Are we happy with our financial life? What kind of money conversations do we have with ourselves? Do you think that financial life is all about Investing? Do you think that the commission-driven world of finance has been deliberately obfuscated(confusing) for the layman? Do you worry about not making Smart Decisions? If you need to pick a personal finance book for Indians, by Indian, of Indians, a money book without charts and calculators, without boring jargon-filled text or numbers, written in simple language and is not long(208 pages only), not expensive(MRP Rs 399) then Let’s Talk Money by Monica Halan, consulting editor of Financial newspaper Mint, is the book for you. Let’s Talk Money sells nothing. There’s no mention of top mutual fund schemes to buy or fund managers to bet on or fancy structured product. It does not provide a single-shot solution. Let’s Talk Money by Monica Halan provides simple rule of thumbs to help to organize your finances in a structured system, called money box, which will allow you to get on with your life, with all its complications, rather than stay worried.

Money and our relationship with it—our fears, greed, insecurities and over-confidence—define who we are and what we do.

Table of Contents

Money Conversations

Money talks, I’ll not deny, to me It says, Goodbye.

We feel guilty about the mess in our money lives. We worry about not having enough for our kids and ourselves in future years, about not making the ‘smart’ decisions, about missing the money-making train as it zips past. We worry about emergencies and hoard cash. The cash accumulates, and then some sharpshooter comes along(neighbour, Bank relationship manager, a friend of a friend) and offers this fantastic deal. He’s persistent; pushy; throws numbers; works on your fears, emotions, guilt. And gets your money. This ends in several ways. In a total loss, a partial loss or simply a bad investment that gives you returns worse than a bank FD (fixed deposit). Yes, the regulators are there but they mostly take action after the event.

Talking about money has been frowned upon as gross in families and social situations. The rich are called filthy rich, Being above money. People may boast about great investments, like the stock that made them super-sized returns but shy away from mentioning the strain on their financial life due to the EMIs of a big house or the foreign travel that you admired on social media. And We rarely have open and honest conversations about our spending and saving habits with others and even with ourselves.

Managing your finances is not a luxury for the rich, it is hygiene for everyone.

Money is complicated Honey!

You keep hearing on TV, Internet about the economy, union budget, interest rate, different asset classes, portfolios, best mutual funds or stocks to buy, how to save tax on invest for retirement, those TLA(Three letter acronyms) such as PPF, NPS, CAGR, XIRR and get really intimidated. Get this straight. It is in the interest of the financial sector to keep things complicated for you. The less you understand, the more you can be cheated. The more complicated you think the world is, the more they can obfuscate.

You need to treat the finance industry and those who sell the same like walking through reptile-infested waters

Navigating through the jargon can feel like trying to cut through a dense thicket with a butter knife. No wonder then, like the proverbial ostrich, many of us stick our heads in the sand, hoping if we don’t see the problem, it doesn’t see us too

Our money worries usually centre around finding the best return on investment. But there is a lot more to financial fitness than just investments.

Money needs a structured system, a Money Box

In Let’s Talk Money, Monika advocates two important principles:

- Build a system, rather than a single-shot solution.

- Each financial product you buy must solve the problem you have.

Think of your financial life as a Moneybox. Each cell in the money box represents a different need – expenses-recurring and special, being ready for an emergency, protection of you and your family through insurance, short-, medium- and long-term investments, retirement planning, emergency needs, among others. She suggests

- Three bank accounts: Income Account, Spend it Account and Invest it Account. As soon as the salary comes in the Income Account, part of it moves to the Spend It account and the rest moves to the Invest It account

- Spend It Account: into which your month’s spending money flows,

- Invest It Account: To be used for Investing.

- Emergency Fund: you must have an emergency fund that will keep you going for six months without a paycheck.

- Insurance: The purpose of insurance is protection and not wealth creation. 5 types of insurance one should get are health, life, critical illness, accident, home

- one retirement account.

- Investment: types of investment approaches

Video on Monika Halan Talking about her Book Let’s Talk Money

In an exclusive interview with CNBC Awaaz, the author of Let’s Talk Money, Monika Halan talks about the correct way to financial planning – right from earning, savings, expenses to investment.

Let’s Talk Money by Monika Halan

Let’s Talk Money has 14 chapters in 208 pages which covers following. Its MRP is Rs 399 but is often available on discount on Amazon, Flipkart

- Almost everything in our Financial Life: Budget, Emergency, Insurance, Investing, Will, Retirement. List of Chapters is given below.

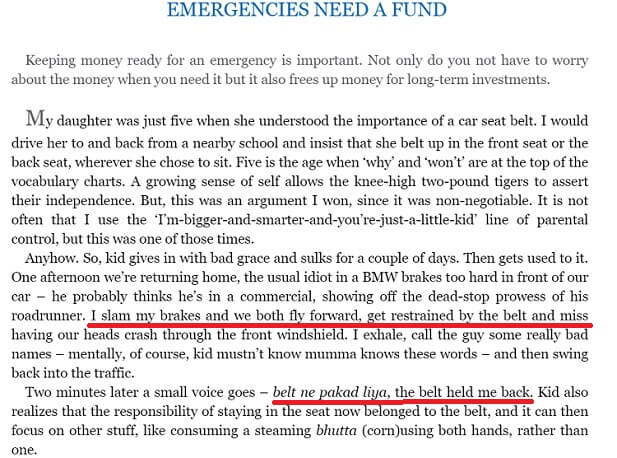

- The language is simple, no jargons, no charts, no mathematical formula. Excerpt of how she talks about budgeting, explains emergency fund by using seat belt example with her daughter is given below

