The income tax rules for FY 2019-2020 or AY 2020-21 was based on two budgets. All ITR forms for FY 2019-20 has now been issued by the income tax department. The last date for filing returns for ITR 2020-21 or FY 2021 is 10 Jan 2021. This article covers Income Tax rules for FY 2019-20 or AY 2020-21. You will know about new rules like Tax rebate, housing loan under section 80EEA with examples and also rules on various types of Income that are applicable.

Table of Contents

Overview of New rules in Income tax for FY 2019-20 or FY 2020-21

- The standard deduction of Rs 50,000 is available for salaried individual and pensioners for FY 2019-20( For FY 2018-19 standard deduction was Rs 40,000.)

- If your total taxable income(after all deductions) is less than 5 lakhs, resident individual and senior citizen will get a rebate of up to Rs 12,500 under section 87A.

- Extra Exemption of Rs 1.5 lakh under section 80EEA on the interest for a first-time buyer buying self-occupied residential property by taking a home loan of Rs 45 lakh between 1 Apr 2019 to 31 Mar 2020. This is over and above 2 lakh limit provided under section 24. To provide affordable housing finance to the common man.

- A deduction for interest payments up to Rs 1,50,000 is available under Section 80EEB for purchase of the electric vehicle

- The income tax department has allowed taxpayers the laxity of making tax-saving investments for FY 2019-20 till 30th June 2020 in view of the coronavirus lockdown. Deductions under Chapter-VIA-B of IT Act which includes Section 80C (LIC, PPF, NSC, etc), 80D (mediclaim) and 80G (donations) the dates for making the investment, construction or purchase for claiming rollover benefit in respect of capital gains under sections 54 to section 54GB has also been extended to June 30, 2020

The income earned between 1 Apr 2019 to 31 Mar 2020, called FY 2019-20, will be assessed for tax in the AY 2020-21. The last date for filing returns is 10 Jan 2021.

- On 1 Feb 2019 interim budget was presented by Railway Minister Piyush Goyal. He was given additional charge of the Finance Ministry as FM Arun Jaitley had gone to the US for treatment. Arun Jaitley as Finance Minister had presented earlier Budgets.

- FM Nirmala Sitaraman presented her maiden full budget on 5th July 2019.

Changes in ITR for FY 2019-20 or AY 2020-21

The income tax department notified the income tax returns( ITR) on 30 May 2020.The income tax department had introduced the ITR1 and ITR4 for FY 2019-20 on 3 Jan 2020, but was withdrawn due to income tax rules due to COVID pandemic. The tax department is yet to release the tax filing utilities. Ideally, one should file the return from 1 April onwards and before the due date of 31 July. But this year last date of filing ITR is 30 Nov 2020.

- ITR-1 which is also known as ‘Sahaj’ can be used by an individual whose incomes primarily include salary income and whose total income does not exceed Rs 50 lakh during the FY

- ITR-4 can be used to file returns by resident individuals, Hindu Undivided Family and firms (other than LLP) having a total income of up to Rs50 lakh from business and profession

