Any investment done for a tenure of more than three years is generally considered as a long-term investment. The primary focus behind investing is to meet long-term goals and future expenses such as:

- Children’s education

- Marriage of children

- Purchasing a home

- Setting a retirement corpus

Or any other long-term goals that you wish to achieve. If you invest your money wisely, it helps in providing a sense of financial security and yielding higher returns on your investments in the long-run.

However, to achieve these goals you need to understand that both investment and insurance are essential components of a long-term plan. Both these components help in achieving your life goals in the longer duration. In addition, these investments also help you in claiming tax deductions every year.

Government of India allows tax-deductions on investments made in specific instruments, and if you invest in these instruments for a longer-run, they not only help you in yielding better returns but also help in tax saving. Some of these tax saving investment options are as follows:

- PPF

PPF (Public Provident Fund) has been the favourite savings avenue for many investors. After all, the interest earned from PPF has a sovereign guarantee and the returns received are entirely tax-free.

PPF currently offers an interest rate of 8 per cent per annum. You can open an account on your name or on behalf of a minor for whom you are the guardian. Moreover, the deposits made in PPF account every year are eligible for tax deductions under Section 80C up to the limit of Rs. 1.5 lakhs. Details of PPF are shown in the image below.

- NPS

NPS is a government authorized pension scheme regulated under the PFRDA (Pension Fund Regulatory and Development Authority). The primary aim of this investment is to build a retirement corpus.

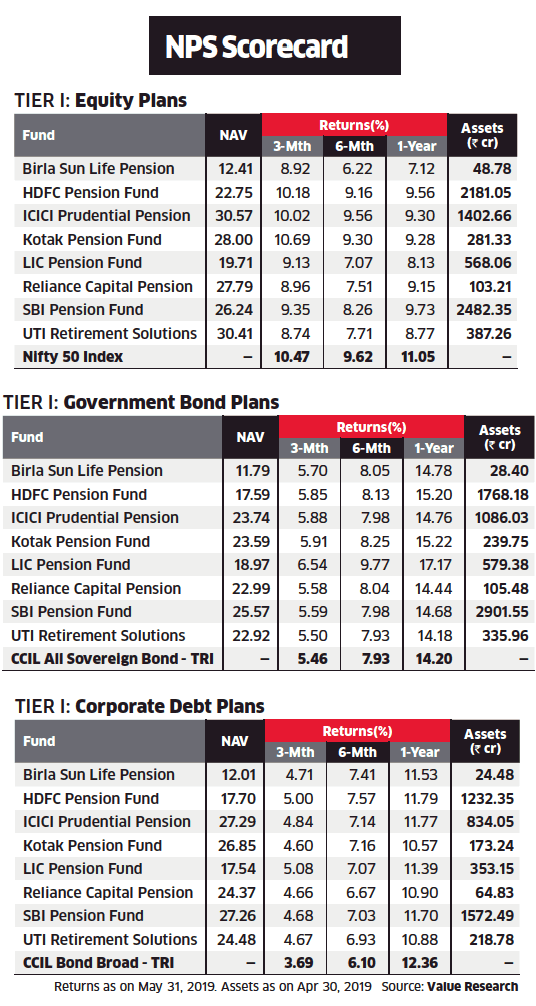

You can start by investing in NPS at the age of 18 (maximum up to 65 years of age). Investments made under NPS every year are eligible for tax deductions under Section 80C. Moreover, if you are a salaried individual and have exhausted your tax limit under Section 80C, you can also claim for additional tax deduction under Section 80CCD(1B) by investing in NPS. Returns from NPS are shown in the image below.

- Traditional Insurance Plans

Traditional insurance plans can be money-back, endowment or whole life insurance plans. These plans have an inbuilt savings feature in them and are available for a fixed term at a fixed sum assured.

The premiums of these plans are mainly based on the age of the buyer, the coverage amount needed and the time period. While the premium paid towards these plans qualify for tax saving benefits under section 80C every year, the maturity value and the death benefits are tax-free.

- ULIPs

Unit linked insurance plan (ULIP) is a hybrid financial instrument, a combination of both insurance and investments. It not only provides life cover to the policyholder but also offers the chance of channelling savings into various market-linked funds.

In most ULIP plans there are more than five fund options, and you are allowed to switch funds according to your choice. While some companies might have switching charges, reputable insurers like Max Life Insurance offer 12 free switches to their customers in a financial year.

Moreover, the investments made in ULIPs are eligible for tax deductions of Rs. 1.5 lakh under Section 80C and maturity benefit is entirely tax-free under Section 10 (10D).

- Sukanya Samriddhi Yojana

Sukanya Samriddhi Yojana or SSY is a deposit scheme for small girls that was launched under the ‘Beti Bachao Beti Padhao’ campaign. The SSY scheme of GOI currently provides an interest rate of 8.1 per cent on investments while offering tax saving benefits. Investments made towards SSY are eligible for tax deductions (U/S) 80C of the Income Tax Act.

The SSY account can be opened any time after the birth of a girl until she turns 10. A minimum deposit of Rs. 1000 is required to open this account, and this amount can increase up to Rs. 1.5 lakh during a financial year. The SSY account remains active for 21 years from the opening date or till the marriage of the child. Details of Sukanya Samriddhi Yojana are shown in the image below.

Details of Post Office Returns

Returns of NPS

When It Comes to Wealth Creation Go Long-Term

The above-stated long-term investment options help you in fulfilling your commitments while providing you with tax benefits. Every investment made towards these instruments gives you extra money in terms of tax savings while securing your future financially.

Moreover, investing for long-term in these investments also help in:

- Building a good corpus for yourself

- Gaining benefits from the power of compounding

- Generating higher returns