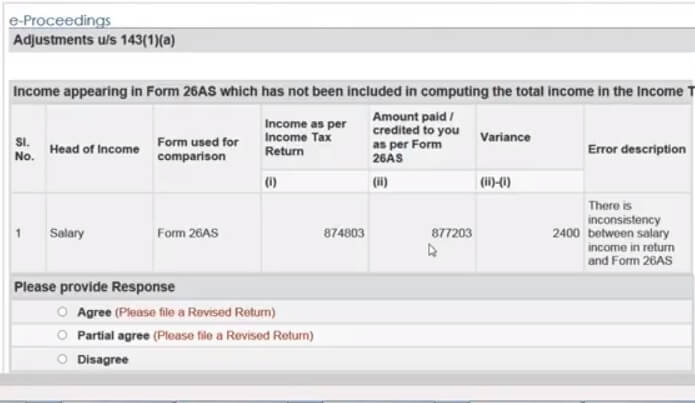

On 6 May 2018, many salaried employees got an Income Tax Notice, a notification from IT department regarding inconsistency between salary income and Form 26AS in ITR. First, relax you are not alone. Thie article talks about What does Income Tax Department consider as Income from Salary? Let’s understand why Income Tax Department sent notice by looking at Form 26AS, Form 16, Form 12BA. It is basically due to missing details such as professional tax or exempted allowances. If you agree to the variance you can revise your return appropriately by filling in missing details. If Disagree then you can go for e-proceedings and respond.

Table of Contents

How to agree to Notice for Inconsistency of Salary Income and Form 26AS

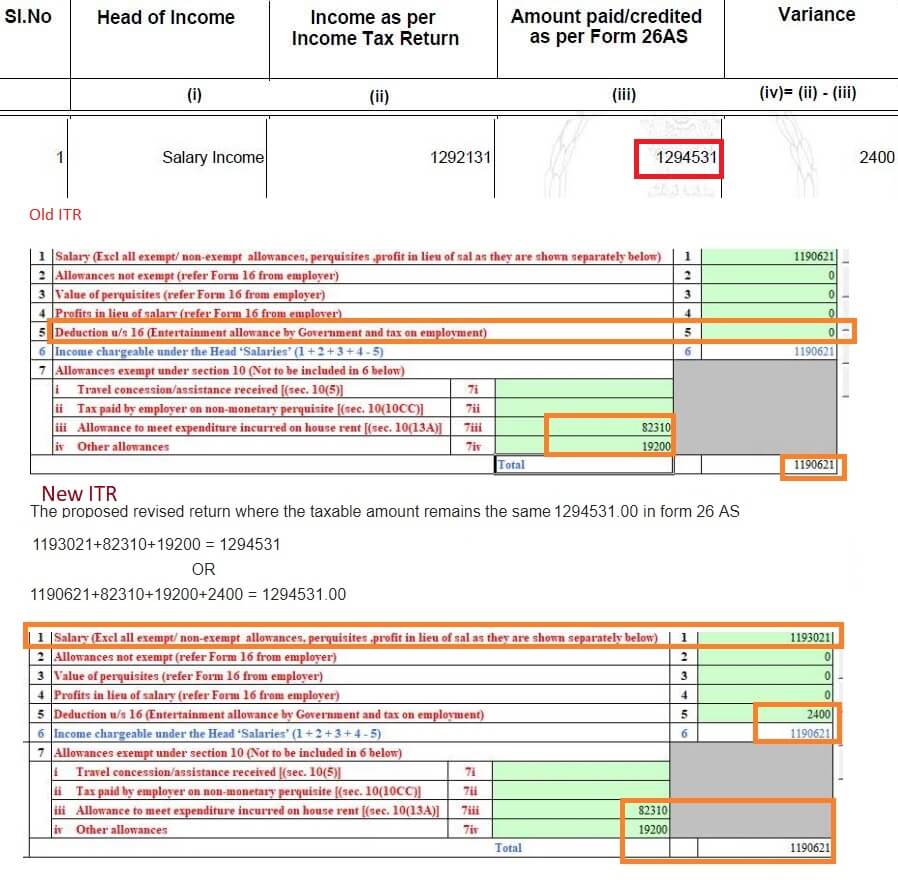

The Income Tax Notice, a notification from IT department is regarding inconsistency between salary income and Form 26AS in ITR. The breakup of salary in ITR2 is not shown properly. You can disagree and give the reason as missing HRA /Professional Tax. We would recommend agreeing as the problem is that salary details have not been filled properly. Adding the missing details does not incur any tax liability. You have to file the revised return only.

Go to the e-Proceeding tab.

- Please click on the link ‘Proceeding Name’ and you will be taken to the next screen

- Under response click on the Submit button

- select the type of your response i.e., Agree/Partially Agree/Disagree.

- If you select Agree The system will auto-populate the acknowledgement number of the latest revised return you have filed in response to the intimation.

- After selecting ‘Agree’ click on submit button. And File Revised Return.

