Exchange-traded funds (ETFs) and Index funds are giving better returns race than actively managed large-cap funds in the recent past. Is it a current market phenomenon? Or is beginning of a trend? In our article What are Index funds? What are ETFs? Do Index Funds Work? we have discussed Index Funds and ETFs and had just touched the reasons on whether Index Fund or ETF Work. In this article, we shall look in detail about Does Index Fund or ETF work? Will they work in India

Table of Contents

Why people don’t talk about Index Funds or ETF or Passive Investing?

No Distributor will recommend Passive Funds like Index Funds and ETFs. Fund house will also not recommended. Reason being unki roji roti ka sawaal hai. Distributors get a commission, while Fund Managers and his team earn from the Expense Ratio. Expense Ratio of Index Funds is less than that of Active Managed Fund. Would these guys be paid if they recommended passive index funds?

In 2016 when Mutual Funds disclosed the incomes of their Fund Manager, Prashant Jain, Executive Director and Chief Investment Officer (CIO) with HDFC Mutual Fund, earned Rs 6.16 crore as a salary component and Rs 16.33 crore from ESOPs(granted over the period of 2008-2013). Our article How much do Mutual Fund Managers earns discusses it in detail.

Give a monkey enough darts and they’ll beat the market

In 1973 a Princeton University professor Burton Malkiel claimed in his bestselling book, A Random Walk Down Wall Street, that “A blindfolded monkey throwing darts at a newspaper’s financial pages could select a portfolio that would do just as well as one carefully selected by experts.”

Article by Research Affiliates highlighting the simulated results of 100 monkeys throwing darts at the stock pages in a newspaper discussed in Forbes Article of 2012, Any Monkey Can Beat The Market

This 8-minute video by Coffee Break beautifully explains about the Monkey on Wall Street.(A Must watch)

Efficient market hypothesis

Efficient market hypothesis (EMH) formulated by Eugene Fama in 1970, suggests at any given time, prices fully reflect all available information about a particular stock and/or market. Fama was awarded the Nobel Memorial Prize in Economic Sciences jointly with Robert Shiller and Lars Peter Hansen in 2013.

According to the EMH, no investor has an advantage in predicting a return on a stock price because no one has access to information not already available to everyone else. You can’t profit from it by saying its undervalued or overvalued. In fact, market efficiency does not require prices to be equal to fair value all the time. Prices may be over- or undervalued only in random occurrences, so they eventually revert back to their mean values. As such, because the deviations from a stock’s fair price are in themselves random, investment strategies that result in beating the market cannot be consistent phenomena.

In efficient markets, prices become not predictable but random, so no investment pattern can be discerned. A planned approach to investment, therefore, cannot be successful. In fact, the EMH suggests that given the transaction costs involved in portfolio management, it would be more profitable for an investor to put his or her money into an index fund. Furthermore, according to EMH an investor who outperforms the market does so more out of luck than skill due to the laws of probability: at any given time in a market with a large number of investors, some will outperform while others will underperform.

According to Investors like Warren Buffet and Peter Lynch markets are inefficient and you can get bargains because Market doesn’t value stocks correctly.

Counter-arguments to the EMH state consistent patterns are present. For example, the weekend effect is the tendency for stock returns on Monday to be lower than those of the immediately preceding Friday. Studies in behavioural finance, which look into the effects of investor psychology on stock prices, also reveal investors are subject to many biases such as confirmation, loss aversion and overconfidence biases.

In the discussion with Fama, Richard Thaler(Noble Prize Economics 2017 ) distinguishes two aspects of the efficient-markets hypothesis: “One is whether you can beat the market. The other is whether prices are correct.”

On the first aspect, Fama and Thaler are in agreement: generally, even professional mutual fund managers fail to consistently beat the market, after subtracting management costs (Michael Jensen from Harvard University first provided evidence for this hypothesis in this paper).

Is Indian Market InEfficient?

For a market to be efficient,

- A market has to be large and liquid.

- Accessibility and cost information must be available to investors at more or less the same time.

- Transaction costs have to be cheaper than an investment strategy’s expected profit

US market is supposed to be efficient. Vanguard’s total stock market ETF, VTI, became the third ETF to surpass $100 billion in assets.

but India market was not supposed to be efficient because its size was small, It was dependent on Foreign Institutional Investors (FIIs), the research on companies is limited, not all information is available to the consumer.

FII = Foreign Institutional Investors (Institutions from foreign countries investing in Indian markets are FII’s) Eg: Morgan Stanley, the Pension fund of Canada etc.

