Priya had an arranged marriage. She has a professional degree and a well-paying career. She is settled with a husband(from the same community), Suhas, who also earns well. At the time of the wedding, her parents had given her jewelry and other gifts as per their tradition and custom. Hence when her parents passed away without leaving a will, her brothers expected to inherit their estate with no share for their sister. Are they right? How much right Priya has on her husband’s Suhas property & wealth? What is she had married outside her caste? What if instead of Priya , it had been Salma or Suzie? What are the Inheritance rights of women in India?

Table of Contents

Inheritance Rights in India

Right of Inheritance is passing of the property, titles, debts, rights, and obligations to another person on the death of an individual. Inheritance rights Differ based on Will or No Will, Whether the property is ancestral or self-acquired. Our article Inheritance Rights in India covers it in detail.

When a person dies his or her assets are distributed amongst the persons as specified in the will. While nominations help in transferring movable assets like bank deposits or insurance policies, a will takes legal precedence over a nomination.

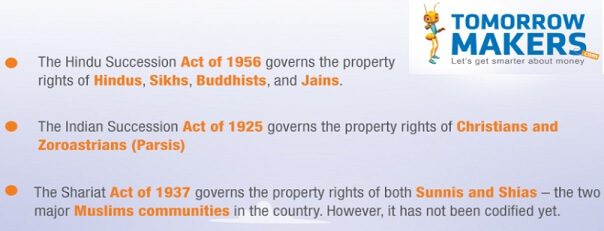

However, if a person who dies didn’t leave a will, technically called intestate, then the assets would be distributed according to the law based on his or her religion. This is technically called as non-testamentary succession. As India has no uniform civil law and hence personal laws based on religion guide the rights. The succession of Hindu, Jain, Buddhist and Sikh is governed by the Hindu Succession Act. Muslim succession is governed by the Muslim Law and Christians are governed by the Indian Succession Act.

It is important to understand what can be defined as ancestral property, separate and self-acquired property. As the rights differ based on it. ancestral property. It is the property which was inherited by three generations of male lineage – father, his father (grandfather), his grandfather (great-grandfather). That is, the property should have been in the family for four generations and not have been divided at any point in time.

There is no inheritance or gift tax if the property is inherited from a relative or is acquired through a will. Once inherited, any source of income, such as rent or interest, is transferred to the new owner and he must pay tax on it.

Tax is levied on capital gains when the inherited property is sold. The gain is based on the period for which the property is held by the owner. This also includes the period for which it was held by the previous owners.

Once succession to the immovable property is confirmed, the heir must apply for mutation of property in his own name. Mutation updates the government records and doesn’t act as a transfer of title. Once you acquire the property, you can reside in, lend or sell the property.

Inheritance right of Hindu Women

Inheritance right of Hindu Wife

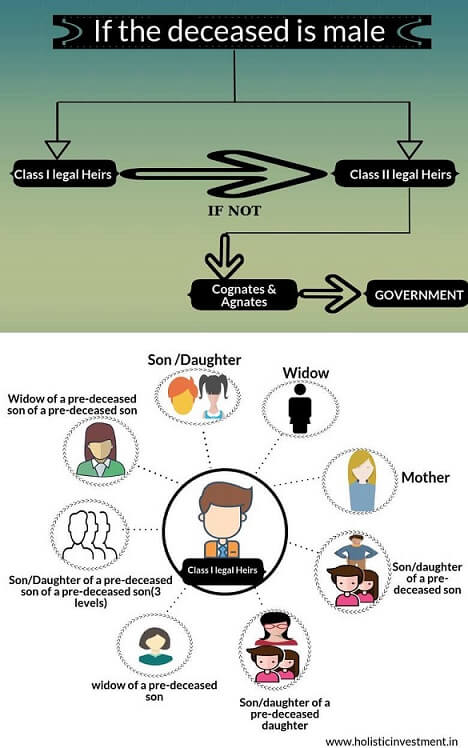

A wife is considered a Class I heir and gets an equal share along with other surviving Class I heirs.

If a couple is divorced, then the settlement happens at the time of severance and an ex-wife has no rights over a deceased man’s estate.

If a man has more than one wife, meaning he has remarried without divorcing his first wife, then the other wives cannot inherit anything (but her kids can).

Inheritance right of Hindu Daughters

The amendment to the Hindu Succession Act in 2005 ensures equal rights to daughters in the ancestral property. Before 2005, only sons inherited the ancestral property. After the amendment, daughters have an equal share in the inheritance, ancestral and self-acquired. Their marital status does not make a difference. The only condition is that the father should have been alive as on 9-September-2005. If he had died before this date, the daughter cannot stake a claim to the property. It should also be noted that even if the daughter had passed away before the date of the amendment, her children could stake a claim to the property.

Inheritance right of Mother & Sisters

Mother is also considered Class I heir to a predeceased son. Hence she gets an equal share as other Class I heirs. A sister is a Class II heir and can stake a claim only if there are no Class I heirs.