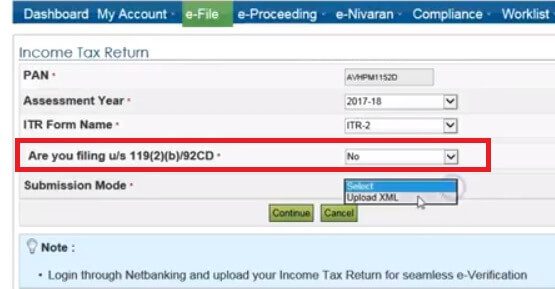

- You have to file the revised return under section Revised 139(5). So say No to Question Are you filing u/s 119(2)(b)/92CD

Income Tax Notice when Form 26AS does not meet Income from Salary in ITR

Let’s see what Income tax department considers as Income from salaries and you have to look at your Form 26AS, Form 16, Form 12BA.

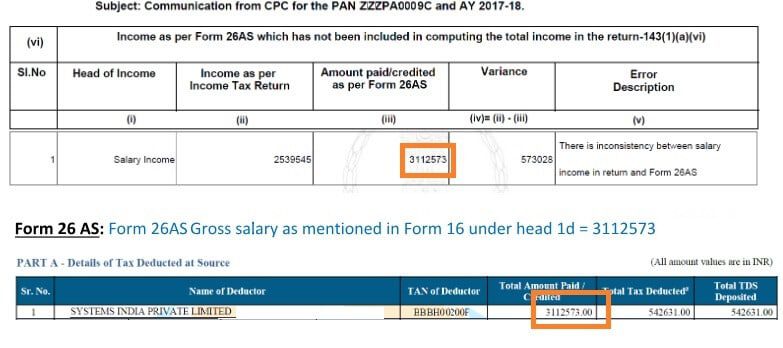

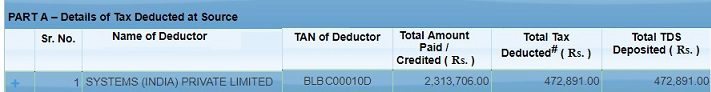

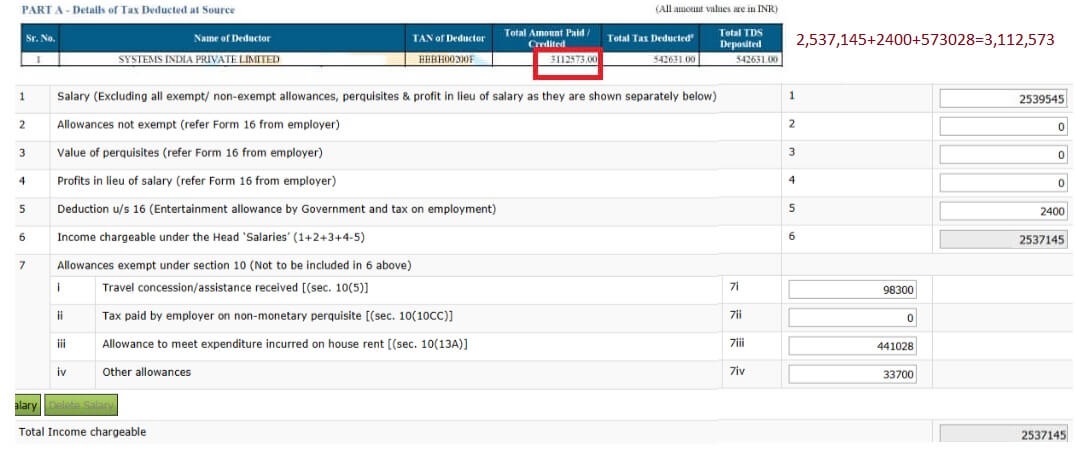

For Income Tax Department their source of your salary income is Total amount Paid/credited in Form 26AS. Quick e-File ITR option on incometaxindiaefiling.gov.in of ITR1 picks this amount in”Income under Salary” column.

- It is not INCOME CHARGEABLE UNDER THE HEAD “SALARIES” (3-5) from Form 16

- It is not “Income under the Head “Salaries” of the Employee(other than from perquisites) Form 12BA

Income chargeable under head salaries is the sum of Perquisites

So if you look at Form 26AS and Part A which shows the TDS details your Income from Salary should match the amount mentioned in the Total amount paid/credited,

If your Income under Head Salaries in ITR does not match Total Amount Paid/Credited in Form 26AS you would get this notice. Income from Salary is filled in two places in ITR or Income Tax Return, one in Income from Salary and other TDS details.

You have 2 options to reply to notice and 30 days so take time don’t rush.

- If you Agree to the notice fully or partially you have to revise the ITR. Income from Salary is filled in two places in ITR or Income Tax Return, one in Income from Salary and TDS details. Explained for Mismatch in Profesional Tax in ITR2 here and for Variance due to Missed Allowances here.

