What are the Interest Rates of Post office Small Savings Schemes like PPF, SCS, MIS etc? Do the interest rates of Post office Small Saving schemes change? When are the changes in the interest rate of Post office Small Savings Schemes announced? What were the changes in Small Saving Schemes in various quarters? How do changes in post office small savings rates affect your earlier investments in FD, Senior Citizen Schemes etc.

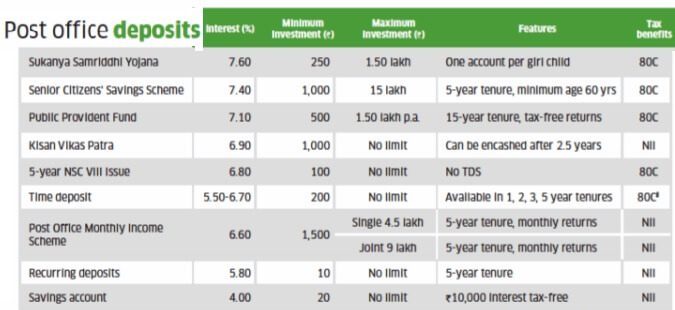

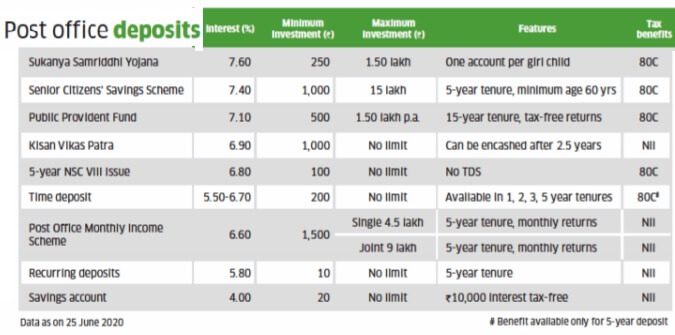

Interest rates of Post Office Schemes are as shown in the image below.

While PPF and Sukanya Samriddhi Yojana can be opened in various banks and post offices, for other post small saving schemes one needs to have a Post office bank account. The post office now provides online banking and mobile banking, as discussed in our article Post Office :Internet Banking, Mobile Apps and Core Banking Solution

Table of Contents

Current Interest Rates of Post Office Small Saving Schemes

In April -Jun 2020 Quarter, the Government had reduced the interest rates on small saving schemes such as PPF, NSC, KVP, SCSS etc. Interest rates on small savings scheme for the various quarters are shown below. But the rates have been kept unchanged after that.

Govt on 31 Mar 2021 had reduced the Interest rates on Post office saving schemes but reversed its decision on 1 Apr 2021.

So Rates that were valid till Mar 2021 will continue till at least 31 Dec 2021, shown in the table below.

| 1 Apr 2020- 31 Dec 2021 | Jul 2019-Mar, 2020 | Apr-Jun, 2019 | Jan-Mar, 2019 | Oct-Dec, 2018 | Jul-Sep, 2018 | Apr-Jun, 2018 | Jan-Mar, 2018 | |

| PPF | 7.1 | 7.9 | 8.0 | 8.0 | 8.0 | 7.6 | 7.6 | 7.6 |

| SSY | 8.4 | 8.5 | 8.5 | 8.5 | 8.1 | 8.1 | 8.1 | |

| SCSS | 7.6 | 8.4 | 8.7 | 8.7 | 8.7 | 8.3 | 8.3 | 8.3 |

| NSC | 6.8 | 7.9 | 8.0 | 8.0 | 8.0 | 7.6 | 7.6 | 7.6 |

| KVP | 6.9 | 7.6 | 7.7 | 7.7 | 7.7 | 7.3 | 7.3 | 7.3 |

| PORD 5 year | 5.8 | 7.2 | 7.3 | 7.3 | 7.3 | 6.9 | 6.9 | 6.9 |

| POTD 1 year | 5.5 | 6.9 | 7.0 | 7.0 | 7.0 | 6.6 | 6.6 | 6.6 |

| POTD 2 year | 5.5 | 6.9 | 7.0 | 7.0 | 7.0 | 6.7 | 6.7 | 6.7 |

| POTD 3 year | 5.5 | 6.9 | 7.0 | 7.0 | 7.2 | 6.9 | 6.9 | 6.9 |

| POTD 5 year | 6.7 | 7.7 | 7.8 | 7.8 | 7.8 | 7.4 | 7.4 | 7.4 |

| POMIS | 6.6 | 7.6 | 7.7 | 7.7 | 7.7 | 7.3 | 7.3 | 7.3 |

| PMVVY | 7.4 | Rates are announced every year.

