This page lists all the articles for understanding basics of Income Tax. If you have income there is a tax. To understand Income Tax we need to understand what is Income, Income Tax slabs, Types of Income, the tax on different types of Income when it is taxed, dates and year related to Income Tax, tax cut i.e TDS, how to see TDS, how and when to pay advance tax, how to pay tax due.

The income earned between 1 Apr 2020 to 31 Mar 2021, called FY 2020-21 will be assessed for tax in the AY 2021-22. The last date for filing returns is 30 Sep 2021. Our article How to File ITR for FY 2020-2021 or AY 2021-2022 talks about it in detail.

Table of Contents

Important Tax Dates For Individual for Income Tax

| Date | What to do |

| 31st July | File ITR |

| 15th Jun | 1st installment of advance tax for individuals for current FY |

| 15th Sept | 2nd installment of advance tax for individuals for current FY |

| 15th Dec | 3rd installment of advance tax for individuals for current FY |

| 15th March | 4th installment of advance tax for individuals for current FY |

- If there is no pending tax to be paid, you may file your return without paying any penalty by 31 March of that Assessment Year.

- But if you still have a tax liability, you will have to pay monthly penal interest on the tax due if you file your return by 31 March of Assessment Year.

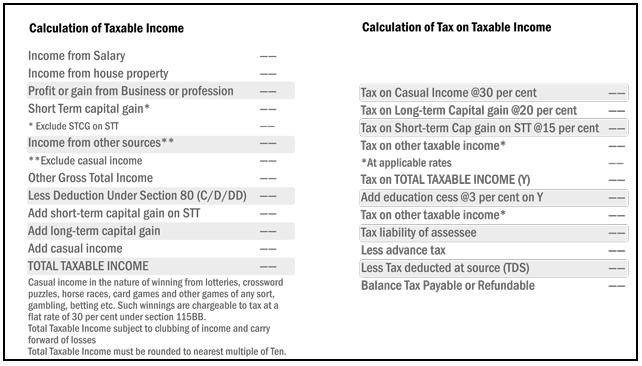

How to Calculate Income Tax

Income tax filing and processing comprises of following stages. Our article Everything about Income Tax: Basics,How to fill ITR, Income Tax Notices for how to file Income Tax Return

-

- Computation of total income.

- Claiming TDS deducted, Advance Tax paid

- Deducting valid deductions to save tax(80C, 80D).

- Determination of the tax payable.

- Filling ITR

- Paying the Self Assessment tax if any and updating ITR.

- Submitting ITR.

- E-verifying ITR / Sending ITR-V

- Processing of ITR : Either Processed / Notice

The following image shows how to calculate Income Tax.

Basics of Income Tax Return

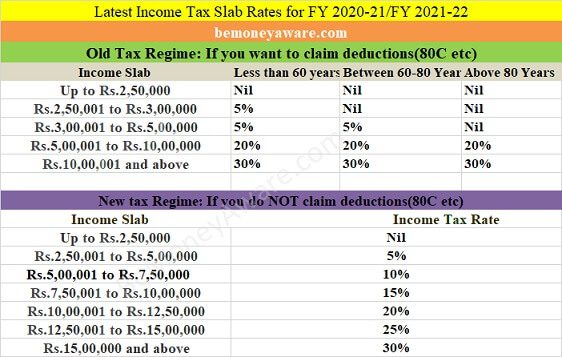

Income tax in India is charged based on one’s income, more the income more the tax. Tax is on a range of income called the income slabs. There are 5 types of Income.

- What is Financial Year and Assessment Year, Difference, ITR,Fiscal Year of World

