US Market is the hub of global companies with a wide geographical reach and a high growth potential. What makes the US Stock Market lucrative? What are the Risks in Investment in the US Stock Market? How to invest? Stocks or International Mutual Funds? How can an Indian invest in the US stock market to have a chance to earn high returns by extending their investment portfolio?

Table of Contents

What makes the US Stock Market lucrative for Indian Investors?

The reasons why the US Market is lucrative for investors over the world are:

- Biggest Economy in the World: The US Economy is also known as an economic superpower and it accounts about 25% share in the Gross World Product. These figures signify the dominance of the US Market in the world.

- Presence of Global Companies: The US Market has a number of Global Companies having high growth potential. They offer fast growth and better returns in comparison to investing in other companies locally.

- Technological Dominance: The US Market offers a competitive edge to the investors due to their innovative nature. The technological dominance nature of these companies makes them a strong player in the market. Some of the renowned players in the industry include Google, Facebook, and Apple.

- Strong Reach among customers: The US Market has a strong reach among customers due to its strong customers base. For example, companies like Amazon have a strong market share. More than 75% of people in the US use Amazon for their daily purchase.

- Children Education: Indians are planning or sending children abroad for higher education, international holidays. Given this, it makes sense to diversify geographically.

- Diversification: Investing in International funds offer investors a number of advantages especially in terms of Diversification.

All these factors make the US Market a highly lucrative market among investors. The High Net Worth Individuals and Retail Investors in India find the market a highly lucrative market for investment and long-term growth potential. The image below shows different markets such as US, India have performed in different years.

Risks in Investment in the US Stock Market

The foreign stocks are exposed to a number of risks. The investors are therefore required to identify the following things to ensure that their investment is made in the right direction.

- the Currency Fluctuations: As you will be investing in US dollars you have to be prepared for currency risk, due to fluctuations. For example, in Oct 2018, the value of the dollar versus rupees was $1 = Rs. 72.5 and in Apr 2019 it has reached $1 = Rs. 69.0. This, in turn, could impact the net asset value (NAV) of the fund. For example, if the rupee depreciates against the dollar, you will get more rupees for every dollar invested in that region and your NAV could be higher. On the contrary, if the rupee appreciates against the dollar then you get fewer rupees for every dollar invested there and your NAV will take a hit to that extent.

- The volatility of Market: You would have to understand and worry about the Indian market as well as the US market.

- Understanding Financial statements of the US Companies.

- Taxes and Capital Gain.

Taxes on Investment in US stock market

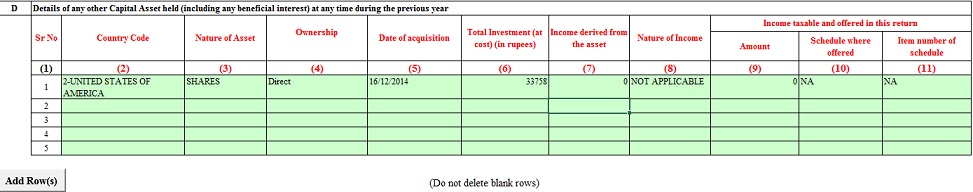

If you buy stocks of US or of other countries then it becomes your Foreign Income and it needs to be reported in the Income Tax Return(ITR2)

When you get a Dividend From US stocks Companies generally roll out dividends on the stock in order to distribute profits. This is shown as Income from Other sources(like Dividend in Indian stocks)/ For US stocks Tax is deducted at a flat rate of 25%, the balance of 75% will be paid as a dividend. However, due to the Double Tax Avoidance Agreement (DTAA), the tax deducted in the US can be claimed against the tax liability in India. One gets Form 1042-S which shows Tax Deducted. One can claim it by filing Form 10.

When you sell stocks of the USA or of other countries then the Capital Gain comes into play and the tax rate is based on how long you hold the stocks.

- Long-term Capital Gains These are applicable in the cases where the stocks are held for more than 24 months(For Indian stocks it is 12 months). The tax has to be paid @20% (plus surcharge, if applicable and cess) with indexation. (for Indian stocks LTCG is taxed at 10% for more than 1 lakh)

- Short-term Capital Gains In short-term capital gains, stocks are held for a short period of time i.e. less than 24 months. In this case, the tax is required to be paid at the income tax slab rate, same as the Indian Stocks

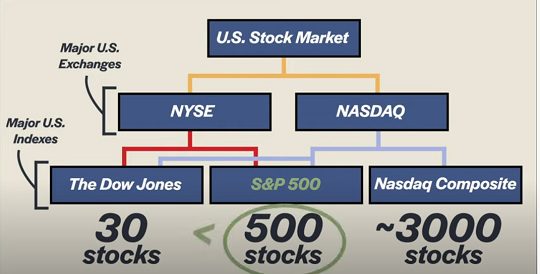

Popular US Stock Market Indices

The USA has different Indices to measure the performance of the companies. The US Indices are the representation of the various sectors of the economy. An investor must understand these Indices to better understand the industry and to ensure that their funds are raised in the right direction. The popular US Indices are Dow Jones, S&P 500 & NASDAQ. They differ in what companies are in the index and in what proportion. Our article Difference between Dow Jones, S&P 500, Nasdaq covers it in detail.