- If you Disagree then you can go for e-proceedings and respond explained here

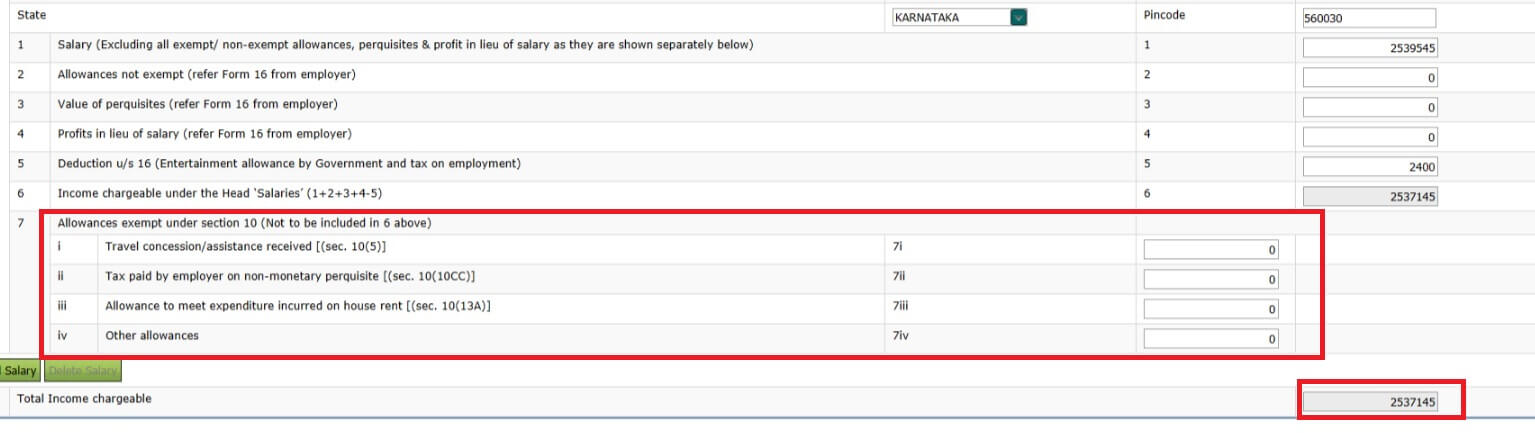

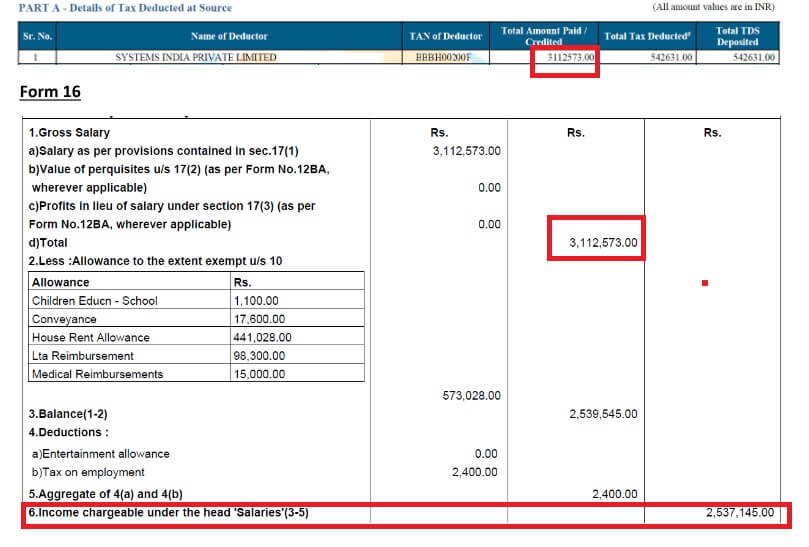

The ITR was filed with no details about Allowance exempted under section 10 as shown below.

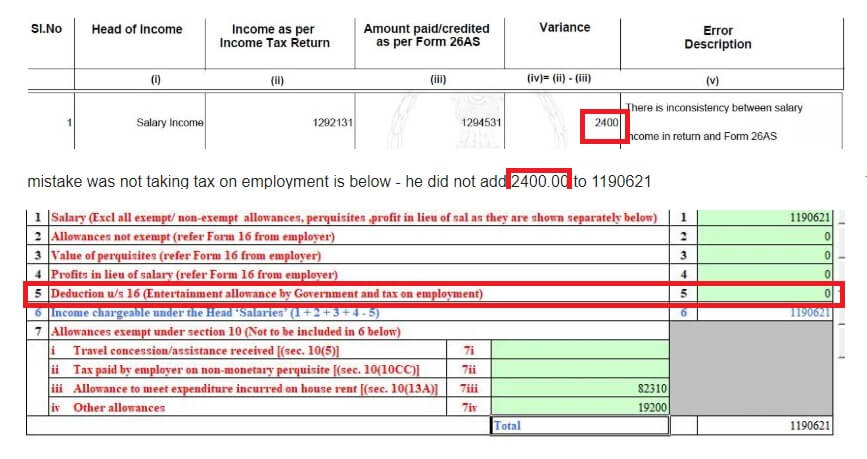

Many also get an Income Tax notice when they had not filled in the Professional Tax while filing ITR as shown below. Thanks to Mahesh mirpuri(@invest_mutual ) for the details of the case.

Form 26AS, Form 16 and Form 12BA for Income from Salary and ITR

Lets recap Form 26AS, Form 16 and Form 12BA.

- Form 26AS also called as Annual Statement, is a consolidated tax statement which has all tax-related information (TDS, TCS, Refund etc) associated with a PAN. It shows how much of your tax has been received by the government and is consolidated from multiple sources like your salary/pension/interest income etc. Our article Understanding Form 26AS and What to Verify in Form 26AS? explores Form 26AS in detail.

