Try as I might, I find it difficult keeping a track on my expenses. Noting down the expenses..painful. Which is why I decided to get a little help from my smartphone of course. There are numerous apps that allow you to track your spending by reading your SMS texts, so that you can watch your budget without having to manually input any details whatsoever. Here are a few money app that can help you keep a tab on where your money is vanishing? We first explain why is Tracking Spendings important? How can one Track Expenses? How do Money Apps read the SMS and track your spendings. Overview of ETMoney App.

Table of Contents

Why isTracking Spendings important?

The process of tracking expenses seems intimidating and tedious. When we were young for many of us our parents had taught us to note down where our pocket money went (and we hated it..noting down the expenses, not the pocket money). When we started earning then it was our money. It was easy to blow a bunch of money on a night out with friends, a weekend away. But If you’ve found yourself three days away from payday wondering where the heck your money went, then you can definitely benefit from knowing where it’s going.

If You Want to Do Something Differently With it, It STARTS with KNOWING Where It’s Going. If you don’t know where your money goes or how you spend it, you won’t know what habits you can change in order to make your money work for you. Even your small daily expenses can make you blow your budget.

Tracking your spending allows you to see where your money is really going. It can help you identify spending issues. It can help you find if your spending matches your priorities? if you want to travel but are eating out every other day or going for parties on both days of the weekend then your dream of traveling will remain just a dream. It Forces You to Prioritize. You have a finite amount of money to allocate to certain categories, based on what you earn. Laying out your expenses will force you to prioritize where you want your money to go.

Tracking your spending ultimately allows you to take control of your financial situation. Knowing where your money is going is empowering.

How Do I Track My Expenses?

Paper and Pen: An easy way to track your expenses is to simply write down every Rupee that you spent and where you spent it in a notebook. But that sounds painful.

Credit Card Statements: If you use a Credit card then you can use your credit card statements to track your spending. At the end of each month, you can use your statements to add up how much you spent for each category (i.e. housing, transportation, etc.).

Money Apps on your Smart Phones: They help you to keep a track of your spendings and help you spend as per budget. There are many apps which tracking your expenses by SMS messages that you receive such as Walnut, Money View Money Manager, mTrack, Qykly, ET Money etc. The video below shows how App that track spendings by viewing SMS messages work. These apps help you to Keep track of expenses by

- Classification of expenses likes shopping, grocery, food, drinks etc.

- Summary of expenses in each head.

- Reminds your bills before due dates.

- Check BANK BALANCES

- Manage multiple bank accounts at a click.

- Make your own custom categories to track expenses and quickly add cash spent too

- Many also give Suggestions of how to cut down on these expenses and spendings that can be used to claim tax exemptions.

- EXPORT your data and generate expense reports

- Many Apps allow to SPLIT expenses with friends !

- Many Apps allow TRANSFER MONEY to your friends for FREE – send money direct to bank accounts, no more money stuck in wallets, no need to remember account numbers and IFSC codes

- App like Walnut allow you to Find ATMs with Cash near you in real-time, PAY your Credit Card Bills

As you may have noticed, many apps are free on Android, and they have access to your SMS inbox through which they can learn all your financial information. Every app here assures users that it does not store your data, nor read any personal messages, only transactional ones. The apps also have additional features, such as subscriptions and tax savers. So carefully consider the pros and cons before installing any app that can read your personal information.

Statistics of the Money Apps

| Name | Rating | Number of Reviews | Number of Downloads | Android |

| Walnut | 4.4 | 113,510 | 5,000,000 – 10,000,000 | 4.0.3 and up |

| ET Money | 4.4 | 22,134 | 1,000,000 – 5,000,000 | 4.0.3 and up |

| Qykly | 4.5 | 4,063 | 100,000 – 500,000 | 4.0.3 and up |

| Money View Money Manager | 4.3 | 132,483 | 10,000,000 – 50,000,000 | 4.0.3 and up |

| mTrakr Money Manager | 4.3 | 634 | 50,000 – 100,000 | 4.0.3 and up |

ET MONEY App

Here we shall review the ET Money App. Why? Because coming from Times of India Group we felt comfortable downloading it. As Harivansh Rai Bachchan said राह पकड़ तू एक चला चल, पा जाएगा मधुशाला।

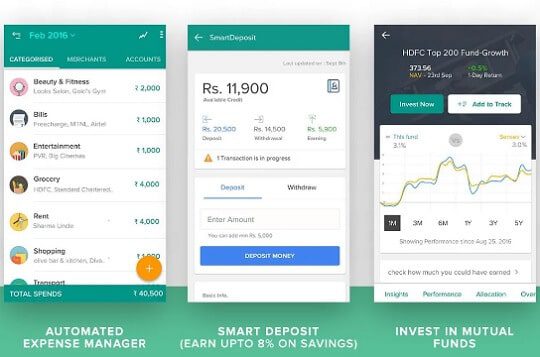

ET Money app allows you to keep a track of your income and expenses. This app was earlier called SmartSpends. The automated expenses are based on your SMS texts and categorized in a number of different buckets. The app also allows manual entry of spends. Now ETMoney is not just an expense tracker, but a money manager that helps you to invest in mutual funds and save taxes.

It features are as follows:

- Spends: A user can enter the outlays or expenses incurred in a day. These expenses can be segregated into various heads and notes can be added for better management.

- Complete personal expense manager app. Automatic finance tracker with zero manual input

- Gives simplified summary of your weekly/monthly expenses, investments, bills through its Expense Tracker

- Bill Reminders Automatically get all your bills in one place & get smart bill reminders so you never miss a bill

- Investment: This app allows the user to discover new and appropriate investment instruments introduced in the market. A user can also add the details of the investments already made to track them in an enhanced manner

- Invest in the best mutual funds without any cost or paperwork. The app analyzes over 5000 funds and shows the pertinent returns and risks associated with the funds so that the user can take an informed decision.

- If KYC of the user is not done, the app provides a quick and paperless KYC solution.

- A user can also add the details of the investments already made to track them in an enhanced manner

- Once you have invested, you can easily look into your portfolio. You can collate all the investments made via other channels and this app together to have all your investments under one roof.

- SmartDeposit- Invest in in liquid and low risk funds Mutual Funds to get a steady return on your idle money. Instant Withdrawal facility on this makes this as good as money in your wallet.

- Get smart suggestions to help you improve your performance.

- Investing or withdrawals from the app are absolutely free for users.

- Best Card offers: If you add the details of your credit or debit card on this app, it ensures saving by customizing the best offers available on card. You have to enter the bank and the type of card properly for precise offers. Depending upon your need like shopping, movies, grocery etc. it gathers a list of the best offers and displays where it can be availed, percentage of discount etc.

- Insurance: You can also buy Bike, Car or Life Insurance

Click here to Download ET Money App from Google Play Store

Click here to Download ET Money App from iOS

Review of ET Money on YouTube

Related Articles:

- Paying Credit Card Bill, Understanding statement,Paying Just Minimum

- Go Cashless: Digital Wallets, NEFT, IMPS,UPI, Debit Cards, Credit Cards

Do you keep track of your expenses on a regular basis? If so, how do you do it?

Do you use Apps for expense tracking? Which money app do you use? Would you prefer making investment, buy insurance via money app?