Mutual funds are of various types but the idea remains the same – Investors put their money in a mutual fund and let the mutual fund handle investments. Every mutual fund is managed by a fund manager. The fund manager leads a team of highly skilled professionals. The team conducts in-depth research in whatever they invest in.

In case of mutual funds, the range of returns varies depending on the type of fund:

- Debt funds – Mutual funds that invest in money market instruments give returns in the range of 7-10% per annum. They are low risk mutual funds. These are ideal for investing for less than 2 years.

- Equity funds – Mutual funds that invest in the share markets are called equity funds. They are of higher risk when compared to debt funds. But their returns are also much higher. Depending on their category, they can give returns anywhere between 12% to 20% per annum.

When the markets are doing well, some of these funds have given returns as high as 30% per annum. The ideal investment period for this fund is more than 4 years. - Balanced funds – These are a hybrid of equity and debt funds. They invest in both money market instruments as well as equity. They are ideal for investing for a duration of 2-3 years.

You can expect a return of around 8-12% per annum from these funds based on past performance.

Compare Mutual Fund Returns with other investment options

Now, let’s compare mutual fund returns with the returns from some common investment options.

- Public Provident Fund (PPF) – These are low-risk investments. However, the returns are very low in this case, about 7.8% per annum. They also remain locked in for 15 years.

- Fixed Deposit (FD) – Another one of the top favourites of investors in India, FD gives returns around 6.5%. Such returns are obviously very low. With risk similar to FD, you can get around 1-2% higher returns if you invest in debt funds.

- Gold – The glittering metal seems to have lost its sheen. At least, from an investment perspective. In the last 5 years or so, gold prices have barely changed.

- Real-estate – It wasn’t long ago that a real-estate investment was considered a sure-shot way to increase one’s wealth quickly. In the past few years, that has turned out to be false. Real-estate prices in the cities have either stagnated or become extremely slow moving.

- Stocks – Now, this sector is one that holds immense promise. Many have heard tales of investors turning rich in a matter of days.

However, the truth about stock markets is that while a lot of wealth can be made, not everybody is skilled enough to do so. Only the investors with the requisite skills and knowledge can effectively invest in stocks.

If you don’t know much about stocks but still want to take advantage of the rapid growth they have to offer, you can invest in equity mutual funds and let experts handle your money. - Cryptocurrencies – Bitcoin, Ethereum, Ripple, are just a few of the many new coins out there. Cryptocurrencies have given returns like no other modern day investment.

A few rags-to-riches stories float around the internet encouraging more new investors to invest. However, cryptocurrencies are incredibly risky. Unlike the stock markets or real-estate markets that have been studied and analysed over the years, cryptocurrencies have no history. There is no consensus as to if there virtual coins are a bubble waiting to burst or not.

Investing meaningful amounts of money in cryptocurrency could turn out to be disastrous. If at all you want to invest in cryptocurrencies, invest an amount that you aren’t afraid of losing.

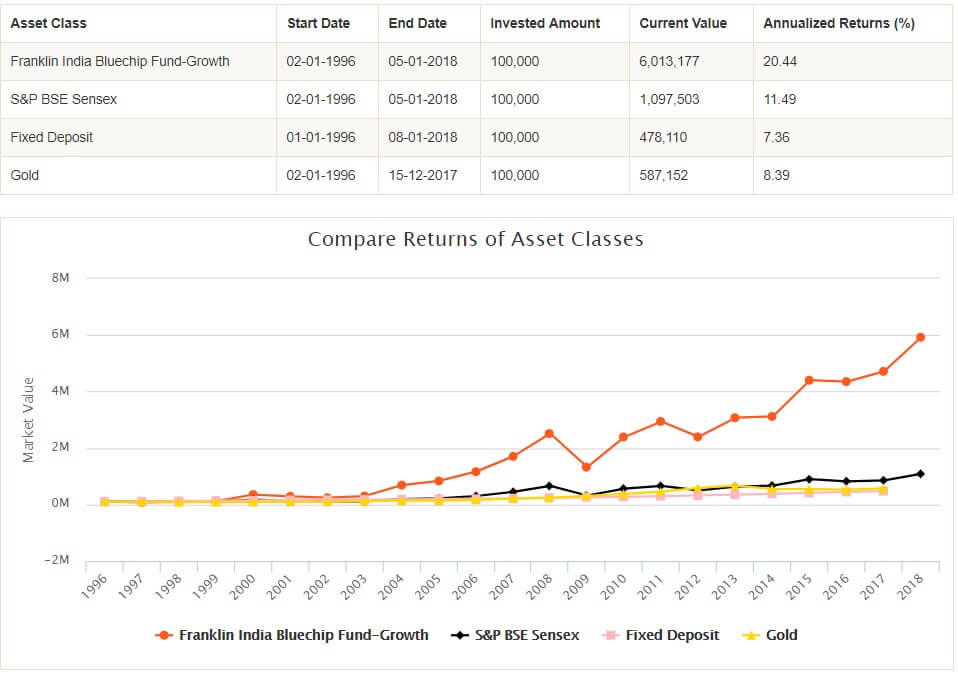

Mutual funds not only give one of the highest returns among other investment options, they are also one of the easiest to invest in. The image below shows the return of the various asset classes with Franklin India BlueChip Fund(Growth) from 1996. Ref:AdvisorKhoj

Why are mutual funds ideal?

Here are 6 reasons why mutual funds are ideal:

- No lock-in period – Unless mentioned, mutual funds do not have any lock-in period. You can take your money out of a fund anytime you wish to.

- Higher returns – Historically proven higher returns than other options.

- Ideal for any duration – There are funds that are ideal for investing for a few weeks to years.

- Low Amount – You can start investing in mutual funds with an amount as low as Rs 500.

- Convenient – SIP or Systematic Investment Plans let you automatically invest every month. You can choose a fixed amount of money and the mutual fund to invest in.

Extremely easy to invest – Online options like Groww.in now allow you to invest, track, and take out your money as easily as shopping online.

Related Articles:

All About Mutual Funds : Basics, Choosing, Paperwork, Direct Investing