The ITR-2 form for AY 2014-15 requires taxpayers to give a detailed break-up of tax-exempt allowance in schedule S. Schedule S is for filling the salary income in ITR2. This article explains the changes in filling Schedule S in ITR2 this year.

Table of Contents

What is Schedule S of ITR?

The ITR2 to ITR6 has multiple schedules such as Schedule S which is for salary. Schedule-HP which is Computation of income under the head Income from House Property. Schedule-CG Computation of income under the head Capital gains. These schedules can be thought of as different sections related to Income Tax calculations. One is not required to fill all schedules, Many of the schedules are optional . For example a person who has not bought/sold a house has no Computation of Income under Income From House Property and hence would not be required to fill the Schedule HP.

In ITR utilities a taxpayer can decide which of the sheets are relevant for their eFiling and can choose to view only such sheets. For ex : If there are no House Property details to be submitted, the taxpayer can deactivate / hide this sheet . XML will only be generated hence for the active sheets. Explained in our article Filling ITR1 Form

Our article Income Tax for AY 2014-15:Tax slabs, ITR Forms explains in detail about ITR for AY 2014-15 or FY 2013-14.

Tax Exemptions Under Scanner

The tax exemptions are increasingly being put under the scanner by the CBDT. The Centeral Board of Direct Taxes (CBDT) is a part of the Department of Revenue in the Ministry of Finance of the Government of India. The essential functions of the CBDT include: a) It provides the essential inputs, ideas and requirements for planning and policy in India, with regard to direct taxes in India. b) It helps in the administration of direct taxes throughout India through Income Tax Department.

In October 2013, it had declared that the salaried taxpayers who claim HRA exemption will have to report their landlord’s PAN if the total rent in a year exceeded Rs 1 lakh.In case the landlord does not have a PAN, the employee will have to submit a declaration to this effect from the landlord, along with his name and address. Earlier, you were not required to submit the landlord’s PAN details if the total rent paid was less than Rs 15,000 a month. The new rule effectively reduced this limit to Rs 8,333 a month. Though this was meant to plug tax evasion by salaried professionals who submitted fake rent receipts to maximise their HRA exemption, even honest taxpayers had to suffer the collateral damage. The new rule created problems for many employees because landlords are generally reluctant to provide PAN on rent receipt to tenants.

Tax Exemptions for Salary under Scanner

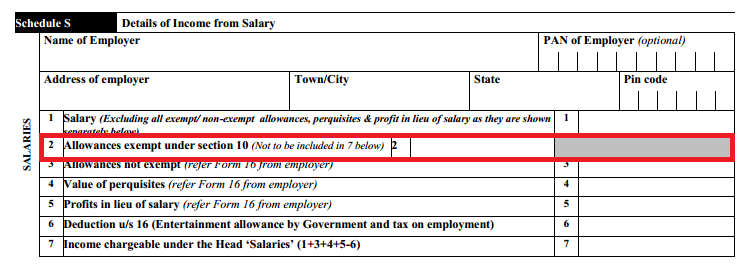

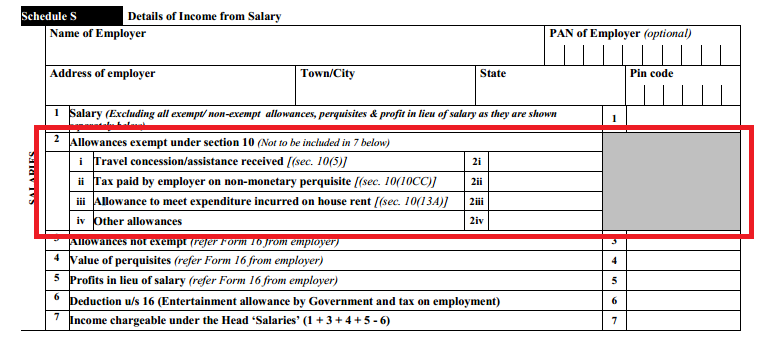

Many employees get house rent allowance (HRA), leave travel assistance (LTA) and travel allowance as part of their salaries. These allowances are exempt if certain conditions are met. Till AY 2013-14 the taxman had no issues if you mentioned a consolidated figure in your return, but now he wants to know how much you received under different heads. You will now have to separately mention the figures for, say, HRA and LTA. Images below show the difference in the form for AY 2013-14 and AY 2014-15. If you look at Image of Schedule S for AY 2013-14 , point 2, Allowances exempt under section 10 were bundled together, highlighted by red box.

