It’s been a mixed bag as far as returns from various asset classes go in 2020. How have equity, Gold, Mutual Funds, NPS, Post office saving schemes, RBI bonds performed in 2020? An investor must allocate to different asset classes: equity, debt, fixed income, gold. Your goal horizon, risk appetite and available surplus are critical factors in deciding your asset allocation pattern.

Planning for financial freedom is a marathon and not a sprint.

Allocate capital in various asset classes to remain diversified

Remember: Last date to file Returns for FY 2019-20 or AY 2020-21 is 30 Nov 2020. Covered in detail in our article Income Tax for AY 2020-21 or FY 2019-20

Table of Contents

Investing in 2020: Sep 2020

The market may remain rangebound with positive bias in the near-term on hopes of stimulus announcement both from the US and Indian government.

The market would get direction from the outcome on the loan moratorium case on 5 Oct; RBI’s monetary policy on 6 Oct, and the September quarter results season which would kick start with TCS reporting its numbers on 7 Oct.

- In Sep both Sensex and Nifty had losses.

- In September Sensex fell by 1.45 per cent and Nifty dropped 1.23 per cent. Nifty fell sharply to mark a low of 10,790.

- But BSE Midcap inched up by 0.3 per cent & the BSE Smallcap index had strong gains of 3.71 per cent.

- Among the sectoral indices, BSE IT rose 10.66 per cent followed by Pharma, Consumer Durables and Teck indices. BSE Telecom and Bankex suffered strong losses of 15.66 per cent and 9.71 per cent, respectively.

- Gold had fallen below ₹49,500 in Sep. Gold trades near the key $1900/ounce level but has taken support from lower levels as the US dollar index continued to retreat from recent highs. Silver has rebounded from its recent lows due to improved outlook for industrial demand amid pick up in industrial activity in China and globally. Despite the recent price correction, gold has gained 24% so far this year,

Gold and Silver Price 2020

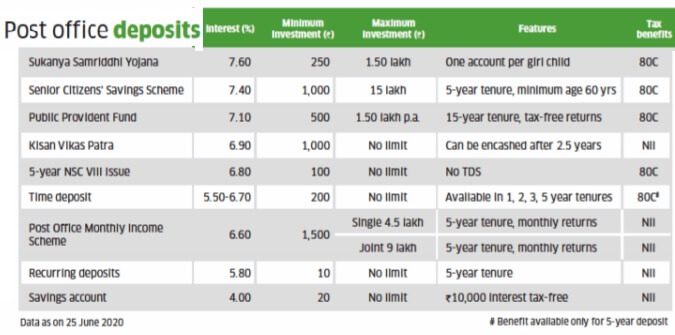

- Post office Small Savings Schemes: the Government has kept the interest rates of various small savings schemes unchanged. There are nine government-run small saving schemes available today: PPF, SCSS, Savings Account, Time Deposit, Recurring Deposit, Monthly Income Scheme (MIS), Sukanya Samriddhi, National Savings Certificate and Kisan Vikas Patra. The rates are scheduled to be next reviewed towards the end of December 2020. Our article Interest Rates of Small Savings Schemes covers it in detail.

- Multi Cap Mutual Funds: On 11 Sep 2020, SEBI(the Securities and Exchange Board of India) released a circular mandating Multi-Cap Funds to allocate least 25 per cent of their portfolios in large-, mid- and small-caps each by February 2021. Those invested in Multi-Cap Funds should avoid a knee-jerk reaction to the revised norms by exiting those funds immediately. Multi-Cap Fund investors should wait for more clarity from their fund houses regarding how they would position their existing Multi-Cap Funds to comply with revised norms

- IPO’s: September 2020 was one of the busiest months for initial public offerings (IPOs) in close to a decade, with nearly 8 IPOs being launched. Earlier in September 2011 more than 8 IPOs were launched in a month. It was stellar listings for the three IPOs,(Rossari, Happiest Minds, Route Mobile)have buoyed the prospects for the primary markets.

