Nearly ₹4000 crores have been side-pocketed by mutual funds out of which ₹3000 crores have been segregated by Franklin alone. This article covers, Which Mutual Funds have created which segregated portfolio’s in which schemes, which Mutual Funds have received the outstanding dues and how they have paid it to their investors?

Table of Contents

Segregated Portfolio, Tax

Debt Mutual Funds have chosen to create more than 30 side pockets for their bond exposures to Yes Bank, Vodafone-Idea, Adilink Infra and Multi trading Pvt. Ltd, Altico Capital India, and Dewan Housing Finance Corp. Ltd.

After the credit crisis in IL&FS and DHFL, SEBI, the market regulator, issued a comprehensive circular in December 2018, allowing the creation of segregated portfolios of debt and money market instruments subject to conditions like a downgrade of a debt or money market instrument to ‘below investment grade’ or suffer from a default. Features of Segregated Portfolio from our article Segregated Portfolio, Side Pocketing in Debt Mutual Funds are given below.

- Existing investors in the Schemes, as on the day of creation of segregated portfolio(s), shall be allotted an equal number of units in the segregated portfolio(s) as held in the main portfolio(s).

- AMC will disclose separate NAVs of segregated and main portfolios from the date of creation of segregated portfolio(s).

- A statement of account indicating units held by the investors in the main and segregated portfolio(s) along with the respective NAVs as on the day of the credit event will be communicated to the investors within 5 working days of the creation of the segregated portfolio(s).

- Units of the segregated portfolio will not be available for subscription or redemption. However, AMC will enable listing of units of the segregated portfolio(s) on the recognized stock exchange within 10 working days of the creation of segregated portfolio(s) and enable transfer of such units on receipt of transfer requests

- Investors redeeming their mutual fund units will get proceeds based on the NAV of the main portfolio, while they will continue to hold units of the segregated portfolio.

Upon recovery of money from the Issuer in the segregated portfolio(s), whether partial or full, it will be distributed to the investors in proportion to their holding in the segregated portfolio(s). For example, On 10 Jul 2020, Vodafone Idea made payments of ₹2,850 crores to mutual funds and bank.

You do not need to do anything to get your dues. The fund house will credit the amount to your registered bank account. If there is no registered bank account in your folio, then the fund house will send you a cheque.

When the payout is processed outstanding units in the plans of the segregated portfolio of respective schemes are extinguished. It is like, segregated units are redeemed.

When you get the payment for segregated units then it is considered as the redemption i.e sale of segregated units. It is taxed like debt mutual funds and you need to calculate capital gain tax based on the date of purchase of original investment (even if you have redeemed units from the main portfolio any time) and NAV of the segregated portfolio.

Vodafone interest payment Jul 2020: Franklin, Nippon, UTI

Side pockets of Franklin Templeton India schemes have received ₹1252 crore, UTI Mutual Fund has received ₹166 crores and Nippon India Mutual Fund has received ₹121 crores. For Franklin and Nippon for many of their segregated portfolio, this is the full and final payment.

These part payment will be credited in investors’ accounts in the coming week.

The payout shall be processed by extinguishing proportionate units in the plans of the segregated portfolio of respective schemes.

UTI and Nippon India Mutual Fund side pocketed their respective exposures to Vodafone Idea on 17 February.