In AY 2014-15 Allowances exempt under section 10 are now split into Travel concession/assistance received, Tax paid by employer on non-monetary perquisite etc highlighted by the red box in image below.

Explanation of exempt Allowances

Travel concession/assistance received is under section 10(5). It basically refers to Leave Travel allowance or LTAwhich is an allowance you get from your employer when you are on leave from work and you along with your family actually travel domestically i.e. within India. Our article What is Leave Travel Allowance or LTA explains it in detail.

Tax is paid by the employer on non-monetary perquisites (sec 10(10CC)) . Perquisite is a benefit received by an employee in excess of his salary. Perquisite can be provided both by way of a monetary payment or a non-monetary payment/benefit. Payments which can be called non-monetary payments are car facility, chauffeur salary paid directly, benefit on account of interest-free loans, rent-free accommodation, furniture provided to employees, soft furnishings and so on. A perquisite by way of a monetary payment could be a case where the employee initially incurs the expense and the same is later reimbursed by the employer to him. If an employer paid the tax on behalf of an employee, which is otherwise payable by the employee is considered as taxable perquisite. However, under section 10(10CC) of the Income Tax Act, 1961, an employer has been given an option to pay tax on the whole or part of the value of perquisite on behalf of employee without deduction of it from the salary of an employee. When the tax actually paid by an employer as non-monetary perquisite, it is not taxable in the hands of employees. As far as Section 10(10CC) of the I-T Act is concerned, payments made to a third party on behalf of the employee are a non-monetary benefit in kind. Direct Monetary payments to employees are outside the purview of the exemption. Our article Understanding Perquisites deals with Perquisites in detail.

Allowances to meet expenditure incurred on house rent under section 10(13A). House Rent Allowance or HRA is given by the employer to the employee to meet the expenses of rent of the accommodation which the employee has taken for his residential purpose. House Rent Allowance so paid by the employer to his employee is taxable under head Income from Salaries , but it can help you save taxes under Section 10(13A) of the Income Tax Act. Our article HRA Exemption,Calculation,Tax and Income Tax Return deals with HRA calculation in detail.

Tax exemption in Form 16 and showing it in ITR for AY 2014-15

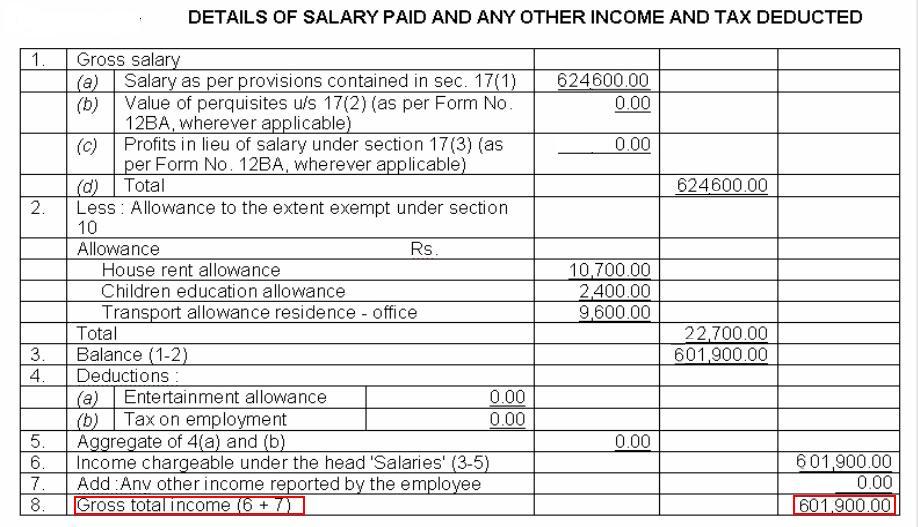

To fill the values in Schedule S such as of tax exemptions, one would have to look at Form 16. A sample Form 16 from our article Filling ITR1 Form is given below. Our article Understanding Form 16: Part I explains Form16 in detail.