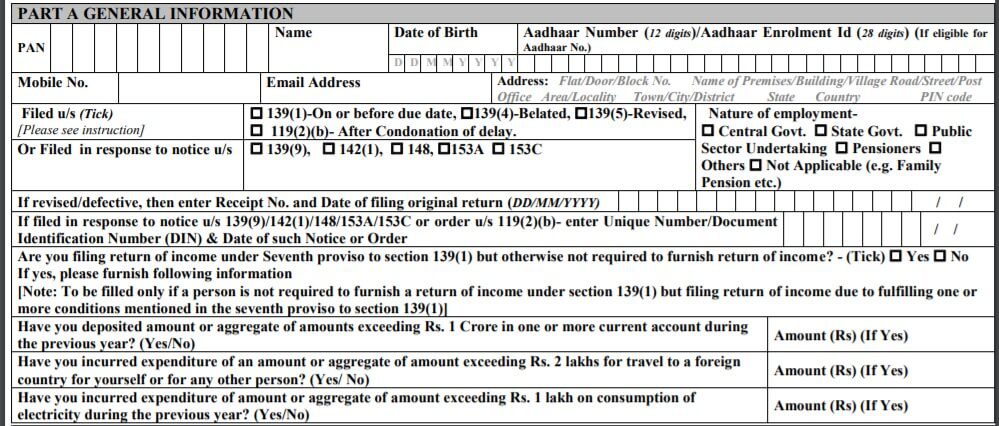

Changes in ITR1 are given below as shown in the image of ITR1 is given below

-

- 1) If you have taxable income as a dividend from domestic companies, you are not eligible to file ITR-1 form.

- 2) Those with joint ownership of house property cannot file ITR-1 or ITR-4.

- 3) Taxpayers need to answer the following questions related to deposits in current accounts, foreign travel and electricity bills in all the ITR forms:

- a) “Have you deposited an amount or aggregate of amounts exceeding Rs. 1 Crore in one or more current account during the previous year?”

- b) “Have you incurred expenditure of an amount or aggregate of amount exceeding Rs. 2 lakhs for travel to a foreign country for yourself or for any other person?”

- c) “Have you incurred expenditure of amount or aggregate of amount exceeding Rs. 1 lakh on consumption of electricity during the previous year?”

- Details of your employer Until last year, a taxpayer simply had to select the nature of employment, i.e., Government, PSU, Pensioners, Others from a drop down menu. This year’s ITR-1 asks for detailed information about your employer

- such as TAN, name, nature, address of the employer.

- According to the notified form, these details will be pre-filled automatically, once TAN of the employer is filled by the taxpayer in ITR-1. You can find the employer’s TAN details in your Form-16.

- Eligibility criteria for ITR-1 restored The ITR-1 can be filed by a resident individual whose total income does not exceed Rs 50 lakh and is not either director in a company or has invested in unlisted equity shares. Further, the sources of income should be from salary, single house property, interest income, family pension etc.

-

In its notification issued on January 3, it stated that ITR-1 could not be used by individuals who own single house property that is jointly owned or fulfilled one of the conditions in the seventh proviso of 139(1).

-

The seventh proviso of 139(1) refers to those individuals who have incurred expenses of Rs 2 lakh or more for travel to foreign country either on himself or any other person or individuals who have deposited more than Rs 1 crore in one or more current accounts or/and paid electricity bill of more than Rs 1 lakh in FY2019-20.

-

However, the tax department rolled back the restrictions it announced. According to press release dated January 9, 2020, the income tax department said that concerns raised for the changes in ITR-1 are likely to cause hardships to individual taxpayers as such taxpayers would require to file detailed ITR form if they own a house property jointly or satisfy any conditions of the seventh proviso of 139(1).

-

- The income tax department has allowed taxpayers the laxity of making tax-saving investments for FY 2019-20 till 30th June 2020 in view of the coronavirus lockdown. Deductions under Chapter-VIA-B of IT Act which includes Section 80C (LIC, PPF, NSC, etc), 80D (mediclaim) and 80G (donations) the dates for making the investment, construction or purchase for claiming rollover benefit in respect of capital gains under sections 54 to section 54GB has also been extended to June 30, 2020. So while filling ITR you have to fill when you made investment during FY 19-20 or between 1 Apr 2020 to 30 Jun 2020.

Income Tax Slabs for FY 2019-20 (AY 2020-21)

| Tax | MEN and WOMEN | SENIOR CITIZEN(Between 60 yrs to 80 yrs) | For Very Senior Citizens(Above 80 years) |

| Basic Exemption | 250000 | 300000 | 500000 |

| 5% tax | 250001 to 500000 | 300001 to 500000 | – |

| 20% tax | 500001 to 1000000 | 500001 to 1000000 | 500001 to 1000000 |

| 30% tax | above 1000000 | above 1000000 | above 1000000 |

| Surcharge | 10% of tax where total income exceeds Rs. 50 lakh

15% of tax where total income exceeds Rs. 1 crore 25% on income between Rs 2 crores to Rs 5 crores 37% on income between Rs 5 crores to Rs 10 crores |

||

| Education Cess | Health & Education cess: 4% of tax plus surcharge | ||

| Tax Rebate | Rs 12,500 for income up to 5 lakh under/section 87A | ||

Income from House Property

- Homeowners can claim a deduction of up to Rs 2 lakh on their home loan interest for self-occupied house i.e if the owner or his family resides in the house property. The same treatment applies when the house is vacant.

