The government has decided to make Aadhaar number mandatory for filing of Income Tax returns as well as linking it with Permanent Account Number (PAN) card. This article explains the procedure of how to For Income Tax ITR link Aadhaar with PAN Card for filing income tax return. It also explains what to do when PAN details do not match Aadhaar details.

The last date for linking the Permanent Account Number (PAN) to Aadhaar is March 31, 2021, otherwise, the PAN card is likely to become invalid. If not linked, one may also be liable to pay a penalty.

The government had first announced in 2017 that it would require all individuals to link their PAN with Aadhaar. While it has given several extensions since then, this year it has finally been made mandatory.

Table of Contents

How to link your PAN with your Aadhaar online

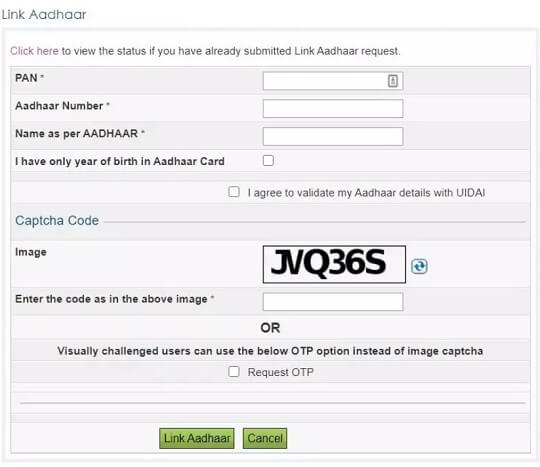

- Open the Income Tax department’s e-filing portal here.

- Click on the ‘Link Aadhaar’ option on the left, or click here.

- Now, enter your PAN, Aadhaar number and name as per your Aadhaar card.

- If your Aadhaar card contains only your year of birth instead of the complete date of birth, check the box, else leave it unchecked.

- Now, click on the agree checkbox to validate your Aadhaar details with UIDAI.

- Finally, enter the captcha code and click on the ‘Link Aadhaar’ button.

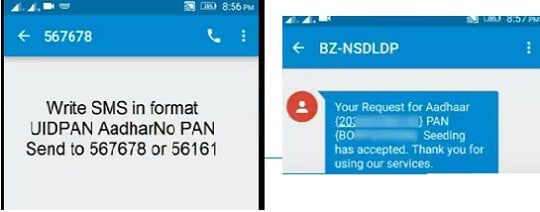

Link Aadhaar with PAN Card using SMS

Consequences if Aadhaar is not linked to PAN

All the PAN cards which are not linked to Aadhaar would be useless and declared “inoperative”. You might not be able to do any financial transaction if your PAN is not linked to your Aadhaar.

The government added Section 234H in the Income Tax Act, 1961 to penalise those who fail to link their PAN with Aadhaar by the deadline.

A penalty of Rs 10,000 may apply as per Section 272B of the Income Tax Act if you fail to link the two documents by the deadline and your PAN becomes inoperative and it will be assumed that your PAN has not been furnished as required by the law.

Opening a bank account, buying mutual funds or shares, and even making cash transactions of over Rs 50,000 are the several purposes for which a PAN card is mandatory.

Who doesn’t have to link Aadhaar with PAN Card?

Only a resident individual has to link Aadhaar with PAN Card.

It is clarified that such mandatory quoting of Aadhaar or Enrolment ID shall apply only to a person who is eligible to obtain Aadhaar number. As per the Aadhaar (Targeted Delivery of Financial and Other Subsidies, Benefits and Services) Act, 2016, only a resident individual is entitled to obtain Aadhaar. Resident as per the said Act means an individual who has resided in India for a period or periods amounting in all to one hundred and eighty-two days or more in the twelve months immediately preceding the date of application for enrolment. Accordingly, the requirement to quote Aadhaar as per section 139AA of the Income-tax Act shall not apply to an individual who is not a resident as per the Aadhaar Act, 2016.

People Exempted from linking Aadhaar with PAN card are:

- (i) Those categorized as Non-resident Indians as per the Income Tax Laws

- (ii) Not a citizen of India

- (iii) Is of age 80 years or more at any time during the tax year

- (iv) Residents of the states of Assam, Meghalaya and Jammu and Kashmir

If I don’t have Aadhaar then what should I do?

Those who do not have Aadhaar number must apply for it and can quote Aadhaar enrolment id. You can apply for Aadhaar card.

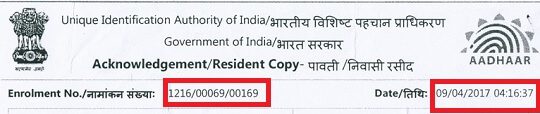

When you apply for Aadhaar you have to visit an enrollment Centre and fill the enrolment form. After giving demographic and biometric data and submission of proof of Identity and address documents you get an acknowledgment slip which has your Aadhaar Enrolment ID or Aadhaar Enrolment number. New income tax return forms released for FY 2016-17 (AY 2017-18) have a 28 digit column for quoting Aadhaar enrolment number. To enter your 28 digit enrolment id you will also need the date. The Aadhaar enrolment slip is shown below

For example for the Aadhar Acknowledgement receipt given below one has to enter Enrollment No followed by date and time as shown in the image below

PAN Card details do not match Aadhaar

What should I do if my details as per my PAN card do not match with the ones mentioned on my Aadhaar card?

If the details on your PAN card such as spelling of the name, date of birth or gender do not match the ones on your Aadhaar card, then you can either update PAN or Aadhaar.

