In another step towards cleaning black economy, the govt has launched operation clean money campaign. Data mining exercise under Operation Clean Money will be undertaken in several phases over the next two years. Under Phase 1 of Operation Clean Money launched by the Income Tax department on January 31 2017, the department had sent SMS and emails to 18 lakh people who have made suspicious deposits of Rs 5 lakh and above between November 10 and December 30, 2016.This article talks about how to check whether you have received the notice or not for cash transactions 2016 deposited during demonetization? How Income Tax Department used Big Data Analytics to come up with the list?

Nearly half of the 18 lakh people under the I-T scanner for suspicious bank deposits, after the cash ban, have been put in the doubtful category, but action against them will follow only after the new tax amnesty scheme,Pradhan Mantri Garib Kalyan Yojana, ends on March 31.

Even if you have not received any message and did not deposit much money, do check your e-filing account to see if there is notice for you. If you get a mail/SMS or you have a notice you need to respond within 10 days of getting the message. If the department is convinced with the reply of the assessee, the case will be closed and that will be communicated by SMS and email.

Table of Contents

Operation Clean Money a Huge success

The operation has seen an overwhelming response and till 12th February 2017 more than 5.27 Lakh taxpayers have already submitted their response. Out of the 7.41 Lakh accounts confirmed by the 5.27 Lakh taxpayers, the cash deposit amount has been confirmed in more than 99.5 per cent accounts. The Department is encouraged to note that taxpayers have increased the cash deposit amount in nearly 90,000 accounts and provided details of additional 25,000 bank accounts in which cash was deposited. The explanation of cash deposit submitted by the taxpayer is being analysed in the context of nature of business and business profile in the earlier returns of the taxpayer.

This exercise has identified around 4.84 lakh taxpayers not yet registered with the e-filing portal. SMS have been sent on the mobile number of these unregistered persons. Income Tax Department is keeping a vigil on the PAN holders who have still not registered on the e-filing portal or who have not yet submitted their online response. Such taxpayers are advised to register themselves at the e-filing portal https://incometaxindiaefiling.gov.in. and submit an online explanation.

In order to facilitate online responses, the last date for their submission has been extended up to 15th February, 2017 and a detailed Frequently Asked Question (FAQs) has also been issued to assist the taxpayers in submitting their response. The taxpayers should submit their response within this further extended period with a view to avoid enforcement actions under the Income-tax Act and other applicable laws.

How to check whether you have received notice under Operation Clean Money?

Data mining exercise under Operation Clean Money will be undertaken in several phases over the next two years. In the first phase, around 18 lakh persons have been identified whose cash transactions do not appear to be in line with their tax payment profile. Even if you have not received any message and did not deposit much money, do check your e-filing account to see if there is notice for you. Overview of how to check for Cash Transactions is given below.

- Login into your e-filing account on the income tax department website https://incometaxindiaefiling.gov.in which has PAN as the and keep your password handy.

- If you are not yet registered on the e-filing portal (at https://incometaxindiaefiling.gov.in) you should register by clicking on the ‘Register Yourself’ link.

- Registered taxpayers should verify and update their email address and mobile number on the e-filing portal to receive electronic communication.

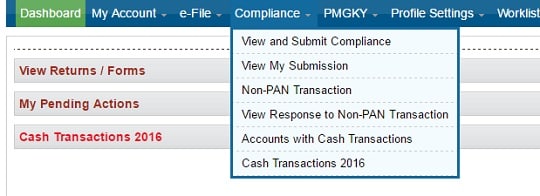

- Click the Cash Transactions, 2016 option from the drop down list under Compliance section.

- If there is no cash deposit-related compliance against your profile, it will show the message: Presently, you are not required to submit any response. You may check again later. Please ensure that your email and mobile is updated in the profile.

- However, if you did make deposits that are out of tune with your past returns, it will reflect the details of transactions related to cash deposits between 9 November and 30 December 2016. In such a case, you will be further required to submit responses, which can be done online.

Overview of how to submit response to the notice received for Operation Clean Money

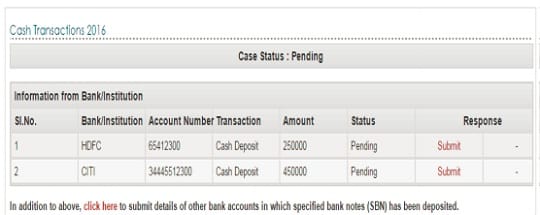

ITD has enabled online verification of these transactions to reduce compliance cost for the taxpayers while optimising its resources. If you get a mail/SMS or you have a notice you need to respond within 10 days.The response to the notice has to be submitted in two steps given below. A detailed user guide on Income tax website is available on the portal to assist the taxpayer in submitting the online response. If you face of any difficulty in submitting on line response, help desk at 1800 4250 0025 may be contacted. If you have cash transactions then screen will similar to shown below

- The first step is to acknowledge whether the transaction information belongs to you or not. For each transaction, you can choose: “The account relates to this PAN” or “The account does not relate to this PAN”.

