advance tax.

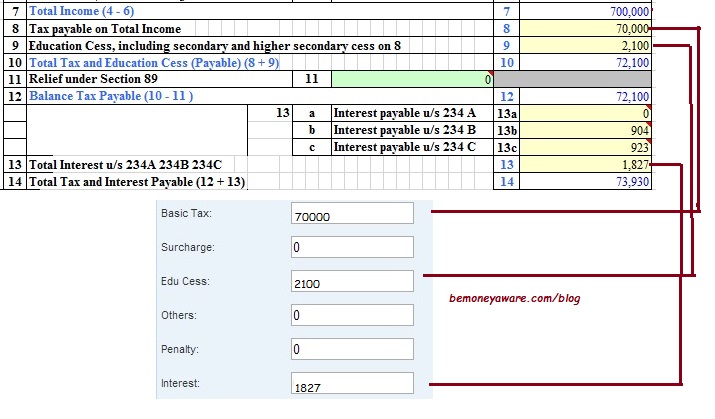

If at the time of filing of return you find that you have some balance tax to be paid after taking into account your advance tax, TDS & TCS, the short fall of tax is to be deposited by you(before filling income tax return ) as Self Assessment Tax. Our article Paying Income Tax : Challan 280 explains how to pay advance Tax, Self Assessment tax in detail. Details of the Self Assessment Tax, Advance Tax in ITR as shown in the image below.

Show Self Assessment Tax in ITR

What if my tax saving investments are not accounted for in Form 16?

If you did not declare your tax saving options or did not submit proof within due time(usually by mid Feb) and still made some tax saving investments then you can still claim it while filing returns. Our article How to Claim Deductions Not Accounted by the Employer discusses it in detail.

Filing Income Tax Return

What is the Income Tax Return or return of income or ITR?

It is a prescribed form through which the particulars of income earned by a person in a financial year and taxes paid on such income is communicated to the Income tax department after the end of the Financial year, called as income tax return or ITR. It is like your report card in school but instead of marks you have income and taxes. It is the constitutional obligation of every person earning income to compute his income and pay taxes correctly. Different forms are prescribed for filing of returns for different Status and Nature of income. The form can be downloaded from the incometaxindia.gov.in webpage download-forms. Forms for Financial Year 2012-13 will be made available after 31 Mar 2013.

Why is return filing mandatory even though all my taxes and interests have been paid and there is no refund due to me?

Amounts paid as advance tax and withheld in the form of TDS or collected in the form of TCS will take the character of your tax due only on completion of self-assessment of your income. This self-assessment is intimated to the department by way of filing of return. Filing of return is critical for this process. Failure will attract levy of penalty. I-T Department to quiz PAN holders not filing returns tells how The department is sending letters to 35,170 PAN holders in the first phase asking why they have not filed returns.

What are the benefits of filing my return of income?

Filing of return is your constitutional duty and earns for you the dignity of consciously contributing to the development of the nation. This apart, your IT returns validate your credit worthiness before financial institutions and make it possible for you to access many financial benefits such as bank loan etc. As an assessee himself calculates the tax and income, pays tax if due files his return of income. This process of self-calculation of income and tax is therefore called Self-assessment

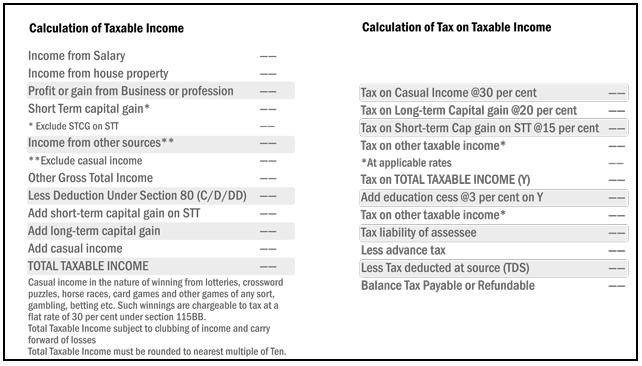

How to calculate my tax liability?

