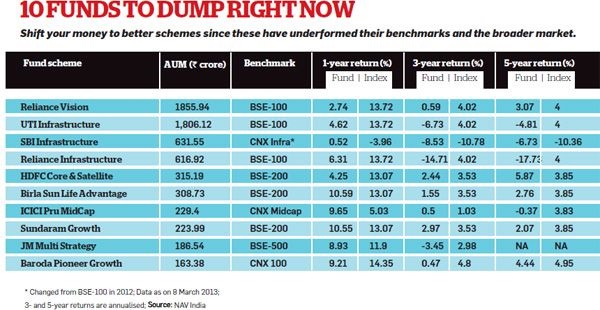

More than Rs 6,000 crore of investors’ wealth is languishing in just 10 of these laggards. An equal amount may be stuck in scores of smaller funds that have not generated significant returns for investors in the past 5-6 years. An equal amount may be stuck in scores of smaller funds that have not generated significant returns for investors in the past 5-6 years said the newspaper ET Wealth in MF laggards: 10 funds to dump right now

India has 44 AMCs, which were managing assets worth around Rs.8.26 trillion as of 31 January 2013. According to Mint research, 117 out of 329 open-ended equity schemes underperformed their benchmark indices in the past year; 98 of 298 schemes underperformed in the past three years; and 80 out of 209 schemes underperformed in the past five years. Livemint’s Wind up or stop charging, Sebi tells mutual fund laggards (Feb 27 2013)

Table of Contents

Is investing in Mutual Funds always Profitable?

“In order to beat the inflation one needs to have some of his assets in equity. Since you don’t understand the intricacies of market,you should invest in the markets through mutual funds.” TV ,financial magazines , newspapers, financial adviser suggest Mutual Funds, investing through SIP as the simple easy way to grow money. In our article Investing in Mutual Funds for Beginners we looked at the pros and cons of investing in Mutual Funds.We had mentioned that Not all Mutual Funds give profit.

The world of mutual fund performance is complex and daunting. Advertisements in newspapers talk about “five-star funds.” Banner ads talk about “the NUMBER ONE FUND” and histories of past performance refer to “returns of 26.8% over the last six months.” If one were to pay attention to all of the talking heads on television, all the magazines that promise a list of “great funds for the upcoming year,” one would be convinced that there are hundreds of funds out there that can tout great performance. This simply isn’t the case. It’s not that if you invest in mutual funds you will never have loss. There are always leaders as well as laggards. Investing is like a knife, You can stab someone with it, or you can slice bread with it but remember “A bad knife cuts one’s finger instead of the stick” This article highlights the fact and shows the Mutual Fund Laggards, how to find if it is a laggard? What to do when you find a laggard?

Schemes that have under performed

Let’s look at the schemes that have under-performed. From ET Wealth in MF laggards: 10 funds to dump right now

Quoting from Livemint’s Wind up or stop charging, Sebi tells mutual fund laggards (Feb 27 2013) (with links to valueresearchonline.com)

According to data from financial information provider Capitaline, as on 25 February, Some of the largest schemes in terms of assets under management to have under performed include

- Reliance Growth Fund (Rs.5,465.65 crore), which has under performed its benchmark, the BSE-100 index, by 2.46% over a three-year period.

- Birla Sun Life Tax Relief 96 (Rs.1,526.88 crore) under performed the BSE-200 by 1.5% in a five-year period,

- Birla Sun Life Equity Fund (Rs.737.84 crore) has under performed its benchmark BSE-200 index in three years.

- HDFC Index Nifty Fund (Rs 70 crore) has under performed CNX Nifty over a three-year period.

Benchmark: How is the mutual fund is doing ?

After taking all the steps needed to find great investment ideas, how do you then measure and compare the success of those ideas as investments?It’s the answer to the question, “how am I doing? For the majority of investors, mutual fund performance is ultimately the most important factor in determining which mutual fund to invest in.Mr Sharma earned 12% returns in mutual fund. Is it good or bad? It’s like saying a child has got 92% in exams? Questions is compared to what? If Mr Sharma’s mutual fund gave 12% when Nifty gave a return of 15%! 12% is not so good but if Mr Sharma’s mutual fund gave 12% when Nifty gave 7% then 12% is good. When evaluating the performance of any investment, it’s important to compare it against an appropriate benchmark.