- If you choose The account relates to this PAN, you will be directed to the next step where you have to respond about the details of the transaction.

- you need to confirm that the amount mentioned in the transaction or deposit is correct. If there is a mismatch in what you deposited and the amount against which the department is seeking your response, you can mention the correct amount you had deposited in the bank account.

- Give details about the deposited amount. Please take utmost care while responding about the source of deposited money. Based on the information provided by the individual, the department will take further necessary action.

- If you claim that the deposited cash was out of earlier income or savings, you may need to provide additional information, which will be matched with your income tax returns filed earlier.

What happens after submitting the response to the Cash Transactions 2016 Notice?

The response of taxpayer will be assessed against available information. Data analytics will be used to select cases for verification, based on approved risk criteria. If the case is selected for verification, request for additional information and its response will also be communicated electronically. The information on the online portal will be dynamic getting updated on receipt of new information, response and data analytics.

If the department is convinced with the reply of the assessee, the case will be closed without any need to visit Income Tax Office and that will be communicated by SMS and email. But, in case of unsatisfactory reply, the decision to issue notice will be taken by Assistant Commissioner and Commissioner rank officers,

In case explanation of the source of cash is found justified, the verification will be closed. The verification will also be closed if the cash deposit is declared under Pradhan Mantri Garib Kalyan Yojna (PMGKY).

How did Income Tax Department check the Cash Transactions?

During the demonetisation period when old notes of Rs 500 and Rs 1000 were no longer legal tender, individuals were asked to visit their bank branches to exchange or deposit the old notes. If the account was KYC compliant, there was no limit on cash deposits into the account.

Income Tax Department used its data bank to run all deposits during the 50-day window provided post demonetisation to get rid of junked notes. This method of examining a large amount of data to uncover hidden patterns, correlations and other insights is called Big Data Analysis or Data Analysis. With today’s technology, it’s possible to analyze huge data and get answers from it almost immediately. Income tax department used Data analytics for comparing the demonetisation data with information in Income Tax databases about ITR filed.

Data mining exercise under Operation Clean Money will be undertaken in several phases over the next two years. First phase was verifying the cash deposits in the bank account. The second phase of the Operation Clean Money is expected to begin after the compilation of the responses received in the 10-day window gets completed. Since the first phase included only the analysis of data of cash deposits after demonetisation, the subsequent phases will widen the scope to other financial transactions such as sale of gold by jewellers, which will be matched with their respective tax returns.

Phase 1 of Operation Clean Money: Cash Deposits

Under the Operation Clean Money, which began from February 1, 2017 the income tax department after risk analysis and matching of cash deposits data with profiles of taxpayers had detected over 1 crore accounts wherein the cash deposits exceeded Rs 2 lakh after demonetisation.

I-T department has compiled data that shows there are over one crore accounts, each with post-demonetisation deposits of over Rs 2 lakh. These accounts involve unique Permanent Account Numbers (PAN) of 70 lakh people. Out of these 1 crore accounts, the tax department sent communications initially to 18 lakh taxpayers whose cash deposits after demonetisation did not match their taxpayer profiles.

The Initial phase of the operation involved e-verification of large cash deposits made during 9th November to 30th December 2016. They segregated the deposits of those persons who have deposited Rs 5 lakh or more and deposits between Rs 3 lakh and Rs 5 lakh of suspicious nature and who have poor tax compliance. As the Prime Minister has clearly said that (for deposits) up to Rs 2.5 lakh we will not ask (questions), that data has been put aside at the moment.

- For examples, deposits of Rs 3 lakh are “justified” if a person has an annual taxable income of Rs 10 lakh and the tax department will “not touch” him. Or if companies show a cash in the balance sheet of Rs 10 lakh and have deposited Rs 5 lakh, the tax department will not scrutinize those.

- But if you have deposited Rs5 lakh and you have not filed return of last three years, that you may be called for scrutiny Similarly, if you file income tax return (ITR) of Rs 2.5 lakh income but you deposit Rs10 lakh in different bank accounts, then the income tax department will ask for it.

- And if there is large deposit may be more than a crore of rupees, and if it is not matching with ITR filed, then the man would be taken for law enforcement. What is the law enforcement will be is still not clear

In the first batch, around 18 lakh persons have been identified in whose case, cash transactions do not appear to be in line with the tax payer’s profile. The Income department has and will send emails and SMSes to these 18 lakh account holders, for submitting online response on the e-filing portal giving them ten days to provide an explanation about their source of funds. Don’t ignore these messages. If you ignore the message, income tax notices would be sent for further action.

The information in respect of these cases is being made available in the e-filing window of the PAN holder after login at the portal https://incometaxindiaefiling.gov.in. The PAN holder can view the information using the link “Cash Transactions 2016” under “Compliance” section of the portal. The taxpayer can submit online explanation without any need to visit Income Tax office.

Taxpayers who are not yet registered on the e-filing portal (at https://incometaxindiaefiling.gov.in) should register by clicking on the ‘Register Yourself’ link. Registered taxpayers should verify and update their email address and mobile number on the e-filing portal to receive electronic communication.