- Debt Mutual Funds: Depends on Interest rates, which depends on RBI rate. RBI’s will be announcing it’s monetary policy on 6 Oct

- In 2020, RBI has slashed the reverse repo by 155 basis points to 3.35 per cent and repo by 115 bps to 4 per cent.August’s retail inflation, was at 6.69 per cent,

- Consumer prices in India rose 6.69 per cent in August, compared with 6.73 per cent in July. Supply disruptions are primarily blamed for such prints that extend beyond the central bank tramlines.

- India’s first-quarter GDP(gross domestic product) shrank a record 23.9 per cent.

- US Federal Reserve does not expect to lift its fund rates until 2023. Globally, central banks are boosting liquidity to help combat the effects of the deadly virus.

- Changes in Rules from 1 Oct 2020

- No physical verification of documents like Driving License and RC. Drivers can maintain their vehicular documents on Central govt’s online portal like Digi-locker or m-parivahan. Our article New Traffic Fines in India, Documents to carry, DigiLocker covers it in detail.

- Use Mobile phones only for route navigation

- 5% tax will be levied on foreign fund transfer: Any amount sent abroad to buy foreign tour packages, and every other foreign remittance made above ₹7 lakh, will attract a TCS. While the tax on foreign tour packages will be 5% for any amount, for other foreign remittances the tax will kick in only for the amount spent above ₹7 lakh.

- Sweet sellers will need to display ‘best before date’

- RBI’s new credit and debit card rules: Card users will now be able to register opt-in or opt-out of services, spend limits, etc. for international transactions, online transactions as well as contactless card transactions.

Reasons

- Unlock 5.0 and macro data(ex September auto sales numbers) are encouraging for the market.

- The global cues seem to have turned slightly positive now, led by better-than-expected macro data and rising hopes for an additional stimulus package.

- The sentiment is high based on by reports that we may soon get an effective vaccine for COVID. Reports suggest positive progress towards a possible coronavirus treatment by Regeneron Pharma and Moderna’s coronavirus vaccine trials.

Concerns

India continues to see a rising number of coronavirus cases. Rising COVID-19 cases in the US and the resurgence of the virus in Europe continue to remain a major overhang

Equities: Buy more or get out?

The main thing that people ask in Stock market is: Buy more, or get out?

Capital Mind aptly sums it

The answer, we believe, is to let this play out and just rework allocations as time passes. We don’t have to win every battle, we just have to last long enough to win the war. There’s a famous saying in the markets:

If you don’t bet, you can’t win.

If you lose all your chips, you can’t bet.

Our emotions tend to live on one of these lines at every point in time.

The real power lies in between them.

IPO Listing gains in 2020

September 2020 was one of the busiest months for initial public offerings (IPOs) in close to a decade, with nearly 8 IPOs being launched. Earlier in September 2011 more than 8 IPOs were launched in a month. It was stellar listings for the three IPOs,(Rossari, Happiest Minds, Route Mobile)have buoyed the prospects for the primary markets.

Our article IPO: Process, Types of Investors covers what is IPO? What is IPO process? who are the investors in IPO? How does the allotment in IPO works?

| Issue Details | Subscription | Price | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | IPO Name | Issue Size (in crores) |

QIB | HNI | RII | Total | Issue | Listing Open | Listing Close | Listing Gains(%) |

CMP | Current Gains (%) |

| 01-10-20 | CAMS | 2244.33 | 73.18 | 111.85 | 5.55 | 46.99 | 1230.00 | 1535.00 | 1401.60 | 13.95 | 1,401.60 | 13.95 |

| 01-10-20 | Chemcon Special | 318 | 113.54 | 449.14 | 41.21 | 149.33 | 340.00 | 731.00 | 584.80 | 72 | 584.80 | 72.00 |

| 21-09-20 | Route | 600 | 89.76 | 192.81 | 12.67 | 73.30 | 350.00 | 708.00 | 651.10 | 86.03 | 783.80 | 123.94 |

| 17-09-20 | Happiest Minds | 702.02 | 77.43 | 351.46 | 70.94 | 150.98 | 166.00 | 351.00 | 371.00 | 123.49 | 342.65 | 106.42 |

| 23-07-20 | Rossari | 51929390 | 2.75 | 4.34 | 2.51 | 2.97 | 425.00 | 670.00 | 742.35 | 74.67 | 795.60 | 87.20 |

| 16-03-20 | SBI Cards | 10286.2 | 57.18 | 45.23 | 2.50 | 26.54 | 755.00 | 658.00 | 683.20 | -9.51 | 838.65 | 11.08 |

