Scamsters posing as bank officials have duped people by gaining remote access to their mobile phone screens through an app. They call up the victim and tell him his KYC needs to be validated, offer to help him complete the procedure online and then hack into his bank account. In July 2019, Sandeep Choubey of Indore got a call from a man who identified himself as a customer care executive from an online food-ordering company. He lost ₹2.28 lakh to the fraud. In Sep 2019, Mumbai based Dhananjay Joshi lost ₹1.6 lakh after a fraudster got him to download an app such as AnyDesk to complete his KYC details.

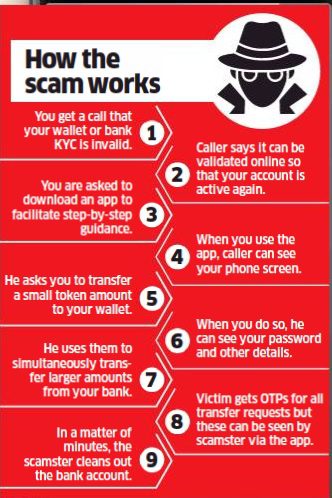

How does the KYC Fruad Work?

- You get a call that your wallet or bank KYC is invalid.

- Caller says it can be validated online so that your account is active again.

- You are asked to download an app to facilitate step-by-step guidance.

- When you use the app, caller can see your phone screen.

- He asks you to transfer a small token amount to your wallet.

- When you do so, he can see your password and other details.

- He uses them to simultaneously transfer larger amounts from your bank.

- Victim gets OTPs for all transfer requests but these can be seen by scamster via the app.

- In a matter of minutes, the scamster cleans out the bank account.

Related Articles: