Petrol and Diesel Prices in India are affected by changing prices of Crude Oil. This article covers, How much crude oil India produces and imports? Common terms related to Oil, OPEC, BRENT CRUDE, WTI and DUBAI, OPEC. Impact of Taxes on Petrol and Diesel Prices. How Oil, Petrol and Diesel Prices have changed over the years?

Table of Contents

Basics about Crude Oil, Petrol

First, let us get some basic rights and understand what we mean by crude oil. There are 3 kinds of Crude oil use in the World: Brent, WTI and Dubai/Oman. India imports more than 70% of its oil requirements. The crude oil (extracted in India or imported) is refined in 23 refineries in the country into useful products such as petroleum, gasoline, diesel fuel, asphalt base, heating oil, kerosene, liquefied petroleum gas, jet fuel and fuel oils. The Indian economy is impacted by the rise of crude oil prices. High Petrol and Diesel Prices in India are due to Taxes imposed by the Govt.

India Crude Oil, ONGC, IOC, BPCL, Reliance

India produces nearly 30 % of the Petroleum it needs and the rest it has to import from other countries.

Most of the crude in India is extracted by ONGC & IOC. The largest reserves are found in the Western Offshore (Mumbai High, Krishna-Godavari Basin) (40%), and Assam (27%). The largest reserves of natural gas are located in the Eastern Offshore (38.13%) and the Western Offshore (23.33%).

The crude oil (extracted in India or imported) is refined in 23 refineries in the country. Crude oil is refined into useful products such as petroleum , gasoline, diesel fuel, asphalt base, heating oil, kerosene, liquefied petroleum gas, jet fuel and fuel oils. Public sector unit like Indian Oil Corporation (IOC),BPC (Bharat Petroleum), HPC(Hindustan Petroleum) and refineries of Private players (2 of Reliance. Jamnagar Refinery is the biggest refinery in India).

According to Petroleum Planning & Analysis Cell, the Indian basket of crude oil is a derived basket comprising of sour grade (Oman & Dubai average) and sweet grade (Brent dated) processed in Indian refineries in the ratio of 74.77 to 25.23. India imported 213.93 million tonnes (MT) of crude oil 2016-17 for USD 70.196 billion or Rs 4.7 lakh crore.

Types of Crude Oil: Brent, WTI and Dubai

- Brent: Brent is low-density crude oil with low sulphur content (sweet). It is extracted from the North Sea and comprises of Brent Blend, Forties Blend, Oseberg and Ekofisk crudes. Since it is low-density and low-sulphur oil, it is ideal for refining into diesel, petrol and other fuels.

- WTI: WTI is crude oil extracted from wells in the US. WTI is also light and sweet but since it is extracted in land-locked areas instead of sea, it becomes difficult from the transportation point of view. The WTI crude oil is sent via pipeline to Cushing, Oklahoma.

- Dubai/Oman: Dubai/Oman crude oil is of slightly lower quality, putting it in sour grade. It is a basket of crude oil from Dubai, Oman or Abu Dhabi. The composition of Dubai/Oman and Brent in the Indian basket of crude oil is decided on the processing capacity of oil companies. Dubai/Oman crude oil is popular in the Asian market.

Why there is a price difference between Brent and WTI

Brent prices are heavily influenced by decisions taken by the Organization of the Petroleum Exporting Countries (OPEC). As of September 2018, the 14 member countries accounted for an estimated 44 percent of global oil production and 81.5 percent of the world’s “proven” oil reserves. A larger group called OPEC+ was formed in late 2016 to have more control on global crude oil market OPEC, the oil cartel, can control Brent prices by deciding to increase or decrease oil supplies. Due to the COVID-19 pandemic, the demand for OPEC oil has fallen to 30 years low in the second quarter of 2020.