Name in PAN and Aadhaar mismatch

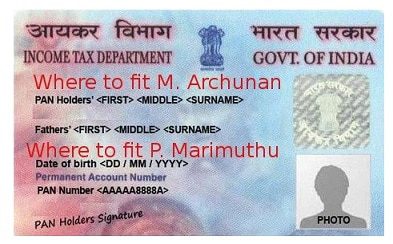

Several people, particularly those from the southern states, are having problems linking their Permanent Account Number with their Aadhaar card. The primary reason being they have two different names on their PAN and Aadhaar cards. Unlike the rest of India, most people in the South do not use surnames and put initials either before or after their names, for example, K.Venkatesh. Although their school leaving certificates and other government documents have the initials of their surnames, their PAN card and passport have the expanded version K.Venkesh gets expanded to Krishnaswamy Venkatesh, where Krishnaswamy is his father’s name.

K S Srinivas, PAN card details have full stops between his initials while the Aadhaar card doesn’t

Activists are angry.”This is threatening to turn taxpayers into defaulters,” says Gopal Krishna of Citizens Forum for Civic Liberties.

M. Archunan has started a petition on Change.org, regarding the name mismatch issue. In his petition, he said, “how can a person, whose legally accepted name is M. Archunan and has all his legal documents are carrying the name of M. Archunan, apply for a PAN Card. This is a very faulty system or procedure followed by our Government.” Although, some 10-13 years back, I have got a PAN Card in the name of Archunan Marimuthu after convincing the authorities, but, now only I understood that it was not a proper solution. Because now I have two identities. One is M. Archunan and the other is Archunan Marimuthu. It has come to my knowledge that this problem is applicable in the Passport of India also. If you also feel the same please do sign the petition. Click here or the image below

How to correct/change Information in PAN Card?

If you want to change information about yourself in your PAN Card then You can do it online or offline. But if you Change your names on the PAN card it would mean having to change several other documents, having to inform the banks, submitting fresh KYC documents for bank accounts, demat account, and informing the insurance companies.

- The fee for processing PAN application is 107.00 ( 93.00 + 15.00% service tax).

- Payment can be made either by

- Demand Draft

- Credit Card / Debit Card

- Net Banking

You can correct following details on PAN card.

| Correction/Change in PAN Card Holder’s Name | Correction/Change in PAN Card Holder’s Father’s Name |

| Correction in Date Of Birth (as printed on card) | Correction/Change in Address for Communication |

| Correction/Change in Signature (as printed on card) | Correction/Change in Gender |

| Correction/Change in Photo (as printed on card) | Correction/Update of AADHAAR number |

To update PAN details offline: One can submit the request for the change in PAN data by filling in the form for Request For New PAN Card Or/ And Changes In PAN Data (pdf) . Post it with valid documents.

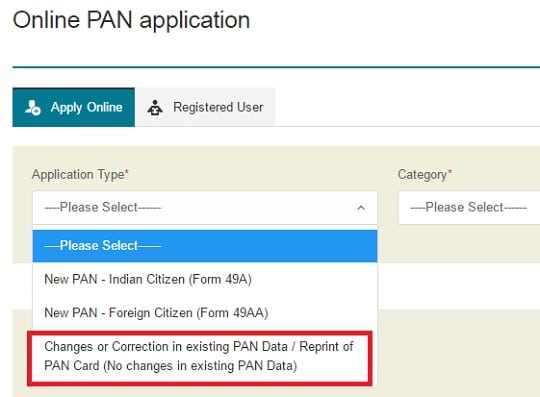

To update PAN details online using NSDL visit https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html . Select the Changes or Correction in existing PAN Data as shown in the image below.

How to correct or change information in Aadhaar

You can update or correct the following data in Aadhaar either by submitting your request Online or sending the request through Post. There are no charges for updating Aadhaar, its free. If you plan to use Online mode it is mandatory to provide the mobile number as it may be used for Verification by calling the Applicant. Status of application will be intimated to the resident by sending an SMS to this mobile number.

- Name

- Gender

- Date of Birth

- Address

- Mobile Number

Documents required during Update/Correction

- Name Correction/Update – Requires Proof of Identity (PoI) listed in Supported Proof of Identity(PoI) Documents Containing Name and Photo for Name Corrections/Update

- Date of Birth Correction – Requires Date of Birth (DoB) listed in Supported Proof of Date of Birth (DoB) Documents

- Address Corrections/Change – Requires Proof of Address (PoA) listed in Supported Proof of Address (PoA) Documents Containing Name and Address

One has to attach self-attested supporting documents as per the Valid Documents List.

It is a 4 Step process at https://ssup.uidai.gov.in/web/guest/ssup-home ,an overview of which is given below. This is discussed in detail later in the article here

- Step 1: Login with Aadhaar

- Step 2: Select field for update

- Step 3: Fill new data for update

- Step 4: Upload Documents & Submit

Related articles:

- What is PAN Card?

- How to Update or Correct Details in Aadhaar

- Aadhaar : What is Aadhaar, How to enrol,Check Aadhaar status,Download e Aadhaar

- Changing Name:What to do?

- Understand Income Tax, Fill ITR,Income Tax Notice

Thanks for sharing information,PAN card is a very useful item for everyone,This ID number is a 10 digit string of alphanumeric characters.Now it mandatory to link pan with your finfyi.com/aadhar-card aadhar card

My name, DOB, gender are all “exactly” the same on both my PAN card and Aadhar Card. But despite that, I’m facing repeated authentication errors while linking the two on the income tax site. It’s a nightmare!

That’s shocking.

Is order of first name and surname is same?

Did you try uploading the Document?

I was also having problems while filing new itr forms then i visited this link where everything related to new itr forms was explained in such appropriate manner which helped me a lot to understand about new itr forms.

https://blog.tax2win.in/new-itr-forms/