DII = Domestic Institutional Investors (Institutions in India investing in Indian markets are DII’s) Eg: LIC, HDFC Mutual Fund(AMC) etc.

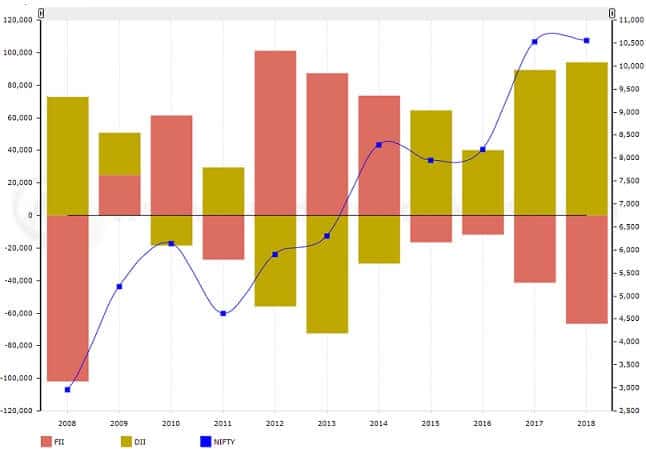

But now India is seen as a reforming economy with the prospects of strong long-term growth. A major factor that has changed is that the domestic buyer now sets market prices as shown in the image below(Data: FII vs DII). What has saved the markets from a potential mayhem is the Rs 97,739.02-crore investment by domestic institutional investors (DIIs) in 2018 which has kept the indices in the green zone on a year-to-date basis. Domestic mutual funds had bought equities worth $15.3 billion against $8 billion by foreign investors in 2017.

Many companies in the Indian market are less than 100 crores so it can be easily manipulated as big investors or funds which bring in huge capital can shift the price direction or trend.

The number of investors in Equity, especially through Mutual funds, are increasing.

Interested readers can also read this paper EFFICIENCY OF INDIAN STOCK MARKETS: A STUDY OF NSE