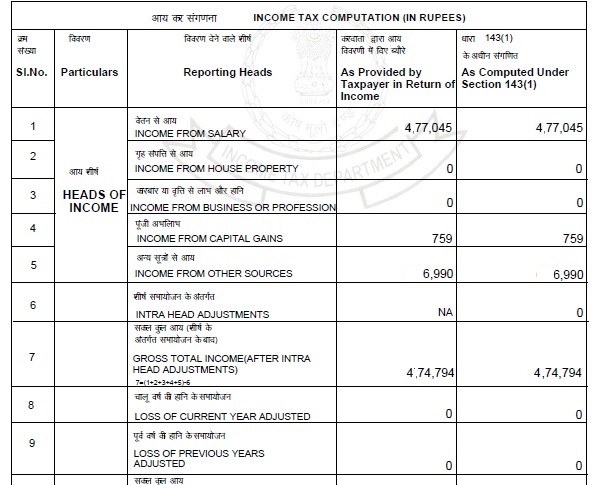

Income tax assessment comprises of following stages:

- Computation of total income.

- Deducting valid deductions.

- Determination of the tax payable thereon.

- Paying the tax (if any).

- Filling Income Tax Return Form.

Our article Income Tax overview covers it in detail.

Calculation of income tax

Example of income tax calculation

| Income from salary | Rs. 8,50,000 |

| Income from other sources | |

| Interest on Saving Bank Account | Rs 14,000 |

| Total Income (interest from saving bank account exempt up to 10,000) | 8,64,000 |

| Deductions: | |

| Under Section 80C : Employee Provident Fund | 94,000 |

| Total Taxable Income | 7,70,000 |

| Income Tax Calculations | |

| Tax on Income upto Rs 2,50,000 | 0 |

| Tax at 5% ( on income between Rs 2,50,001 to Rs 5,00,000) | 12,500 |

| Tax at 20% (on income exceeding Rs. 5,00,000 i.e 270000) | 54,000 |

| Total tax on income of Rs 7,70,000 | 66,500 |

| Education Cess @ 4% of Income Tax Payable | 2,660 |

| Total Tax liability | 69,160 |

| Less: TDS / Advance Tax deposited | 66,248 |

| Net Income Tax due | 2,912 |

How to pay Advance Tax or Self Assessment Tax?

To deposit Advance Tax, Self Assessment tax and Regular Assessment Tax an individual has to use challan ITNS-280. It can be paid both through the internet (online or e-payment) and at designated branches of banks empaneled with the Income Tax Department (offline). Our article Paying Income Tax : Challan 280 explains how to pay Advance Tax, Self Assessment tax in detail. Your tax liability should be Zero before you submit your ITR. So need to pay Self Assessment Tax before you file your income tax -return.

If I have paid excess tax how and when will it be refunded?

The excess tax can be claimed as refund by filing your income tax return. It will be refunded by crediting amount to your bank account. The department has been making efforts to settle refund claims within four months from the month of filing return.

How can I know which form is applicable to my income?

Different income tax return forms are made available by Income Tax Dept every year based on kind of income (remember there are five kinds of income, salary, income from house property etc). You should choose a return form according to your status(resident etc) and nature of income. For FY 2018-19 (AY 2019-20) one needed to fill one of the following forms:

- ITR1 For Individuals having Income from Salary/ Pension/ family pension & Interest

- ITR2 For Individuals and HUFs not having Income from Business or Profession

- ITR3 For Individuals/HUFs being partners in firms and not carrying out business or profession under any proprietorship

- ITR4 For individuals & HUFs having income from a proprietary business or profession

- ITR5 For firms, AOPs and BOIs

- ITR6 For Companies other than companies claiming exemption under section 11

- ITR7 For persons including companies required to furnish return under section 139(4A) or section 139(4B) or section 139(4C) or section 139(4D)

- ITR8 Return for Fringe Benefits

- ITR-V Where the data of the Return of Income/Fringe Benefits in Form ITR-1, ITR-2, ITR-3, ITR-4, ITR-5, ITR-6 & ITR-8 transmitted electronically without digital signature

Our article Filling ITR 1-Form explains the process in detail (For FY 2011-12 or AY 2012-13)

What documents are to be enclosed along with the return of income?