- Allowances like leave travel allowance, medical reimbursement, house rent allowance (if an individual lives in a rented accommodation) and transportation allowance, etc are exempt from taxes.

- Allowances not exempt include allowances like special allowance. It also includes the house rent allowance (HRA) if the individual owns a house and lives in it.

For example let’s take a look at salary structure of Mr Verma

- Basic: 1,44,400

- House rent allowance : 72,000

- Special allowance : 96,720

- Transport Allowance : 9,600

- Medical Reimbursement : 15,000

- Leave travel allowance : 15,000

- Bonus :1,80,000

Salary includes your basic salary and the bonus earned during the course of the year. In the case of Mr. Verma, the basic and bonus amount to Rs 3,24,000.

Allowances not exempt include allowances like special allowance. It also includes the house rent allowance (HRA) if the individual does not live in his own house.

If Mr. Varma lives in his house, then his HRA is taxable. The total of his special allowance (Rs 96,720) and HRA (Rs 72,000) works out to Rs 1,68,720. The income chargeable to tax under this head,Income from Salary works out to Rs 4,92,720.

If Mr. Verma lives in a rented house then his HRA ,72,000, will be exempt and would have to be shown under Allowances to meet expenditure incurred on house rent under section 10(13A) in Income Tax Return ITR2.

His Leave travel allowance of Rs 15,000 if claimed will be exempt and would be shown under Travel concession/assistance received is under section 10(5) in ITR2

Related Articles:

- Income Tax for AY 2014-15:Tax slabs, ITR Forms

- Income Tax Overview

- Income Tax Calculator

- Understanding Income Tax Slabs,Tax Slabs History

- Income Tax articles organized , example articles

Note: We are planning to have a Google Hangout session on a Sat (date not decided yet) to give overview of Income Tax process. If interested please drop an email to bemoneyaware@gmail.com

Please check that details of Schedule S in ITR2 are filled property for Exempt Allowances, whether you file it yourself or you get it filled with someone. Income tax laws are becoming stricter and stricter , so please verify your ITR to avoid notice from Income Tax Department.

respected sir or mam, I want to know about what is the exemption for reimbursement of educational expenses by his employer , is there exemption for this entry in SALARY, GROSS TOTAL INCOME.

Hi,

I have a Tax liability of around Rs. 20,000 which I need to pay. However, when I fill ITR-2 and do Calculate Tax, there is NO Amount payable showing up in Part B- TTI. Even the complete Total Taxes Paid (TDS) amount is getting reflected in the Refund column. Neither any Interest (234A, 234B, 234C) is also been shown, nor any Education Cess.

Basically, it seems as if the complete Part B- TTI section is not getting computed. What could be the likely reasons for it. How do I solve this.

When I try to Validate TDS tab on the ITR-2 sheet, I get the following message:

Schedule TDS2: Amount carried forward at Sr. No. 2 should not be greater than 14 digits.

I don’t have any 14 digit entries in the sheet.

How can I resolve this? Could this be causing an issue?

Thanks,

Ritg

Please ensure that the Status is set as “Individual” or “HUF”, whichever is applicable in the Part A-GENERAL of the ITR-2 form. This will resolve the issue.

Thanks for the solution

Hi,

I have a simple question which seems to have been asked in various threads on various pages of this website, but never suitable answered. Request you to please answer this question as precisely as possible without any extra information.