Post office Small Savings Schemes

Features of Post office Small Saving Schemes are given below. More details in our article Interest Rates of Small Savings Schemes

Investing in 2020: Aug 2020

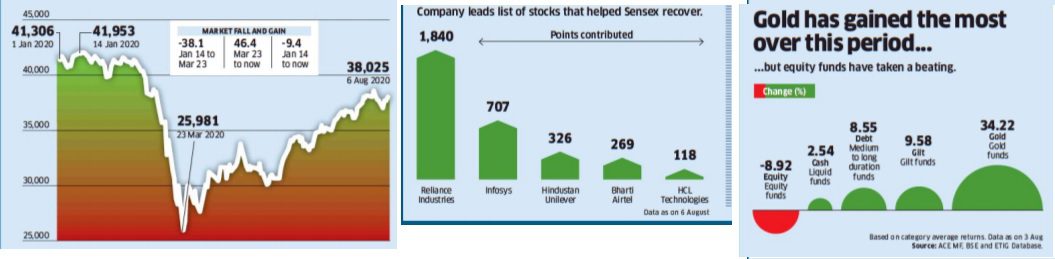

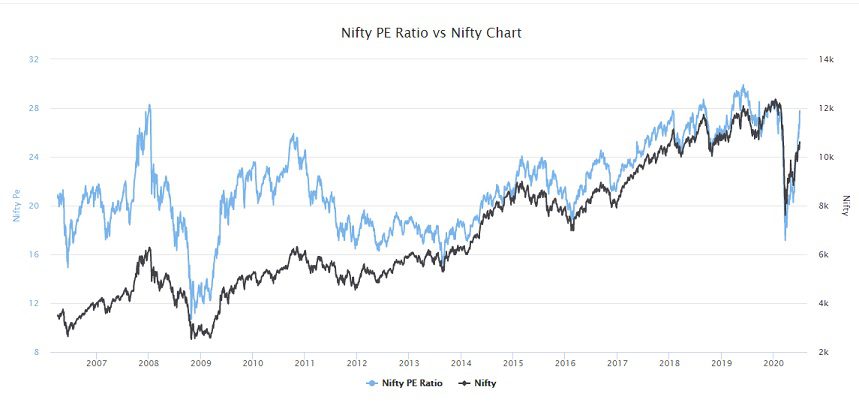

- Nifty rose higher crossing 11,000. The PE price to earnings ratio of the stocks that constitute the Nifty 50 index stood at 31.1 as on 14 August.

- Open-ended equity MFs saw a net outflow of ₹2,480 cr in July 2020. Though Inflows into mutual funds through SIPs remained strong during the month.

- The price of gold slid after reaching a peak of Rs 56,000 per 10 gram. 2020-21 Series VI Series of Sovereign Gold Bonds would be available from August 31-Sept 04, 2020

- The repo rate and reserve repo rate remain at 4.00 per cent and 3.35 per cent, respectively. Repo rate is the rate at which the RBI lends to banks, while the reverse repo rate is at which it borrows from banks. These rates affect the FD interest rates & Loans Interest rate.

India continues to see a rising number of coronavirus cases.

US, UK in Recession

Official figures on 12 August confirmed that the UK had entered a recession for the first time in 11 years. UK GDP fell by 2.2% in the first quarter of 2020 (January to March), as the economy began to feel the effects of lockdown. Figures for the second quarter (April to June) showed the steepest fall on record, of 20.4%, as the lockdown brought many areas of the economy to a complete standstill. Those two quarters in a row of falling GDP confirm that the UK is in a recession.

