Have you missed filing the ITR (Income Tax Return) for past years such FY 2017-18 or AY 2018-19? The last date for filing of ITR for FY 2017-18 was 31 Mar 2019. You now cannot file a return for FY 2017-18 or AY 2018-19 or for earlier years. What can you do? You may receive a notice from the Income Tax Department with penalty charges for not filing ITR. The alternatives and the risk for not filing the ITR vary from individual to individual depending on their tax due. You should pay off your income tax liability as soon as possible rather than waiting for the Income Tax Notice. You can also apply for Condonation of Delay in Filing ITR Section 119(2)(b) within 6 years of from the end of the assessment year for which income tax return has to be filed. Let us look at these alternatives in detail.

Note: An ITR filed but not verified is treated as an invalid return by the income tax department. An invalid return would mean that you have not filed the ITR for a particular assessment year.

Table of Contents

Overview of What to do on Missing Filing ITR

If you have total taxable income below the exemption limit, which was of Rs. 2,50,000 for FY 2017-18 and you have forgotten to file the ITR return then you do not need to worry. You do not need to take any action because in case of income below taxable income the filing of ITR is not mandatory.

If you have taxable income above the exemption limit, which was of Rs. 2,50,000 for FY 2017-18 then you need to check if have to any income tax liability.

If You have paid all income tax due then you can worry less, as if and when you get income tax notice you can reply with details of income tax paid. But if you have paid more getting refund might be difficult.

If you have not paid all income tax due you will get a notice for not filing the return with due income tax. You would be required to pay interest at the rate of 1% for every month, or part of a month, on the amount of tax remaining unpaid as per section 234A. The calculation of penalty will start from the date immediately after the due date i.e. 31st July (For FY 2017-18, it was 31st August). So, the longer you wait the more you will have to pay.

The income tax officer can initiate proceedings for prosecution for a term of starting from 3 months to 2 years and with fine if you don’t file your ITR. If the tax you owe exceeds Rs. 25 lakh, the period may extend to 7 years. The above proceedings shall not be initiated where the net tax payable does not exceed Rs. 3000. Further, the income tax officer may impose a penalty up to 50% of the tax due in case of under-reporting of income.

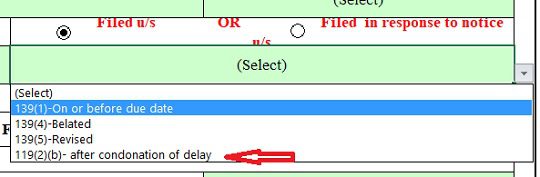

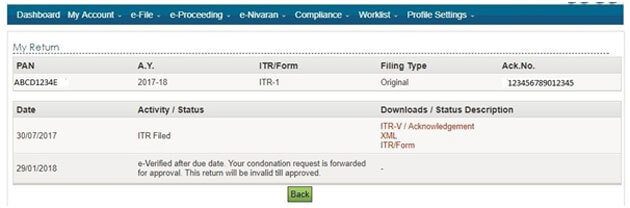

You can file Condonation of delay request to the Income Tax Department on the income tax e-filing website under section 119(2)(b). Condonation of delay request can be filed within 6 years from the end of the assessment year for which income tax return has to be filed. But it is better you file ASAP. Once you file the condonation request, you can track the status through the e-filing portal. After the request is accepted you file the ITR under section 119(2)(b)- after condonation of delay

What is ITR?

ITR stands for the Income Tax Return with the help of which individuals inform the government about the income they have earned during a given financial year. In accordance with the law, Income Tax Returns must be filled on your income, dividends, interest, capital gains, and other income sources at the end of each financial year. This is applicable for both the individuals and businesses.

The benefits that the taxpayers can avail by filing ITR include claiming of refund, carrying forward the capital losses, eligibility for loans, VISA processing, buying life cover, and filing up of the government tenders.

The returns are required to be filled before a specified due date every year which usually is 31st July(extended at times for few days for specific reasons). The submitted forms are then processed by the Central processing Centre(CPC) of Income Tax Department of India.

