Systematic investment plans (SIPs) are considered the most convenient and efficient way to invest in the equity markets. But how have been SIP returns over a period of time? It’s a misconception that SIPs will never lose money. The returns depend on the market and the performance of the scheme In December 2016, the average 2-year SIP returns from equity funds were 2.88%. The article looks at SIP returns over Market Cycles, gives SIP returns of equity funds and asks investors not to stop SIP when markets are down.

Table of Contents

SIP in Mutual Funds

What is SIP?

A Systematic Investment Plan or SIP in Mutual Fund allows you to invest a certain pre-determined amount at a regular interval (weekly, monthly, quarterly, etc.).

A SIP is a planned approach towards investments and helps you inculcate the habit of saving and building wealth for the future. SIPs are the simplest way of investing regularly without having to worry whether to invest or not. SIPs instill an investing discipline because the amount gets invested on the due date without fail.

Equity markets are inherently volatile. With volatile markets, most investors remain skeptical about the best time to invest and try to ‘time’ their entry into the market. Investing through SIP allows you to opt out of the guessing game. Since you are a regular investor, your money fetches more units when the price is low and lesser when the price is high. Note SIPs only help to average out the costs but there is no assurance of capital protection.

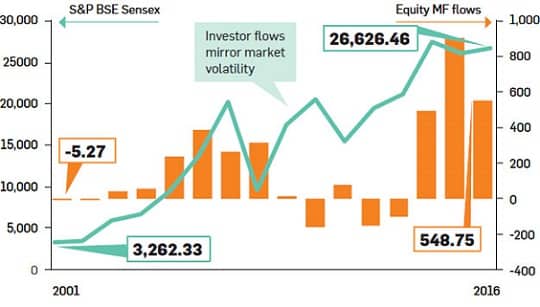

AMFI data clearly shows that SIPs have been gaining popularity among mutual fund investors. The mutual fund industry had added about 9.26 lakh SIP accounts each month on an average during the FY 2017-18, with an average SIP size of about Rs 3,300 per SIP account. In Jan 2018, mutual funds have about 1.80 crore SIP accounts. Mutual funds collected a sum of Rs 6,222 crore through SIPs during December 2017.

Best performing SIP mutual funds

Mutual Funds, including large cap, midcap, multi cap and Equity Linked Saving Schemes (ELSS), which have generated the maximum returns when invested via SIP, for investors both in five-year and 10-year periods are shown in the image below. Reference: Economic Times

