Should a married couple apply for a joint home loan or not? Priya and Rahul a young couple, both earning, are looking for the right investment for their savings. After considering various options, they have decided that investing in a house would be a good financial decision and would also satisfy the basic necessity of owning a home. After finding a suitable property, they find that they need to apply for a home loan as their savings could not cover the cost of the house. They went through the various loan offers. Some of the banks insisted that the co-owner be the co-applicant too. So they had to seriously look at the advantages and disadvantages of a joint loan. They were in a quandary: Should they apply for a joint home loan or not?

Table of Contents

What is a joint home loan?

Joint home loan is a housing loan that is taken by more than one person and repaid with equal or proportionate financial responsibility. Immediate family members like parents, spouse, siblings, children, can be co-applicants or co-borrowers. The only condition is that he/she should be an earning individual.

Pros of Taking Joint Home Loan

Larger Loan amount if Joint Home Loan

A joint loan means higher eligibility as they can pay higher EMIs. The lender will consider both their incomes to assess the repayment capacity. They could afford a bigger house or a better location with a bigger loan amount.

Suppose a couple wants to buy a house for Rs. 1 Cr. And the loan needed is Rs. 75 lakh. The EMI could work out to Rs. 64,000 for 20 years. If one of the spouses earning about Rs. 70,000 pm applies for a loan, the possibility of the application getting rejected is higher. The lender would question the capability of the individual to pay the EMIs even though the EMI is lower than the monthly take home. If the couple applies together, the joint income is considered for the EMI payment and the chances of approval are higher.

Higher tax benefits for Joint Home Loan

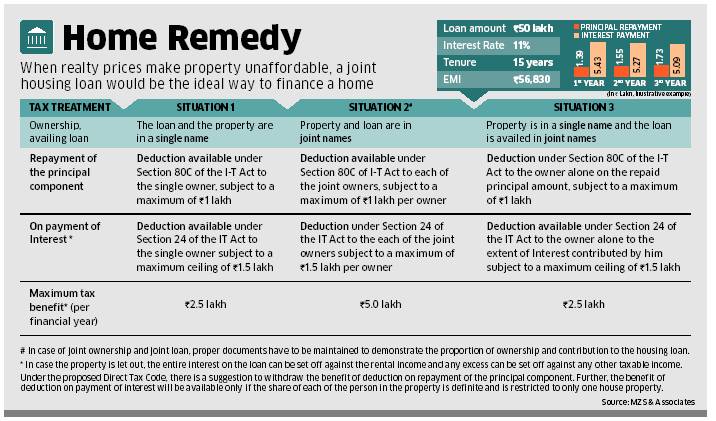

Tax deductions available to home loan beneficiaries are given below. In a joint home loan, each co-applicant is individually eligible for the above tax deduction. This will be based on the proportion of the ownership of the property. So if a wife and husband are the joint owners of a property and if the wife has a separate source of income, then they can both claim tax deductions individually. The tax benefit will depend on the ownership share of each co-owner.

- Principal repayments are eligible for deduction under Section 80C of the Income Tax Act up to a maximum limit of Rs.1.50 lakh.

- Home loan interest payments enjoy tax deduction under Section 24 up to Rs 2 lakh if the property is self-occupied

So, if 2 applicants are sharing the loan on a 50-50 basis, which means their monthly EMIs are equal, as a couple they get to double their tax benefits, which can go upto Rs. 7 lakhs per annum.

The main condition to enjoy tax benefits is that the co-borrowers also need to be co-owners of the said property. The image below,from our article Joint Home Loan and Tax, shows the tax benefits in various situations of loan and ownership of property

Difference between Co-owner and Co Applicant of Joint Home Loan

Co-applicancy refers to sharing the responsibility of paying a loan while Co-ownership refers to the right over a property.

If two people are co-owners then both own the property jointly i.e both share the right over the property for which they are co-owners. If one is a co-applicant, but not a co-owner, dies or stops paying the EMIs, the onus of loan repayment falls entirely on the co-applicant, but without the ownership of the property

All Co-applicants may not be Co-owners. Banks and Housing Finance Companies insist that all the co-owners of a property be co-applicants to a home loan but there is no insistence on all co-applicants being co-owners. In certain combinations the lender may insist on co-applicants being co-owners like when two brothers apply for a loan together. If an unmarried daughter is applying with father/mother then lenders insist that the father/mother should not be a co-owner. When a couple apply for a loan together then they could choose to be co-owners or not but it is always better that they do decide to be co-owners too, so as to avoid any legal issues in case of any unfortunate event in the future

Lower interest rates for women applicants

Some lenders offer a discount on the home loan interest rates to women applicants, around 0.05%. This is an incentive to have the wife as the joint owner/co-applicant for the property.