While WTI gets influenced by Brent’s trading price, it is still largely dependent on the US production

Calculating Crude Oil Cost 2020

Below is Crude Oil Cost Comparison from 3rd March to 14 March 2020

| 1st January 2020 | 14 March 2020 | |

| International Price of Crude Oil with Ocean Freight (round off) | 67$ per Barrel | 35 $ per Barrel |

| Currency Exchange Rate | Rs 71.4 / USD | Rs 73.96 / USD |

| Crude Oil in Indian Currency | Rs 4784 | Rs 2588 |

| 1 Barrel of Crude Oil | 159 Litre | 159 Litre |

| Crude Oil – Cost per Litre | Rs 30.08 per Litre | Rs 16.28 per Litre |

As can be seen that even after Depreciating Currency, the Crude Oil Cost is 40% lower in March 2020 than as what was in January 2020. But the Benefits are not what passed on to consumers

Taxes on Petrol and Diesel

Taxes account for half of the price we pay for petrol and diesel. Taxes vary in different states and hence there are variations in retail prices. Petrol and diesel do not come under the purview of goods and services tax (GST). Other factors in retail price of petrol and diesel include excise duty, VAT, BS IV premium, marketing cost and margins, dealers commission etc. Here is a break up of taxes imposed on fuel prices in Delhi.

On June 16, 2017, the central government allowed oil companies to revise prices fuel daily. If both Central and state governments removed all taxes, petrol would cost only Rs 40.55 per litre in Delhi. The Centre charges an excise duty of Rs 20.66 per litre. Additionally, states charge as sales tax or value added tax anywhere between 16.6% (Goa) and 40% (Greater Mumbai Region). Both could cut taxes to lower fuel prices. However, both rely heavily on tax revenues from petroleum products. Ref: Times Of India Article.

Simplified Calculation Chart for Petrol & Diesel Prices in New Delhi – (as on 14 March 2020)

| Petrol Price Calculation* | Diesel Price Calculation * | |

| Crude Oil – Cost per Litre (14 March 2020) | Rs 16.28 per Litre | Rs 16.28 per Litre |

| Basic OMC Cost Calculation * | ||

| Entry Tax, Refinery Processing, Refinery Margins, OMC Margin, Freight Cost, Logistics | Rs 12.2 per Litre | Rs 15.8 per Litre |

| Basic Cost of Fuel after Refining Cost | ||

| Indicative Price as on 14 March 2020 | Rs 28.48 per Litre | Rs 32.08 per Litre |

| Central Government Taxes & Dealer Commission | ||

| Additional: Excise Duty + Road Cess as Charged by Central Government |

Rs 22.98 / Litre on Petrol | Rs 18.83 / Lit on Diesel |

| Commission to Petrol Pump Dealers | Rs 3.55 per Litre | Rs 2.49 per Litre |

| Fuel Cost Before VAT | ||

| Cost as on 14 March 2020 | Rs 55.01 per Litre | Rs 53.4 per Litre |

| VAT Calculation | ||

| Additional:VAT (Varies from State to State – 27% on Petrol & 16.75% on Diesel + 25p as Pollution Cess with Surcharge) (14th March 2020) | Rs 14.86 / Litre on Petrol | Rs 9.18 / Litre on Diesel |

| Final Retail Price as on 14th March 2020 in Delhi | Rs 69.87 per Litre | Rs 62.58 per Litre |

Are high Petrol and Diesel prices due to high Oil Prices?

The government might be blaming crude prices for record high petrol and diesel rates, but the last time petrol crossed 76 per litre, five years ago, it was 40 per cent costlier before taxes.

Fuel prices have shot up now because of very high taxes. Central tax on diesel has increased more than three-fold, and it has doubled in case of petrol. In 2016-17, the Centre earned 2.7 lakh crore from taxes and duties on petroleum products, which is 117 per cent higher than the 1.3 lakh crore it earned in 2014-15 when NDA came to power.

Taxes on Diesel also have increased

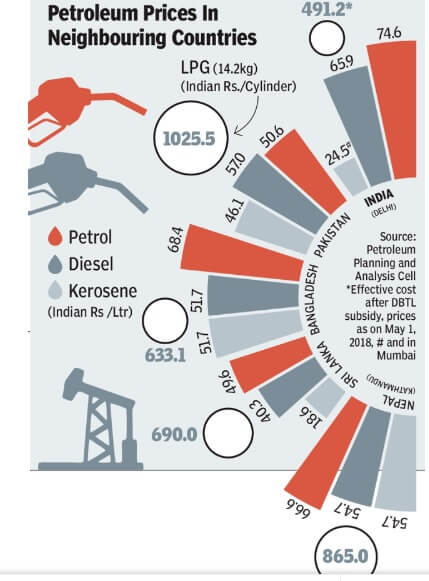

Comparison of India LPG, Petrol prices with Other Nations

How much oil does India import, consume?

India imported 213.93 million tonnes (MT) of crude oil 2016-17 for USD 70.196 billion or Rs 4.7 lakh crore.