Extended till 31 Mar 2023 |

||||||

| RBI Saving Bonds | 7.15% | Introduced in Jul 2020 with only non-cumulative option.

Interest rate will be set every 6 months and would be .35% more than NSC |

||||||

| Index

PORD – Post Office Recurring Deposit |

||||||||

Why did Govt reduce the Post office saving deposit rates?

It was an act of fiscal desperation.

The revised estimate (RE) of the fiscal deficit (FD) for 2020-21 was ₹1,848,655 crore or a staggering 9.5% of India’s GDP. It was 98% higher than the actual FD for 2019-20

The budget estimate (BE) of the FD for 2021-22 is also massive at ₹1,506,812 crores or 6.8% of GDP. Thus, after falling short by ₹1,848,655 crores in the financial year FY2020–21, GoI expects to fall short yet again in 2021-22 by another ₹1,506,812 crores.

What are the Post office Small Saving Schemes?

Small savings schemes are designed to provide safe and attractive investment options to the public and at the same time to mobilize resources for development. The National Savings Schemes (NSSs) regulated by the Ministry of Finance offers the complete security of investment combined with good returns. These schemes are operated through post offices and banks, public sector and private throughout the country. It is estimated that nearly $137 billion or over Rs. 9 lakh crore are currently tied up in small savings schemes. These schemes also act as instruments of financial inclusion especially in the geographically inaccessible areas due to their implementation primarily through the Post Offices, which have reached far and wide in India. Interest Rates on Small Saving Schemes are market-linked ie they are related to the G-Secs.

Some of the popular Small Saving Schemes are as follows.

- Public Provident Fund or PPF

- Sukanya Samriddhi Scheme

- Monthly Income Scheme

- Senior Citizen Savings Scheme

- KVP (Kisan Vikas Patra)

- NSC (National Savings Certificate)

- Time Deposits

- Recurring Deposits

- RBI 7.75%

Comparison of the various Post office savings schemes

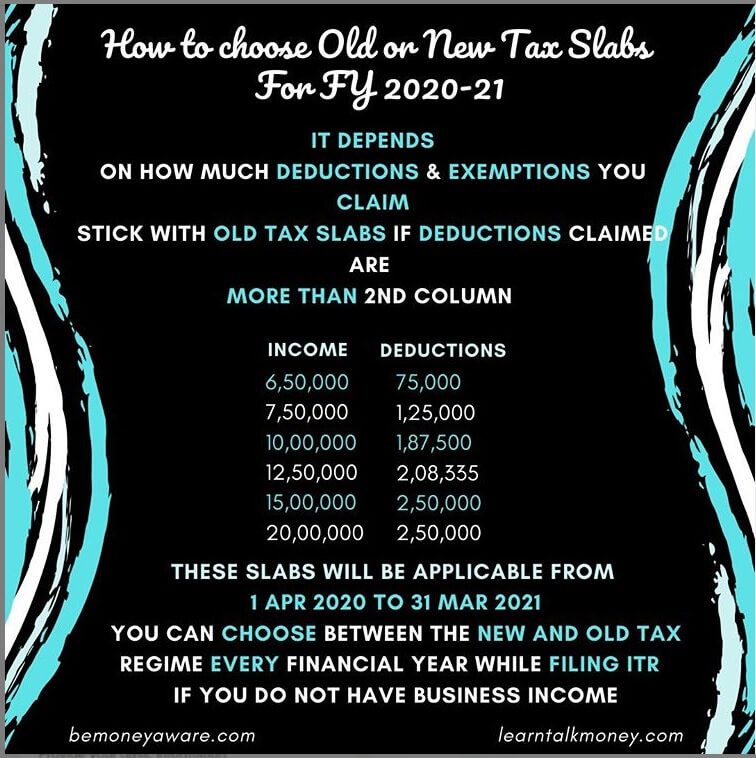

The table below compares the various Post office saving schemes. Remember that from 1 Apr 2020, the income tax slabs have been restructured in Union Budget 2020-21. Now taxpayer has a choice to Take Deductions and stick with the old tax slabs or not take deductions and opt for new tax slabs. So if you are investing in Post office saving schemes for saving tax read our article Old or New Tax Regime to choose with Calculator for Income Tax for FY 2020-21