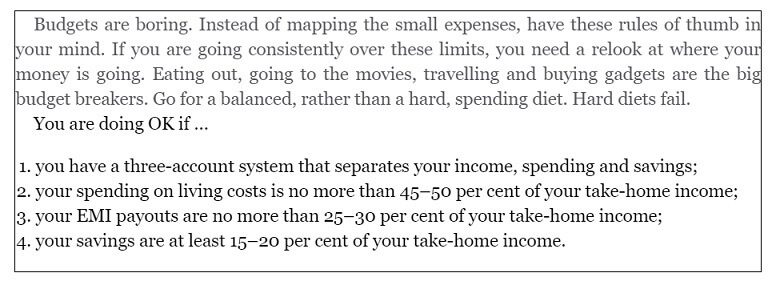

- A section at the end of each chapter which summarises the chapter gives rules of thumbs which is like a checklist cum Action Plan

Monika Halan is consulting editor of Newspaper Mint. She has served as editor of Outlook Money and worked in some of India’s top media organizations, including the Indian Express, the Economic Times and Business Today. The book has forward by Nandan Nilekani, co-founder of Infosys.

Chapters in Lets Talk Money

- THE MONEY ORDER

- DON’T STASH THAT CASH!

- EMERGENCIES NEED A FUND

- BUILDING YOUR PROTECTION

- WHAT IF YOU DIE?

- FINALLY, WE’RE INVESTING

- LETS DE-JARGON INVESTING

- EQUITY

- MUTUAL FUNDS

- PUTTING IT ALL TOGETHER

- MY RETIREMENT

- REDO THE BOX

- WILL IT

- WHAT KILLS A MONEY BOX?

Excerpt from the book Let’s Talk Money

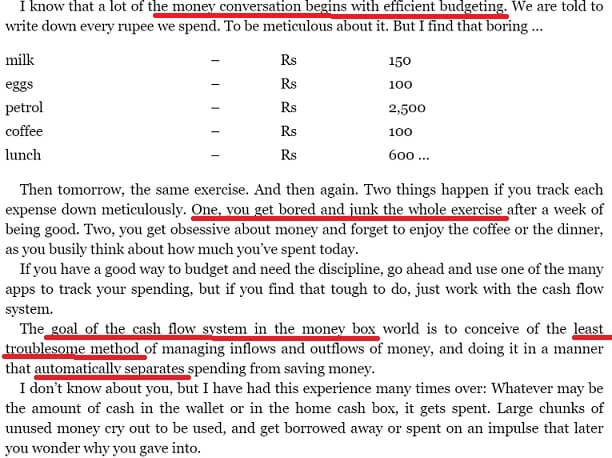

Excerpt of how to budget from Lets Talk Money. All money conversation begins with efficient budgeting, but budgeting is boring and we junk it.

Why we need Emergencies Need a fund

You are doing OK

The part I liked most is a section at the end of each chapter which summarises the chapter, gives rules of thumbs which is like a checklist cum Action Plan and which says: “You are doing okay if you are doing following things.

Others Books in Personal Finance

In our article Money,Personal Finance Books for Indian by Indian authors we have covered the following books.

- Retire Rich: Invest Rs 40 a day by PV Subramanyam:

P V Subramanyam, a Chartered Accountant by qualification and a financial trainer by profession and passion. He runs personal finance blog http://www.subramoney.com. The book was first released in 2010. A new and updated edition was released in Mar 2019. Our review Retire Rich: Invest Rs 40 a day by PV Subramanyam Book Review

- How to be Your Own Financial Planner in 10 steps

by Manish Chauhan. Manish Chauhan runs personal finance blog jagoinvestor.com. The book concentrates on ten most critical aspects of finance, namely life insurance policies, health insurance, estate planning, short term/long term goal planning, debt repayment, start your retirement planning, emergency fund planning, how to be ready for your future, organize your financial life, credit report and cleaning up other investments. The book explains how one should take health insurance before the age of forty-five. The book illustrates key concepts that we ignore like our credit scores and how it affects our chances of getting a loan at a reasonable rate. We should try to eliminate the debts for which we are paying a high-interest rate.

- Book Review-JagoInvestor:16 personal finance principles every investor should know

- You Can Be Rich Too : With Goal Based Investing

by PV Subramanyam and M. Pattabiraman: The book is an attempt at making investing very common sensical and simple. It is meant for beginners and young earners to quickly understand the basics and implement them. The book also caters to experts who will find the sections on mutual fund selection, portfolio construction, and the online calculators useful. Book is written by PV Subramanyam of financial blog subramoney, and M. Pattabiraman, IIT Madras professor who runs blog freefincal.com. Review of the Book: You Can Be Rich With Goal based Investing

Related Articles:

- Money,Personal Finance Books for Indian by Indian authors

- Retire Rich: Invest Rs 40 a day by PV Subramanyam Book Review

- Book Review-JagoInvestor:16 personal finance principles every investor should know

- Review of the Book : You Can Be Rich With Goal based Investing

What kind of money conversations do you? What do you think about Personal Finance? How do you handle money in your life? Which books on personal finance have you read?