- Form 16 is the TDS certificate that an employer issues to you when TDS is deducted by them. When an employer deducts TDS on salaries, the income tax act requires that a certificate must be issued by the employer, where the details of tax deducted and deposited is certified. Our article Understanding Form 16: Tax on income explains form 16.

- Form 12BA is provided by an employer to his employee when an employee receives ‘perquisites’ from his job. Our article Understanding Form 12BA covers Form 12 BA in detail.

Professional Tax

Profession tax the tax by the state governments in India. A person earning an income from salary or anyone practising a profession such as a chartered accountant, company secretary, lawyer, doctor etc. are required to pay this professional tax. Each state has a slab that it declares and the professional tax is deducted based on these slabs. There are some states and union territories that do not charge professional tax too. The states which impose the professional tax are Karnataka, Bihar, West Bengal, Andhra Pradesh, Telangana, Maharashtra, Tamil Nadu, Gujarat, Assam, Kerala, Meghalaya, Odisha, Tripura, Madhya Pradesh, and Sikkim.

Professional tax is collected by the employers from the monthly salaries. It is then paid by them to the government failing which they can have penalties imposed on them for not collecting or failing to pay the professional tax.

Income from Salaries in Form 16 and Form 26AS

Let’s look at Form 16 from the employer which shows the details of income and TDS. So in the example of Form 16 below, Income chargeable under the head salaries is 2,313,706 and Form 26AS shows this as the Total amount deducted or credited.

Form 26AS with Total AMount Paid

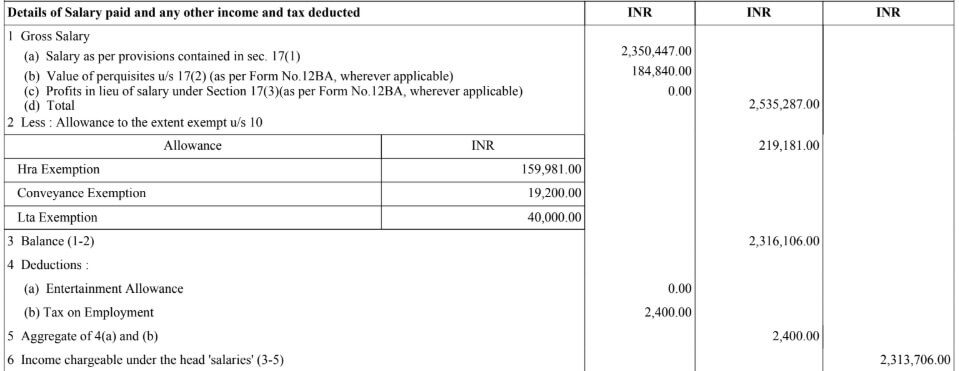

Let’s look at another example where the salary mentioned in Form 26AS is not the income chargeable under the head salaries but Gross Salary + Profits+Perquistes. So, in this case, your filling of salary details will be different from that in the earlier case.

How to Revise ITR2 When Income tax notice is for variance in Professional Tax

If you have a similar case best option is to Agree to the notice and revise the ITR. So amount in Form 26AS should be Income chargeable under salaries + Professional tax.

For TDS just enter the figures from your Form 26AS.

Please check Procedure to file Revised Return here.

How to Revise ITR2 When Income tax notice is for variance in Exempted Allowances

If you have a similar case best option is to Agree to the notice and revise the ITR. Just add the Allowances in the proper category. The net income for the example will be 2,537,145+2400+573028=3,112,573 the figure mentioned in Form 26AS.

For TDS just enter the figures from your Form 26AS.

Please check Procedure to file Revised Return here.

How to Revise ITR2 When Income tax notice is for variance but with Perquisites

If you have perquisites then you need to open Form 12BA and see the value of income from Salaries other than perquisites. Add 2400 to it. You need to show your perquisites and other allowances to as shown in the image below. How to enter the details in ITR2 as per Form 26AS, Form 12BA is shown below.

Please check Procedure to file Revised Return here.

Procedure to file Revised Return

To file Revised Income Tax Return gather following information:

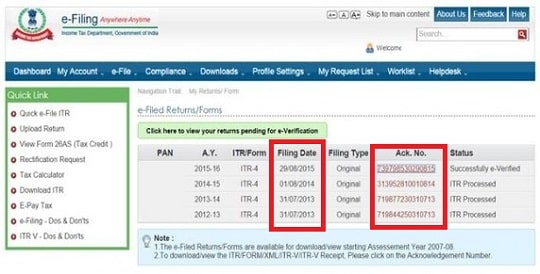

- Receipt No of Original Return

- Date of Submission of Original Return

To get it from the income tax filing website, login in and click on the ‘View Return’. You would see all the returns you have submitted electronically. Get the Ack.No number as well as filing date.

- Check for the discrepancy in the original return e-filed

- Log on to incometaxindiaefiling website

- Prepare Return just like like you filed the first time, correcting or filling what had got omitted earlier.

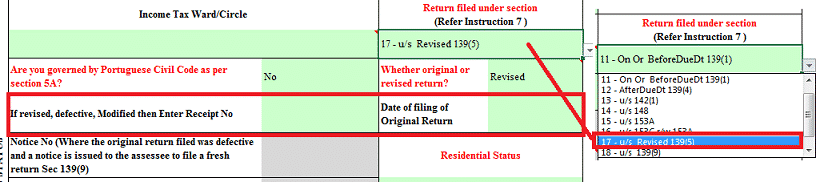

- Go to part of ITR with Filing Status , PART-A General, for example shown in image below (Fill Excel ITR form : Personal Information,Filing Status)

- For Whether original or revised return select R-Revised.

- For Return filed under section select Revised 139(5). So say No to Question Are you filing u/s 119(2)(b)/92CD

- Section 119(2)(b) is when you file income tax returns for a financial year, whose due date of filing income tax return and due date of filing belated income tax return has elapsed.

- Enter the E-filing acknowledgement receipt number from the ITR-V Which you would have got after filing the original return.

Our article How to file Revised Income Tax Return ITR explains it in detail.

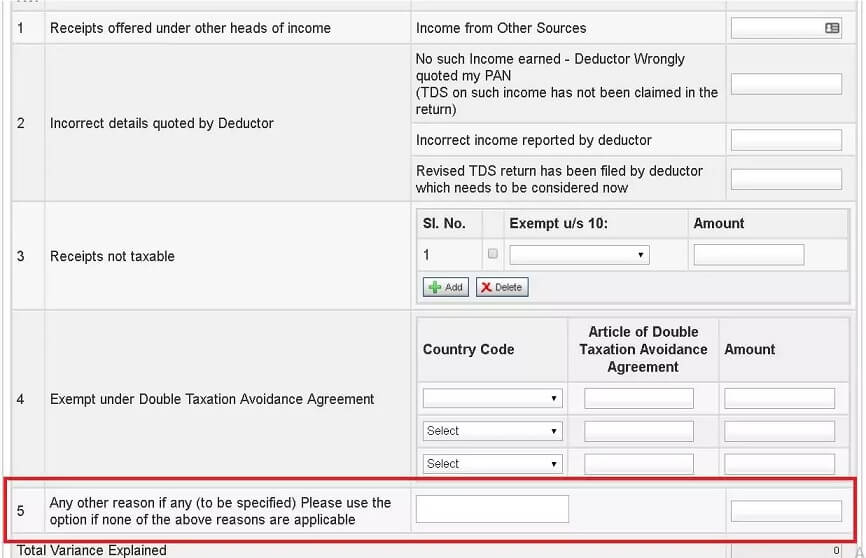

If you Disagree with Variance in Income from Salary and Form 26AS

If you disagree with variance in Income from Salary and Form 26AS then

- log into the income tax e-filing portal,

- click on e-proceedings,

- Click on respond and you will see (a) agree with an option to file a revised return (b) partially agree with an option to file a revised return and (c) disagree (I clicked this) as shown in the image below

Note: This article is evolving so please bear with us as we get more information. This article is for educational and informational use only. Please do not construe this as professional advice. Please consult a qualified financial tax consultant!

Related Articles:

- Understanding Form 26AS and What to Verify in Form 26AS?

- Understanding Form 16: Tax on income

- Understanding Form 12BA

- How to agree to income tax notice under 143(1)(a) due to variance in income and file revised

- Self Assessment Tax, Pay Tax using Challan 280, Updating ITR

- How to file Revised Income Tax Return ITR

Hope it helped in understanding why the Income Tax notice was issued? What does Income Tax Department consider income from salary, how to revise return. Please leave a comment if it helped /tweet/post on Facebook. If your case is different from the one taken in the article, you can mail the details to bemoneyaware@gmail.com.

I have received 1 year’s salary in arrears. However, my employer did not deduct income tax from the arrears amount and therefore have said that they would not update that amount on my 26AS. Now, total amount credited in 26AS is around 6 lakh but in ITR-1, I had to show around 12 lakh (6 lakh + arrears of 6 lakh). I have already filed 10E for relief u/s 89(1). My question is whether IT dept. will issue notice for greater amount of salary shown in ITR-1 form?

Thanks in anticipation.

Hi, I also have a notice u/s 143(1) for inconsistency in salary b/w 26as and ITR filled. The reason is due to exemption u/s 10 not disclosed separately (rather these exemptions were shown net off in the Row of “salary” in ITR. I disagreed explaining the variances, but a received another notice saying IT dept disagrees and they want me to respond again within 30 days.

I can file a revised return now, but I already paid interest u/s 234B. Does revising the return mean the interest will increase and be charged until the date of revised return? please advice

Revise the return and disclose the exemptions properly . If there is no change in total income in compare to previous return than there wont be any interest furthermore

Really appreciate the efforts of helping out individuals for 143(1) notice.

I have one doubt. I initially filed ITR2 and got the notice for 143(1)(a).

Can I file revise return with ITR1 ?

Yes u can file in different form bt before expiry of time limit given in the income tax act to file revise return

Sir, In my case they have sent me 143(1)

I checked out and found that i claimed 33k (21K Parents +12k family & self) in section 80D

Choose option Self and family, including Senior citizen parents. for which limit is 50k.

Still I got the intimation.

I’m not able to understand How CPC can send intimation of this? Have you heard such case yet?

Shall I reply to them via Disagreement?

Your blog is helpful.

Thanks!

Looking for your answers soon.

Sir without seeing the notice we cannot say anything.

We haven’t heard of such case.

Hello,

I have withdrawn EPF of INR 27,012 from 2 of my previous employers. They have not deducted TDS not have they shown this anywhere in Form 16.