- Till FY 2016-17, loss under the head house property could be set off against other heads of income without any limit. However, form FY 2017-18, such set-off of losses has been restricted to Rs 2 lakhs. This amendment affects taxpayers who have let-out/ rented their properties.

- The deduction to claim principal repayment is available for up to Rs. 1,50,000 within the overall limit of Section 80C.

- Stamp duty and registration charge and other expenses related directly to the transfer are also allowed as a deduction under Section 80C, subject to a maximum deduction amount of Rs 1.5 lakh. Claim these expenses in the same year you make the payment on them.

- Interest deduction on housing loan under Section 80EEA up to Rs 1.5 lakh for a home loan(upto Rs 45 lakh) taken on self-occupied house property during the period 1 April 2019 to 31 March 2020. The individual taxpayer will not be entitled to deduction under section 80EE.

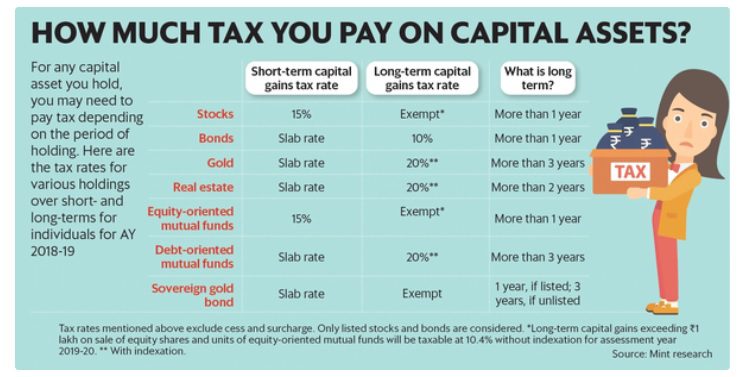

Income from Capital Gains

When you sell Stocks, Bond, Gold, Land or Property, Mutual Funds you need to pay a tax called as Capital gain tax. It is classified as Long Term Capital Gain Tax(LTCG) and Short Term Capital Gain(STCG) based on the asset you sold, the time period you owned the asset as shown in the image.

Income from Business and Profession

- Business: It referred to any economic activity carried for earning profits. Economic activity refers to any trade, Commerce, Manufacturing Activity, Trading Activity or any other concern in nature of all.

- Profession: In Profession, a person provides services using their skill & knowledge like that of CA, Doctor, Engineer, etc.

Typically, businesses have to maintain books of accounts, prepare a profit and loss statement to calculate profit and prepare a balance sheet to file returns, get his accounts audited, which can be quite a task.

To give relief to small taxpayers from this tedious work, the Income-tax Act has framed the presumptive taxation scheme under sections 44AD, 44ADA and 44AE.

- They are required to file return in Form ITR 4 if they only have Income from the profession. For example, if they have Capital gain and income from profession they have to file ITR3

- As per GST regulations, if a professional or businessman had a turnover of less than ₹ 20 lakh during last fiscal year, then he is not required to obtain the GST registration and he can still opt for the presumptive scheme

- Net income is estimated to be 8% or 6% (in case of digital receipts) of gross turnover (for businesses) or ₹ 7,500 per month for each vehicle where the taxpayer plies, leases or hires trucks or 50% of the total gross receipts for the year in case of professionals

