Table of Contents

Overview of the Mutual Fund SIP with Insurance

- SIP is like a normal SIP so a fixed amount will be invested in the scheme on a fixed day every period such as month.

- One will get insurance based on the SIP amount and how long is the SIP. For example, A monthly SIP of Rs 20,000 will get you a life cover or sum assured of

- Rs 2 lakh in the first year,

- Rs 10 lakh in the second year,

- Rs 20-24 lakh third year onwards.

- If you stop SIP before three years you end up losing your life cover.

- But one has to commit to doing SIP for 3 years at least.

- You can exit the fund fully or partially. But if you exit the fund partially or in full before the SIP tenure or on attaining the maximum specified age your insurance will also lapse.

- One can have multiple SIPs in same or different schemes. If an investor has more than 1 SIP in Mutual Funds SIP schemes with Insurance, then the extent of insurance cover will be up to a maximum limit(Rs 50 lakhs) per investor across all schemes/plans/folios

About Insurance With these funds

- It is not a ULIP.

- No extra payment has to be done for Insurance.

- No medical check-ups are required.

- Insurance is group insurance and not an individual one. You will get an insurance letter from the Insurer directly.

Should you go For Mutual Fund SIP with Insurance?

- There are a limited number of funds in which you can invest.

- You are locked in for at least 3 years.

- In the case of death claim, you need to approach the Insurer directly.

Your choice of a mutual fund scheme should not be dependent on the fund which provides Insurance. It should depend upon its suitability to your goals and your time horizon, its performance record and the consistency of the fund manager. You should buy or should have bought an appropriate term cover and not get lured into buying a fund simply for the charm of free insurance. The insurance offered by Mutual funds should not be seen as a replacement for proper insurance.

But if there is a fund which you would have invested in anyways, then Insurance is like an extra benefit, as the cherry on the cake.

List of Mutual Funds SIP with Insurance

Currently Aditya Birla Mutual Funds, Reliance and ICIC Prudential provide Insurance with SIP. Aditya Birla calls it Century SIP, Reliance as SIP Insure and ICICI Pru as SIP Plus

| Aditya Birla Century SIP | Reliance SIP Insure | ICICI Pru SIP Plus |

| ABSL Frontline Equity Fund

ABSL Midcap Fund ABSL Digital India Fund(Erstwhile ABSL New Millennium Fund) ABSL Tax Relief ’96 Fund ABSL Focused Equity Fund (Erstwhile ABSL Top 100 Fund) ABSL Banking & Financial Services Fund ABSL MNC Fund ABSL Medium Term Plan ABSL India GenNext Fund ABSL Dividend Yield Fund (Erstwhile ABSL Dividend Yield Plus) ABSL Pure Value Fund ABSL Equity Hybrid ’95 Fund (Erstwhile ABSL Balanced ’95 Fund) ABSL Equity Advantage Fund (Erstwhile ABSL Advantage Fund) ABSL International Equity Fund – Plan B ABSL Equity Fund ABSL Index Fund ABSL Small-cap Fund (Erstwhile ABSL Small & Midcap Fund) ABSL Regular Savings Fund (Erstwhile ABSL MIP II Wealth 25 Plan) ABSL Credit Risk Fund (Erstwhile ABSL Corporate Bond Fund) |

Reliance Growth

Reliance Vision Reliance Tax Saver (ELSS) Fund Reliance Retirement Fund – Wealth Creation Plan Reliance Retirement Fund – Income Generation Plan Reliance Large Cap Fund Reliance Value Fund Reliance Multi Cap Fund Reliance Small Cap Fund Reliance Banking Fund Reliance Pharma Fund Reliance Power & Infra Fund Reliance Consumption Fund Reliance Focused Equity Fund Reliance Balanced Advantage Fund Reliance Equity Hybrid Fund Reliance Equity Savings Fund Reliance Hybrid Bond Fund |

ICICI Prudential Infrastructure Fund

ICICI Prudential Bluechip Fund ICICI Prudential Long Term Equity Fund (Tax Saving) ICICI Prudential Large & Midcap Fund ICICI Prudential Technology Fund ICICI Prudential Exports and Services Fund ICICI Prudential Balanced Advantage Fund ICICI Prudential Banking & Financial Services Fund ICICI Prudential Midcap Fund ICICI Prudential FMCG Fund ICICI Prudential Value Discovery Fund ICICI Prudential Multicap Fund ICICI Prudential Equity & Debt Fund ICICI Prudential Smallcap Fund ICICI Prudential Focused Equity Fund ICICI Prudential Multi-asset Fund ICICI Prudential Dividend Yield Fund ICICI Prudential Equity Savings Fund ICICI Prudential US Bluechip Equity Fund ICICI Prudential Global Stable Equity Fund ICICI Prudential Regular Savings Fund ICICI Prudential Pharma Healthcare and Diagnostics (P.H.D) Fund ICICI Prudential Manufacture In India Fund |

