You can file ITR4S or ITR4 if you have income from Business or Profession or freelancing. What is ITR4S? Difference between ITR4S and ITR4.How to choose which ITR to file between ITR4S and ITR4? What does ITR4S covers? Structure of the ITR-4S Form,How to file the ITR-4S Form ? Videos on how to fill ITR4S

Table of Contents

ITR4S or ITR4

As per the Income Tax Act, an income from any profession that involves work, which requires you to use a skill, which is an intellectual skill or is a manual skill, then such income will be taxable under the head Profits and Gains of Business and Profession. As ITRs are based on type of income (among others) so One has option to file ITR4 or ITR4S.

ITR-4S is a four page document, while ITR-4 is a detailed form, possibly one of the two longest of all tax return forms. Called Sugam, the ITR 4S is for businesses what the Saral ITR 1 is for individuals -short, easy to understand and file. Section 44AD has been from assessment year 2011-2012 (AY 2011-12) into Income Tax Act. Before AY 2011-12 section 44AD was only applicable to the business of civil construction. However, it is now applicable to all types of businesses

ITR-4S is a special case ITR, applicable for businesses where income is calculated on ‘presumptive method’. As per Dictionary, Presumed means to accept legally or officially that something is true until it is proved not true. As per Dictionary, Presumptive means presumed in the absence of further information. So Your tax liability is calculated on the basis of a `presumed business income’, irrespective of what your actual income may be.

It is covered by Section 44AD and Section 44 AE

- Under Section 44AD Your Net Income is estimated to be 8% of the gross receipts of your business. Gross receipts or Turnover mean the total collections of the business. The receipts shall be inclusive of VAT & Excise Duty. The receipts shall also include delivery charges as well as receipts from sale of scrap. Discounts given, advances received and money received on sale of assets should be excluded. Section 44AD specifically mentions the word business, therefore section cannot be applied in case of professionals.

- Under section Section 44 AE you can report your income as Rs 7,500 per month for each vehicle if you are in the business of plying, leasing or hiring trucks.

- From FY 2016-17 or AY 2017-18 Section 44ADA is introduced for Professionals. Professionals whose Total Gross Receipts do not exceed more than Rs. 50 Lakhs in a financial year can claim benefit of this Section from Financial Year 2016-17 onwards.

- You don’t have to maintain books of accounts, profit & loss statements or audits. of this business.

- You don’t have to pay Advance Tax for such a business.

- You are not allowed to deduct any business expenses against the income.

The taxpayer can voluntarily declare a higher income and pay tax on it. In case the taxpayer chooses to declare lower income than 8% of gross receipts, he shall have to maintain books of accounts and get them audited.

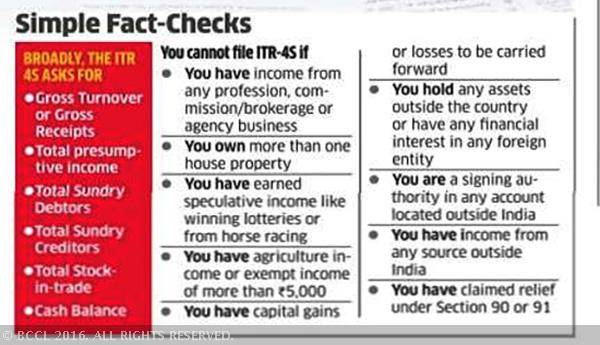

Who can file ITR4S?

Conditions to file ITR-4S are

- You must be resident of India.

- You may be an individual, a HUF or a partnership firm but not a company. So, all startups who have registered with the Registrar of Companies do not qualify

- Your gross receipts or turnover must be less than Rs 1 crore. For FY 2016-17 the threshold limit of section 44AD from 1 Crore to 2 Crore rupees

- You must not carry out following business:

- Income from commission or brokerage, like insurance agents or wealth advisers, are also not eligible to file ITR4S.

- Agency business

- Income of professionals or freelancers Who are carrying on profession of legal, medical, engineering, architectural, accountancy, technical consultancy, interior decoration, an authorised representative, film artist, company secretary and information technology. Authorised representative means: Any person, who represents someone, for a fee or remuneration, before any tribunal or authority under law. Film artist includes a producer, actor, cameraman, director, music director, art director, dance director, editor, singer, lyricist, story writer, screenplay writer, dialogue writer, dress designer – basically any person who is involved in his professional capacity in the production of a film.(These are the professions listed under section 44AA(1)).

- If your business earns income from sources outside India. For example, if your are a software developer and have clients outside India, you can not file ITR-4S.

- You must not have

- Ownership of more than one house property

- Capital gains

- Losses to be carried forward

- Agriculture income or exempt income more than Rs 5,000

- A resident taxpayer who holds any asset outside India or financial interest in any foreign entity

- A resident taxpayer who is a signing authority in any bank account located outside India or has income from any source outside India

- Speculative income like winning from lotteries, horse races

- Relief claimed by taxpayer under Section 90, 90A or 91

No business expenses are allowed to be deducted from the net income. Depreciation is also not deductible. However, in case of a partnership firm, separate deduction for remuneration of partners and interest paid to partners is allowed. This must be within the limit specified under section 40(b). Even though depreciation is not allowed as a deduction written down value (WDV) of the assets shall be considered as if depreciation has been allowed.

