Life insurance is meant to offer financial protection to dependents in the unfortunate event of one’s death. But In tough financial times, people sometimes need cash to meet their expenses and emergency demands. Life insurance policies are generally perceived to be illiquid as encashing the policy via surrender comes at a cost. However, Life Insurance policy can be used to avail loan again insurance policy, avail Critical illness rider or Accident Benefit Rider, one can also make the policy paid up if one does not want to pay more premium. This articles goes into details about Loan against insurance policy, when can you claim rider benefits.

Table of Contents

Benefits of Life Insurance Policy you can avail before Maturity

Basically, life insurances come in two forms – term life insurance and non-term life insurance. Term insurance pays out the benefits once the policyholder passes away while the policy is still in effect. On the other hand, non-term life insurance plans such as endowment, money-back policies are expensive as they have an investment component to it. This means that such life insurance policies allow building cash value over time.

If you have a non-term life insurance policy and want to tap into the policy’s cash value, you can do it in following ways. Getting cash out of your life insurance by tapping into its cash value is the easiest way to cash in the life insurance policy. However, it doesn’t work for the term life insurance policies, since they don’t have any cash value.

Loans: Most of the life insurance companies allow the people to take a loan from the accumulated cash value of their policy. They can also serve as collateral for some other loan. E.x While purchasing a flat you need a fixed amount for the down-payment but are falling short. In such a case, you can take loan against your policy and assign the policy to the bank or Non-Banking Financial Company (NBFC) providing the home loan. When you take a loan against your life insurance policy a lower rate of interest is charged in comparison to a personal loan. One additional benefit of loans against life insurance policy is that the policy value does not change with the market as in the case of loans against gold or shares. So, not only does it provide security, but it also helps when one is going through a cash crunch

Riders: Riders are Additional covers that can be added to a life policy, for a cost Claim if you had taken Riders when you bought the Insurance policy.

Paid up: convert it into a paid-up policy without exiting. You would not have to pay further premium.

Surrender: Surrendering a policy means cancelling it. Once you cancel your policy, it releases all the cash value to the policyholder. However, before surrendering you need to be sure that you don’t need the coverage of the policy anymore.

Our article Surrender or Make policy paid up or Continue explains it in detail.

Loan against an Insurance policy

Loan only against Life Insurance Policy. This facility is, however, not available against term insurance policies or Ulips. For traditional insurance policies like Endowment Plan, Money back policy etc are eligible for Loan against Insurance Policy provided policyholder is paying the premium for 3 year.

Upon taking a loan against a life insurance policy, policyholders need to continue paying premiums. If one does not pay the premium, some insurers may terminate the policy.

Even after the assignment of the policy, the tax benefit stays with the assignor(if he is paying the premium) because his life is insured under the policy.

How much loan will you get against your Insurance Policy?

To calculate the maximum loan amount, some insurance companies take into consideration

- type of policy and its surrender value. Surrender Value is basically the amount which the policyholder will get if he decides to close the insurance policy before maturity

- Total premiums paid

The maximum value of a loan depends upon the type of policy and its surrender value. The amount of loan is typically a percentage of the surrender value of the policy. Surrender Value is basically the amount which the policyholder will get if he decides to close the insurance policy before maturity. The surrender value of policy keeps increasing with the policy term depending on the insurance product as you accumulate bonus over a period of time. Normally surrender value of the policy is 30% of the Policy Value. The loan amount can be as high as 80% to 90% of surrender value in case of traditional money back or endowment insurance policies. For example, if you have an insurance cover of Rs 20 lakh and its surrender value is Rs 5 lakh, you are probably eligible for a loan amount Rs 4-4.5 lakh.

Some insurance companies take into consideration about 50% of the total premiums paid to calculate the maximum loan amount. Assuming, for a policy of Rs 10 Lakh, you have paid a premium of Rs 8 lakh at the time of availing Loan Against Insurance Policy. You can get a max loan of Rs 4 Lakh

Interest on the Loan against Insurance Policy

The rate of interest and other terms of the loan will vary from insurer to insurer, so it is important to inquire about the same before taking a loan.

Insurance companies charge an interest rate in the range of 8%-12% and are revised annually. Usually, interest is paid every 3 months, 6 months, or annually, some insurers have a minimum 6 months duration where you need to pay the interest for minimum 6 months before you decide to foreclose your loan within 6 months. Still, this is more economical as compared to personal loans which charge interest around 13%-15% p.a.