Benchmark is a standard against which the performance of a security, mutual fund or investment manager can be measured. Funds themselves compare their performance with a market benchmark—indicated on a fund’s fact sheet or prospectus. The index that a fund chooses can shed light on why it owns certain assets and how it might fit into your investment strategy. There are a myriad market indices in the industry, some of which are broad-based and others that are specific to one industry or type of investment (such as international investing).Index are like a thermometer for the stock market – they give us a general sense of whether things are hot or cold.But many indexes of the differing segments of the market exists. These different indices don’t always move in tandem. If they did, there would be no reason to have multiple indexes.

- Broad based Indices like SENSEX, BSE-100, BSE-200, BSE-500, BSE Mid-Cap and BSE Small-Cap index

- Sector Indices like:BSE Auto Index, BSE BANKEX, BSE Capital Goods Index, BSE Consumer, Durables Index, BSE FMCG Index, BSE Healthcare Index, BSE IT Index, BSE Metal Index, BSE Oil & Gas Index, BSE Power Index, BSE Realty Index

And NSE has following indices:

- Major indices like: S&P CNX Nifty, CNX Nifty Junior, CNX 100,Nifty Midcap 50

- Sectoral Indices like CNX Auto,CNX Bank, CNX Energy

- Thematic indices like: CNX Commodities, CNX Consumption, CNX PSE

It is important to select/understand the benchmark used by the fund -it should be the one that matches your investment objectives. Benchmarks of some of the funds are:

HDFC Top 200 Fund (BSE 200), Reliance Banking (CNX Bank), JP Morgan ASEAN Equity Off Shore (MSCI South East Asia) ICICI Pru Focused Bluechip Equity Reg ( CNX Nifty),DSPBR Top 100 Eqt Reg (S&P BSE 100) SBI Magnum Balanced (Crisil Balanced)

You want to compare apples to apples so your results do not appear to over or underachieve.For example Quoting from Livemint’s Are HDFC Top 200, HDFC Equity the same? (Oct 2011)

HDFC Top 200 Fund (HT200; corpus size of Rs 12,122.23 crore) and HDFC Equity Fund (HEF; corpus size Rs 10,555.65 crore ) are part of the same fund house, HDFC Asset Management Co. (AMC) and both these schemes are managed by Prashant Jain, chief investment officer, HDFC AMC. But HT200 is a diversified equity fund that benchmarks itself against BSE 200 index. HEF, on the other hand, is an aggressively managed large-cap-oriented equity fund which benchmarks itself againt CNX-500. Aggressive investors may go for HEF, while conservative investors may go for HT200,

Analysts often use the Sharpe ratio which helps you gauge how much of the extraordinary returns generated by a fund are a result of extra risk taken by the fund manager. A higher ratio indicates that the investor is earning a good return despite low risk. Investopedia’s Sharpe Ratio explains it in detail. Our article Understanding Returns: Absolute return, CAGR, IRR etc covers ways to measure risk adjusted returns Alpha, Beta, R-Squared, standard deviation.

But it’s important to remember that like other gauges of historical performance, a fund’s record in beating a benchmark doesn’t offer a guarantee that it will do well in the future.

Peer or Category

While seeing how a fund has performed in the past is extremely useful, you don’t have a complete picture of how well the fund has done unless you compare it to other similar funds in the similar category. For example Mutual funds can be classified on basis of :

- What they invest in : Equity(Stocks), Bonds, Gold,

- Where they invest : International, India

- How big or small companies they invest in : Large, MidCap, Small Cap, Diversified

- Particular group of companies(sector ) or group of sector ex Bank Fund would invests only in Banks and other financial institutions, or Infrastrurcture funds .

Comparing a fund which invests in Gold with a bank mutual fund or a small cap fund would be like comparing apples to oranges.

Time Period for Performance

Past performance may or may not be sustained in the future says any mutual fund-related literature. The investment environment is constantly changing with respect to government policies, interest rates, disposable income, inflation and also economic growth. And all these factors have a bearing on the performance of mutual funds, stocks, bonds, gold, real estate, etc, so the sectors or stocks. The reasons for which a product performed well the previous year have almost certainly been replaced by a new set of factors, some of which are completely different to each other. For example In 2007, Reliance Vision was among the most highly recommended diversified equity funds. Today, it is floundering, having consistently under-performed its benchmark in the past 1, 3 and 5 years.