The new return forms are annexure less. Hence no documents need to be attached. That doesn’t mean you can hide your income etc. With the advancement in technology the income earned, tax deducted is easily traceable now through your PAN number.

Where and how am I supposed to file my return?

Computing and filing your I-T return has to be done online(offline in some cases). Our article Income Tax Overview covers the filing of returns in detail.

- You could either hire a Chartered accountant(CA) who will do the entire groundwork as well as compute your tax liability, or

- you can do it yourself: you would need to download the relevant ITR Form from www.incometaxindia.gov.in download-forms . Fill up the required details in the form, submit it online.

- For Offline you need to submit at the ward concerned at the income-tax office(Assessing Officer) and collect the acknowledgement. You can find the ward, assessing officer from the official income tax webpage incometaxindia.gov.in:Know your Assessing Officer as to your jurisdiction.

Online filing of ITR

You can use Indian Govt tax e filing website which is free or non-govt e-filing websites such as cleartax.com, taxspanner.com, taxshax.com, taxsmile.com and taxsum.com.

You can e-verify the return and return is done. Otherwise, you will have to print the acknowledgement, ITR V form and send it by post to the Central Processing Centre (CPC) Bangalore within 120 days of e-filing your return.

The facility of paper filing (offline) is now only available to those who are more than 80 years old and are filing ITR-1 or ITR-4, rest everyone must mandatorily file online For the Assessment year 2019-20.

What are the due dates for filing returns of income/loss?

The due dates for the individual is usually 31st July of the Assessment Year. For FY 2018-19 (AY 2019-20) the last date for filing return is 31st July 2019 (Companies & their Directors 3oth September, Other business entities, other than companies, if their accounts are auditable & their working partners 3oth September). You need not wait until the end of July. Once you get Form 16 (usually around min May) you can file the return.

If I fail to furnish my return within the due date of filing, will I be fined or penalized?

Yes. This may take the form of interest if the return is not filed before the end of the assessment year. If the return is not filed even after the end of the assessment year, the penalty may also be levied.

Can a return be filed after the due date?

If you have missed filing ITR on the due date(which is usually 31 Jul), you can file your ITR with penalty.

As per the new law, Late Filing Fees u/s 234F will be levied. The Late filing fee is a penalty of Rs 5,000will be levied if the return is filed after the due date but before December 31 of that year and Rs 10,000 post-December 31. However, if your income is not more than Rs 5 lakh, the maximum penalty levied will be Rs 1,000.

If there is some tax due then you would have to pay interest on the tax due under section 234A/234B/234C

Yes. It may be furnished at any time before the expiry of two years from the end of the financial year in which the income was earned. For example, in case of income earned during FY 2010-11, the belated return can be filed before 31st March 2013.

You now cannot file a return for FY 2017-18 or AY 2018-19 or for earlier years. You may receive a notice from the Income Tax Department with penalty charges for not filing ITR. Our article Missed Filing ITR: Check Tax Liability,File Condonation of Delay, explains it in detail.

If I have committed any mistake in my original return, am I permitted to file a corrected return?

Yes, provided the original return has been filed before the due date and provided the department has not completed assessment. However, it is expected that the mistake in the original return is of a genuine and bona fide nature.

Am I required to keep a copy of the return filed as proof and for how long?

Yes. Since legal proceedings under the income tax act can be initiated up to six years prior to the current financial year, you must maintain documents, Form 16, Form 12BA, bank statements, proof of tax saving investments at least for this period. Our article Paper Work A Necessary Headache talks about in detail.