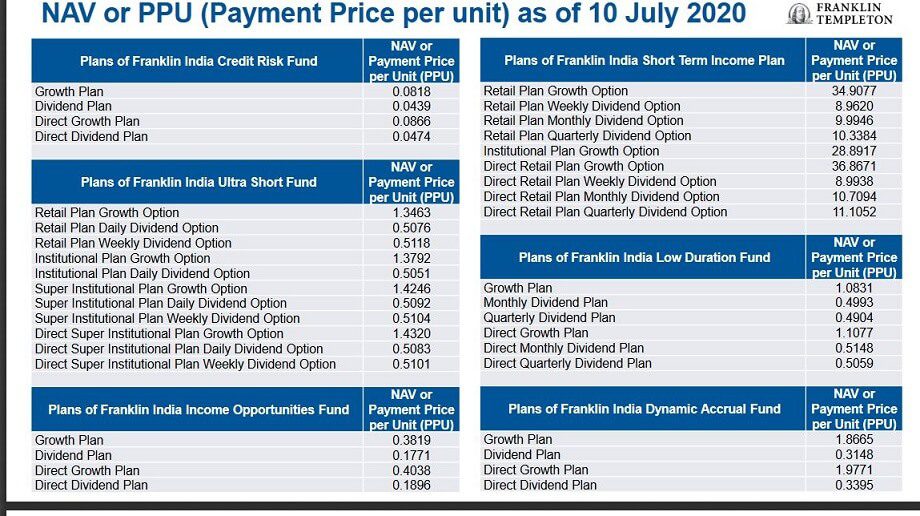

Franklin had side pocketed exposure to Vodafone in 6 debt schemes on 24 January following a downgrade by CRISIL. Though these 6 debt schemes are currently under winding-up process following a decision by the fund house on 23 April. The interest payment by Vodafone Idea to Franklin schemes segregated portfolio does not affect the refund process of these schemes. The Payout ratio would be as shown in the table below

Franklin Templeton and Vodafone interest payment Jun 2020

Vodafone owed Franklin Templeton an interest payment that was due on June 12, 2020, and the last portion of interest plus principal on July 10, 2020, the bond’s maturity date. Vodafone paid the June 12 interest to fund houses of about Rs 103 crore.

There are six schemes which had made investments in this Vodafone Idea bond, these are Franklin India Income Opportunities Fund, Franklin India Ultra Short Bond Fund, Franklin India Low Duration, Franklin India Short Term Income Plan, Franklin India Credit Risk Fund, Franklin India Dynamic Accrual Fund.

Segregated portfolios were created for these units This interest was distributed among investors in proportion to their holdings in the plans of the segregated portfolios.

Mutual Funds with segregated portfolios

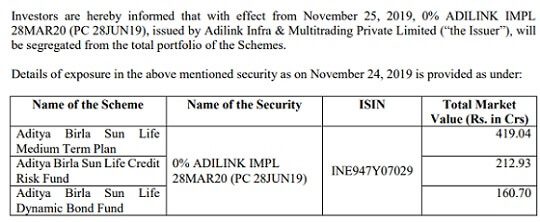

Aditya Birla Sun Life Mutual Fund segregated portfolio

On 25 Nov 2019, Aditya Birla Sun Life Mutual Fund segregated portfolios in three of its debt mutual fund schemes because of a default in payment by Adilink Infra and Multilink Trading. The schemes affected are shown in the image below.

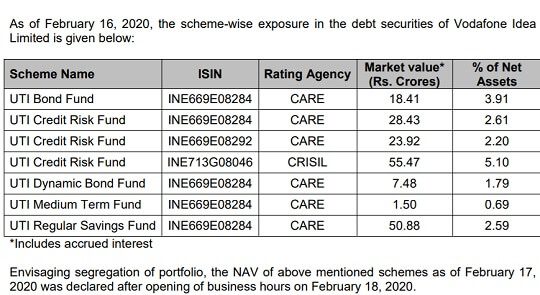

UTI Mutual Fund schemes with segregated portfolio for Vodafone

On 18th February 2020, the UTI Mutual Fund created a segregated portfolio as Care Rating downgraded the debt instruments of Vodafone Idea to ‘BB-’ (i.e. below investment grade) on 17 February 2020. UTI mutual fund schemes had exposure of Rs 180 crore in debt instruments issued by Vodafone Idea. Schemes of UTI are shown below in the image

UTI Mutual Fund schemes with segregated portfolio for Altico

On Sep 2019, UTI Mutual Fund created a separate portfolio, UTI Credit Risk Fund segregated, following the downgrade of debt instruments of Altico Capital India, a lender to real estate companies. UTI Credit Risk Fund has an exposure of Rs 201.82 crore in debt security (INE587O07230) of Altico Capital India, amounting to 5.85% of AUM.