Q. In Schedule S (Salary) of ITR – 2, point 1 asks to enter only salary (without any allowances) – which is alright – so I enter salary from point 1 in form 16. Now when I enter the allowances (exempt under section 10) in point 2 of ITR2, these allowances are not subtracted from my total taxable salary. This makes my total taxable salary appear as Gross Salary + perquisites. But my taxable salary should be = Gross salary – emempt allowances + perquisites.

Hi Hemanth, I have exactly the same problem. Did you find a way around it?

I am filing ITR-2 for AY 2015-2016 (FY 2014-2015), I have received a Leave Encashment when I resign my previous job in above mention period. I came to know that Leave Encashment at the time of leaving the job is tax exempted as per sec 10(10AA)(ii). But I could not find the correct column in ITR-2. Please assist me where I can mention 10(10AA)(ii) amount in ITR-2.

Leave encashment is exempt but if you are private employee then you would have to calculate how much of leave encashment is exempt.

Govt Employees ( Central Govt and State Govt employees only): Leave encashment of accumulated leave at the time of retirement, whether on superannuation or otherwise, received by a Govt employee, is fully exempt from tax . No tax would be levied on any amount received as leave encashment by govt employees on retirement.

Other Employees : Leave encashment of accumulated leave at the time of retirement whether on superannuation or otherwise received.

by any other employee (except those covered above) is exempt from tax to a certain limit. In such a case, the least of the following shall be exempted :-

Leave encashment actually received

10 months “average salary”

Cash equivalent of unavailed leave calculated on the basis of maximum 30 days leave for every year of completed service.

Amount specified by the Govt i.e. Rs. 3,00,000

Step (a) – Find out duration of services in number of years (ignore any fraction of year).

Step (b) – Find out rate of earned leave entitlement from the service rules – how many days leave is credited at the rendered for each year of services (earned leave entitlement can not exceed 30 days for every year of actual services rendered for the employer from whose services he has retired). For instance, if earned leave is credited at the rate of 45 days leave for each year of service, for step (b) calculation shall be made at the rate of 30 days leave for each year of service. If, however, earned leave is credited at the rate of 23 days leave for each year of service, for step (b) calculation shall be made at the rate of 23 days leave for each year of service.

Step (c) – Find out earned leave actually taken or enchased (in number of days) during the service time,

the computation shall be made as follows:- Step (a) × Step (b) minus Step (c) ÷ 30

Note- 2 How to find out Average monthly salary? Salary, for this purpose, means basic salary and includes dearness Allowance if terms of employment so provide. It also includes commission based upon fixed percentage of turnover achieved by an employee, (if any). ‘Average Salary’ for the aforesaid purpose is to be calculated on the basis of average salary drawn during the period of 10 months ending on the date of retirement.

You can download the calculator from Leave Salary encashment Exemption, Calculation, Download calculator (Bottom of page)

After calculating the Leave Encashment check if it is above the exempt limit.

Then you can follow the video 776 (Income tax) How to show Leave encashment allowance in income tax return to fill the appropriate amount

is the school fee exempted from tax as this money is spent for purpose of encouraging the academic, research and training pursuits in educational and research institution, please clarify

1.My son’s Form 16 does not indicate any deductions like conveyance and medical etc.,.

2.Very importantly, his name is registered as middle name and may name as First name.

What should we do ?

Thanks in advance

Mani

Is his PAN number correct?

If you are filing ITR1 then you don’t need to worry about different deductions. Sample Form 16 is at

How To Fill Salary Details in ITR2, ITR1

1.My son’s Form 16 does not indicate any deductions like conveyance and medical etc.,.

2.Very importantly, his name is registered as middle name and may name as First name.

What should we do ?

Thanks in advance

Mani

Is his PAN number correct?

If you are filing ITR1 then you don’t need to worry about different deductions. Sample Form 16 is at

How To Fill Salary Details in ITR2, ITR1

Hi,

Please clarify what exactly needs to be filled here:

1.Salary (Excluding all allowances, perquisites & profit in lieu of salary)..

2.Allowances not exempt

Form16 doesnt have a split of these.

I think (1) needs to be basic only.

Please clarify asap.