ITR Verification and Income Tax Notice

Does my income tax return get verified?

Every system, right from the school requires assessment and verification. Legally one should return only that much income which one earns. But there are mal-practices such as showing less income so as to pay less tax or some people file ITR in name of their children or wife or other relatives. Processing of income tax returns is done by Central Processing Centre (CPC) and for cases which CPC cannot deal with by Assessing Officer. The Bangalore Centralized processing centre (CPC) was set up for bulk processing of income tax returns. It processes all electronic returns from the entire country. Infosys has been processing tax returns filed online by Indian citizens since 2009.

CPC has reduced the processing time of IT returns considerably. As against average processing time of more than 12 months in past, CPC succeeded to bring it down now less than a month(in some cases even a week)

Our article Income Tax Helpline numbers:CPC,TRACES,ASK talks about CPC in detail.

During the processing of Income Tax return, the return of income is checked on the face of it, verified that TDS claims match Form 26AS. If there is any short of tax individual will be notified and if there is any excess of tax paid he shall refund the same. and if everything is alright you will be intimated under section 143(1). Based on information available with the department a small percentage of returns are picked up for verification. This process is called scrutiny. Our article After filing Income Tax Return discusses it in detail.

Our article Income Tax Notice :Sections,What to check,How to reply discusses it various notices

Please also read TaxGuru Beginners Guide to Income Tax with FAQ.

Related articles:

- Income Tax for Beginner

- Income Tax Overview

- Understanding Form 16: Part I,

- Paying Income Tax : Challan 280

- Paper Work A Necessary Headache

This article is dedicated to our reader Subin and other readers and is based on questions asked by them and our replies.

If you are based in Bangalore and can arrange a group of 10 people bemoneyaware can do a session on income-tax, finance. Drop us an email at bemoneyaware@gmail.com

In this article we have talked about Form 16, verifying TDS, Form 26AS and filing income tax returns, documents required, what happens after filing the returns. If you have any doubts, questions, feedback please leave a comment so that other readers can also benefit.

What are the Tax free_ not 80 c_ investment avenues for safe investing , for senior citizens and also those below 60 yrs

Examples relate to past. Old periods. Why not talk of last and current years say 2015/16/17

Hey are using WordPress for your blog platform? I’m new to the blog world but I’m

trying to get started and create my own. Do you need any coding knowledge to make your

own blog? Any help would be greatly appreciated!

Little coding knowledge is benefiical as it helps to sort out issues.

It all depends on why you are blogging and for which platform you are using and is it your own domain or fee

Very helpful and easy to understand explanation on taxation!With the new Budget do you think the tax slabs would be relaxed for individuals (http://in.reuters.com/subjects/india-budget-2013).

Thanks.

He should but will he.

Thanks for the link!

Very detailed and informative post.

Thanks, we strive to provide lots of information

Thanks for a very informative series.

May I suggest to write an article dedicated to taxation and IT Return related aspects for Senior Citizens, who would obviously have income from interest, pensions(may or may not be, house rent or prpoerty related capital gains and of course captial gains and income from securities?

I being one such assesse, would personally appreciate a comprehensive pitcure and status on this subject.

Thanks Sir for your kind words.

A good idea sir , we would surely plan an article around it. Just give us some time to see what information we can gather and how to present it.

We would bug you for more feedback/questions!

In your income tax calculation examples in one e.g Ajay you say that savings bank deposit interest upto 10,000 is exempted but in others e.g Arti no exemption is spoken of, but total interest is added to total income for tax calculation. .why is this difference.

Good observation Durga.

From FY 2012-13 (AY 2013-14) interest from saving bank account is exempt upto 10,000 which is taken care of in the new article but the old article was fro FY 2011-12 (AY 2012-13) for which exemption was not available. Hence the difference. I shall be updating the old articles once the new ITRs are released!

Hope it is clear!