Oil demand growth in India and China is expected to slow down significantly, according to an IEA oil market report released on June 6. The report forecast that China’s oil demand growth in the current quarter would drop from 270,000 b/d year on year to 460,000 b/d in Q1. The report also forecast that India’s growing demand would drop from 360,000 b/d Q1 to 265,000 b/d in Q2.

According to a Reuters report, India imported approximately 705,000 barrels of oil per day from Iran in May 2018. This is the highest amount of oil imported from Iran since October 2016. It does not appear to be slowing down any time soon, even with the United States threatening to pose more sanctions on Iran. Iran officials expect oil imports from Iran to drop significantly in June, as US sanction pressures are mounting, urging several Indian refiners to keep purchases to a minimum. A dispute between Indian state refiners and Iran officials pushed for oil import cuts for 2017/18. The dispute stemmed from development rights of a gas field. However, it did not take long for refiners to rethink their decision after Iran offered them excessive shipping discounts. Current plans are to raise oil imports in the current fiscal year.

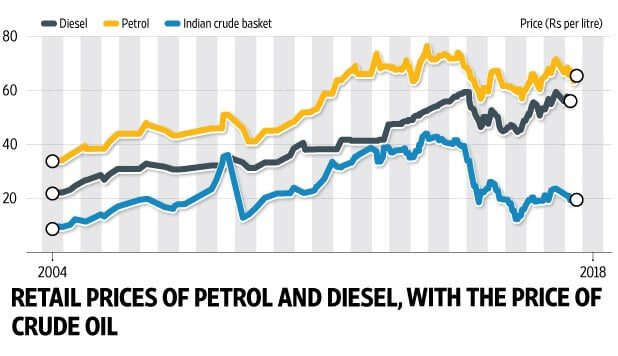

How Oil, Petrol and Diesel Prices have changed over the years

The image below compares the retail prices of petrol and diesel in Delhi since 2004 with the price of the Indian crude basket (a mix of sour grade and sweet grade crude oil in the ratio that is used by major refineries in India). The latter number is normally expressed in terms of dollars per barrel, but for purposes of comparison, it has been converted to rupees per litre (using the prevailing exchange rate on the respective dates and the fact that a barrel holds about 159 litres of crude oil). Sadly India does not have Oil ETFs. Many countries like the US have Oil ETF which are a very popular instrument, as they offer high yields and can be found in equity and commodity asset classes.

- The chart shows that the retail prices of petrol and diesel dropped in late 2014, but the drop was not comparable to the drop in the price of India’s crude oil basket. Once again in 2015-16, when crude prices dropped diesel and petrol retail prices held firm.

- Note that During the second term of the United Progressive Alliance (UPA) between 2009 and 2014, there was a global surge in crude oil price but petrol and diesel prices were perhaps kept artificially low in 2008

Impact of High Oil Prices

The Indian economy is impacted by the rise of crude oil prices. Consumers should expect to see price increases in retail and grocery stores, as the prices at the pump continue to rise. The rise in crude oil prices adversely impacts the current account deficit. The import bill will increase, but this will be offset by better remittances and the increase in oil exports.

Oil Price Affect on Inflation

Oil price affects the entire economy, especially because of its use in the transportation of goods and services. A rise in oil price leads to an increase in prices of all goods and services. It also affects us all directly as petrol and diesel prices rise. As a result, inflation rises. A high inflation is bad for an economy. It also affects companies – directly because of a rise in input costs and indirectly through a fall in consumer demand. This is why the rise in global crude prices comes as a bane to India.

Oil Price Affect on Current account balance

India is one of the largest importers of oil in the world. It imports nearly 80% of its total oil needs. This accounts for one third of its total imports. For this reason, the price of oil affects India a lot. A rise in price would drive up the value of its imports. This helps widen India’s current account deficit – the amount India owes to the world in foreign currency. A rise in oil prices by $10 per barrel decreases the GDP growth by around 0.2-0.3% and worsens the CAD by $9-10 billion.

Oil Price Affect on Rupee exchange rate

The value of a free currency like Rupee depends on its demand in the currency market. This is why it depends to a great extent on the current account deficit. A high deficit means the country has to sell rupees and buy dollars to pay its bills. This reduces the value of the rupee. A rise in oil prices is, thus, bad for the rupee.