In the UK the last recession, caused by the global financial crisis, lasted five quarters – from the second quarter of 2008 onwards. GDP fell by an estimated 7.2% over the whole period.

In the US GDP declined 5% in the first quarter and 32.9% in Q2. Within weeks of COVID 19 pandemic, Congress passed a $2.3 trillion rescue funding bill and the Federal Reserve slashed short-term rates to near zero while enacting close to a dozen lending and liquidity programs.

There have been expectations that the US may dole out another stimulus package to help tide over the Covid-19 crisis. While both Republicans and Democrats have reached broad consensus on the need to generate a second round of stimulus checks, there are several issues that have prevented a new package being pushed through. Chief among these is the overall size of the relief fund with a $2 trillion chasm between the Democrat and Republican proposals. Funding for schools, aid to state and local governments and unemployment pay have also provided stumbling blocks to the approval of the latest relief measures. The divisions between the parties have led to the latest relief package being put on hold, potentially until the Senate reconvenes on 8 September although leaders of both parties have told senators to be ready to be recalled at 24 hours’ notice if required.

Recession, depression, and slow down

Slowdown means when the country’s economic growth or the GDP slows down. The growth rate is not harmful, but it is very less when compared to previous years. If we look at our country, India has been going through an economic slowdown for the past couple of years, even before the pandemic struck.

Recession is when there is negative GDP growth for at least two successive quarters,

Depression is when the recession continues for an elongated period. It is when the economies face -10% or even worse GDP growth for more than three years. The last time that the world witnessed a depression was The Great Depression of the 1920s, which lasted for approximately ten years.

In the 2008 crisis, there was a 3.09% and -2.5% GDP rate in India and the U.S., respectively, while during the Great Depression, there was a global GDP rate of -15%.

Tax Reforms in 2020

On 13 Aug 2020, PM Narendra Modi announced the programme for honouring honest taxpayers and for making tax collection more transparent and Taxpayer’s Charter. It enshrines taxpayers rights and obligations and also lays down commitments from the tax department to the taxpayer. The United States of America and several European countries also have a taxpayer’s charter.

Why are the stock markets rising?

Having slumped 35% from Feb. 20 to March 23, world stocks are now within record highs thanks to lashings of fiscal stimulus, interest rates slashed to 0% or below in most major economies, and massive amounts of Quantitative Easing(QE).

The price to earnings ratio of the stocks that constitute the Nifty 50 index stood at 31.1 as on 14 August. This means that investors are willing to pay ₹31.1 for every rupee of earning for stocks that comprise the Nifty 50. This is an extremely high valuation and has been never been seen in the past.

In August, FIIs have net invested a total of ₹26,147 crores in Indian stocks. Between May and July, the FIIs had invested a net of ₹43,964 crore in the markets.

This is the reason for the US Stock market rising too. (Many say that Donald Trump will keep the US market up due to the US president elections)

In India, the market is witnessing huge divergence as the macroeconomic situation is completely different from the movement of indices. From geopolitical tensions to deteriorating macro to COVID-19, the beleaguered market kept investors on tenterhooks.

The rural economy continues to remain a bright spot and has been doing well despite the COVID-19 crisis and a good monsoon will be a shot in the arm for agriculture and the rural economy.

Despite the recent rally in the market, the uncertainty prevails due to the coronavirus pandemic. Though India has managed to contain the virus so far by enforcing one of the strictest lockdowns globally, there has been a steady increase in new cases since opening up of the economy and is a key risk to the current rally. As long as COVID-19 does not come under control, the cloud of uncertainty will continue to loom.