However, i have calculated the figures and categorise as per below for ITR filing (note – i am yet to file ITR) –

Profits in lieu of salary – 6914

Income from other sources – 3236

Employee contributions to EPF – 16862 (this amount was not part of 80C investments for the years they were contributed).

My questions/concerns are –

(i) Since INR 6914 (which is Profits in lieu of salary) is not captured in form 26AS, i will get IT notice Income under Head Salaries in ITR does

not match Total Amount Paid/Credited in Form 26AS, am i right ? How do i deal with the notice ?

(ii) Would it make sense to add INR 6914 (Profits in lieu of salary) to Income from other sources ?

Appreciate if you can urgently advise me so i can file my ITR before deadline.

Hello,

I have withdrawn EPF of INR 27,012 from 2 of my previous employers. They have not deducted TDS not have they shown this anywhere in Form 16.

However, i have calculated the figures and categorise as per below for ITR filing (note – i am yet to file ITR) –

Profits in lieu of salary – 6914

Income from other sources – 3236

Employee contributions to EPF – 16862 (this amount was not part of 80C investments for the years they were contributed).

My questions/concerns are –

(i) Since INR 6914 (which is Profits in lieu of salary) is not captured in form 26AS, i will get IT notice Income under Head Salaries in ITR does

not match Total Amount Paid/Credited in Form 26AS, am i right ? How do i deal with the notice ?

(ii) Would it make sense to add INR 6914 (Profits in lieu of salary) to Income from other sources ?

Appreciate if you can urgently advise me so i can file my ITR before deadline.

Thanks,

Hi,

I also recieved notice due to variance becuase of HRA, leave exemptions, conveyance allowance and tax on employment and choosen disagree option and filed all details so can you please let me if it will be accepted or should i can change it. Thanks in advance.

hello,

In my case i disagreed to the intimation sent in May, 2018 and requested for exemption under sec-10. However it is another story that i choose the wrong sub-section sec-10(5) which is for LTA for claiming exempt against conveyance allowance. Today i got the cpc processed status after 3 month of disagreeing to the intimation with demand order generated. pls guide what process shall i follow now. thanks navin

Can you mail the notice details sent to our email id bemoneyaware@gmail.com

If we hide income of one month from last employer and filled the ITR for new employer with form no 16 and income from both employers is non taxable and There is no entry in 26 AS FORM from both the employer

1-Can we get the notice ???

And

Second question is

2- can we revised our ITR after notice issued by income tax department?

2-

Very nice article. Keep up the good work.

I also got the notice from IT. They didnt considered HRA hence the gross salary as per 26AS and what I declared is not matching.

At the same time there was a mistake from my end with regards to declaration of FD interest. So on one part IT is at fault and on another I am at fault. Under which section should I file the revised return?

139 read with section 119(2)(b)

139 read with section 92 CD

Section 142(1)

Hi !

My total salary for FY 17-18 is 534681 ,I did the job for 8 month in another company and then join new one ,I live in rented accommodation at ₹6000 per month but due to late /no submission of proof ,26 AS is showing gross salary of ₹5,34,681 ,New employer also deduct ₹4371 for PF and total professional tax for year is ₹2200 ,I would like to know that can I claim exemption of HRA ,Professional tax and deduction of EPF in ITR by showing the exemption amount at respective column or will it create mismatch with 26AS?

You would need to show details of two employers separately.

Details of second job should also be available in Form 26AS.

Our article How to Fill ITR when you have multiple Form 16 explains the process in detail.

My father had filed his IT return for AY 2017-18 on time. However, this May (2018), he has received a notice stating “There is inconsistency between salary income in return and Form 26AS”. The email from CPC also mentioned that we may exercise the option of filing a revised return, so that the omissions in the return of income can be completely taken care of within the meaning of section 139(5).

On checking, we found that we had not included the perquisites as part of the income.

We have filled the ITR 2 again in excel format with the perquisite information and also paid the required tax.

Now, in incometax website, while eFiling using this excel, there is a question – “Are you filing against the notice /order received from Income tax department?” If I select Yes, the only options provided for ‘Filing section’ are:

139 read with section 119(2)(b)

139 read with section 92 CD

Section 142(1)

Can you guide me on which option I need to select under this? Or, do we need to select No for the question – “Are you filing against the notice /order received from Income tax department?”

I am confused as there is a notice, and I am not sure where to map it.

Thanks a lot for your help and guidance in this matter.

You have to file the revised return under section Revised 139(5).

So say No to Question Are you filing against the notice /order received from Income tax department?

Really good article.

Please clarify, should I file a revised return to show medical reimbursement of Rs 15000/- which is exempted u/s 17(2). If yes, where in ITR-2 should I show this exemption?

What if the variance is due to medical reimbursements as per Section 17(2) ?

Where to show this in ITR-2

Thanks a lot for sharing this article..!!

I too received notice for ‘inconsistency in income from other sources’. There are two payouts which i can see in 26AS, considering both i can match up amount highlighted by Income Tax dept. First is earning from an online investment for which 10% TDS was already deducted while i got the monthly return. Second is for interest paid from previous employer on EPF. For which also 10% TDS is already dedcuted. I have also not received that amount in my bank, it should be in EPF account itself.