Saving Schemes and G-Secs

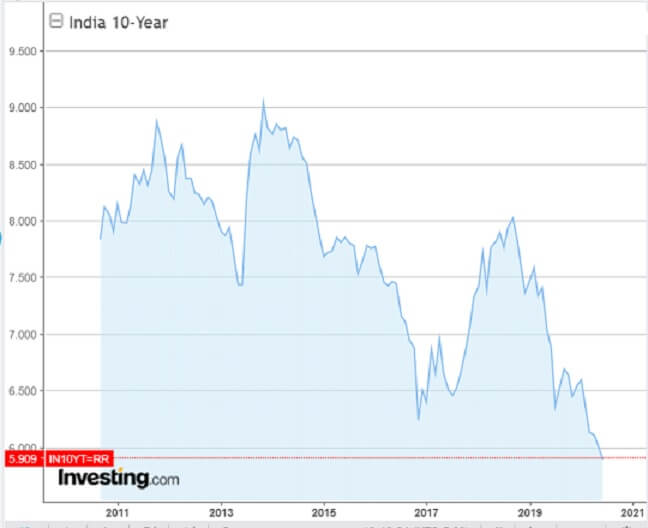

From 2011 Interest Rates of Post Office Small Saving Schemes are market-linked to G-Sec and are above the interest rate of G-Sec by a spread. So what is G-Sec and Spread?

G-Secs or Government securities are sovereign debt obligations of the Government of India. These form a part of the borrowing program approved by the parliament in the ‘union budget’. Government raises short-term and long-term funds by issuing these securities. G-Secs are issued by the Reserve Bank of India on behalf of the Government of India. RBI’s Government Securities Market in India – A Primer covers it in detail.

- Government securities include central government & state government securities, Treasury bill and government-guaranteed bonds.

- The terms of government securities range from 2 to 30 years

- Coupon or Interest offered on government securities are either pre-determined by RBI or arrived through competitive bidding or auction process.

- Coupons which are fixed, paid out semi-annually to the holder of the security.

What is Spread?

The spread is the difference between two similar measures. In the stock market, for example, the spread is the difference between the highest price bid and the lowest price asked. With fixed-income securities, such as bonds, the spread is the difference between the yields on securities having the same investment grade but different maturity dates. For example, if the yield on a long-term Treasury bond is 6%, and the yield on a Treasury bill is 4%, the spread is 2%. The spread may also be the difference in yields on securities that have the same maturity date but are of different investment quality. For example, there is a 3% spread between a high-yield bond paying 9% and a Treasury bond paying 6% that both come due on the same date.

Spreads are generally described in basis points, which is abbreviated bps and pronounced beeps. One percentage point is equal to 100 bps. So if Bond X is yielding 5% and Bond Y is yielding 7%. The yield spread is 2%. A bond trader would say that the yield spread between the two bonds is 200 bps.

Interest Rates of Post Office Small Saving Schemes

Interest Rates of Post Office Small Saving Schemes are market-linked to G-Sec and are above the interest rate of G-Sec by a spread. So what is G-Sec and Spread?

