It is mandatory for all insurance policyholders to link their Aadhaar and PAN details to their insurance policies by 31 Dec 2017. It is mandatory for both life and general insurance policies such as like health, motor, travel and home. You can link the insurance policies online and offline. In order to avail the online linking facility, the mobile number of the policyholder must be registered with the Aadhaar. This article gives an overview of how to link Insurance Policies with Aadhaar and PAN. Explains Why should one link Aadhaar and PAN with Insurance Policies? Explains How to Link LIC policies with Aadhaar and PAN for a Registered User? How to Link LIC policies with Aadhaar and PAN for a Non-Registered User?

Note: No facility to link Aadhaar number to policies is available through SMS in LIC.

Table of Contents

How to link Insurance policies with Aadhaar and PAN?

It is mandatory for all insurance policyholders to link their Aadhaar and PAN details to their insurance policies by 31 Dec 2017. One can link online as well as offline. In order to avail the online linking facility, the mobile number of the policyholder must be registered with the Aadhaar database. Please note that all details submitted by you should match with Aadhaar Information. In case of mismatch Linking of Aadhaar can be refused. How to handle mismatch of data is to be seen?

Aadhaar Linking mandatory for what and by which date? covers all that needs to be linked to Aadhaar and by which date

Link Insurance Policies With Aadhaar and PAN Online

- Online linking for registered user: The policyholder can log in to the website of the insurance company and add his Aadhaar details to his profile. This is the easiest way of updating Aadhaar.

- Online linking for non-registered user: if the policyholder is not a registered online customer, he can visit the insurance company website and complete the process. Here the policyholder will have to furnish details such as policy number, date of birth, PAN, email id, mobile number and Aadhaar number

Authentication

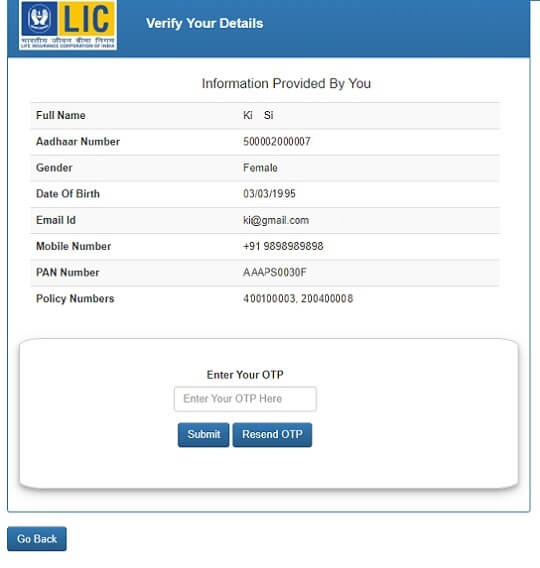

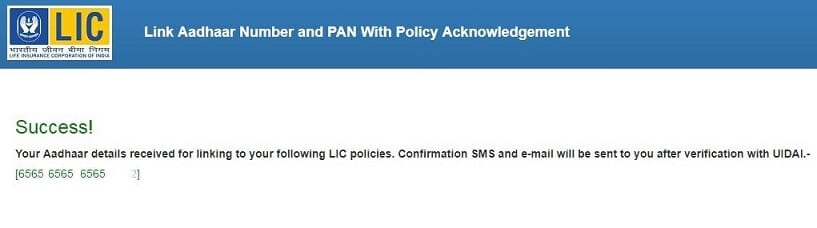

Once Aadhaar number is furnished using any of the above methods, an OTP is sent to the registered mobile number. Once OTP is entered, the Aadhaar number is successfully registered

Link Insurance Policies With Aadhaar and PAN Offline

The policyholders can approach their respective insurance agents or visit the nearest branch office of the insurance company with their Aadhaar card to carry out the linking. A self-attested copy of Aadhaar needs to be furnished to complete the process.

Why should one link Aadhaar and PAN with Insurance Policies?

- In the public sector: There are 54 insurance companies, which include four non-life, one life and one reinsurance company. In addition, there are two government-owned insurers for exports and agriculture.

- In the private sector; there are 23 life insurers, 18 general insurers and five health insurance companies.

- Life Insurance Corporation (LIC) alone is estimated to have around 29 crore policies. In addition, there are 21 crore vehicles and a significant number of health insurance policies.

- In 2016-17, life insurers issued 2.67 crore policies, of which 2.05 crore were from LIC.

Link LIC Policy with SMS: No such facility

LIC claims that some messages have been circulating in social media-with the LIC emblem and logo-asking policyholders to link their Aadhaar number by sending SMS to designated number. LIC of India informs the public and policy holders that no such message has been sent by LIC. Also, no facility to link Aadhaar number to policies is available through SMS in LIC. As and when LIC will enable linking of Aadhaar number with policies through SMS, our website will be duly updated with this option,

How to Link LIC policies with Aadhaar and PAN for a Registered User?

LIC’s e-Services is LIC’s initiative to provide you with on-demand service with a few clicks! If you want to pay the LIC premium online, view your LIC policy schedule, know the bonus, loan and claim status of your LIC policies, revival premium quote if you have missed paying a premium on time online. LIC policyholders can avail the services by registering their LIC policy and policy details with the LIC’s website. Our article How to Register Online at LIC e-Services explains it in detail.

Go to LIC eServices portal. If you haven’t logged in some time you would have to verify your email id and mobile number.

Login to the LIC site.

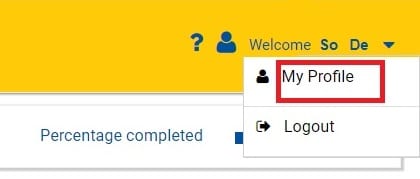

Click on My Profile.

