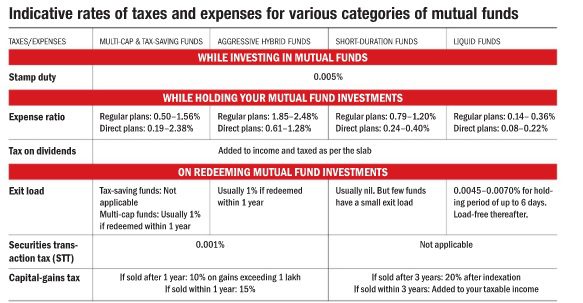

From 1st July 2020, mutual fund investors have to pay a stamp duty 0f 0.005%. Other than that there are expenses and costs associated with mutual funds while holding the mutual funds and then on selling the mutual funds. This article explains the Mutual Fund Expenses such as Stamp duty, Expense ratio, Exit Load, Dividend Tax on buying, holding the mutual funds and on selling the mutual funds, an overview of it is given below.

Table of Contents

Mutual Fund Expenses on buying: Stamp Duty

From 1st July 2020, mutual fund investors have to pay a stamp duty 0f 0.005%. The Stamp duty is applicable on any type of purchase of Mutual Funds,

- One time or Lump sum purchase

- SIP: Systematic Investment Plan

- STPs as it is redemption from one scheme and purchase into another. Likewise,

- Dividend reinvestment plans: As one buys fresh units of the same scheme with dividend money. Since this is also a purchase, it will also attract stamp duty before the allotment of the units

Stamp Duty is not applicable while redeeming your money from mutual funds.

Tho stamp duty will be deducted by the fund house before allotting the units. So. if you invest Rs1 lakh in a mutual fund scheme, the AMC will deduct Rs 5 (0.005 per cent of Rs 1 lakh) and then buy you the units with the remaining Rs 99,995.

In the case of ETFs, the stamp duty is applicable at the rate of 0.015% while making purchases through a stock exchange.

Does Stamp duty impact Investors?

The stamp duty is small and does not affect long term investment. Unless you invest several crores for less than 3 months which is done by corporates who invests crores in liquid and overnight funds.

For example, you purchase liquid funds worth Rs 1 lakh, you will be allotted units worth Rs 99,995.

Now assuming an annualized return of 5%, after taking the impact of Stamp duty, the return will be slightly lower at 4.99% for a holding period of one year. However, if you hold the units for just a week or seven days, the returns will be 4.74%, implying the impact of 0.26%.

| Holding Period | Redemption value (₹) | Effective Returns | Impact on Return |

| 1 Week | 100,090.89 | 4.7390% | 0.2610% |

| 2 Week | 100,186.77 | 4.8694% | 0.1306% |

| 1 Month | 100,405.94 | 4.9389% | 0.0611% |

| 6 Month | 102,460.63 | 4.9896% | 0.0104% |

| 1 Year | 104,994.75 | 4.9948% | 0.0052% |

| 3 Year | 114,994.25 | 4.9981% | 0.0019% |

| 5 Year | 124,993.75 | 4.9988% | 0.0012% |

So as you can see in the table above, investors investing a few lakh rupees will have little to no impact on their investments. However, corporate investors investing several crores for a few days to a month may see some impact.

Costs while holding the mutual Fund: Expense ratio and Dividends

Expense ratio: is the fee charged by mutual fund companies for managing your money. Expense ratio is charged on a daily basis while calculating NAV. NAVs declared by fund houses are inclusive of the expense ratio.

- Expense ratio depends on whether you opt for the regular or the direct plan. Direct plans are cheaper.

- Expense ratios are different for different categories of funds.

- Multicap and Tax saving funds: Regular plans: 0.50 -1.56%, Direct plans: 0.19-2.38%

- Hybrid funds: Regular plans 1.85-2.48%, Direct plans: 0.61-1.28%

- Short duration funds: Regular plans:0.79-1.20%, Direct plans. 0.24-0.40%

- Liquid funds: Regular plans: 0.14-0.36% , Direct plans. 0.08 -0.22%

Dividend: Tax and TDS

In the Union Budget 2020, the dividend distribution tax (DDT) was abolished for mutual funds. And dividend income was made taxable in the hands of the investors as per the income slab of the investor. As discussed in our article Union Budget for FY 2020-21:Income Tax, New Tax slabs, earlier those earning dividend income of Rs 10 lakh or more had to bear a tax of 10% on such income

With the withdrawal of DDT, companies will have to deduct TDS @10% on dividends of over 5,000 during a financial year under Section 194K. If TDS is deducted it will show up in your Form 26AS, as explained in our article Understanding Form 26AS, Tax Statement

For Taxpayers like senior citizens or those below exemption limit who get dividends and don’t want TDS to deducted, will now have to do so or submit Form 15G/Form 15H to each company where they hold shares or equity mutual funds under section 194K. Our article What is Form 15G? What is Form 15H? explains these forms in detail.

