This article covers the Tax rates on Mutual Funds for the financial year 2014-15 or Assessment Year (AY) 2015-16. This would be useful for filing Income Tax return which needs to be filled by 31 Jul 2015 if you have Mutual Funds. Our article Tax and Mutual Funds covers in detail are Mutual Funds tax free or taxed, what are taxes associated with Mutual Funds,what factors affect tax on Mutual Funds,What are Capital Gain? Our article Income Tax for AY 2015-16: Tax slabs, ITR Forms covers the filing of Income Tax Return.

Table of Contents

Overview of Mutual Funds and Tax

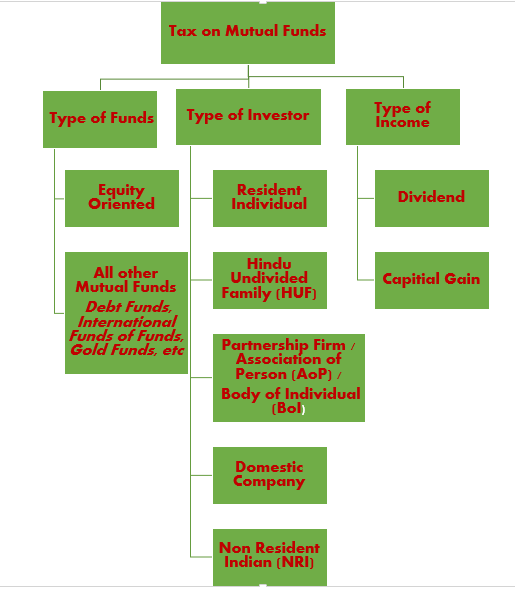

Tax on Mutual Funds depend on the type of Mutual Funds, type of Investor and type of Income earned from Mutual Funds. The image below gives an overview

Tax and Dividends on Mutual Funds

Dividends are paid during the time one is invested in the fund. Dividends are tax free in hands of investor and is exempt income but still has to be shown in Income Tax return. The Mutual Fund pays Dividend Distribution Tax based on type of fund. Dividends are not guaranteed and the mutual fund is not under any obligation to announce a dividend. Dividend amount or when it will be declared is also not fixed. The amount of dividend that is declared will be reduced from the Net Asset Value (NAV). Tax Implications on Dividend are given in table below.

| Individual/ HUF |

Domestic Company |

NRI |

|

|

Dividend |

|||

| Equity oriented schemes |

Nil |

Nil |

Nil |

| Debt oriented schemes |

Nil |

Nil |

Nil |

| Tax on distributed income (payable by the scheme) rates ** | |||

| Equity oriented schemes* |

Nil |

Nil |

Nil |

| Money market and Liquid schemes |

25% + 12% Surcharge + 3% Cess |

30% + 12% Surcharge + 3% Cess |

25% + 12% Surcharge + 3% Cess |

|

= 28.84% |

= 34.608% |

= 28.84% |

|

| Debt schemes(other than infrastructure debt fund) |

25% + 12% Surcharge + 3% Cess |

30% +12% Surcharge + 3% Cess |

25% + 12% Surcharge + 3% Cess |

|

= 28.84% |

= 34.608% |

= 28.84% |

|

| Infrastructure Debt Fund |

25% + 12% Surcharge + 3% Cess |

30% + 12% Surcharge + 3% Cess |

5% + 12% Surcharge + 3% Cess |

|

= 28.84% |

= 34.608% |

= 5.768% |

|

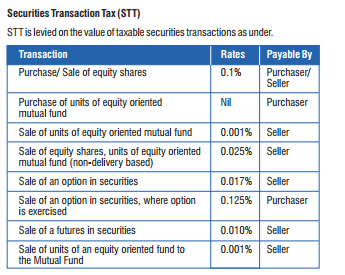

* Securities transaction tax (STT) will be deducted on equity funds at the time of redemption/ switch to the other schemes/ sale of units.

** With effect from 1 October 2014, for the purpose of determining the tax payable, the amount of distributed income has to be increased to such amount as would, after reduction of tax from such increased amount, be equal to the income distributed by the Mutual Fund.

Capital Gains and Mutual Funds.