Common Terms associated With Crude Oil

OPEC

The Organization of the Petroleum Exporting Countries (OPEC) is an intergovernmental organization of 15 nations. As of 2018, the 15 countries accounted for an estimated 44 per cent of global oil production and 81.5 per cent of the world’s “proven” oil reserves, giving OPEC a major influence on global oil prices. It was founded in 1960 in Baghdad by the first five members (Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela), and headquartered since 1965 in Vienna, Austria. This 4 minute video by CNBC explains beautifully

BRENT CRUDE, WTI and DUBAI

Crude oils are not all the same, but rather vary in colour, composition, and consistency. They are generally classified as” light” or “ heavy”, and “sweet” or “sour”. it’s easier for refiners to make gasoline and diesel fuel out of low-sulfur, or “sweet,” crude than oil with high sulfur concentrations. Low-density, or “light,” crude is generally favourable to the high-density variety for the same reason.

Unlike water, crude oil is not a chemical compound. Rather, it is a complex mixture of molecules, consisting of compounds formed from hydrogen and carbon atoms, called “hydrocarbons”. Just as water boils at 212 degrees Fahrenheit, each of the compounds in crude oil has its own boiling temperature. In general, the more carbon atoms in the hydrocarbon molecule, the higher the temperature at which it boils and vaporizes. It is this phenomenon that permits crude oil to be refined into so many different products.

Most oil is priced using Brent Crude as the benchmark. However, in the United States, West Texas Intermediate is the preferred measure.

BRENT North Sea Brent crude was discovered in the early 1960s. It is now sourced primarily by the United Kingdom, Norway, Denmark, the Netherlands and Germany. These days, “Brent” actually refers to oil from four different fields in the North Sea: Brent, Forties, Oseberg and Ekofisk. Crude from this region is light and sweet, making them ideal for the refining of diesel fuel, gasoline and other high-demand products. And because the supply is water-borne, it’s easy to transport to distant locations. Brent crude oil is not as light or as sweet as its counterpart, West Texas Intermediate oil.

West Texas Intermediate (WTI): WTI refers to oil extracted from wells in the U.S. and sent via pipeline to Cushing, Oklahoma. The fact that supplies are land-locked is one of the drawbacks to West Texas crude – it’s relatively expensive to ship to certain parts of the globe. The product itself is very light and very sweet, making it ideal for gasoline refining, in particular. WTI continues to be the main benchmark for oil consumed in the United States.

Dubai/ Oman: This Middle Eastern crude is a useful reference for oil of a slightly lower grade than WTI or Brent. A “basket” product consisting of crude from Dubai, Oman or Abu Dhabi, it’s somewhat heavier and has higher sulfur content, putting it in the “sour” category. Dubai/Oman is the main reference for Persian Gulf oil delivered to the Asian market.

This 2 min video explains different types of oils

India Crude Basket

Indian Basket is a representation of a derived basket of crude oils comprising sour (Dubai and Oman) and sweet (Brent) processed in Indian oil refineries. During the year 2016-2017, the ratio was 72.38: 27.62 (Dubai: Brent). The Indian Basket is a weighted average of daily prices and is updated daily on the website of the Petroleum Planning and Analysis Cell of the Ministry of Petroleum and Natural Gas. It is used as an indicator of the price of crude imports in India and the Government of India watches the index when examining domestic price issues.

Oil ETF

Oil commodity exchange-traded funds provide a simple way to expose your investment strategy to the price and performance of oil, without actually owning any oil itself. Oil ETFs consist of either oil company stocks or futures and derivative contracts that track the price of oil, or in some cases oil-related indexes. Many countries like the US have Oil ETF which are a very popular instrument, as they offer high yields and can be found in equity and commodity asset classes.

Related Articles:

- How much to pay for LPG cylinder , How much LPG subsidy I will get

- Base fare, UDF,Passenger Fees and Fuel Surcharge: Fees and charges of Airlines

- Booking Tatkal Ticket

Dear sir While making a Self Assessment Tax challan for assessment year 2018-19, I wrongly wrote the assessment year as 2017-18 and the challan has been processed by the bank and also I get the BSR Code and challan number. I have following queries

1. Can i file the revise return of previous year i.e. assessmnet year 2017-18 and claim the refund of the extra amount deposited ?

2. As the time frame to get the assessment year rectified by the bank has already expired , how much time the AO will take to rectify the assessmnet year keeping in view the last date to file the returns for the current assessment year is very near ?

Thanks in advance

useful informative post thanks to sharing

Thanks