As an investor, it is important to know that different sectors outperform at different times. FMCG and pharmaceuticals, for instance, are known to be defensives and do well during recessionary phases. On the other hand, sectors such as capital goods and commodities do well during bull runs. For instance, infrastructure funds, at the helm during the bull run of 2007, fell flat after the financial crisis that began in late 2008 with many languishing in the bottom quartile today Dhirendra Kumar, CEO of Value Research, said a fund’s performance was best gauged over a longer period. “A fund has to be evaluated over a period of time. One needs to make sure that the evaluation takes into account an entire market cycle and not just a specific time-period” EconomicTimes Don’t base your plans on immediate past as the financial environment constantly changes (Mar 2013) talks about it in detail. The fund’s consistency in returns, the fund’s strategy needs to be looked into to gauge the fund.

Is My Fund a Laggard?

Invest in mutual funds for the longer term but do review the performance of the funds in which you have invested at least once a year. So, how do you decide whether your mutual fund portfolio needs refurbishing?What are the things to watch out for that could ring those alarm bells that tell you it’s the time to exit a fund? You should study

- Change in Fund : Ownership of the asset management company(ex Fidelity Fund now is L&T fund) , change in Fund Manager,change in composition of fund,change in Fund’s strategy and how it co-relates with your investment objective

- Fund’s consistency in returns: If it has been consistently lagging the benchmark and category, it is time to get rid of it and shift to another scheme.

- Altered life-goals of a person.

According to market experts, investors can look at whether the fund has been a consistent laggard, has consistently under performed its benchmark in the past 1, 3 and 5 years. Check if it is lagging the category for 1,3,5 years. If fund is lacking the benchmark and category find out why. For example Reliance Vision fund has a significant exposure to mid-caps and some of their recent calls have not worked. The auto sector, capital goods sector where fund has invested are not doing well.

What is SEBI doing?

India’s capital market regulator ,Securities and Exchange Board of India (SEBI), is concerned about the under-performance of the scheme. It has pulled up fund houses for the under-performance and even hinted at stricter norms for laggard funds. It wants to know why these under-performing schemes should charge an expense ratio if they have failed to generate even the same returns as their benchmark indices. Sebi has also asked AMCs to explain why they do not wind up non-performing schemes before they launch a new one and has refused to clear applications for launching new funds by asset managers that have non-performing schemes. While Sebi does have the powers to question AMCs on performance and restrain new launches, it cannot dictate the fees charged by AMCs as long as they are within the specified limits. But it does have ways to persuade them to pare fees by questioning them on the performance of existing schemes and restraining them from launching new ones.

SEBI has come up with color-coding of schemes just like vegetarian and non vegetarian products are marked in green and red. Effective July 1, 2013, all the mutual fund schemes will have a clear labeling of asset allocation and the risk associated with them in the form of separate colour coding.

- Schemes with the least risk, such as FMPs, will sport the colour blue

- while yellow will be for those which carry medium risk, such as hybrid schemes.

- Equity schemes, which are perceived to carry the highest risk, will have the colour brown marked against them.

But there is nothing for differentiating between the various schemes in a category.

Difference between selling loss making stock and underperforming Mutual Fund

There is a fundamental difference between exiting an under-performing fund and selling a loss-making stock. A stock may be down because of a number of reasons fundamental, technical and sentimental. If the fundamentals are intact, any dip in the price is likely to be short lived and the stock will eventually bounce back. If you sell a stock when it is down and reinvest elsewhere, you could miss out on the gains when it rebounds. Besides, there is no guarantee that the scrip in which you reinvest the proceeds will also rise. It could be a double whammy if this scrip falls even as the stock you had exited takes an upward trajectory.

However, none of this applies when you move out of an under-performing mutual fund. If you transfer the investment to another plan, you will not miss out on the gains when the market moves up. In fact, there is a greater chance that a good scheme will outperform the market while the laggard will fall behind. So, one should shed the sentimental clinging and dispose of the loss-making investment before you pile up further losses.

What to do with Mutual Fund laggard?

What do people do when they find fund is a laggard. Quoting from ET Wealth in MF laggards: 10 funds to dump right now

Vaibhav Sharma is hoping that the mutual fund he invested in, in July 2007, will turn around some day and he will be able to recoup his money. The NAV of the SBI Infrastructure Fund (originally SBI Infrastructure Series 1) has never risen above its NFO price of Rs 10 ever since it became open-ended in July 2010. “I am just waiting for the price to touch Rs 10. Even if I don’t make any money, I won’t lose it either,” he says.