As you are aware the Dividend is not applicable to growth plans.

So If you have opted for Dividend Plans of Mutual Fund, when you get Dividend from Mutual Funds check for any TDS deducted and pay tax as per your income slabs. You need to pay it as advance tax or while filing an income tax return (ITR).

Mutual Fund Expenses on Selling: Exit Load, Capital Gain Tax

Exit load: On Selling Mutual Funds

A small fee charged on your investments if you redeem your money too soon. How soon? Depends on the category of the fund and the holding period of your Mutual Fund scheme. Varies for different categories of funds. As discussed in our article How to sell or redeem Mutual Fund Units: Online, Exit Load,

- Exit loads vary from scheme to scheme but have to be within the limit prescribed by the market regulator, the Securities and Exchange Board of India (SEBI). There are many mutual fund schemes which do not charge an exit load. After the predefined period, most equity funds have zero exit load.

- Exit load is applicable if you invest a lump sum or the Systematic Investment Plan (SIP). In SIP, each instalment is taken as a new investment and, hence, you will be charged an exit load for it if you sell units allotted in each instalment within the predefined time.

- One has to pay exit load for mutual funds bought through Direct plans also.

Fund house deducts it before transferring the redemption proceeds

For example, If an investor redeems 10 units with NAV of Rs 10 and the exit load specified is 1% if sold within a year. Then if he sells within the year selling price per unit will be Rs 9.9. It means that the amount of money that he will get is Rs 9.9 X 10 units or Rs 99.

Information about these charges for mutual funds is easily available. You can check the Fees & Details of Mutual Funds.

Our article Selling or Redeeming Mutual Fund: Exit Load, Taxes explains it in detail.

Securities transaction tax (STT) on Mutual Funds

Tax levied by the government at a rate of .001%. Applicable only on selling equity-oriented mutual funds. Fund house deducts it before transferring the redemption proceeds

Capital Gain Tax and Mutual Funds

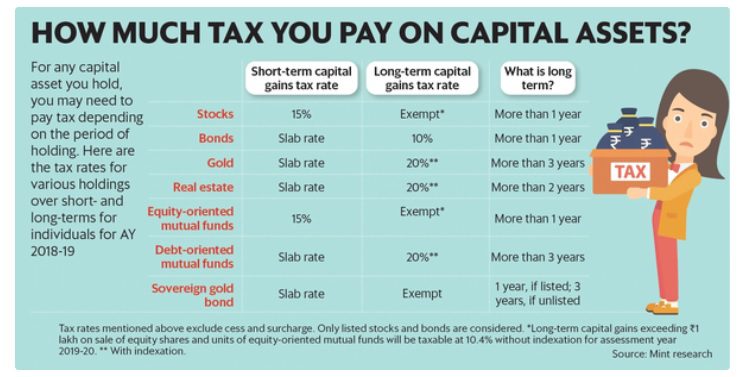

Capital gains tax Tax levied by the government on the gains from mutual fund investments. Payable only when you sell your mutual funds. Depends on the type of mutual fund and holding period.

- Equity Mutual Funds:

- If sold after 1 year: 10% on gains exceeding 1 lakh

- if sold within 1 year: 15%

- Non-Equity Mutual Funds (Debt, Gold Funds. Funds with < 65% in equity)

- If sold after 3 years: 20% after indexation

- If sold within 3 years: As per your tax slabs.

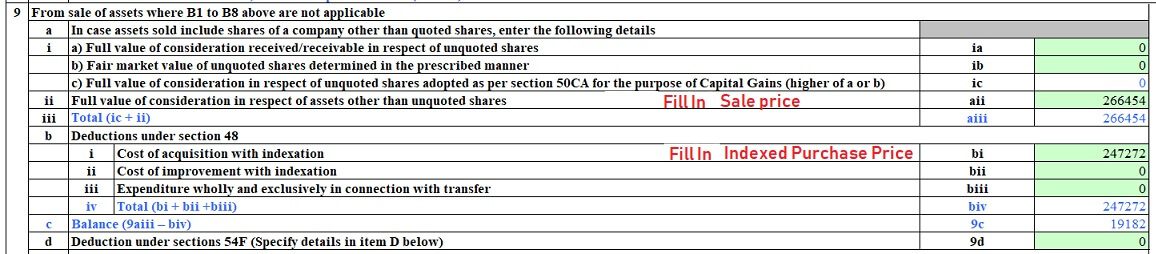

The image below from our article shows how to fill Long Term Capital Gains from Debt Mutual Funds in ITR

Related Articles:

All about Mutual Funds : Basics, Choosing, Paperwork, Direct Investing

- How to sell or redeem Mutual Fund Units: Online, Exit Load,

- Union Budget for FY 2020-21:Income Tax, New Tax slabs, Mutual funds

- how to fill Long Term Capital Gains from Debt Mutual Funds