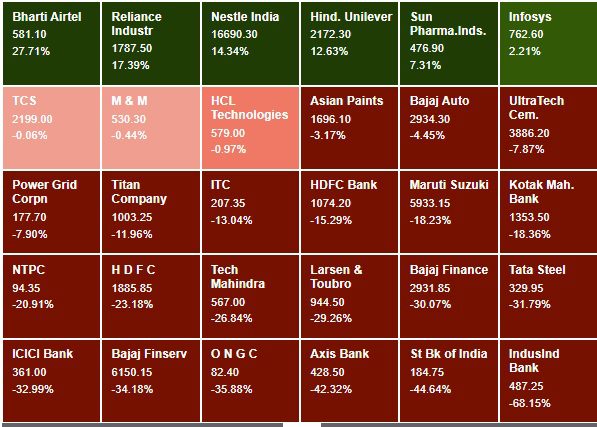

Do note that rally is due to few stocks(like Bharti AirTel, Reliance Industries, Nestle, Hindustan Lever) showing strength while the broader indices are still weak. The Heat map in the image below shows the performance of the various stocks in Sensex in the last 6 months.

Will stock markets correct?

Yes, they would but when no one knows.

Many experts suggest one needs to follow Nifty PE Ratio. Nifty PE Ratio or price to earnings ratio is used to identify how cheap or expensive a particular index (such as Nifty – Nifty PE ratio ) or a particular stock such as (TCS – TCS PE ratio) is. Simply put P/E ratio implies the amount an investor is willing to pay to earn one rupee as profit. If Nifty PE ratio is 23, it means investors are willing to pay Rs 23 for one rupee profit collectively earned by all the companies that are included in Nifty.

Based on historical data and pure common sense, investors can safeguard their investment portfolio and earn handsome profit by following the investment rationale suggested in the following table. From equityfriend.com

When the stock market crash happens and the tide goes out can we learn who has been swimming naked. Hence, it is better to be patient and invest selectively only in companies that have high cash, robust books with minimal to zero debt, high return ratios, strong management and a smooth working capital cycle.

Nifty returns over the years have been volatile. But we like to think it in a linear fashion, i.e., what I buy and what I hold will keep moving up. It means is that you have to handle these variations from time to time

Investing in Gold in 2020

Gold is the flavour of the season. Gold prices have shot up in the past year.

The price of gold slid after reaching a peak of Rs 56,000 per 10 gram.

Typically, gold shares an inverse relationship with stock market, and the safe-haven appeal of the precious metal rises with any sign of increased risk in equities. But this year gold and stock market are going in sync.

Gold prices slid in the international market as well. The US gold futures have fallen by 2.8% to $1,892 an ounce and silver at $23.96 per ounce. Will Gold may once again touch the level of $1,700 an ounce in the global market, according to experts.

Many experts say that Russia’s announcement about the development of a safe vaccine against the coronavirus disease (Covid-19) boosted confidence in the stock market and has led to profit-booking in gold and silver, bringing their prices down sharply.

But Long-time precious metal bugaboo, Warren Buffett’s Berkshire Hathaway bought 20.9 million share investment in Barrick Gold Corp. He also reduced holdings in financial institutions such as JPMorgan and Wells Fargo. What is it’s the significance?

Why is Gold price rising?

Gold is rising due to a series of events that began last year. A trade war between the US and China, geopolitical tensions and dovish central bank actions initially sent gold prices soaring over 20% last year.

This year, the uncertainty caused by COVID has spurred gold as investors shunned riskier assets and flocked to what has traditionally been a safe haven.

Remember Gold does well during periods of negative “real” interest rates—when the inflation rate is higher than the prevailing interest rate. With major central banks continuing to pump in more money into economies to avert a recession, currencies are getting devalued and interest rates are heading lower. For examples, the 10-year US Treasury bill currently yields 0.64%—lower than the expected inflation rate

Central banks worldwide are adding gold reserves to diversify their holding. The past two years have in fact seen the highest level of net purchases of gold by central banks.

The rupee depreciation is a critical contributor to domestic investors’ returns. In India, the landed price of gold is calculated by converting international gold price into rupee terms using the prevailing dollar-rupee exchange rate, apart from the customs duty rate. The sharp depreciation in the rupee has given a leg up to gold returns. With the government borrowing heavily to fund its stimulus package, India’s credit profile has deteriorated further. This will contribute to rupee depreciation.

Can gold go higher?

Gold topped $1,800. Gold is at 8-Year High, Can Rally Go On? Gold has not closed above the $1,800 level since Sept. 21, 2011.

Your guess is as good as mine. The basic safe-haven appeal of gold will not go away as economic activity is not likely to revert to normal anytime soon.

While the gradual reopening of industries and the ensuing spurt in activity may suggest a quick recovery, this rebound is likely to be short-lived. There is heightened uncertainty around jobs and a decline in household incomes and growing expectations of a global recession, unprecedented levels of stimulus from central banks and historically low-interest rates. Despite the 22% rally in 2020, many feel that gold still has a lot of steam left, many believe that gold will touch higher levels

Most experts suggest investors maintain around 10-15% allocation to gold at all times as a simple diversification tool.

Gold is an asset that you buy and pray it doesn’t do well because that would mean the rest of your portfolio will most likely do well.

Best ways to invest in gold

There are many ways to invest in Gold such as Gold Jewellery, Bars- Coins and Biscuits, Sovereign Gold Bonds, Gold ETFs, Gold Saving Funds, Gold Mining Funds, Gold Futures as explained in our article Ways to invest in Gold

If you want to add gold to your portfolio, avoid physical gold. It has issues such as concerns over purity, very high making charges and storage costs etc. Best ways are Sovereign Gold Bonds and Gold ETFs/Gold Funds. Details of Sovereign Gold Bonds at All about Sovereign Gold Bonds

2020-21 Series VI Series of Sovereign Gold Bonds would be available from August 31-Sept 04, 2020

Mutual Funds in 2020

Open-ended equity MFs saw a net outflow of ₹2,480 cr in July 2020. Though Inflows into mutual funds through SIPs remained strong during the month.

A total of ₹7,831 crores was invested in MFs through SIPs in July. This was 9.4% lower than the high of ₹8,641 crore invested in March earlier this year. Inflows into MFs through SIPs have come down, a little, while the overall investment into open-ended equity MFs has taken a huge beating during the same period. In March, open-ended equity MFs saw a net investment of around ₹11,723 crore

Mutual fund industry AUM falls 8% to ₹25 trillion in June quarter. Average AUM of the industry, comprising 45 players, stood at ₹24.82 trillion in the April-June quarter 2020 as compared to ₹27 crores in the preceding quarter, according to Amfi data.

HDFC Equity and HDFC Top 100, managed by Prashant Jain, were downgraded by Morningstar, from ‘gold’ to ‘silver’, saying that it sees enhanced risks to the investment strategy employed by Jain. The agency said over the 5-year and 10-year time frames, the funds have been underperforming their respective benchmarks as well as category peers.

Equity Mutual Funds

Monthly returns of the Equity Mutual Funds are given below.

Debt Mutual Funds

Trailing Returns of Debt Mutual Funds are shown in the image below. Source Valueresearchonline

Gilt funds are giving double-digit returns, over the past one-year period. Returns from these funds have risen as Reserve Bank of India had cut policy rates, which consequently brought down the yields on government securities (G-secs). As G-sec yields fall, their prices go up. Gilts can be highly volatile as they are sensitive to the interest rate movement. There are two kinds of gilt funds.

- Gilt funds that invest mostly in government securities across maturities.

- Gilt funds with a constant maturity of 10 years – these funds must invest at least 80% of their assets in government securities with a maturity of 10 years.

It is extremely important to time the entry and exit in Gilt schemes because they are extremely sensitive to interest rate movements. They do very well in a falling interest rate regime, but they suffer and start giving negative returns one the rates start hardening.

Investors can look at banking and PSU funds after studying their portfolios. The scheme should have at least 85% investment in AAA-rated papers, which have higher coupons with negligible default risk. Moreover, they typically have shorter durations which may suit debt investors better.

Debt Mutual Fund Returns

Bharat Bond ETF 2

Two Bharat Bond ETF NFOs were open from 14 July to 17 Jul but you can invest in them later too since they are open-ended schemes.

One Bharat Bond ETF will mature after five years in 2025 and the other after 11 years in 2031.