Repayment of Loan against Insurance Policy

The loan should be repaid during the term of the policy. The policyholder has the option of either paying back the principal along with interest or only the interest amount. Repayment options also vary.

- If one pays only interest, the principal amount due will be deducted from the claim amount at the time of settlement. For example, for LIC you need not pay the Principal amount provided you are paying the interest on time. At the time of maturity or claim, principal outstanding will be deducted from the policy value. Balance amount will be paid to the beneficiary or policyholder. If the policy is pledged to a bank then you need to pay the principal amount as per amortization schedule. Normally, the repayment period is 6 months

- If the policyholder chooses to pay back only the interest, in the event that they die during the loan term, the pending amount due will be deducted from the claim amount and only what remains will be paid to the nominee.

How to take Loan against Insurance Policy

Loan Processing fee is low in the range of 0%-3% of the loan amount. Some insurers might also charge a flat fee. There is less scrutiny of Loan against your Insurance Policy and your loan will be sanctioned between 2-7 days of the application. CIBIL Score is not checked for Loan against Insurance Policy. Therefore, people with low CIBIL Score can also avail the loan.

You’ll have to visit the branch of your preferred insurance company and fill the application form for a loan. The application form must be accompanied by

- The original insurance policy document.

- Copy of a cancelled cheque Nowadays insurers directly transfer to a bank account using NEFT, RTGS, they have stopped issuing cheques, you’ll have to also provide a cancelled cheque of the bank account in which you want the loan amount to be credited by the insurer and sign a receipt for the same.

- Deed of assignment, if required: In the form, you’ll be asked to assign the policy absolutely in favour of the insurer. This means that in case of a claim/maturity benefit due, the insurer will have the first right over the money and will repay you after deducting the outstanding loan principal and interest. The assignment deed needs to be executed by the policyholder in the prescribed format. Assignment details are endorsed on the policy document as well.

Assignment of Insurance Policy on Taking Loan

Difference between Nomination and Assignment

In the nomination, the nominee has no right to the benefits of life insurance policy if the policyholder is alive. A nominee is simply the receiver of the policy benefits in case of death and he has to transfer the same to the legal heirs.

In the assignment clause, the assignee has full right to the benefits of the life insurance even if the policyholder is alive. This happens because in assignment, all the rights, including the liabilities of the policy is transferred to the assignee and the original policyholder’s right is terminated (basis the type of assignment) while in nomination, the policyholder only nominates the person for receiving policy money after the death of the policyholder and all the rights remains with the policyholder and his heirs.

Riders

Riders are Additional covers that can be added to a life policy, for a cost. For example – If Akshay, has taken a policy which offers a sum assured of Rs. 10 lakhs and has taken an accidental death benefit rider of an additional Rs. 10 lakhs. In the event of death of the policy holder due to an accident during the tenure of the policy, the nominee would get Rs. 20 lakhs as the death benefit.

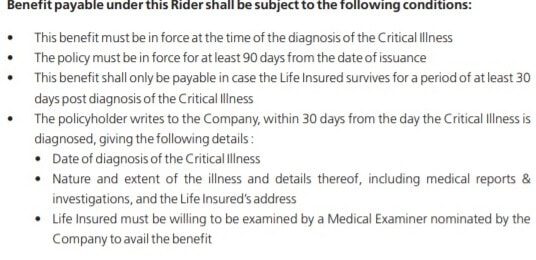

- Critical illness rider: A rider that provides a policyholder financial protection in the event of a critical illness such as cancer, coronary artery bypass surgery(CABG), heart attack, kidney failure, stroke, major organ transplant etc based on insurance provider.

- Accident Benefit Rider : A rider that compensates a policyholder in the event of death or injury by accident

- Disability/dismemberment benefit rider: A rider that provides for additional cover in the event of disability, or dismemberment, of the policy holder due to an accident

The real purpose of a life insurance is to provide death benefits to support your loved ones, that doesn’t mean that you cannot reap the benefits of your policy while you’re alive. The aforementioned ways help and cash in your life insurance policy. It should be availed only for emergency situations. Even if the loan is availed, it should be repaid within 6 months – 1 year so that benefits of the policy can be restored.

useful informative post sharing

Thanks for leaving a comment.