Inheritance right of Muslim Women

Muslim law recognises two types of heirs-sharers and residuaries. Sharers are entitled to a certain share in the deceased’s property. Residuaries take up the share in the property that is left over after sharers have taken their part. The Muslim Personal law usually gives half the share to a woman as compared to a man. Thus when a man dies without a will, he may have both male and female heirs, but the share of the women would be half of the male heirs.

Inheritance right of Muslim Wife

A wife with children gets 1/8th of the property. If she has no children, she gets 1/4th of the property. If there are more wives, the share diminishes proportionately. If the wife is not a Muslim, she has no rights to the property.

Inheritance right of Muslim Daughters

As mentioned earlier, daughter’s share is half of the son’s share. If there are no sons, daughter gets half of the property. If there is more than one daughter, they collectively receive 2/3rd of the property.

Inheritance right of Muslim Mothers

Mother gets 1/3rd of the property if the predeceased son has no children. Otherwise, she would get 1/6th of the property.

Inheritance right of Christians

In the absence of a will, both daughters and sons get an equal share of the inheritance.

Inheritance right of Christian Wife

A wife gets 1/3rd of the property if the deceased husband has children. If there are no children, but he has other relatives, she would get half of the property. The rest would go to the relatives. Only if there are no other relatives, the wife will get the entire property.

If the deceased man had more than one wife, only the first wife and her children have rights over the inheritance.

Inheritance right of Christian Mother

Mother is considered a relative and will get a share only if the predeceased son had no children and after deducting half the property as the widow’s share.

Who inherits Woman’s property

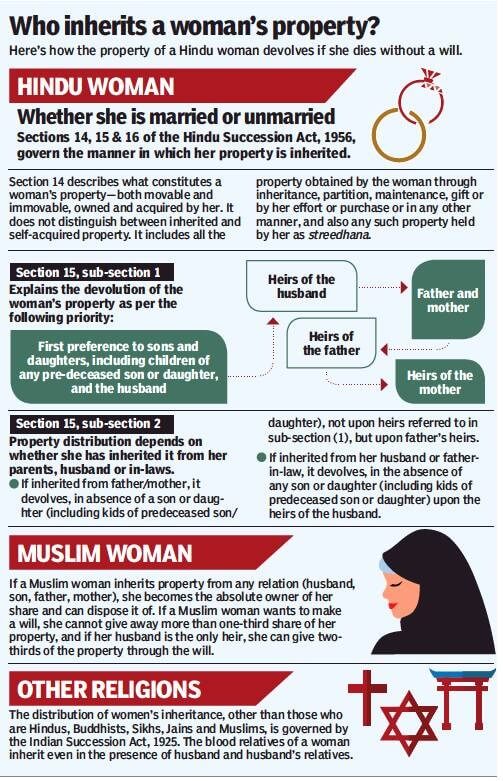

Inheritance right of Hindu Woman’s property

If a woman does not leave a will, the husband’s heirs inherit the property, not her parents. Note the difference where a mother is an heir to a predeceased son.

The ownership of a Female Hindu dying intestate shall be divided as per following rules:

- first among the sons and daughters (including the children of any pre-deceased son/daughter) and the husband

- then amongst the heirs of the husband

- then among the mother and father

- then amongst the heirs of the father

- then among heirs of the mother

5.3 S.15(2) carves out an exception to the order of succession specified above. In case of an Hindu female dying intestate and without any issue or any children or any predeceased children, any property inherited by her from her parents shall not devolve upon her husband or his heirs but revert to her natal family.Similarly, in case a Hindu female dies intestate and without any issue or any children or any predeceased children, then any property inherited by her from her husband or her father-in-law devolves upon the heirs of her husband. Thus, property inherited from her husband would not devolve upon her father or his heirs.

Both the above provisions of s.15(2) would only apply if the female dies without leaving behind any children or children of any predeceased children. If she has left behind any children, then they would take the property in preference to all other heirs. Further, the provisions only apply to “inherited” property and not property acquired by way of a will or under a gift.

What if you don’t get your share in Inheritance?

If you believe that you have a right over an inheritance, the only recourse is to sue the other heirs. Read up and get a legal opinion before getting into a legal battle which can be long drawn.

- If a woman does not get her due share in ancestral property, she can send a legal notice to the party denying her the right.

- If restrained from seeking her claim, she can file a suit for partition in a civil court. She can also seek partition of properties occupied by other legal heirs. If a physical partition is not possible, the court can auction the properties to give the woman her share

- To ensure the property is not sold during the pendency of the suit, she can seek a court injunction.

- If it is sold without her consent, she can add the buyer as a party in suit if she has not instituted a suit yet, or can request the court to add the buyer as a party if the suit has been filed.

Related Articles:

- StreeDhan : What is it? Why should one know about StreeDhan?

- Prenuptial agreement,Financial discussion before marriage, Money and divorce

- Maternity Leave :Duration, Wages,Maternity Benefit Act

Well,

this article gives absolute points of inheritance of woman rights.

Thanks for sharing.