Thanks,

Vamshi

Hi,

Please clarify what exactly needs to be filled here:

1.Salary (Excluding all allowances, perquisites & profit in lieu of salary)..

2.Allowances not exempt

Form16 doesnt have a split of these.

I think (1) needs to be basic only.

Please clarify asap.

Thanks,

Vamshi

I have filed ITR1 for salaried individual and have not mentioned the HRA details as required what to do now?and i don’t want to revise it as i have mentioned the income correctly what will be the consequences?

HRA breakup etc is only for ITR2 and not ITR1. So relax.

Thanks for your quick reply

1.But that salaried individual income contains HRA please clarify.

2.My next question is one of my client Form16 is not matching with Form 26AS so shall i wait till both the form get matched or shall i file the return on the basis of Form 16.

Shweta

1.Our article How To Fill Salary Details in ITR2, ITR1 explains it in detail.

2. Please fill in ITR as per Form 16. Else he will not be able to revise his return. The worst that can happen is that IT will ask for Income tax to be paid.

There is no guarantee when Form 16 will match Form 26AS

I have filed ITR1 for salaried individual and have not mentioned the HRA details as required what to do now?and i don’t want to revise it as i have mentioned the income correctly what will be the consequences?

HRA breakup etc is only for ITR2 and not ITR1. So relax.

Thanks for your quick reply

1.But that salaried individual income contains HRA please clarify.

2.My next question is one of my client Form16 is not matching with Form 26AS so shall i wait till both the form get matched or shall i file the return on the basis of Form 16.

Shweta

1.Our article How To Fill Salary Details in ITR2, ITR1 explains it in detail.

2. Please fill in ITR as per Form 16. Else he will not be able to revise his return. The worst that can happen is that IT will ask for Income tax to be paid.

There is no guarantee when Form 16 will match Form 26AS

I have one question about the Schedule HP for let out property. The latest ITR-2 for A.Y. 2014-15 has the ‘Name of Tenant’ field mandatory i.e. it cannot be left blank.

What should one fill in it if the property is not really let out and if i am going to enter deemed rent value.

I cant leave it blank (which i used to earlier). Can i enter “Deemed Let out”?

One can fill in any character. CA I know fills in * but even Deemed Let out is ok.

Please Let us know what you filled in and if you faced any problem

I have one question about the Schedule HP for let out property. The latest ITR-2 for A.Y. 2014-15 has the ‘Name of Tenant’ field mandatory i.e. it cannot be left blank.

What should one fill in it if the property is not really let out and if i am going to enter deemed rent value.

I cant leave it blank (which i used to earlier). Can i enter “Deemed Let out”?

One can fill in any character. CA I know fills in * but even Deemed Let out is ok.

Please Let us know what you filled in and if you faced any problem

Where i should declare Medical reimbursement, and Transportation allowance??

Can i declare it under iv. Other allowance …. ?????

Is it correct???

Plz revert

What you declare in Salary section in ITR2 has to match what is given in Form 16.

Medical reimbursement allowance does not come in that section.

Please correct me if I am wrong

Where i should declare Medical reimbursement, and Transportation allowance??

Can i declare it under iv. Other allowance …. ?????

Is it correct???

Plz revert

What you declare in Salary section in ITR2 has to match what is given in Form 16.

Medical reimbursement allowance does not come in that section.

Please correct me if I am wrong

Your articles are very informative and clear.

I have one question about the Schedule HP for let out property. The latest ITR2 for 2014-15 has the ‘Name of Tenant’ field mandatory i.e. it cannot be left blank.

What should one fill in it if the property is not really let out and if i am going to enter deemed rent value.

I cant leave it blank (which i used to earlier). Can i enter “–“?

Dinesh are you using excel utlity to file ITR? Which ITR are you filing?

First one has to fill “Is the Property Let Out” Yes/No.

Only when Yes is selected will the name of tenant compulsory.

Isn’t that happening?

General guidance for filling forms (paper) are

If any schedule is not applicable score across as “—NA—“.