Comparing the Mutuals Funds SIP with Insurance

| Description | Birla Century SIP | ICICI Pru SIP Plus | Reliance SIP Insure |

|---|---|---|---|

| Minimum SIP Instalment(rs) | 1000 | 1000 | 500 |

| Minimum Number of SIP Years | 3 years | ||

| Insurance Company | With the relevant Insurance Company as determined by the Birla Sun Life Asset Management Co. Ltd. (BSLAMC) | ICICI Prudential Life Insurance Company |

Reliance Nippon Life Asset Management |

| Sum Insured for 1-2 years | 1st Year: 10 times of the monthly SIP Plus instalment 2nd Year: 50 times of the monthly SIP Plus instalment. |

||

| Sum Insured after 3rd Year | 100 times of the monthly SIP Plus instalment | 100 times of the monthly SIP Plus instalment | 120 times of the monthly SIP Plus instalment |

| Max Sum Insured | 50 Lakhs | ||

| Insurance Up to Age | 60 years | 55 years | 55 years |

| Life Cover Proceeds | Provided to the registered nominee | ||

| Benefits to Nominee | Scheme Value + Sum Assured based on the number of Years of SIP contributed (100 times of SIP instalment after 3rd year for Birla and ICICI Pure while 120 times for Reliance) | ||

| Age Entry/Exit |

18 years to 51 years (Insurance cover will be ceased on completion of 55 years of age, but SIP shall continue till the end of tenure if SIP is registered beyond 55 years of age.) |

||

| Exit Load | 2% if redeemed or switched out within 1 year

1% from 1st year to 3rd year. |

As per Scheme | |

| Exclusions for Insurance | 1. Death due to suicide shall be dealt with as per IRDAI Regulations 2. Death within 45 days from the commencement of SIP instalments except for death due to the accident. |

||

What is the process for claim procedure for Mutual Fund SIP with Insurance?

In case of death of the applicant, his/her legal representatives/Nominee will have to file a claim directly with the Insurance Company supported by all relevant documents as required by the Insurer and the payment of the claim will be made to the legal representatives by the insurance company

What is Group Insurance

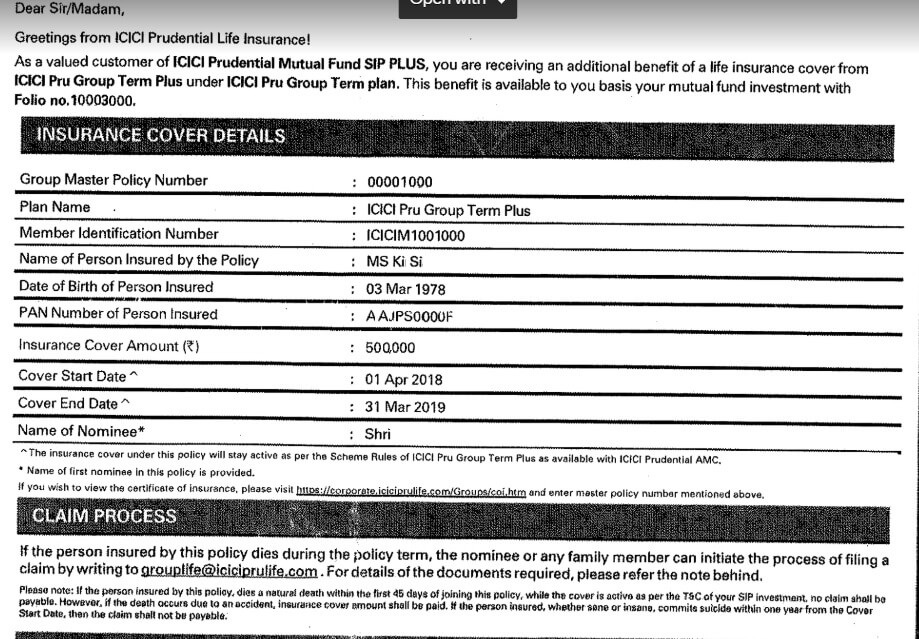

Group Insurance is the insurance which covers a group of people instead of one individual. Group Insurance may offer life cover, health cover, and/or other types of personal insurance. A sample group Insurance cover is shown in the image below.

- The group is usually employees of the same company or members of the same association. Coverage occurs under a master policy issued to the employer or association.

- The main advantage of group insurance is that life cover is made available to members irrespective of age, gender, socio-economic background or profession, so long as they belong to the group that is applying for insurance.

Related Articles:

- Systematic Transfer Plan or STP in MF: What is STP,How to invest

- Switching of Mutual Funds

- Redeeming Mutual Funds : Check Exit Load,Taxes

- Claiming Deceased’s Mutual Fund Units

- Debt Funds Crisis: ILFS, Zee, DHFL, Ballarpur, JSPL

Biggest Advantage of Mutual Fund with SIP is that you get Group Insurance at no extra cost. There are a limited number of funds in which you can invest. The insurance offered by Mutual funds should not be seen as a replacement for proper insurance. But if there is a fund which you would have invested in anyways, then Insurance is like an extra benefit, as the cherry on the cake. Do you think that Mutual Funds SIP with Insurance makes sense? Have you invested in Mutual Funds SIP with Insurance?