- Income Tax Overview

- Income Tax for Beginner

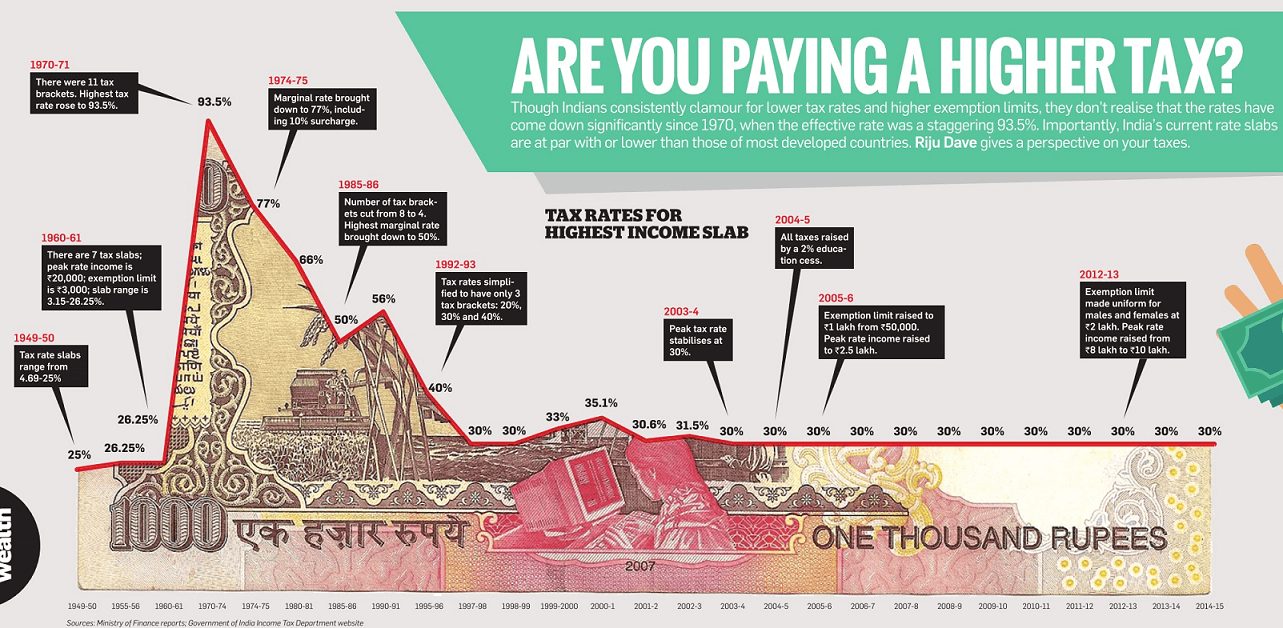

- Understanding Income Tax Slabs, Tax Slabs History

- Financial tasks you should complete before 31 March

- Senior Citizen and Tax

- NRI and Income Tax

Income Tax Slabs for FY 2020-21/FY 2021-22 are

| Surcharge | 10% of tax where total income exceeds Rs. 50 lakh

15% of tax where total income exceeds Rs. 1 crore 25% on income between Rs 2 crores to Rs 5 crores 37% on income between Rs 5 crores to Rs 10 crores |

||

| Education Cess | Health & Education cess: 4% of tax plus surcharge | ||

| Tax Rebate | Rs 12,500 for income up to 5 lakh under/section 87A | ||

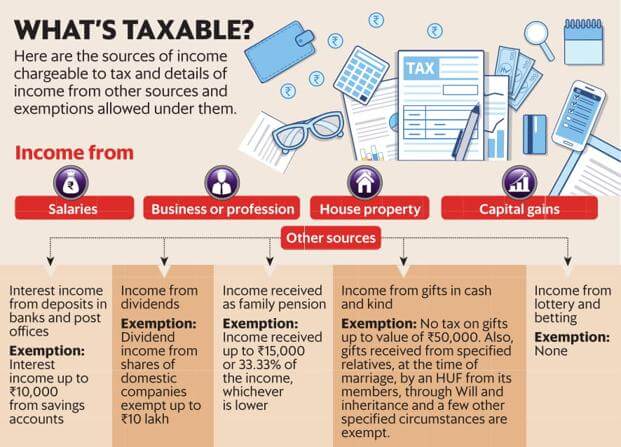

Types of Income

The gross total income is the sum of all sources of income that an individual has or the total income he earns in a financial year. It can fall into one of the five heads:

- Income from Salary:

- Income from House Property: Any residential or commercial property that you own will be taxed. Even if your piece of real estate is not let out, it might be considered earning rental income and you will need to pay tax on it. If you have taken a home loan, then claiming Interest on Loan also comes under this category.

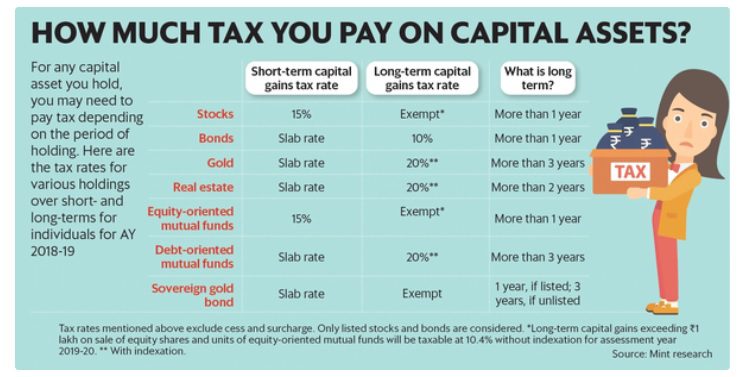

- Income from Capital Gains: When you sell Stocks, Bond, Gold, Land or Property, Mutual Funds you need to pay a tax called as Capital gain tax. It is classified as Long Term Capital Gain Tax(LTCG) and Short Term Capital Gain(STCG) based on the asset you sold, the time period you owned the asset.