As TDS is already deducted for these two sources, what should be my response to notice that i got…?

Could you please help to advice.

TDS being deducted does not mean that your tax liability is over

For example, For FD interest is taxable as per income slab.

Bank deducts TDS at the rate of 10%.

So if one is in 30% income tax slab then one needs to pay extra tax as self assessment tax.

We need to know why TDS was deducted and did you cover your tax liability.

From the information you have provided we think that you owe tax, have to pay tax and file revised return.

It is best to consult an income tax lawyer.

If you want us to look at it in detail then we charge Rs 250 for looking at the data and suggesting.

You can mail the documents to bemoneyaware@gmail.com

Hi. This article is really very useful giving the steps as well as snapshots for the understanding. I have one primary doubt on the medicual reimbursement exemption: whether it comes under 80 D or other exemption section. Please clarify..

Section 17(2) of the Income-tax Act, 1961, provides that any reimbursement against medical expenses to an employee by an employer up to R15,000 in a year is exempt from tax, irrespective of whether it has been claimed in part or full.

Mediclaim premium paid can be taken as an income tax deduction u/s 80D separately.

Medical reimbursement’ is a payment made to employees against medical bills produced by them subject to their entitlement. The maximum tax benefit available is Rs. 15,000 per annum. Under this head, one may avail for the reduction in the taxable income for a maximum of or up to Rs. 15,000 for medical expenses during each financial year.

After verification of bills employer reimburses the employee.

If person is not providing medical bills, the entire amount would be taxable.

Please note that LTA and Medical Reimbursment cannot be directly claimed while filing your return. You can only claim it through your employer.

if you didn’t submit your medical bills your employer will deduct tax and pay you the remaining amount.

Thanks for the article. I too received similar notice and on checking found that i forgot to add other allowances under section 10. As per your suggestion filled a revised ITR 2 and then agree in response to notice and submit. Now my revised ITR and response is submitted and waiting for it to be processed.

Thanks for update Nitin.

Do let us know when you hear something from Income Tax Department.

hi,

I too received tax notice : “Income as per Form 26AS which has not been included in computing the total income in the return-143(1)(a)(vi)”

Difference of amount is equal to “allowances under section 10” plus “Tax on employment” between “Income as per Income Tax Return” and “Amount paid/credited as per Form 26AS”.

I have used cleartax website to fill my original ITR and the revised ITR. When I observe the revised ITR, “Details of Income from Salary” section’s “6-Income chargeable under the Head ‘Salaries’ (1+2+3+4-5)” still not matching with “Amount paid/credited as per Form 26AS” where as your “http://bemoneyaware.com/wp-content/uploads/2018/05/income-tax-variance-notice-form26as-revise-itr2.jpg” shows both same. Any reasons for this difference?

Cannot say till we see the Form 16, Form 26AS and notice.

If its ok, you can send these at bemoneyaware@gmail.com. We do not share data.

Mostly they match.

HI

Even I too have similar issue, and still I have not filed my ITR. So what are the best possible options to complete the process. Please suggest me.

Continue filing with difference (ITR & 26AS) and once I get notification should I disagree. ?

Or

Is there any way to mention u/s 10 exemptions in ITR1.

Thank you in advance.

Your blog is awesome, helping so many members. Keep it up 🙂

Thanks for kind words.

Please file your ITR on time , you can revise it later.

If you want some clarification, you can send details to bemoneyaware@gmail.com

Please go through our article How To Fill Salary Details in ITR1, ITR2 etc with breakup of salary for details.

Thanks for this informative blog post. I got similar notice because I failed to mention conveyance allowance of Rs. 19200 in my ITR 2. Based on information provided in your blog, I believe I need to file revised return this time with conveyance allowance mention under ‘Other allowances’ under Schedule S. Please confirm if this is correct understanding.

Hello,

Really a useful article to get detailed online help.

I too received the notice of intimation for variance in the income from other sources.

However, the tax department calculation shows the variance amount of 10,403 while in the form 26AS, the FD interest is 19,063.

For filing the revised return, which amount should I consider in the head – Income from other sources – 10,403 or 19,603?

Please go through our article How to agree to income tax notice under 143(1)(a) due to variance in income and file revised return which takes up the case of Fixed Deposit and ITR.

Hello,

Really a useful article to get detailed online help.

I too received the notice of intimation for variance in the income from other sources.

However, the tax department calculation shows the variance amount of 10,403 while in the form 26AS, the FD interest is 19,063.

For filing the revised return, which amount should I consider in the head – Income from other sources – 10,403 or 19,603?

Thanks for sharing this info, that too at the right time when we received the notice 🙂 In my case I received a similar notice saying Your return for AY 2017-18 bearing Ack. No. was taken up for processing and on verification it was found that it contains arithmetical errors/ incorrect claims/ inconsistencies with respect to Audit Report /Form 26AS and the same is indicated in the table annexed.

I found that it has excluded conveyance allowance. Would it be ok to disagree and Select an option under exempt u/s 10 that is related to conveyance? Also, how different is it from filing a revised return. Would be really helpful if you could please explain.

You can disagree and say conveyance allowance.

But notice was sent to you because the ITR was not filled properly.

But for this year please do fill the Salary details properly.