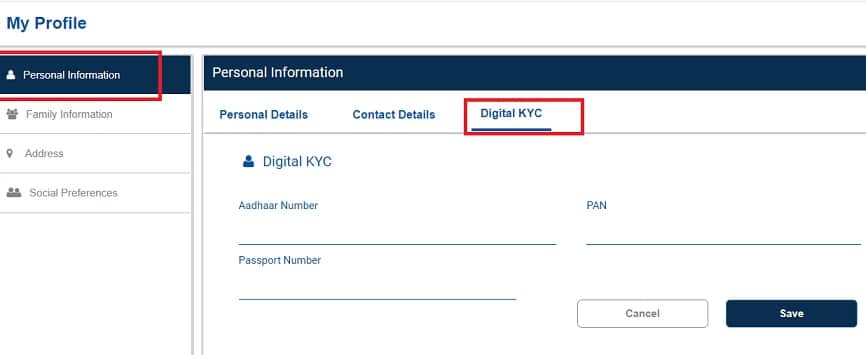

Select Personal Information, Digital KYC.

Enter PAN and Aadhaar Details. You can enter Passport number too.

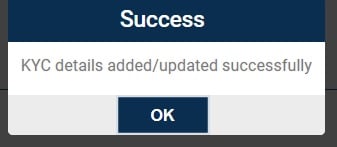

Click on Save.

How to Link LIC policies with Aadhaar and PAN for a Non-Registered User?

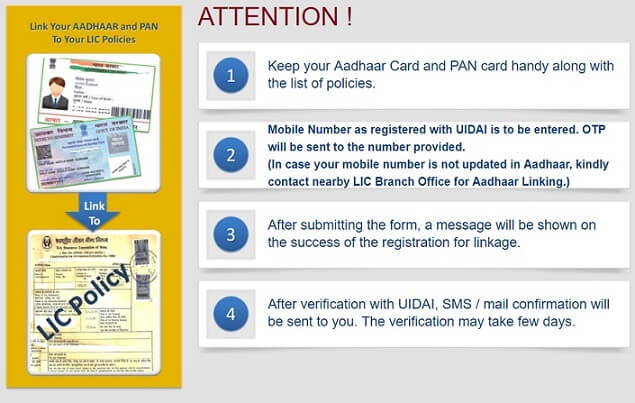

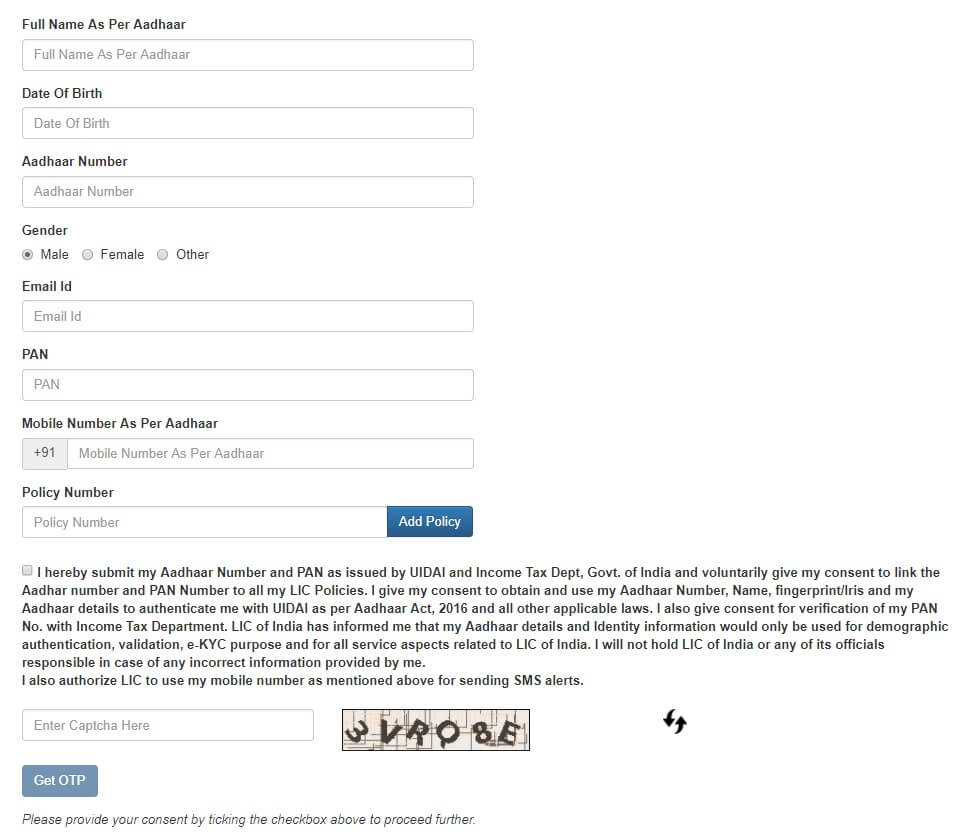

Please Keep your Aadhaar Card and PAN card handy along with the list of policies

- Provide details as per Aadhaar: your full name, Date of birth, Aadhaar number, email-ID, PAN, Mobile number (which is linked to your Aadhaar) & provide your LIC policy number in the respective field

- If you have multiple LIC policies, you can link all these policies at one time. Add the Policy Number and Click on Add Policy. The Policy number would be added below.

- Enter captcha code

- Click on Get OTP button. An OTP will be sent to your mobile number.

Very good article , this is save my time, I link my aadhaar number to my LIC policy online So don’t need to go branch. Thanks

Didn’t know there was another way to link for registered users.

Good to know. Thanks Kirti!!!