How can you invest in US markets?

You must know about the rules and regulations of India that define how much amount you can invest and the do’s and don’ts that you must keep in your mind while you are investing your money.

There are three ways to invest in US stocks,

- You have a brokerage account with Indian Brokers. The Domestic Broker that offer such facilities includes ICICI Securities, Kotak Securities, India Infoline, Reliance Money, and Religare. These Brokers have a tie-up with the foreign brokers that allow the investors to invest in the foreign market.

- You have a brokerage account with Foreign Brokers

- invest in the US focused International mutual funds in India e.g. ICICI, Franklin, etc.

For investing through brokerage firms, you are allowed to invest under the LRS (Liberalized Remittance Scheme) up to $250,000(around 1.7 crore) per year per person.

For investments in US focused mutual funds in India, there is no limit for India residents as investments are made in India. You can invest in International mutual funds or International Fund of Funds and invest in INR in India only.

International Mutual Funds

There are certain International Mutual Funds that invest in the US Stock Market. Investors can identify how much a mutual fund invests in which stock and if they find a Mutual Fund with a maximum stake in their preferred company then it would be the best option to opt for. Our article International Mutual Funds: What are these, Pros and Cons, Tax covers International Mutual Funds in detail.

The popular International Funds that are traded in India include:

- Franklin India Feeder – Franklin US Opportunities Fund

- ICICI Prudential US Bluechip Equity Fund

- DSP BlackRock US Flexible Equity Fund, etc.

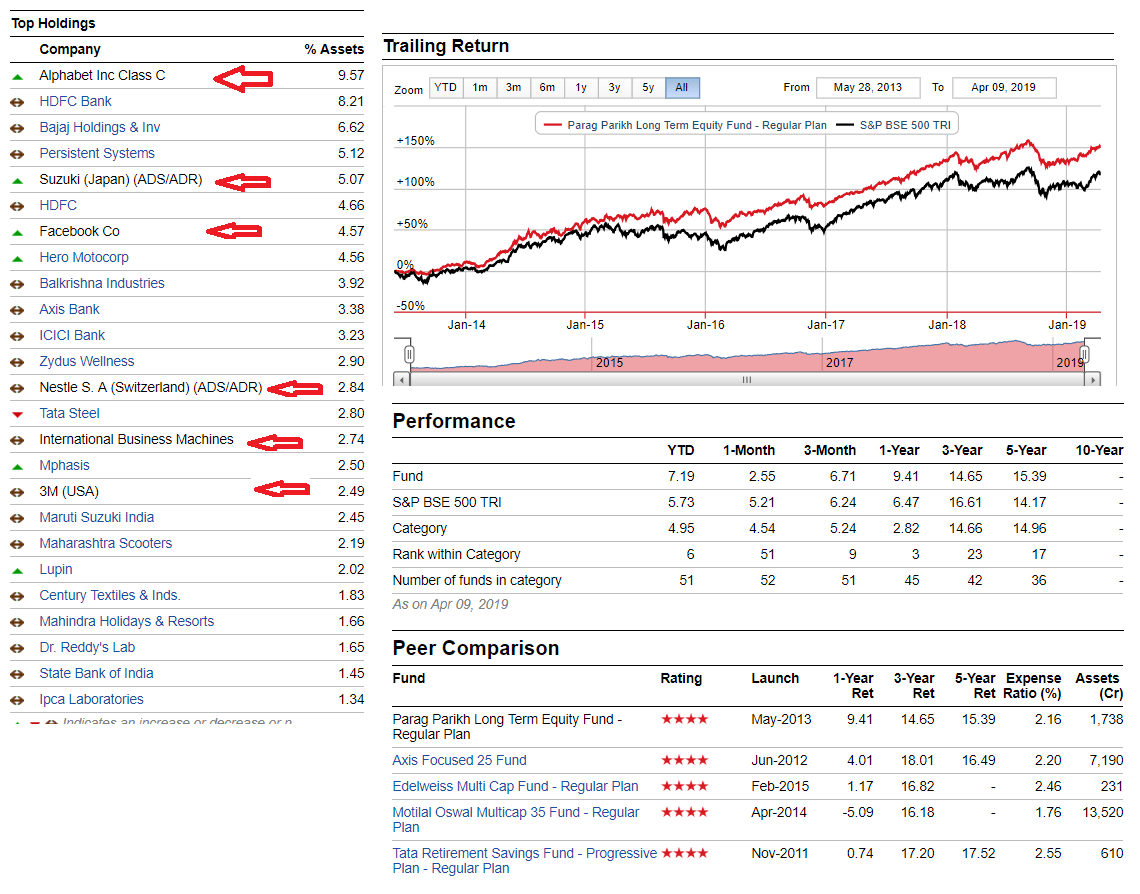

Besides these, there are also Mutual Funds like Parag Parikh Long Term Equity Fund that invest in both the Domestic and International marketplace.