If you would Let us know what you chose and any update from Income tax department after it, we will appreciate it.

have referred your blog for this case and the given step-by-step procedure is really helpful to understand the given notice and further action.

I have decided to revise my tax returns due to the notice of mismatch of professional tax. I have followed the below approach.

1. Used Java utility and opened the last filed.xml file (original return).

2. Modified the “Schedule S” section to accommodate the professional tx

3. Tried to save the .xml. But it is not generating any .xml file.

How to solve this problem? Can you help on this?

Download latest utility and try it.

We tried it and it works

Have referred your blog for this case and the given step-by-step procedure is really helpful to understand the given notice and further action.

I have decided to revise my tax returns due to the notice of mismatch of professional tax. I have followed the below approach.

1. Used Java utility and opened the last filed.xml file (original return).

2. Modified the “Schedule S” section to accommodate the professional tx

3. Tried to save the .xml. But it is not generating any .xml file.

How to solve this problem? Can you help on this?

Regards,

Srini

Thank you very much for the very useful details.

If the amount difference is “Entertainment allowance” or “Allowance to the extent exempt under section 10”, there is no related option in Disagree. You have to file revised return and Agree the response.

while uploading the revised return I am getting error with xml file. it says XML schema is invalid. at line no 215 invalid content found starting with content invalid format address detail.

Does anyone know how to deal with this?

Check if there are some extra characters,

check if you are uploading against correct year.

Else try regenerating the XML and upload again.

If it still fails, you can send xml to bemoneyaware@gmail.com

If you are disagreeing in which column should you fill HRA and Conveyance Allowance?

Column 3 or Column 5

I think HRA should be filled in Column 3 but not sure where Conveyance Allowance should be filled.

Conveyance Allowance should go in Other Allowances.

Hi , I also got a similar notice. Thanks for the article , it is very helpful. In case the Gross Salary Variance is due to HRA and Conveyance Allowance then what is an advisable option to take – Agree/Revise Return OR disagree. Please advise.

Thanks Sir for kind comments.

We would recommend agreeing as the problem is that salary details have not been filled properly.

Adding the missing details does not incur any tax liability.

HRA would go in Allowance to meet expenditure incurred on house rent [(sec. 10(13A)]

Rest in Other allowances

But if there is a refund before notice will it be revised? ( difference between form 16 and form 26 as is due to hra and other allowances)

if the difference is due to medical allowances, there is no field in ITR2 to show exempt income for u/s 10 section.. can you clarify how to revise return for this?

Medical allowance is taxable. So it is not exempt under Income Tax Act. So you should agree, revise return and pay extra tax as demanded.

“medical reimbursement” and “medical allowance” are often used interchangeably. They are different terms that offer different tax treatment under the Income-Tax Act, 1961.

‘Medical reimbursement’ is a payment made to employees against medical bills produced by them subject to their entitlement. Medical reimbursement comes under Section 80D, wherein the maximum limit prescribed is Rs. 15,000 per annum.

Medical allowance is a fixed allowance paid to the employees of a company on a monthly basis irrespective of whether they submit the bills to substantiate the expenditure or not. If an employee is provided an allowance instead of reimbursement, it will be considered as part of the taxable component of the salary of the employee.

Hi. This article is really very useful giving the steps as well as snapshots for the understanding. I have one primary doubt on the above medicual reimbursement exemption: whether it comes under 80 D or other exemption section. Please clarify..

Section 17(2) of the Income-tax Act, 1961, provides that any reimbursement against medical expenses to an employee by an employer up to R15,000 in a year is exempt from tax, irrespective of whether it has been claimed in part or full.

I have the same problem and diff is about 84414.

HRA 62814

Conveyance allowance 19200

Tax on Employement 2400

Can i go ahead and click on disagree and mention above thing. The only problem is for Conveyance and Tax on employment there is no section and i have to fill in other reason.

Will it be accepted? Please suggest.

My difference was 16000 due to missed professional tax and medical allowance. I need to file revised return or can i disagree and enter details .

We would recommend you to agree and revise your return

Mobil no chang

Nice sharing with good information

useful informative post sharing

Thanks. Good to know you liked it.

If the variance is due to u/s 10 deductions like HRA etc .than what to do revise return or disagree and select reasons as listed in e proceedings.

Yes, you can.

Please go through the section How to Revise ITR2 When Income tax notice is for variance in Exempted Allowances which includes HRA.

After you input the HRA details, your net salary doesnt reduce. Check your screenshot, the net salary is same after deduction of professional Tax. Here the HRA is only for disclosure purpose and not deducing you correct net salary.

Net salary in row 6 (income chargeable under salaries ) and after 7 with the exemption in HRA will be same as these are exemptions and are for record purpose

Thanks for the post. Is filing a revised return required as there’s no mention of it while disagreeing? Also, in the dropdown not all options are available that are tax exempt (e.g. medical reimb, sodexo vouchers etc.). And there’s no way to attach Form 16 too.

What is supposed to be done in this case? Is only mentioning total variance amount in ‘Other’ section sufficient or filing a revised return with correct figures in all necessary fields is required?

I believe If you disagree then there is no option or requirement to revise return. Just choosing correct options in drop-down should be fine.

Thanks for pointing out Umang. You have to revise return if you fully or partially agree.

Article has been updated.