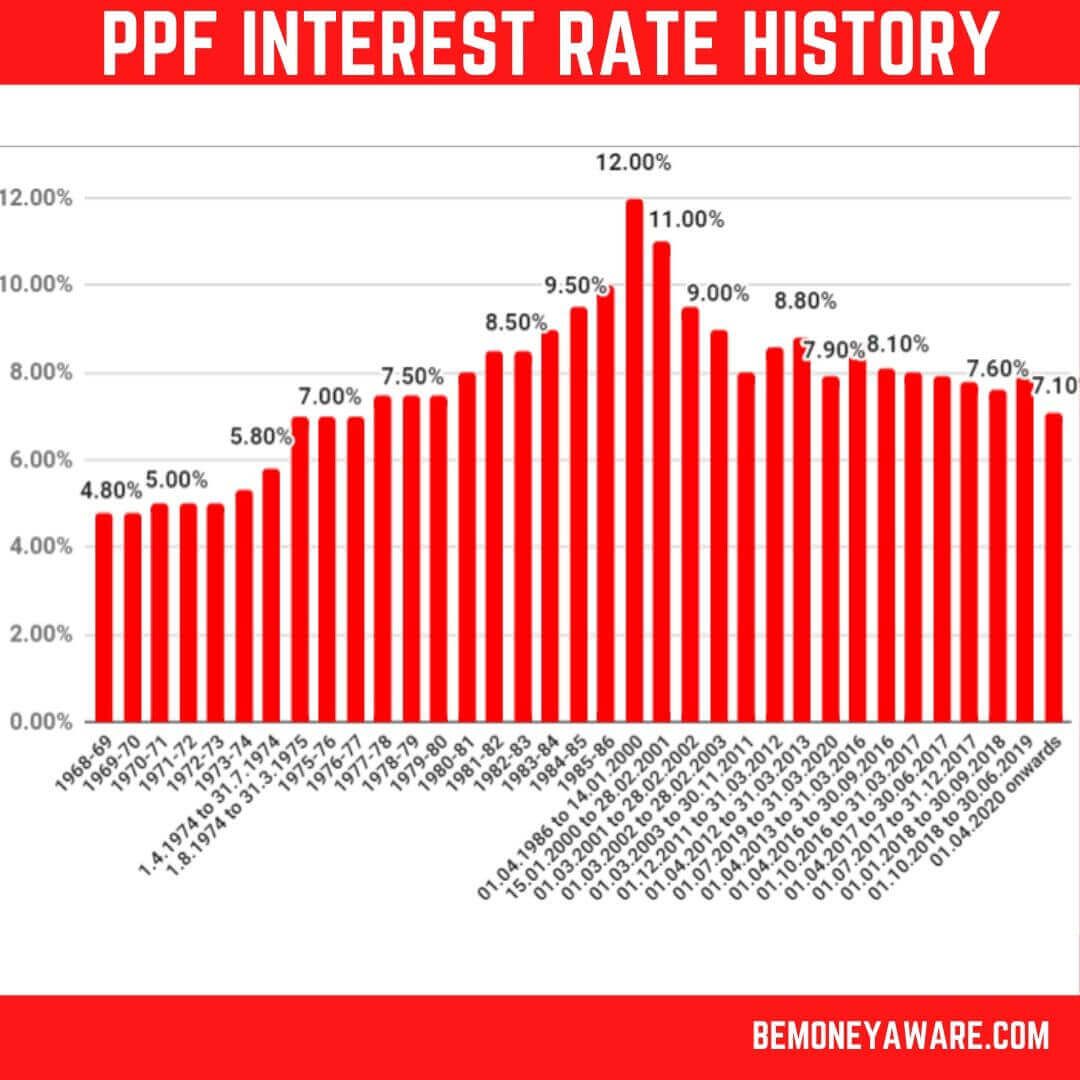

Before 2011, rates on these small savings were fixed. The interest rates on Post Office Small Saving Schemes decided by the government, remain unchanged for years. A committee headed by Shyamala Gopinath, former deputy governor of the Reserve Bank of India, had recommended that the rates on small saving schemes except for post office accounts, be reviewed every year and linked to rates on government securities (G-Secs) of similar maturity. Returns on post office small savings instruments were linked to the market in 2011, ie the returns on the Small saving schemes will fluctuate with the rise and fall in interest rates and since then have been adjusted annually.

For example, The interest rate on PPF has a markup of 25 basis points over and above the G-Sec rate (Govt Bonds rate). So, if comparable maturity G-sec rate is say 8.5% then the interest rate on PPF will be determined as 8.75%. (One Basis Point is equivalent to 0.01%)

So investment in the small saving schemes will fetch higher returns in a high-interest regime. To protect investors from large volatility, the rates will not be changed by more than 1 percentage point. Generally, G-secs yields rise in a tighter liquidity environment and fall in case of ample liquidity. The interest would also depend on the Reserve Bank of India. In a high-interest rate regime, yields on G-Secs are higher and are lower during the low-interest rate regime.

The following image shows the movement of 10 year Govt Yield Bonds. 10 year Bond yield on 18 Jun 2020 was 5.83% while on 18 Jun 2019 was 6.89%.

The image below shows how PPF Interest rates have changed over the years.

How do changes in the interest rates of Post Office Saving Schemes affect investors?

The interest rates on the schemes will change but how does it affect the investors. In schemes like senior citizen savings scheme, NSC, KVP, etc, the new rates are applicable only for new customers. You are locked at the rates at which you buy. In other products like PPF, the lowered rates will be applicable for the entire accumulated corpus and not just for the new investments. So if the rates are going down after as on 1 Jan 2017, you can buy NSC, KVP and Senior Citizen Scheme at new rates.