Financial year v/s Assessment year

To get started with the ITR filing, it is important to know the differences between the two terms. The taxpayers often get confused between the terms a financial year and the assessment year.

Financial Year: A financial year (FY) can be defined as a period between April 1 to March 31. This is the period in which you earn income from different sources.

Assessment Year: An assessment year (AY) can be defined as the year which immediately follows the financial year. In this year, income from the financial year is assessed and taxed. The assessment year also starts from April 1 to March 31.

For example, an FY can be from April 1, 2018, to March 31, 2019. Now, the AY would start from April 1, 2019, to March 31, 2020. The due date for filing of ITR of the given financial year i.e. FY 2018-2019 would be July 31, 2019.

Once the due date for filing of ITR i.e. July 31, 2019, is passed then you can file ITR for the assessment year but with the penalty. However, you can still file the ITR if you have missed the given due date. The procedure for filing the ITR in such cases has been described below.

If you miss the due date of filing of ITR

If you have missed filing ITR on the due date, you can file your ITR with penalty.

As per the new law, Late Filing Fees u/s 234F will be levied. The Late filing fee is a penalty of Rs 5,000 will be levied if the return is filed after the due date but before December 31 of that year and Rs 10,000 post-December 31. However, if your income is not more than Rs 5 lakh, the maximum penalty levied will be Rs 1,000.

If there is some tax due then you would have to pay interest on the tax due under section 234A/234B/234C

Income below Minimum Exemption and Missed Filing ITR

The present minimum exemption limit is Rs. 2,50,000. In such cases, if you have forgotten to file the ITR return then you do not need to worry. You do not need to take any action because in case of income below taxable income the filing of ITR is not mandatory.

However, in this case, you will miss a number of benefits that are associated with filing the ITR. This could be availing a loan, benefits of scholarship which would not be undertaken as it is based on your income, benefits relating to the visa application, credit card application, etc.

Income above Minimum Exemption and missed filing ITR

This case comprises of people who have an income above the minimum exemption limit i.e. above Rs. 2,50,000. This case is subdivided into two scenarios:

Scenario I – TDS Deducted/Advance Tax Paid – If the tax due on your income in the financial year is deducted from your TDS or you have paid an advance tax then you would not face any trouble. Even if you get a notice, in this case, you do not need to worry as all your tax would already be settled. However, if the tax paid in advance is more than the accumulated tax then you might face trouble in getting back the excess amount.

Scenario II – Less TDS/Less Advance Paid – In this case, there is a maximum probability of getting a notice from the IT Department. In such cases you would later be asked to pay the accumulated tax; Therefore, it is better, in this case, to pay the income tax liability to the IT department. By doing so it would ensure that you would be protected in case any notice comes from the IT Department.

Condonation of Delay in Filing ITR Section 119(2)(b)

Central Board of Direct Taxes has given the powers to income tax authorities to accept the income tax return for a financial year even after the expiry of due date of the same by using its powers as laid down under section 119(2)(b) of the Income Tax Act.

However, such relief is given to taxpayers based on certain criteria. Following are the criteria based on which an individual’s request for condonation delay can be accepted:

a) There is a genuine hardship on merits;

b) Claim is genuine and correct;

c) Income for which ITR is filed, is not assessable in the hands of any other person.

The income tax department issued a circular dated 9/06/2015 pardoning such delays and has laid down the procedure to be followed in such situations. This circular supersedes all the earlier circulars, instructions and notices.

Application u/s 119(2)(b) has to be filed within 6 years from the end of the assessment year for which income tax return has to be filed.

The limit of 6 years shall apply to all Income Tax authorities having powers to pardon the delay including the board. A condonation application (pardon) should be disposed of within 6 months from the end of the month in which the application is received. In a case where refund claim has arisen consequent to a court order, the period for which the proceedings went on will be ignored in the calculation of 6 years, provided such pardon was filed within 6 months from the end of month in which court order was issued or the end of the financial year, whichever is later.