People dislike losing more than they like winning. People have a strong tendency to avoid losses and allow loss aversion bias to affect their investment decisions.What you paid for an asset has no bearing on the future price. Ask yourself would this asset be worth buying now at today’s price? If not, sell it! While patience is certainly a virtue when it comes to equity investing, it should not mean that investors lose sight of their funds’ performance compared with their peers and the broader market.

Related articles :

- Investing in Mutual Funds for Beginner

- Understanding Returns: Absolute return, CAGR, IRR etc

- Returns of Stock Market, Gold, Real Estate,Fixed Deposit

- BeginnerToInvesting,

Find if your mutual fund is losing money, is a laggard for how long? If it has under-performed the benchmark, category for 1,3,5 years think would this asset be worth buying now at today’s price? If not, sell it. Do you have/had underperforming mutual funds? If yes what did you do? how did you decide to sell it? How to your review your mutual funds? How often?

For most recent information you have to go to see world-wide-web

and on internet I found this web page as a best website for latest updates.

Thanks for the article, 2 questions

1. Why are MF returns generally shown for odd number of years – 1,3,5, etc and not for all years 1,2,3..n ?

2. To find a laggard, the article suggests to compare with benchmark for 1,3,5 years. So, is it really required to wait and compare after 5 years where one could have lost most of the capital? Or would it be sane to do it after 1 year or at most 2?

Sheetal

No idea as to why MF returns generally shown for odd number of years – 1,3,5, etc and not for all years 1,2,3..n ? Tried searching on net but couldn’t get any answer. Have asked on twitter.

Let’s see what comes up. A very good question Sheetal, till you raised it I did not think about it at all.

No to find the laggard you SHOULD NOT wait for 5 years. Track it performance for a quarter or two (depending on how often you review your portfolio). If you find it slipping below the benchmark in a quarter try to find why is it so? If you understand the reason wait else should sell it. Quoting from The Sell Decision With Mutual Funds: Knowing When to Walk Away

While quarterly returns can be monitored to alert you to signs of deteriorating performance, one-year returns are the shortest relevant performance span for long-term investors to examine. However, that doesn’t mean you should automatically sell if one-year returns turn up poor. Deciding how much time to give a poor performer to rebound is not easy, but you should seriously start to think about selling a fund that has lagged its benchmark and peers for the past 18 months to two years.

Hi Kirti, will look forward to your answer about the number of years thingy.

So 2 years is the kind of time one should wait before selling a fund based on its bad performance. Now as an example per VRO, HDFC Equity is 5* fund and BSL Div Yield Plus is 4* fund and both have been lagging their benchmarks for last 2 years. I am taken aback how these continue to have that rating on a site like VRO. Any clues on why these continue to have those ratings and is it time to dump these funds?

This raises another question about investing in MFs. Majority of the funds are chart toppers in an year maybe two and then start slipping down. These are owned by reputed fund houses and they manage to get many investors on board. Once the slide starts investor waits say for a year or two or more in hope of recovery and maybe these funds lost the plot now and cannot recover anymore. The investor is left in a dilemma and maybe exits out of exhaustion. Out of hope on equity he moves onto the next topper in the charts and the vicious cycle continues.

What I am trying to say is – Is investing in MFs a zero sum game? If fund houses cannot at least beat the benchmark with their mandate how long can investor continue to chase this chimera if I may say so?

Sheetal a very very good question you have asked.

Ratings are not fixed they keep on changing. Infact a friend of mine getting duped by ratings have decided not to invest in 5 star rated funds. He invests in 3 and 4 stars funds.

In our article Investing in Mutual Funds for Beginner we have touched upon the ratings of mutual funds.

Ratings should be the starting point for making an investment decision. They are not the be all and end all of mutual fund investments. There are other important factors like portfolio management, age of funds and more, which should be taken into account before making an investment. One needs to look at the fund’s pedigree and fund manager’s conviction. Typically there is no need to worry if a five-star fund slips to four stars. Even a three-star rating should not trigger panic. But when it falls to below three stars, it is time to act. One star, and you know you have the wrong fund. One needs to keep track of his fund’s performance and make necessary changes.