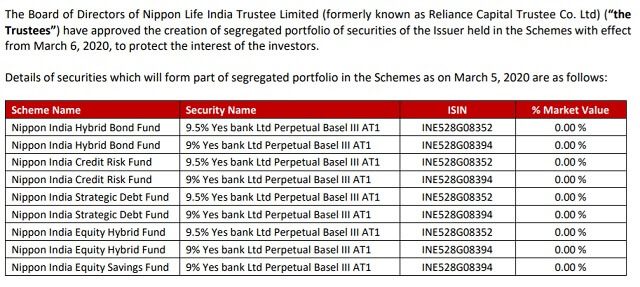

Nippon segregated portfolio for Yes Bank

Franklin Mutual Fund Schemes with the segregated portfolio for Vodafone

Franklin Templeton MF, had 62%(Rs 1,738 crore) exposure in Vodafone Idea (VIL). There are six schemes which had made investments in this Vodafone Idea bond, these are Franklin India Income Opportunities Fund, Franklin India Ultra Short Bond Fund, Franklin India Low Duration, Franklin India Short Term Income Plan, Franklin India Credit Risk Fund, Franklin India Dynamic Accrual Fund.

Principal and Interest payment was received from Vodafone Idea Ltd for 8.25% Vodafone Idea Ltd 10-JUL-20 (ISIN INE713G08046) on July 10, 2020

Franklin Mutual Fund Schemes with the segregated portfolio for Yes Bank

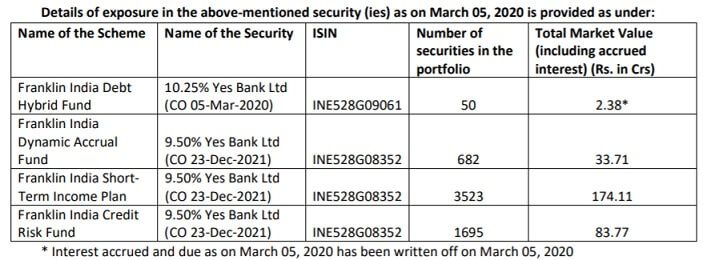

After ICRA downgraded of security 10.25% Yes Bank Ltd (CO 05-Mar-2020) to ICRA D and 9.50% Yes Bank Ltd (CO 23-Dec-2021) to “ICRA D (hyb) (”, i.e. ‘below investment grade’ by ICRA, Franklin TempletonMutual Fund created a segregated portfolio for these Security (ies) in the Scheme(s) effective from March 06, 2020.

Details of the Franklin Templeton Segregated Portfolio for schemes is shown below.

Which Mutual Funds have invested in Vodafone?

According to the Department of Telecommunications (DoT), Vodafone owes Rs 53,000 crore towards AGR dues. However, the company’s initial assessment, as per reports, pegs the amount at a much lower range of Rs Rs 18,000-23,000 crore. At the same time, speculations are also rife on the possibility of Vodafone Idea defaulting on its dues and filing for bankruptcy. Following image shows the Vodafone debt exposure

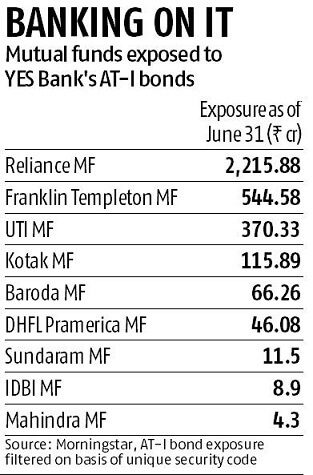

Which mutual funds have invested in Yes Bank?

The MF industry’s exposures to the additional tier I (AT-I) bonds of Yes Bank — which were downgraded by two notches and termed ‘riskier’ by ICRA – stood at Rs 3,394 crore as of June 2019.

Related Articles:

Segregated Portfolio, Side Pocketing in Debt Mutual Funds

- Capital Gain Calculator from FY 2017-18 with CII from 2001-2002

- Debt Funds Crisis: ILFS, Zee, DHFL, Ballarpur, JSPL

- What is IL&FS Crisis? Why the Government had to rescue IL&FS

Had you invested in these Mutual Funds? Did you get interest payment in the segregated portfolio?