- Income from Profits and Gains of Business or Profession: Income earned through your profession or business is charged under the head ‘profits and gains of business or profession.’ The income chargeable to tax is the difference between the credits received on running the business and expenses incurred

- Income from Other sources such as the interest of Saving Bank Account, Fixed Deposit, Recurring Deposit, Senior Citizen Saving Scheme(SCSS) needs to be shown in the Income Tax return. Any income which does not fall under the heads of Salary, House Property, Business & Profession and Capital Gain will fall under the head Income from Other Sources.

TDS and Form 26AS

TDS is a certain percentage deducted at the time of payments of the various kind of Income such as salary, commission, rent, interest on dividends etc and deducted amount is remitted to the Government account.

For example, an employer deducts TDS on the income of his employee every month and gives Form 16 to show TDS deducted. One may have to deduct TDS when one buys property or pays rent above Rs 50,000

- The employer/bank/financial institution will deduct TDS as per TDS rate.

- To avoid TDS, Self-declaration in Forms 15G /15H can be filed by the deductee if his income doesn’t exceed the amount chargeable to tax (Ex Senior Citizen)

- The employer/bank/financial institution issues you a TDS certificate, Form 16/Form 16A which shows this deduction.

- TDS also shows up in Form 26AS. (You should verify it)

- You need to claim TDS while filing ITR.

- Tax liability might be different from the TDS deducted (Ex TDS on FD is 10% but Tax is as per income slab).

- You need to Pay Additional tax before filing ITR (Advance Tax or Self Assessment Tax)

- Mostly All those persons/institutions who are required to deduct tax at source have to obtain Tax Deduction and Collection Account Number or TAN (Exceptions are TDS on Rent, Buying property)

Articles

- Basics of Tax Deducted at Source or TDS

- Fixed Deposit over multiple Financial Years, Tax and ITR

- Viewing Form 26AS on TRACES

- What to Verify in Form 26AS?

When one needs to Pay TDS : Buying property, Paying rent

Advance Tax, Self Assessment Tax and Form 26AS

- Advance Tax:Details-What, How, Why

- Section 234A,234B,234C : Interest Penalty for not paying Expected IncomeTax on Time

- Self Assessment Tax, Pay Tax using Challan 280, Updating ITR

ITR: Income from Other Sources, Exempt Income

- Income From Other Sources :Saving Bank Account, Fixed Deposit,RD and ITR

- Interest on Saving Bank Account : Tax, 80TTA

- Exempt Income and Income Tax Return

- Fixed Deposit , Interest , TDS, Tax,Income Tax Return, Refund

- Fixed Deposit in Name of Wife: Clubbing,Tax,TDS, ITR,Refund

House Property and Income Tax Return

- Tax : Income From House Property

- Income from House Property and Income Tax Return

- Tax and Income From One Self Occupied property

- Tax and Income from Let out House Property

- Pre-Construction Home Loan Interest and ITR

- Joint Home Loan and Tax

- Terms associated with Home Loan

Capital Gains and Income Tax Return

- On Selling a House,

- Capital Loss on Sale of House

- Cost Inflation Index,Indexation and Long Term Capital Gains

- Capital Gain Calculator

- How to show Long Term Capital Gains on sale of House in ITR

How to Calculate Income Tax

Advance Tax, Self Assessment Tax and Challan 280

- Advance Tax:Details-What, How, Why

- Section 234A,234B,234C : Interest Penalty for not paying Expected IncomeTax on Time

Challan 280

- Challan 280: Payment of Income Tax

- Paying Income Tax Online, epayment: Challan 280

- Challan 280 : Paying Income Tax offline

- How to Correct Challan 280

- Self Assessment Tax, Pay Tax using Challan 280, Updating ITR

- Reprint Challan 280 or Regenerate Challan 280

Videos on Income Tax

- Filing ITR : Video on Steps to File ITR, Ways to File,Documents required

- Video on Which ITR to Fill

- What is Income Tax (14 min) Understanding what is income and Income slabs

Income Tax for various years

Income Tax for AY 2016-17 or FY 2015-16 : Last date for filing returns is 31 Jul 2017.

Income Tax for FY 2017-18 or AY 2018-19

Income Tax For Employee i.e Salaried

Form 16

- Understanding Form 16: Part I,

- Understanding Form 16: Chapter VI-A Deductions,

- Understanding Form 16: Tax on income

- Understanding Form 16 – Part 3

Allowances

- HRA Exemption,Calculation,Tax and Income Tax Return

- How to show HRA not accounted by the employer in ITR

MNC

Senior Citizen and Tax

NRI and Income Tax

- NRI and ITR :TDS,Tax and Income Tax Return

- Bank Accounts for NRI:NRO,NRE,FCNR, Their comparison

- NRI : Fixed Deposits, DTAA

- How to report Incomes from India while filing US tax returns