Why did Government bring the Changes in the Post office Small Saving Schemes Rates from 1 Apr 2016?

Due to the substantial cut in policy rates by the Reserve Bank of India in the past one year, there was a demand to revise the rates of small savings schemes. Official Press Release Interest Rates of Small Saving Schemes to be recalibrated w.e.f. 1.4.2016 says

The small savings interest rates are perceived to limit the banking sector’s ability to lower deposit rates in response to the monetary policy of the Reserve Bank of India. In the context of easing the transmission of the lower interest rates in the economy, the Government also has to take a comprehensive view on the social goals of certain National Small Savings Schemes. Accordingly, it has been decided that the following shall be implemented with effect from 1.4.2016 with regard to National Savings Schemes:

The above changes have been brought with the objective of making the operation of National Saving Schemes market-oriented in the interest of over all economic growth of the country, even while protecting their social objectives and promoting long term savings.

What should you do after changes in interest rates of post office Small Saving Schemes?

Though interest rates on post office deposits have been reduced they are higher than the Fixed Deposits offers by leading banks. So even after interest rate reduction, small saving schemes offer better investment opportunity than bank fixed deposits. However, one needs to keep in mind that both small saving schemes and bank fixed deposits attract tax chargeable as per tax slab.

WILL FDS IN WHICH YOU HAVE INVESTED EARLIER AT THE HIGHER RATE WILL ALSO BE REDUCED TO THE NEW RATE?

An FD is a contract between the person who’s investing in the FD and the institution that is accepting the FD. Under this contract, the terms and conditions set at the start of the FD can not be changed unless such terms for change were there in the contract in the first place. The terms and conditions for the FDs under senior citizen schemes do not have any scope for change, including the rate of interest. So if you had invested in a senior citizen scheme before April 1, 2016, the rate of interest at which you started your FD will not change. However, when that FD matures and you want to reinvest the amount in the same instrument in that case you will get the new rate.

Old or New Tax Slabs?

The income tax slabs have been restructured in Union Budget 2020-21. Now taxpayer has a choice to Take Deductions and stick with the old tax slabs and not take deductions and opt for new tax slabs. Which one should one choose? Details in Old or New Tax Regime to choose with Calculator for Income Tax for FY 2020-21

Video on Post office small saving schemes

This video gives an overview of the post office saving schemes

- Senior Citizen : Income and Tax

- Commission on Post office schemes, Insurance, Stocks and Mutual Funds

- Taxation of investments : EEE, ETE, TEE..

- Income From Other Sources :Saving Bank Account, Fixed Deposit,RD and ITR

- Alternatives to Fixed Deposits: PPF,FMP,Debt MF,RD,CD

Many thanks sir, my utmost gratitude for the effort of

your team, i am indeed a regular visitor to your articles , i thought to, (out of courtsey)

provide some suggestion and feedback of my own ,

would be thankful if you could reply or recognize my recommendations to make this site more

content oriented .

Regards.

Rana Duggal.

Sure please do share your recommendations either on the site or by emailing us at bemoneyaware@gmail.com

Thanks for the detailed article 🙂

Thanks for the comment. It is encourging

Thanks for such an insightful article which helps us all.

A very informative article indeed. I really liked the question and answer section. Thank you for sharing your detailed insights on the different small savings schemes.

Sir, eversince the bold move of DEMONETIZATION of MODIJI GOVERNMENT, it would be fine if the interest rates of SENIOR CITIZEN MONTHLY SCHEME be allowed an INTEREST RATE OF AT LEAST 10 TO 10.5 %,so that as we are well aware huge sums of black money has been cleansed from circulation as also tremendous inflow of currency by hidden revenue has come to the government coffers. this welcome scenario must give a very big boost economic regeneration & consequent growth potential for the country. SUCH BEING THE CASE, THE GOVERNMENT SHOULD BE MAGNANIMOUS ENOUGH TO SHARE THIS ”BONANZA” WITH ELDER CITIZENS OF THE COUNTRY,HENCE I WOULD REQUEST ON BEHALF OF SENIOR CITIZENS TO ENHANCE THE INTEREST RATES OF SCSS SCHEME FROM PRESENT 8.5 % TO 10 % OR 10.5 %.PLEASE.