Examples of who can file ITR 4S or ITR4

Can a doctor file ITR4S or ITR4?

No. Doctors are not eligible to file ITR-4S irrespective of the income they have earned.

Can an insurance agent file ITR4S or ITR4?

No those earning from commission cannot file ITR4S.

Can an interior decorator file ITR4S or ITR4?

An interior decorator cannot file ITR-4S, as the profession is listed as non-eligible to file ITR-4S. Interior decorator has to file ITR4.

Can a clothing merchant running wholesale business file ITR4S or ITR4?

If the turnover is less than 1 crore then a wholesale business file ITR4S. When turnover exceeds Rs 1 crore one has to file ITR4.

A freelancer can file ITR4 or ITR4S?

ITR-4S is not applicable to professionals, therefore it cannot be filed by Freelancers.

ITR4 or ITR4S in case of multiple businesses

When one has you have more than one business,you can opt for presumptive scheme for the business which comes under section 44AD/44AE. In such a case,

- The relief of not maintaining accounting records & no requirement of audit is only applicable to the business to which this scheme applies. For other businesses which are not covered under this section, the accounting records have to be made and audit is also required.

- The exemption from payment of advance tax is only granted for the business for which this scheme has been opted for. If you have income which is other than from such business, where your tax liability exceeds Rs 10,000 in a year, you have to advance tax on such other income. Advance tax will only be calculated on the remaining income and not for the business covered under section 44AD.

- You have to file ITR-4, since you can file only one return form. You can include income of presumptive business in ITR-4.

Structure of the ITR-4S Form

ITR-4S is divided into:

- Part A: General Information

- Part B: Gross total income from the five heads of income

- Part C: Deduction and total taxable income

- Part D: Tax computation and tax status

- Verification & signatures on the return

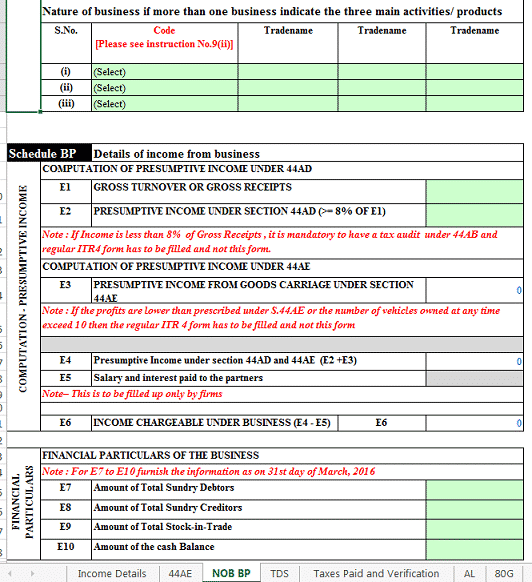

Schedule BP related to Business asksDetails of income from Business. The following information is required in this schedule

- Computation of presumptive income under 44AD

- Computation of presumptive income under 44AE

- Financial Particulars of the Business

- Schedule IT: Statement of payment of advance-tax and tax on self-assessment.

- Schedule-TCS: Statement of tax collected at source.

- Schedule TDS1: Statement of tax deducted at source on salary.

- Schedule TDS2: Statement of tax deducted at source on income other than salary.

- Supplementary schedule TDS1

- Supplementary schedule TDS2

- Supplementary schedule IT

- Supplementary schedule TCS

How to file the ITR-4S Form with the Income Tax Department

You can either file your ITR-4S physically or electronically. Since Financial year 2013-14, electronic filing of ITR-4S has been made compulsory for the taxpayers who…

- Have income of more than Rs. 5 Lakhs.

- Have any assets outside of India, including financial interest in any entity; or signing authority in any account outside of India.

- Those claiming relief under Section 90/90A/91 to whom Schedule FSI and Schedule TR apply.

In case of Physical submission:

- You can submit the ITR-4S in paper form or

- You can submit the barcoded return form duly filled.

The department will provide you with an acknowledgement along with stamp of submission on your copy.

In case of Online / Electronic submission

- You can submit the ITR-4S online after digitally signing the same or

- You can submit the ITR-4S online and subsequently send the the signed verification of filed return in ITR-V to Central Processing Center Bangalore within 120 days of filing.

- Or, with the Electronic Verification, you can avoid sending the ITR-V and get done with the entire process within three to five weeks.

Videos on How to fill ITR4S

- How to File Return (ITR 4S ) for business income (Websites) (Biswarup)

- 498 (Income tax) How to fill presumptive returns ITR 4S (AY 2014 15 ) Hindi

- 561(Presumptive Taxation) How to File ITR 4S for salary and Business Income 44AD AY

- (ITR -4S) How to File income tax return for Website( Rediff)( Tax return filing)

Related Articles

- Which ITR Form to Fill?

- List of Articles to Understand Income Tax, How to Fill ITR,Income Tax Notice…