Home loan interest rate (floating) – Women borrowers Vs Others

Interest rate (per cent, per annum) |

||

| Bank | Women borrowers | Others |

| SBI | 8.7-9.25 | 8.75-9.35 |

| ICICI Bank | 9.1-9.3 | 9.1-9.3 |

| HDFC Ltd | 8.7- 9.3 | 8.75- 9.35 |

| PNB | 8.65-8.7 | 8.7-8.75 |

Note: Rate as on March 27, 2019 (For loan amount < Rs one crore)

Higher tenure

Married couples are allowed a tenure that can go as high as 20 years. Joint home loans with parents or siblings or children are typically given a maximum of 10 years. The cap will always be the retirement age of the oldest applicant. Hence, it is always better to apply for a loan when one is younger.

Loan repayment

It is faster to repay a loan when the burden is shared by more than one person. While it is the collective responsibility of the co-borrowers to repay the loan, they have the freedom to choose the best option to pay the EMIs. It can even be one borrower paying the entire EMI for ease of administration.

Lower registration cost for Women

Several state governments,such as Haryana, Delhi, Uttar Pradesh, Punjab and Rajasthan, offer a partial waiver on stamp duty, for buyers registering properties in a woman’s name, either as a sole owner or as a joint owner. In J&K, women owners do not have to pay any stamp duty while they have to pay a token fee of Rs 1 only in Jharkhand. Stamp duty charges for Women Vs Men in various states is shown below

| State | For men | For women |

| Jharkhand | 7% | Only Re 1 |

| Delhi | 6% | 4% |

| Haryana | 6% in rural

8% in urban |

4% in rural

6% in urban |

| UP | 7% | Rebate of Rs 10,000 on overall charges |

| Rajasthan | 5% | 4% |

| Punjab | 6% | 4% |

| Maharashtra | 6% | 6% |

| Tamil Nadu | 7% | 7% |

| West Bengal | 5% in rural

6% in urban (Plus 1% if property cost is >Rs 40 lakhs) |

Same |

| Karnataka | 5.6% | 5.6% |

Note: List is not exhaustive – charges are indicative and subject to change.

Cons of Joint Home Loan

Equal liability for repayment

If a co-borrower defaults on the payment, the other one is liable to pay for both the EMIs (and the entire loan). Such a situation can affect both the co-borrowers, even if only one individual is at fault.

Death of a spouse and Joint Home Loan

If one is a co-applicant, dies or stops paying the EMIs, the onus of loan repayment falls entirely on the co-applicant. If the husband dies and the wife is co-owner, as per property inheritance laws, the husband’s share has to be divided equally amongst parents, wife and kids. But the loan will be the full responsibility of the wife.

It would be wise for each applicant to take separate life insurance policies to cover the responsibility of the loan in case one of the borrowers dies. Our article Inheritance rights of Women in India: Hindu, Muslim, Christians talks about it in detail.

Divorce and Joint Home Loan

For the financial institution, which has given loan, it does not matter who is contributing and how much one is contributing towards the repayment, as long as the loan is serviced on time. In case of a dispute or death of a co-owner or divorce or insolvency, etc., which may lead to default on the home loan repayment, the lending institution can proceed with the recovery process against all borrowers. Even if the loan is repaid in full, the lender requires NOC(No objection certificate) from the co-borrower to release the original documents. If the couple is divorced or separated at the time of loan closure, the owner may find it difficult to get the NOC and getting the original documents becomes a challenge.

There are many ways to settle joint home loan and the outstanding amount:

- Sell the property and clear the loan. The remaining amount could be divided mutually.

- One party can take over the property ownership, by settling the contribution of the other party. The property can then be refinanced, based on his/her borrowing capability.

- Clear one party’s name from the lending institution’s loan account. The institution shall assess the possibility of doing so and the loan amount outstanding, by examining the other party’s repayment capacity.

Credit score

Irresponsible payment behaviour from your co-applicant will reflect in your credit history too. It will also affect the eligibility of both the applicants in the future.

- If your co-applicant defaults, you will have to make the entire payment yourself.

- if the co-applicant misses or delays a payment, it will lower your credit score as well.

Documents needed to apply for Joint Home Loan

If, after considering the positives and negatives of a joint home loan, a couple decides to apply for a joint home loan, the following documents will need to be submitted:

- KYC documents

- Identity proof

- Address proof

- Income proof – Salary slips or Bank statements

- Proof of co-ownership of the property (which will typically be the agreement of sale that mentions both the names)

- Property documents

Each co-applicant should fill in separate application and provide individual documents for the same loan.

Related Articles:

- Inheritance rights of Women in India: Hindu, Muslim, Christians

- StreeDhan : What is it? Why should one know about StreeDhan?

- Maternity Leave :Duration, Wages,Maternity Benefit Act

- Prenuptial agreement,Financial discussion before marriage, Money and divorce

Conclusion

Joint home loans offer immense benefit when compared to a regular home loan. One should always remember to pay the EMIs on schedule, as any delay or default could lead to legal action on part of the lender, which will affect all the co-borrowers equally.

Don’t rush into buying a house soon after your marriage till you are comfortable with your spouse finance habits. Unlike movies and fairy tales, They lived happily ever after does not always happen!