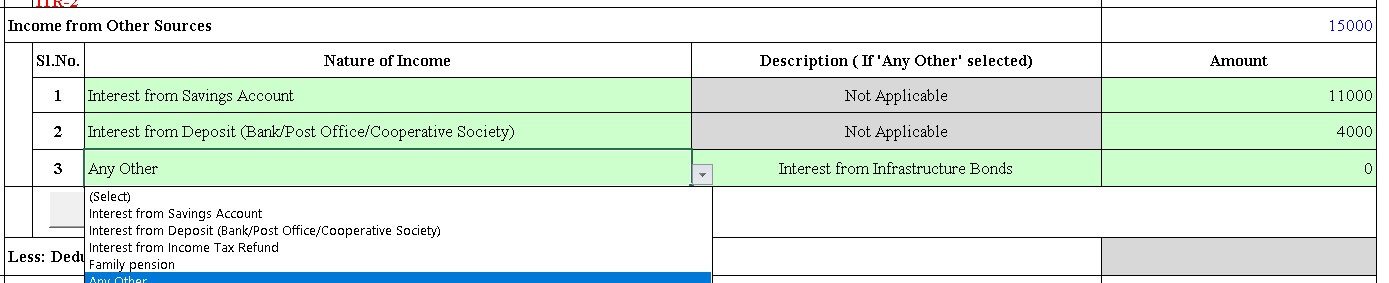

Income from Other Sources

Income from Other sources such as the interest of Saving Bank Account, Fixed Deposit, Recurring Deposit, Senior Citizen Saving Scheme(SCSS) needs to be shown in the Income Tax return. Any income which does not fall under the heads of Salary, House Property, Business & Profession and Capital Gain will fall under the head Income from Other Sources.

You can read in detail at Income From Other Sources: Saving Bank Account, Fixed Deposit, RD and ITR

- Saving Bank interest, however small the amount, is your income. Find the interest on all your saving bank accounts by going through your bank statements. Then sum up the interest on all the bank accounts. Show the total amount in your ITR in Income from Other Sources. Then claim deduction up to Rs 10,000 under section 80TTA.

- Show the entire interest earned in all your FDs in the Financial year in income from other sources. Show the total value in Form 26AS. Claim the TDS deducted if any in TDS section of ITR.

Earlier ITR asked for only the total amount of ‘Income from other sources’, but from FY 2018-19 or AY 2019-20 year you have to give a detailed break-up as shown in image below

Standard Deduction

The standard deduction of Rs 50,000 is essentially a flat amount subtracted from the salary income before calculation of taxable income. Medical reimbursement and transport allowance were removed, but one can claim Allowances like Leave Travel Allowance(LTA), House Rent Allowance(HRA).

Tax Rebate under Section 87A

The salient features of the Income Tax Rebate under Section 87A are given below. Our article Income Tax Rebate under Section 87A covers it in detail

- The amount of tax rebate under section 87A is restricted to a maximum amount of Rs 12,500 for FY 2019-20. If the computed tax payable is less than Rs 12,500, say Rs.1,500 the tax rebate shall be limited to that lower amount ie Rs 1,500.

- Income Tax Rebate under Section 87A is only available to Resident Individuals including Senior Citizens.

- Income Tax Rebate is allowed before the levy of Education Cess and Secondary and Higher Education Cess(SHEC). In other words, Education Cess and SHEC would be levied on the tax payable after allowing for Income Tax Rebate.

- Total income before cess should not be more than a defined limit, which is 5 lakh for FY 2019-20.

- There is no benefit of this Rebate to Super-Senior Citizens i.e. Individuals above 80 years of age as their Income up to Rs 5 Lakh is already exempted from the levy of Income

Example of How Tax Rebate works

In the example of a salaried employee with a total income of 3,15,000 has tax as 3250. He will get a rebate of 3250.