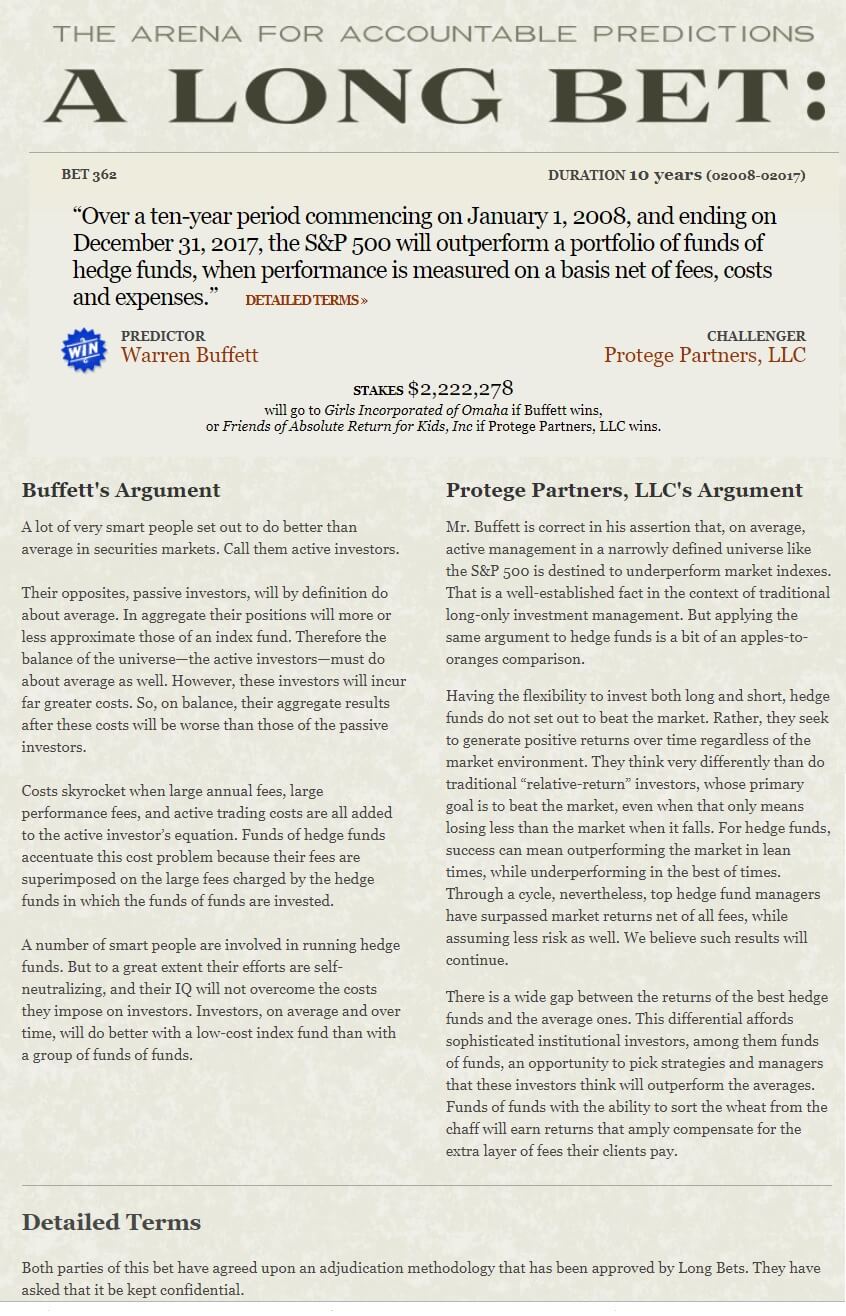

Warren Buffet Won Bet With hedge funds for investing in Index Funds

In Dec 2017 Warren Buffet won the bet of a million dollars that he had placed in 2007. The bet was that an index fund would outperform a collection of hedge funds over the course of 10 years. He said that by investing in a boring, low-cost stock index fund you could outperform most hedge funds. Over the course of the bet, the S&P 500 index fund returned 7.1% compounded annually, significantly more than the basket of funds selected by an asset manager at Protégé Partners. That basket only returned an average of 2.2%.

Buffett and Protégé Partners originally put about $320,000 each into bonds that would appreciate to $1 million over the course of their wager. But the bonds appreciated much faster than expected as interest rates fell so the two sides agreed to go for a bigger prize. In late 2012, they agreed to buy 11,200 shares of Berkshire B shares, which cost $89.70 at the end of 2012. They’ve climbed 121% since then. After Friday, the last day of trading in 2017, those 11,200 shares are worth $2.22 million.

In his shareholder letter, Buffett said he believed the hedge fund managers involved in the bet were “honest and intelligent people,” but added, “the results for their investors were dismal – really dismal.” And he noted that the two-and-twenty fee structure generally adopted by hedge funds (2% management fee plus 20% of profits) means that managers were “showered with compensation” despite, often enough, providing only “esoteric gibberish” in return.

More details on the Bet at Investopedia article which also provides fodder for arguments on both sides. While Buffett won according to the terms of the bet, the hedge fund side showed the merits of a bit of extra tweaking and pruning following the 2008 crash, which put them ahead of Buffett’s Vanguard fund until 2012. The details of bet can be found at http://longbets.org/362 which are given below.

Debate on Whether one should invest in Index Funds or not?

Given below are the two YouTube videos, one by Varun Malhotra(Director EIFS) who explains why Mutual funds are not such a great investment and why Index funds are a much better alternative for stock market beginners. It is 1st of the 4 videos. He is a finance educator giving wealth sessions with even jawans of BSF.

The other video is by Pranjal Kamra, who says learn the complete truth about index funds and why you should stay away from index funds in India and prefer active mutual funds. He sells his Value Investing Course and How to pick good Mutual Funds.

Bemoneyaware Conclusion

Movies from good actors like Thugs of Hindustan from Aamir Khan failed and movies of Ayushman Khurana (Badhai ho, Andhaduaan) have done well in 2018.

Kuch to log kahenge for anything, any topic, the more educated the more discussion. We personally think Index investing has some merit. Sensex and Nifty are best companies and if they don’t do well, well not only would they be removed from the Index but there is a high probability that other companies would not do well.

After recategorization of mutual fund schemes, we feel that instead of Large Mutual Funds one can invest in Index Mutual Fund. We have personally started SIP in an Index Mutual Fund. For Midcap and multi-cap we are still going with the active investing.

Related Articles:

- What are Index funds? What are ETFs? Do Index Funds Work?

- Stock Market Index: The Basics

- All About Mutual Funds: Basics, Choosing, Paperwork, Direct Investing explains

What do you feel about Passive Investing like Index Funds and ETFs? Does it make sense? Do you believe in Wolf of Wall Street or the Monkey of Wall Street? Do you invest in Index Funds or ETF?

ETFs can contain all types of investments including stocks, commodities, or bonds. ETFs offer low expense ratios and fewer broker commissions than buying the stocks individually. Thanks for sharing great article.