WHAT I MEANT SAY IS THAT AT LEAST WITH EFFECT FROM IST OF APRIL 2017 PLEASE ”ENHANCE” THE RATE OF INTEREST UNDER ”SENIOR CITIZEN SAVINGS SCHEME” [SCSS ] TO AT LEAST FROM 10% TO 10.5% WITH EFFECT FROM 01-04-2017.SIR. ALSO PLEASE THE INCOME-TAX LIMIT FROM PRESENT 2.8 TO 5.PLEASE. PLEASE DO US THIS FAVOUR, WE SHALL EVER BE GRATEFUL TO YOU FOR SHOWING GREAT CONSIDERATION TO ”SENIOR CITIZENS”…..THANK YOU.

Just look how each central govt is befooling the native people. Earlier PO MIS was really lucrative for a regular income @8% pa for a tenor of 6 yrs with a maturiy bonus of 7.5% then in the year 2011, the so called secular cheats reduced the tenor to 5 yrs and abolished the bonus but raised the interest rate to 8.4%. Up to this, the situation was somehow acceptable. Now the sangh paribar cheats additionally reduced the interest rate to 7.8%! Where is the charm now?

Hi Sir,

I need your help regarding my father’s investment, he was retired at March 2015 at age 58 but govt. of India & ITI (sick psu) giving his retirement fund by May mid 2016. His total corpus is 29 lacs (23 lacs as PF & 6 lacs from gratuity).As his age is 59 so he is not eligible Senior Citizen scheme.

I would be grateful please provide investment tips so he could get monthly income.

Some of the concerns & inputs are as follows:

a)As interest are decreases sharply and in future chances are there chances of more cuts, so he doesn’t wants to take risk now he needs safe and monthly income from interest.

b)Monthly expenses he needed atleast 30k per month. (25k for expenses & 5k for saving).

c)Other source income are

1)Getting pension Rs 2400 per month.

2)Getting Rent 5000 per month.

Some of the queries are:

1)Where to invest and what is best option to get the better interest return?

2)Our focus is more for senior citizen scheme available in market as interest rate is higher than and after 6 months he would be in senior citizen category as of now we think to invest in bank FD, Is it is a right decision?

3)Like MIS in post office/banks is Mutual Fund MIP is good to invest and as compared to bank/post office which gives higher return in short term and do this scheme giving monthly interest.

4)Investing in Non-Convertible Debentures (NCD), is this investment give better monthly income. (I don’t know anything about it just heard from someone)

5)Where to invest 5k in MF via SIP or 3k in MF and 2k in banks.

Fund selected: HDFC or Tata Balanced Fund

6)How much money to put for emergency fund 1.5 lacs or more please suggest?

Request you to please provide your input on the above query and which will help us to create a path for next upcoming few years.

Thanks,

Shalabh

Hi Sir,

I need your help regarding my father’s investment, he was retired at March 2015 at age 58 but govt. of India & ITI (sick psu) giving his retirement fund by May mid 2016. His total corpus is 29 lacs (23 lacs as PF & 6 lacs from gratuity).As his age is 59 so he is not eligible Senior Citizen scheme.

I would be grateful please provide investment tips so he could get monthly income.

Some of the concerns & inputs are as follows:

a)As interest are decreases sharply and in future chances are there chances of more cuts, so he doesn’t wants to take risk now he needs safe and monthly income from interest.

b)Monthly expenses he needed atleast 30k per month. (25k for expenses & 5k for saving).

c)Other source income are

1)Getting pension Rs 2400 per month.

2)Getting Rent 5000 per month.

Some of the queries are:

1)Where to invest and what is best option to get the better interest return?

2)Our focus is more for senior citizen scheme available in market as interest rate is higher than and after 6 months he would be in senior citizen category as of now we think to invest in bank FD, Is it is a right decision?

3)Like MIS in post office/banks is Mutual Fund MIP is good to invest and as compared to bank/post office which gives higher return in short term and do this scheme giving monthly interest.

4)Investing in Non-Convertible Debentures (NCD), is this investment give better monthly income. (I don’t know anything about it just heard from someone)

5)Where to invest 5k in MF via SIP or 3k in MF and 2k in banks.

Fund selected: HDFC or Tata Balanced Fund

6)How much money to put for emergency fund 1.5 lacs or more please suggest?

Request you to please provide your input on the above query and which will help us to create a path for next upcoming few years.