| Description | Amount |

| Salary Income | 4,50,000 |

| Income from House Property | -50,000 |

| Income from Other Sources | 15,000 |

| Total Income | 4,15,000 |

| Standard Deduction | 50,000 |

| Deductions under 80C | 50,000 |

| Total Taxable Income | 3,15,000 |

| Tax on Income(@5%) | 3250(5% of 3,15,000-2,50,000) |

| Less Rebate(Max 12500) | 3250 |

| Total Tax Payable | 0 |

| Education Cess | 0 |

| Total Tax | 0 |

Following are a few examples of the 87A rebate allowed to Resident Individuals

| Total Income | Tax payable before cess | Rebate u/s 87A | Tax Payable + 4% Cess |

| 2,70,000 | 1,000 | 1,000 | 0 |

| 3,60,000 | 3,000 | 3,000 | 0 |

| 4,90,000 | 12,000 | 12,000 | 0 |

| 12,00,000 | 1,72,500 | 0 | 1,79,400 |

Senior Citizen and interest income of Rs 50,000, section 80TTB

For Senior Citizens(those above 60 years),

- Interest income earned on Saving Banks Account, Fixed Deposits & Recurring Deposits (Banks / Post office schemes)is exempted up to Rs 50,000 (FY 2017-18 limit was up to Rs 10,000). This deduction can be claimed under new Section 80TTB.

- Senior Citizens cannot claim deduction under Section 80TTA.

- For senior citizens, the threshold limit of TDS (Tax Deduction at Source) on interest income is Rs 50,000.

Section 80EEA

Earlier under section 24, you could save up to Rs 2 lakh tax exemption on Interest for a home loan, but under section 80EEA, you can get extra benefit upto Rs 1.5 lakh i.e total exemption of 3.5 Lakhs.(Rs 2 Lakhs + 1.5 Lakhs).

The main motive of this section is to provide affordable housing finance to the common man. Exemption u/s 80EEA comes with some of the conditions to get full benefits of affordable housing finance.

- It is an additional benefit on the top of 2 Lakh benefit extended by section 24.

- The deduction under this scheme is available only to the individuals.

- The above benefit is not applicable for a self-occupied residential property not for the commercial properties.

- A loan has been taken from a financial institute or a housing finance company for buying a residential house property between April 1, 2019, to March 31, 2020.

- Only first time home buyer and not having any residential house in his name can avail the benefit of this section.

- The actual value (stamp duty value) of the house should be 45 Lakhs or less.

- This tax deduction can be claimed for a joint home loan. The joint home loan borrower can individually claim this benefit.

- Carpet area

- in the metropolitan cities of Bengaluru, Chennai, Delhi National Capital Region (limited to Delhi, Noida, Greater Noida, Ghaziabad, Gurgaon, Faridabad), Hyderabad, Kolkata, and Mumbai (the whole of Mumbai Metropolitan Region) does not exceed 645 Sq Feet.

- Non-metropolitan cities must not exceed 970 Sq Feet.

- You need to submit the home loan interest certificate in order to claim this benefit.

Section 80 Deduction Table

| Section | Deduction on | Allowed Limit (maximum) FY 2019-20 |

|---|---|---|

| 80C | Investment in PPF – Employee’s share of PF contribution – NSCs – Life Insurance Premium payment – Children’s Tuition Fee – Principal Repayment of home loan – Investment in Sukanya Samridhi Account – ULIPS – ELSS – Sum paid to purchase a deferred annuity – Five-year deposit scheme – Senior Citizens savings scheme – Subscription to notified securities/notified deposits scheme – Contribution to notified Pension Fund set up by Mutual Fund or UTI. – Subscription to Home Loan Account scheme of the National Housing Bank – Subscription to deposit scheme of a public sector or company engaged in providing housing finance – Contribution to notified annuity Plan of LIC – Subscription to equity shares/ debentures of an approved eligible issue – Subscription to notified bonds of NABARD |