The investors are required to research the Mutual Funds that invest a maximum stake in their preferred stock and accordingly they can invest in that.

Things to be kept in mind

- Identify AUM (Assets Under Management): AUM helps in identification of the overall value of the assets that a mutual fund holds. The investors are required to look at the AUM so that they get an impression about the fund i.e. whether it is a good fund or not.

- Actively Traded: The fund should be actively traded so that an investor can easily get out of it. If the fund is not actively traded then users will not be able to find sufficient buyers when they want to sell the fund.

Liberalized Remittance Scheme (LRS)

Under the Liberalised Remittance Scheme, Authorised Dealers may freely allow remittances by resident individuals up to USD 2,50,000 per Financial Year (April-March) for any permitted current or capital account transaction or a combination of both. The Scheme is not available to corporates, partnership firms, HUF, Trusts, etc.

The LRS limit has been revised in stages consistent with prevailing macro and microeconomic conditions. During the period from February 4, 2004 till date, the LRS limit has been revised as under:

| (Amount in USD3) | |||||||

| Date | Feb 4, 2004 | Dec 20, 2006 | May 8, 2007 | Sep 26, 2007 | Aug 14, 2013 | Jun 3, 2014 | May 26, 2015 |

| LRS limit (USD) | 25,000 | 50,000 | 1,00,000 | 2,00,000 | 75,000 | 1,25,000 | 2,50,000 |

Investing in the US Stock Market through Domestic Broker

Domestic Broker can help the investors open their overseas trading account through which they can start investing in the international stocks. The Domestic Broker that offer such facilities includes ICICI Securities, Kotak Securities, India Infoline, Reliance Money, and Religare. These Brokers have a tie-up with the foreign brokers that allow the investors to invest in the foreign market.

Requirements:

- KYC Requirement The investors are required to do KYC. This is almost the same as that required in trading in the Indian trading account.

- Form A2 Under FEMA(Foreign Exchange Management Act of 1999). This form is required to be filled by the Investors and they have to give a declaration.

Once it is done, you can start trading up to a limit of US $2,50,000.

Things to be kept in mind:

- No Margin facility available: The traders are required to give complete money in advance as there is no margin.

- No Short Selling: The facility of Short selling is not there as is there in the Indian Market. Once you buy a stock it will be credited to your account in the cycle of T+2

Investing in the US Stock Market through Foreign Broker

Foreign Brokers that are based in India can also help you in opening your trading account. Once your account is set-up, you can then buy and sell the US stocks directly. Some of the brokers are Charles Schwab International Account, Interactive Brokers, and others.

In both these ways, you would need to consider a few things in your mind that impacts the overall profit earned by you in the investment. These things include:

Brokerage Charges: Identify how much brokerage amount is charged by the broker; compare the brokers and select the one which caters to your needs.

Currency Conversion Charges: While you buy and sell the stocks, you would need to change the currency in both the cycles. A change in the currency (rise or fall ($ vs INR)) may eventually impact your overall returns. Therefore, while you make a transaction you must account the currency fluctuations and utilize the changes for earning the maximum returns on your investment.

Portfolio of Parag Parikh Long Term Equity Fund

Parag Parikh Long Term Equity Fund is different from other equity-oriented mutual fund in India, as this fund is one of only a handful of Indian mutual fund schemes to invest in a basket of Indian and foreign stocks. It was launched in May 2013. PPFAS Long Term Equity Fund has around 27 per cent of its total portfolio invested in overseas equities with investments in Alphabet(Google), Facebook etc. As per the Sebi guidelines, AMC can only invest up to 35 percent of their AUM in international stocks.

Details about PPFAS Long Term Equity Funds can be found on Value research website here. A snapshot of its portfolio and returns is given below.

Video on Where to Invest in India Stock Market or US Stock Market

This 7 minute video by Varun Malhotra talks about Where they should invest. In mature markets such as the USA or emerging markets such as India.

Related Articles:

International Mutual Funds: What are these, Pros and Cons, Tax

How to report Dividend Income in ITR?

- Understanding Equity Saving Funds, Arbitrage, Taxation

- What are Balanced Mutual Funds

- Understanding ELSS Funds or Equity Linked Saving Schemes

- MF Utility: How to buy and Sell Mutual Funds Directly

- Investing in Equities: Stocks vs Mutual Funds

- Get started with Mutual Fund investing: KYC, Platform

Now that you have understood the process of Investing in the US Stock Market, you can explore investing in the US stock market. Do you think it makes sense to invest in US market? Have you invested in US market or some other market? How has been your experience?

Great article! In this article, you have given very useful information which will help beginners to get knowledge about how to invest in us. but before invest in foreign, you should remember The recipe for a successful foreign investment portfolio includes solid research, some help from a reputable expat-friendly financial advisor, a dose of pragmatism and plenty of common sense. As long as you have all these ingredients, you can prudently manage your foreign investments

Can GIFT in GUJARATH, in anyway replace THE FUNCTIONING of the Indian Brokers or foreign brokers in buying Foreign stocks and or MFs’ of international MFs or ETFs?

What do you want to do?