Coming to HDFC Equity Fund It’s a fund which tracks CNX 500 benchmark, As you rightly pointed out it has been underperforming. Quoting from HinduBusinessLine Fund Talk: SIPs may not work in the short term

HDFC Equity remains a sound fund with a good track record. Its current portfolio has higher weights for finance and energy stocks which have underperformed over the last one year. Besides, unlike earlier years, the fund’s portfolio is biased towards large-cap stocks. In 2012, a good number of mid-cap stocks witnessed sharp rallies while large caps did not participate with the same pace. This appears to be a key reason for HDFC Equity underperforming marginally in 2012 this far.

One can check HDFC’s portfolio on Valueresearchonline

Thanks for the article, 2 questions

1. Why are MF returns generally shown for odd number of years – 1,3,5, etc and not for all years 1,2,3..n ?

2. To find a laggard, the article suggests to compare with benchmark for 1,3,5 years. So, is it really required to wait and compare after 5 years where one could have lost most of the capital? Or would it be sane to do it after 1 year or at most 2?

Sheetal

No idea as to why MF returns generally shown for odd number of years – 1,3,5, etc and not for all years 1,2,3..n ? Tried searching on net but couldn’t get any answer. Have asked on twitter.

Let’s see what comes up. A very good question Sheetal, till you raised it I did not think about it at all.

No to find the laggard you SHOULD NOT wait for 5 years. Track it performance for a quarter or two (depending on how often you review your portfolio). If you find it slipping below the benchmark in a quarter try to find why is it so? If you understand the reason wait else should sell it. Quoting from The Sell Decision With Mutual Funds: Knowing When to Walk Away

While quarterly returns can be monitored to alert you to signs of deteriorating performance, one-year returns are the shortest relevant performance span for long-term investors to examine. However, that doesn’t mean you should automatically sell if one-year returns turn up poor. Deciding how much time to give a poor performer to rebound is not easy, but you should seriously start to think about selling a fund that has lagged its benchmark and peers for the past 18 months to two years.

Hi Kirti, will look forward to your answer about the number of years thingy.

So 2 years is the kind of time one should wait before selling a fund based on its bad performance. Now as an example per VRO, HDFC Equity is 5* fund and BSL Div Yield Plus is 4* fund and both have been lagging their benchmarks for last 2 years. I am taken aback how these continue to have that rating on a site like VRO. Any clues on why these continue to have those ratings and is it time to dump these funds?

This raises another question about investing in MFs. Majority of the funds are chart toppers in an year maybe two and then start slipping down. These are owned by reputed fund houses and they manage to get many investors on board. Once the slide starts investor waits say for a year or two or more in hope of recovery and maybe these funds lost the plot now and cannot recover anymore. The investor is left in a dilemma and maybe exits out of exhaustion. Out of hope on equity he moves onto the next topper in the charts and the vicious cycle continues.

What I am trying to say is – Is investing in MFs a zero sum game? If fund houses cannot at least beat the benchmark with their mandate how long can investor continue to chase this chimera if I may say so?

Sheetal a very very good question you have asked.

Ratings are not fixed they keep on changing. Infact a friend of mine getting duped by ratings have decided not to invest in 5 star rated funds. He invests in 3 and 4 stars funds.

In our article Investing in Mutual Funds for Beginner we have touched upon the ratings of mutual funds.

Ratings should be the starting point for making an investment decision. They are not the be all and end all of mutual fund investments. There are other important factors like portfolio management, age of funds and more, which should be taken into account before making an investment. One needs to look at the fund’s pedigree and fund manager’s conviction. Typically there is no need to worry if a five-star fund slips to four stars. Even a three-star rating should not trigger panic. But when it falls to below three stars, it is time to act. One star, and you know you have the wrong fund. One needs to keep track of his fund’s performance and make necessary changes.

Coming to HDFC Equity Fund It’s a fund which tracks CNX 500 benchmark, As you rightly pointed out it has been underperforming. Quoting from HinduBusinessLine Fund Talk: SIPs may not work in the short term

HDFC Equity remains a sound fund with a good track record. Its current portfolio has higher weights for finance and energy stocks which have underperformed over the last one year. Besides, unlike earlier years, the fund’s portfolio is biased towards large-cap stocks. In 2012, a good number of mid-cap stocks witnessed sharp rallies while large caps did not participate with the same pace. This appears to be a key reason for HDFC Equity underperforming marginally in 2012 this far.

One can check HDFC’s portfolio on Valueresearchonline