Rs. 1,50,000 |

| 80CCC | For amount deposited in annuity plan of LIC or any other insurer for a pension from a fund referred to in Section 10(23AAB) | – |

| 80CCD(1) | Employee’s contribution to NPS account (maximum up to Rs 1,50,000) | – |

| 80CCD(2) | Employer’s contribution to NPS account | Maximum up to 10% of salary |

| 80CCD(1B) | An additional contribution to NPS | Rs. 50,000 |

| 80TTA(1) | Interest Income from Savings account | Maximum up to 10,000 |

| 80TTB | Exemption of interest from banks, post office, etc. Applicable only to senior citizens | Maximum up to 50,000 |

| 80GG | For rent paid when HRA is not received from employer | Least of : – Rent paid minus 10% of total income – Rs. 5000/- per month – 25% of total income |

| 80E | Interest on education loan | Interest paid for a period of 8 years |

| 80EE | Interest on home loan for first time home owners | Rs 1,50,000 |

| 80CCG | Rajiv Gandhi Equity Scheme for investments in Equities | Lower of – 50% of amount invested in equity shares; or – Rs 25,000 |

| 80D | Medical Insurance – Self, spouse, children Medical Insurance – Parents more than 60 years old or (from FY 2015-16) uninsured parents more than 80 years old |

– Rs. 25,000 – Rs. 50,000 |

| 80DD | Medical treatment for handicapped dependent or payment to specified scheme for maintenance of handicapped dependent – Disability is 40% or more but less than 80% – Disability is 80% or more |

– Rs. 75,000 – Rs. 1,25,000 |

| 80DDB | Medical Expenditure on Self or Dependent Relative for diseases specified in Rule 11DD – For less than 60 years old – For more than 60 years old |

– Lower of Rs 40,000 or the amount actually paid – Lower of Rs 1,00,000 or the amount actually paid |

| 80U | Self-suffering from disability : – An individual suffering from a physical disability (including blindness) or mental retardation. – An individual suffering from severe disability |

– Rs. 75,000 – Rs. 1,25,000 |

| 80GGB | Contribution by companies to political parties | Amount contributed (not allowed if paid in cash) |

| 80GGC | Contribution by individuals to political parties | Amount contributed (not allowed if paid in cash) |

| 80RRB | Deductions on Income by way of Royalty of a Patent | Lower of Rs 3,00,000 or income received |

Example of Income Tax Calculation for FY 2019-20 or AY 2020-21

| Particulars | Ravi | Ramesh | Rahul | |

|---|---|---|---|---|

| Annual Salary | 5,00,000 | 10,00,000 | 15,00,000 | |

| Less: Standard Deduction (Medical & Travel Allowance) | 50,000 | 50,000 | 50,000 | |

| Less : Deduction u/s 80C | 80,000 | 1,50,000 | 1,50,000 | |

| Less : HRA deduction as per section 10(13A) | 92,000 | 1,00,000 | 1,50,000 | |

| Gross Taxable Income (GTI) | 2,78,000 | 7,00,000 | 11,50,000 | |

| Tax computation on GTI | ||||

| Up to 2,50,000 | – | – | – | |

| 2,50,001 to 5,00,000 | 1,400 | 12,500 | 12,500 | |

| 5,00,001-10,00,000 | – | 40,000 | 1,00,000 | |

| Above 10,00,001 | – | – | 45,000 | |

| A | Total tax | 1,400 | 52,500 | 1,57,500 |

| B | Less Rebate u/s 87A | 1,400 | – | – |

| C | Add: Health & Education Cess @ 4% on (A-B) | – | 2,100 | 6,300 |

| Tax Payable (A-B+C) | – | 54,600 | 1,63,800 | |

ITR1 for FY 2019-20 or AY 2020-21

The image below shows the first page of ITR1 which changes marked in red box

Related Articles:

If the Salary income say 38 lacks and other income example share sales etc 13lacks..total 51lacks but HRA and other 80c deductions , total taxable income is 49lacks..

How much tax needs to be paid?. Is it 30% + 10% (more than 50lacks income) or just 30% since after deductions taxable total income is 49 lacks.

One pays tax on the total income after deductions as shown in our article http://bemoneyaware.com/income-tax/#How_to_Calculate_Income_Tax

So your total taxable income would be 49 lakhs. And you don’t have to pay surcharge

Very nice article, thanks for your information.

Nice blog waiting for next update

Very nice & informative ways to explain IT slabs with scenario. Thanks

Thanks for encouraging words.

We would be obliged if you can share the information with your friends and family.