Bharat Bond ETFs invest exclusively in AAA-rated papers of public sector companies. It holds the bonds till their maturity and reinvests the coupons received

The two ETFs come about six months after Edelweiss AMC’s first two Bharat Bond ETFs, maturing in 2023 and 2030, were launched. The two ETFs have delivered returns of 6.84% and 8.6%, respectively, from the date of launch to 30 June 2020

Capital gains in the ETFs are taxed at 20% with the benefit of indexation if the ETFs are held for more than three years

Remember that Interest rates are at historic lows.

Fixed Income in 2020: Fixed Deposit rates

The Reserve Bank of India (RBI), in its second bi-monthly monetary meet of FY 2020-21 held on August 6, decided to keep the key policy rates, repo rate and reverse repo rate, unchanged with accommodative stance. The pause has come after two consecutive rate cuts – in March and May 2020.

In the month of May alone, the State Bank of India (SBI) has reduced its FD rates twice. With effect from May 27, 2020, one-year SBI fixed deposit is offering 5.10 per cent for general customer and 5.60 per cent for senior citizens.

Those who depend on FDs for fixed and regular income (many of whom are senior citizens) can consider small saving schemes like monthly income account, post office time deposit. For the June-September quarter of 2020, the government kept rates of small savings schemes unchanged from the previous quarter.

Compared with SBI’s one year FD, the one-year post office time deposit is offering 5.5 per cent, which is higher by .4%.

Our article Interest Rates of Small Savings Schemes: PPF, Sukanya Samridhi, SCSS, NSC from 1 Jul 2020 covers the interest rate and schemes in detail.

Post office saving schemes in 2020: PPF, SCSS, Sukanya

Government has decided to keep Small savings schemes interest rates unchanged for quarter July-Sept of FY2020-21, although the yield on dated Government securities is going down. Our article Interest Rates of Small Savings Schemes: PPF, Sukanya Samridhi, SCSS, NSC from 1 Jul 2020 covers the interest rate and schemes in detail.

RBI Floating Rate Savings Bonds

Govt has launched RBI Floating Rate Savings Bonds, 2020 (Taxable) scheme from 01 July 2020 replacing 7.75% bonds. There is no cumulative option.

Tenure is of seven years. However, premature redemption is allowed only for senior citizens of specified categories. These bonds are not tradable

Unlike a fixed-rate bond, a floating rate bond has a variable interest rate. The interest rate is benchmarked against the prevailing rate of National Saving Certificate (NSC) with a spread of 35 basis points over the NSC rate.

The interest on the bonds is payable semi-annually on 1st Jan and 1st July every year. The coupon on 1st January 2021 shall be paid at 7.15%.

The interest earned is taxable as per individual tax slab rates.

Our article RBI Savings Bonds 2020 : Floating Rate, Taxable covers it in detail.

NPS Returns in Tier 1 Accounts

NPS Returns in Tier 1 Accounts are shown in the image below.

Related Articles

- Ways to invest in Gold

- RBI Savings Bonds 2020 : Floating Rate, Taxable

- New Traffic Fines in India, Documents to carry, DigiLocker

- IPO: Process, Types of Investors

- Interest Rates of Small Savings Schemes

Breaking up your financial independence goals into small chunks can help keep you on track while making the process a bit more manageable & less stressful.

Informative post. I have started investing in stocks last year. thinking mostly of long-term holding.

It is a beautiful article stating about the investing. Anyone searching for same topic may find their shelter here. I am sure many people will come to read this in future. Great blog indeed, will visit again future to read more!! I love your posts always.

Agency Banking services by Panamax broaden the horizon

for banks to help them serve their customers efficiently.

8219964715

https://novascotiya.com/

nice post

FOR BEST INTRADAY STOCK FUTURE TRADING TIPS VISIT BEST STOCK FUTURE TIPS OR WHATSAPP ON 7772909587

https://equitycashcalls.blogspot.com/2020/07/market-report-of-20-july-20.html

Really a very nice and detailed summary of the performance of different asset class over a period of time.

Thanks for encouraging words.