Thanks,

Shalabh

Sir from last two days due to server problem i m not able to open r.d.a/c if due to technical difficulty account can be opened backdated in April

Sir from last two days due to server problem i m not able to open r.d.a/c if due to technical difficulty account can be opened backdated in April

I opened RD in postoffice for 5 years in Feb 2016 @8.4% interest. Will int rate for my Rd will change or same 8.4 for 5 years ?

As per information we could find, it should not.

The new rates are for those who open after 1 Apr 2016. If you help us in confirming we would appreciate.

I opened RD in postoffice for 5 years in Feb 2016 @8.4% interest. Will int rate for my Rd will change or same 8.4 for 5 years ?

As per information we could find, it should not.

The new rates are for those who open after 1 Apr 2016. If you help us in confirming we would appreciate.

Very good article….could you please let me know what will the effect on EPF??

No effect on EPF. Rates for EPF are dealt seperatetly

Very good article….could you please let me know what will the effect on EPF??

No effect on EPF. Rates for EPF are dealt seperatetly

Sir i want to open my mothers account in post office in scss …. Will i get 9.3 interest rate if i open it on or before 30 march 2016…

Yes these new rates are applicable from 1 Apr 2016. The rates in SCSS is locked on the day you buy

Sir i want to open my mothers account in post office in scss …. Will i get 9.3 interest rate if i open it on or before 30 march 2016…

Yes these new rates are applicable from 1 Apr 2016. The rates in SCSS is locked on the day you buy

Good and useful information at the right time. Good job. Continue it. Keep me notified of these changes to my email id given above.

Good and useful information at the right time. Good job. Continue it. Keep me notified of these changes to my email id given above.

What are the interest rate on P O R D for APR 2016 onwards

Changed from 8.4 to 7.4%

What are the interest rate on P O R D for APR 2016 onwards

Changed from 8.4 to 7.4%

Excellent. Quite informative.

I have a question: Will interest rate (8.4) on RD opened in march will be reduced for the months April 2016 on wards?

A very interesting question and for which we are trying to find the answer. While we could find info for NSC,KVP and Senior Citizen Schemes rates are locked at time of purchase for others it seems it would affect entire corpus. If you find something do let us know.

Have updated the article with following information:

The interest rates on the schemes will change but how does it affect the investors. In schemes like senior citizen savings scheme, NSC, KVP , etc, the new rates are applicable only for new customers. You are locked at the rates at which you buy. In other products like PPF, the lowered rates will be applicable for the entire accumulated corpus and not just for the new investments. So if the rates are going down after as on 1 Apr 2016, you can buy NSC, KVP and Senior Citizen Scheme at higher rates.

Excellent. Quite informative.

I have a question: Will interest rate (8.4) on RD opened in march will be reduced for the months April 2016 on wards?

A very interesting question and for which we are trying to find the answer. While we could find info for NSC,KVP and Senior Citizen Schemes rates are locked at time of purchase for others it seems it would affect entire corpus. If you find something do let us know.

Have updated the article with following information:

The interest rates on the schemes will change but how does it affect the investors. In schemes like senior citizen savings scheme, NSC, KVP , etc, the new rates are applicable only for new customers. You are locked at the rates at which you buy. In other products like PPF, the lowered rates will be applicable for the entire accumulated corpus and not just for the new investments. So if the rates are going down after as on 1 Apr 2016, you can buy NSC, KVP and Senior Citizen Scheme at higher rates.

very informative and very good research. Thanks for sharing this valuable information

Thanks for good information

Thanks Sapan and R.Jaiswal. Such comments are very encouraging

Sir

I want to do FD rs 16 lakh, which was matured on 20th march 2020 in state bank of india. My father has invested the amount three years ago.Now my father has expired on 8th january 2019. He was a professor of history in university. So plz kindly suggest me where it is to invested in SBI bank or post office. I want to do FD for 1 year. shall i invest it lump sum or break up the money. Finally my question is that which is better bank or post office

Reply

Sir

I want to do FD rs 16 lakh, which was matured on 20th march 2020 in state bank of india. My father has invested the amount three years ago.Now my father has expired on 8th january 2019. He was a professor of history in university. So plz kindly suggest me where it is to invested in SBI bank or post office. I want to do FD for 1 year. shall i invest it lump sum or break up the money. Finally my question is that which is better bank or post office

very informative and very good research. Thanks for sharing this valuable information

Thanks for good information

Thanks Sapan and R.Jaiswal. Such comments are very encouraging