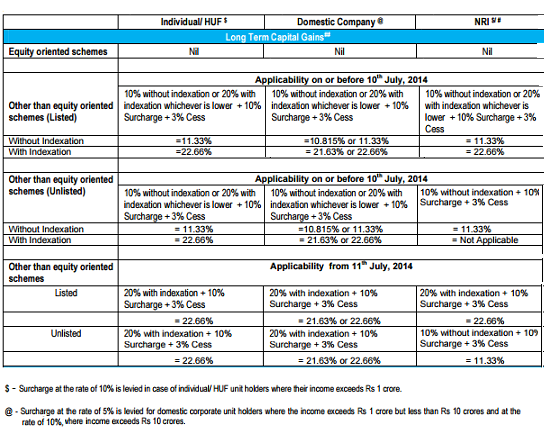

Capital gains come into play when one redeems the Mutual Fund Units. The capital gains could be either long term capital gain or short term capital gain. For Systematic Investment Plan or SIP every investment has to be considered separately and time period calculation has to be done from the date of SIP investment. Our article Basics of Capital Gain explains Capital Gain in detail. Our article Cost Inflation Index,Indexation and Long Term Capital Gains explains how to use indexation for Long term capital Gains. Our Capital Gain Calculator can be used to find Capital Gains.

- Long Term Capital Gain In equity oriented mutual funds, any holding over a period of 1 year is considered as long term. So if you have a gain on your investment in a mutual fund scheme that you have held for over 1 year, it will be classified as Long Term Capital Gain. In non equity Mutual funds,after 10 Aug 2014, period of holding of 3 years to be classified as Long term.

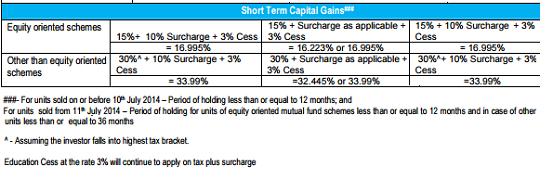

- Short Term Capital Gain For Equity Oriented schemes holding period is less than 1 year. For non equity oriented schemes there was change in Aug 2014.

- Before Aug 2014 If your holding in a non equity oriented mutual fund scheme is less than 1 year i.e. if you withdraw your investment in a mutual fund scheme before 1 year, after making a profit, then the profit will be considered as Short Term Capital Gain)

- After Aug 2014 If your holding in a non equity oriented mutual fund scheme is less than 3 years i.e. if you withdraw your investment in a mutual fund scheme before 3 years, after making a profit, then the profit will be considered as Short Term Capital Gain)

- Education Cess at 3% will continue to apply on tax plus surcharge.

- Surcharge is levied on the individuals or companies if the income exceeds some limit. For example For FY 2014-15 :

- Surcharge is levied at the rate of 5% for domestic companies having total income exceeding INR 1 crore but not exceeding INR 10 crores.

- Surcharge at the rate of 10% to be levied if the total income of the domestic company exceeds INR 10 crore.

- In case of Individuals / HUFs / Firms / AOP / BOI having total income exceeding INR 1 crore, surcharge to be levied at the rate of 10%.

Short Term Capital Gain Tax and Mutual Funds

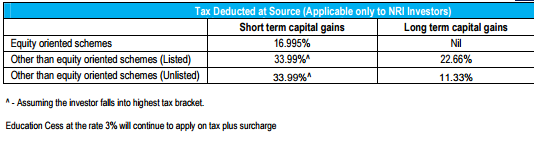

Mutual Funds, TDS & NRI

On Short term/ long term capital gain, tax will be deducted (TDS) at the time of redemption of units in case of NRI investors only. Rate of deduction for FY 2014-15 is given below. Our article NRI : TDS,Tax and Income Tax Return explains who is NRI,Tax and TDS on various kinds of income for NRI, example bank accounts,fixed deposits,mutual funds,stocks etc. How to use DTAA? When should NRI file Income Tax Return?

Securities Transaction Tax or STT

Surcharge at 12% to be levied in case of individual/ HUF unit holders where their income exceeds Rs 1 crore.

Dividend Stripping: The loss due to sale of units in the schemes (where dividend is tax free) will not be available for set off to the extent of tax free dividend declared; if units are: (A) bought within three months priorto the record date fixed for dividend declaration; and (B) sold within nine months after the record date fixed for dividend declaration.

Bonus Stripping: The loss due to sale of original units in the schemes, where bonus units are issued, will not be available for set off; if original units are: (A) bought within three months prior to the record date fixed for allotment of bonus units; and (B) sold within nine months after the record date fixed for allotment of bonus units. However, the amount of loss so ignored shall be deemed to be the cost of purchase or acquisition of such unsold bonus units.

Related Articles:

- Tax and Mutual Funds

- Growth and Dividend Option in Mutual Funds

- Mutual Funds : Why Indians don’t invest

- Returns of Stock Market, Gold, Real Estate,Fixed Deposit

- Capital Gain Calculator

- Income Tax for AY 2015-16: Tax slabs, ITR Forms

Hope it helped you understand the Tax Rates on Mutual Funds for FY 2014-15.