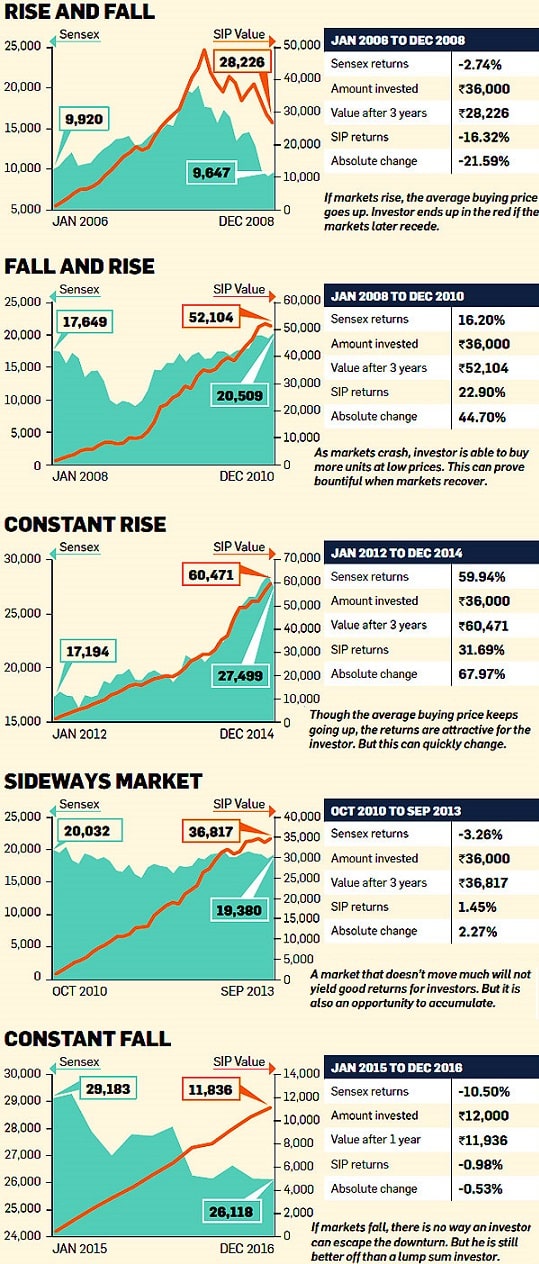

SIP Returns over Market Cycles

It is a misconception that SIPs will always generate positive returns. The returns depend on the market and the performance of the scheme. SIPs only help to average out the costs but there is no assurance of capital protection. SIPs only ensure that the investor buys at all market levels. Let check the performance of three-year SIPs under different market conditions. The markets were rising in 2006 and 2007 but fell sharply in 2008. A three-year SIP started in January 2006 and closed in in December 2008 was deep in the red. On the other hand, markets were down for several months in 2008 and then recovered in 2010. Investors who started SIPs in January 2008 reaped a bountiful harvest. In short, if markets do well, SIP investments will obviously give good returns. But if stock prices recede, there is no way the SIP investor will be able to avoid losses.

In the examples below, we have considered a SIP of Rs 1,000 in the Birla Sun Life Equity Fund. (Ref. Times Of India)

When markets turn volatile, investors start having second thoughts about their equity investments. Though SIPs are a great way to build wealth, some small investors tend to get swayed by interim market volatility and redeem their SIP investments too soon. Lakhs of SIP accounts were either discontinued or redeemed during 2008 and 2011 when markets weren’t doing well. This is the worst thing an investor can do to his portfolio. Stopping SIPs when market is down defeats the whole purpose of systematic investing.

SIP returns of equity funds

Mutual fund investors who started SIPs in equity funds about 1-2 years ago have not earned very good returns. In some cases, the value of the investment may even be lower than the amount invested in the past 12-24 months. Many others have earned less than what a savings bank account offers. In December 2016, the average 2-year SIP returns from equity funds were 2.88% . Following image shows the SIP returns of Rs 1000 over various periods

Don’t stop SIP when markets are down

Though SIPs are a great way to build wealth, some small investors tend to get swayed by interim market volatility. Usually when the market is doing well the SIP investment increase. And when the market is down investors redeem their SIP investments. Lakhs of SIP accounts were either discontinued or redeemed during 2008 and 2011 when markets weren’t doing well. This is the worst thing an investor can do to his portfolio. Stopping SIPs when markets are down defeat the whole purpose of systematic investing.

What is PE?

The price-earnings (P/E) ratio is one of the most widely used value indicators and quite prominently used by investors while investing. Stocks with low PE ratio are perceived as having cheaper current price, hence expected to generate a higher return in the subsequent period. PE ratio is computed by dividing the market price with the company’s earning per share. The study of the historical trend in the PE ratio of the index gives useful information to investors on the attractiveness of the market.

NSE releases the P/E, PB and Dividend yield ratio every day after market hours, Here is the link P/E, P/B on nseindia.com

- Top Mutual Funds in India

- How to sell or redeem Mutual Fund Units: Online, Exit Load, Cut off,SIP

- Understanding Equity Saving Funds, Arbitrage, Taxation

SIP works best if the Mutual fund NAV falls and then moves back up by the end of the SIP tenure. During such a period, you will have the opportunity to lower the average cost of your investment.

When investments turn red, as an investor you tend to wonder whether you have made the right decision. You begin to question the investment choice when on a point-to-point basis the major market indices and even the underlying fund have generated positive returns, but you have suffered a loss of capital.

One of the best article on SIP which shows how the SIP returns will be affected in various types of market cycles. Thanks..