Process to file Condonation of Delay if you Miss filing ITR

An individual can file condonation delay request by logging into his account on the Income Tax e-filing website. Following are the steps using which one can file this request:

STEP 1: Visit www.incometaxefiling.gov.in

STEP 2: Click on Login. Enter your details: User Id, i.e., your PAN, password and date of birth. Enter the captcha code and click on submit.

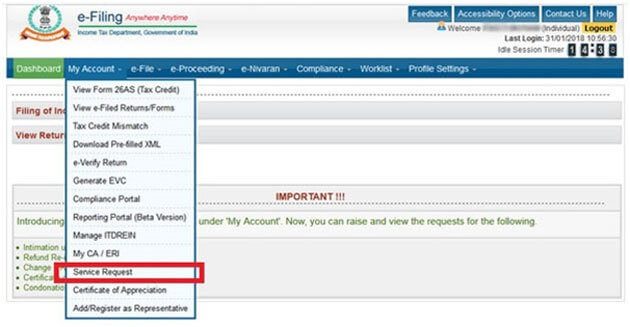

STEP 3: Once logged in, click on the ‘My Account’ tab and select the ‘Service Request’ option.

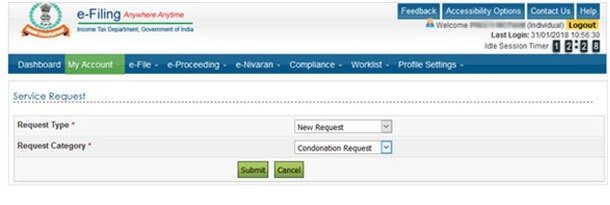

STEP 4: From the drop-down menu, select ‘New Request’ and ‘Condonation Request’ option and click on Submit.

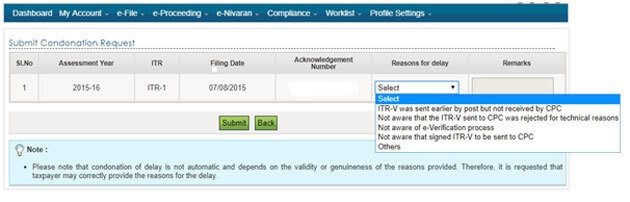

STEP 5: Submit your condonation request by selecting your reasons for the delay and click on submit.

Due dates to file ITR for FY 2018-19

Please don’t miss filing your ITR on time for FY 2018-19. The due dates are given below

- 31 Jul 2019: Regular Due date to File ITR Return for FY 2018-19 or AY 2019-20

- 31 Dec 2019: Belated return to File ITR for FY 2018-19 or AY 2019-20 with 5,000 Rs fine

- 31 Mar 2020: Belated return to File ITR for FY 2018-19 or AY 2019-20 with 10,000 Rs fine

Related articles:

All about Income Tax has all our income tax-related posts in 1 place.

- Income Tax for FY 2017-18 or AY 2018-19 covers the Income Tax for FY 2017-18 in detail.

- ITR for FY 2018-19 or AY 2019-20: Changes, How to file

- Which ITR Form to Fill?

So, now as you have understood the need for filing the ITR, it is better to file your ITR on time. In case you fail to do so on time then do not worry as you can still pay the tax and get yourself protected from the late fines and penalties.

NOT filed itr for ay 2018-19, now how to do the condonation request which form for an induvidual. I tried by special request it always shows as no record found. Ie I am unabe to file new request . pls help me

What if my income does not exceed the exemption limit, however i have TDS, which would be due for refund, if I had filed my ITR? How do I claim that refund now?

After making request of condonation… In what time it shall be approved by department?

No time limit.

I found your article very informative and I totally love how the concepts are explained in this blog post. Thanks for sharing your insights. It helps a lot.

BUT I AM UNABLE TO SEE ANY THING TO SUBMIT CONDONATION REQUEST. IT JUST SAYING NO RECORDS FOUND

Talk to tax lawyer

Yes it is showing no records found

File request for condonation directly to Commissioner

How to do this? To which commissioner we have to request?

send all documents to speed post ????

Same is happening with me. Saying no records found.