(iii) If any item is inapplicable, write “NA” against that item.

(iv) Write “Nil” to denote nil figures.

(v) Except as provided in the form, for a negative figure/ figure of loss, write “-” before such figure.

Don’t use – but NA

Thanks Kirti for the info.

About the file i am using, I am using the batch file that works along with Java to open up a nice User Interface.

It is not an excel file now for 2014-2015.

Dinesh I tried downloading the Java Utility but getting the error you need to update the Java version.

Where did you download the Java from?

I have a Windows 7 64 bit machine

Your articles are very informative and clear.

I have one question about the Schedule HP for let out property. The latest ITR2 for 2014-15 has the ‘Name of Tenant’ field mandatory i.e. it cannot be left blank.

What should one fill in it if the property is not really let out and if i am going to enter deemed rent value.

I cant leave it blank (which i used to earlier). Can i enter “–“?

Dinesh are you using excel utlity to file ITR? Which ITR are you filing?

First one has to fill “Is the Property Let Out” Yes/No.

Only when Yes is selected will the name of tenant compulsory.

Isn’t that happening?

General guidance for filling forms (paper) are

If any schedule is not applicable score across as “—NA—“.

(iii) If any item is inapplicable, write “NA” against that item.

(iv) Write “Nil” to denote nil figures.

(v) Except as provided in the form, for a negative figure/ figure of loss, write “-” before such figure.

Don’t use – but NA

Thanks Kirti for the info.

About the file i am using, I am using the batch file that works along with Java to open up a nice User Interface.

It is not an excel file now for 2014-2015.

Dinesh I tried downloading the Java Utility but getting the error you need to update the Java version.

Where did you download the Java from?

I have a Windows 7 64 bit machine

Hi,

Thanks for wonderful and great article. After reading article I have following doubts-

Where to mention following reimbursement. Is it part of

1. Conveyance Allowance: 9600

2. Medical Bill Reimbursement: 15000 limit

3. telephone bill expence: 18000

Which HRA allowance need to show? That company shows in CTC or which comes after calculation.

Thanks and Regards

Kranti

Hello Kranti

For filling Income Tax Return we need to follow Form 16. Conveyance Allowance, HRA allowance will be mentioned in Form 16.

Telephone bill Expense I am not sure. Mostly it is not in Form 16. For you does it show up in Form 16?

Our article Understanding Form 16: Part I explains Form16 in detail with images.

Hi,

Thanks for your reply. No it doesnt show in Form 16

Yes many companies don’t show Telephone bill expense in the Form16 till now. Going forward I am not so sure..Enjoy that till it lasts

Hi,

Thanks for wonderful and great article. After reading article I have following doubts-

Where to mention following reimbursement. Is it part of

1. Conveyance Allowance: 9600

2. Medical Bill Reimbursement: 15000 limit

3. telephone bill expence: 18000

Which HRA allowance need to show? That company shows in CTC or which comes after calculation.

Thanks and Regards

Kranti

Hello Kranti

For filling Income Tax Return we need to follow Form 16. Conveyance Allowance, HRA allowance will be mentioned in Form 16.

Telephone bill Expense I am not sure. Mostly it is not in Form 16. For you does it show up in Form 16?

Our article Understanding Form 16: Part I explains Form16 in detail with images.

Hi,

Thanks for your reply. No it doesnt show in Form 16

Yes many companies don’t show Telephone bill expense in the Form16 till now. Going forward I am not so sure..Enjoy that till it lasts

I was very encouraged to find this site. I wanted to thank you for this special read.

I definitely savored every little bit of it and I have bookmarked you to check out new stuff you post.

I was very encouraged to find this site. I wanted to thank you for this special read.

I definitely savored every little bit of it and I have bookmarked you to check out new stuff you post.

RESPECTED ..,I WANT TO KNOW ABOUT EXEMPTION FOR REIMBURSEMENT OF EDUCATIONAL EXPENSES BY HIS EMPLOYER. IS THERE EXEMPTION FOR THAT.