Income-tax Return (ITR) Forms for the Assessment Year 2022-23 have been notified by CBDT. The newly notified forms do not change the applicability of forms to different taxpayers but one needs to provide additional details. What are the changes in the ITR Forms for AY 2022-23? Which ITRs are affected and how?

Table of Contents

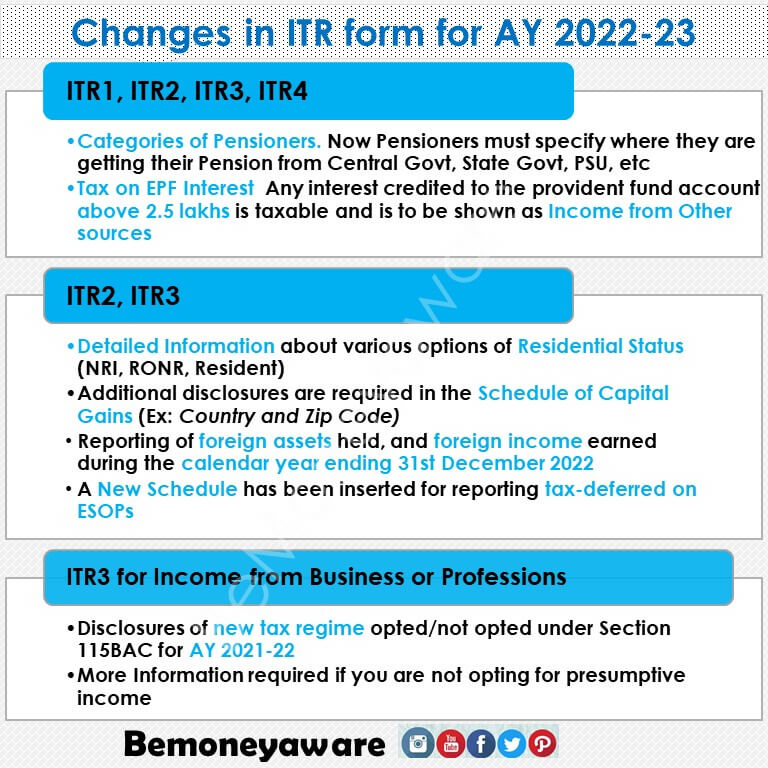

Changes in the ITR Forms for AY 2022-23

The newly notified forms do not change the applicability of forms to different taxpayers but one needs to provide additional details. Check Income Tax website for the update on utilities

ITR1, ITR2, ITR3, ITR4

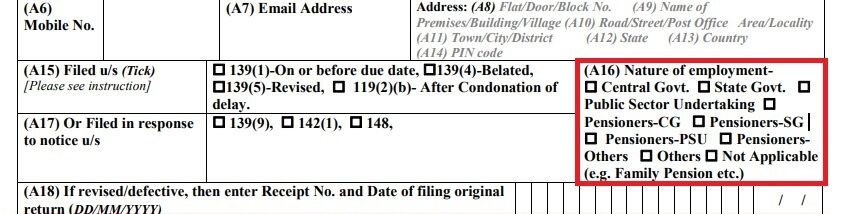

- Categories of Pensioners. Now Pensioners have to specify where they are getting their Pension from Central Govt, State Govt, PSU, etc

- Income from Other Sources, details about Tax on PF Interest. Any interest credited to the provident fund account above 2.5 lakhs is taxable. (Still not clear If PPF is included along with EPF). Such interest will be taxable under the head Income from Other sources and not under the head salaries. Applicable TDS u/s 194A @ 10% will be deducted from the interest amount by EPFO

- Income from Other Sources, Dividend Income. This applies to those shareholders who are the beneficial owner of 10% of a company and get any payment by way of loan or advance The new ITR forms seek separate reporting of dividend income under Section 2(22)(e). Until last year, there was no separate disclosure of dividend income is taxable under Section 2(22)(e).

ITR2, ITR3:

- Detailed Information about various options of Residential Status. An individual has to choose the suitable option in support of his selection of residential status, i.e., an individual has to choose one out of four options if he is an ordinarily resident in India.

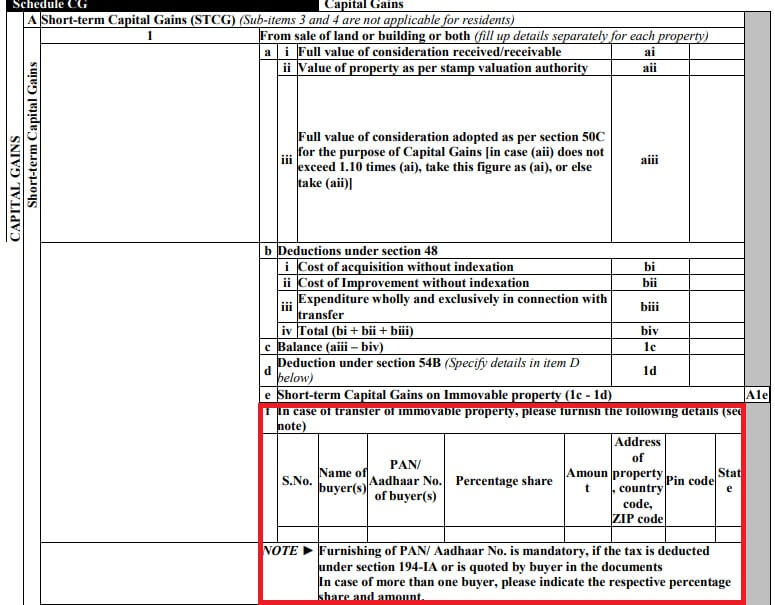

- Capital Gain: Details of Aadhaar number, PAN number on sale of property in Capital Gain section(Both Short and Long). Additional disclosures of the date of purchase and sale of land and building.

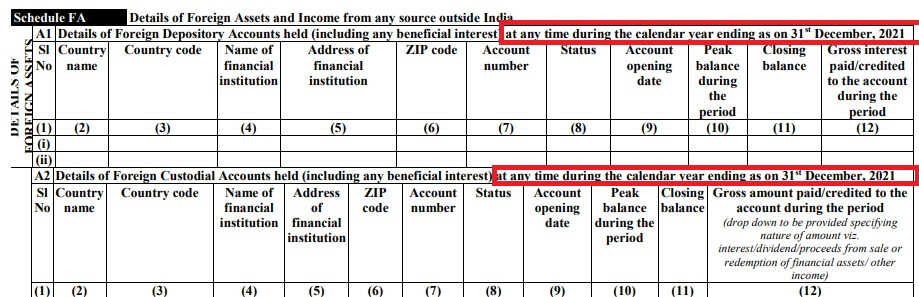

- Foreign Assets Schedule FA requires reporting of foreign assets held and foreign income earned during the calendar ending 31st December. You shall furnish the details of all foreign assets held between 01-01-2021 and 31-12-2021 in return to be filed for the assessment year 2022-23. Earlier it was clear was it till the calendar year(1 Jan – 31 Dec) or Financial Year (1 Apr-31 Mar). It was clarified as a notification in AY 2021-22 but now it’s in the Form.

- A New Schedule has been inserted for reporting tax-deferred on ESOP

ITR3: Income from Business or Professions

- ITR3: Those with Income from Business and Profession, Opted for New Tax Regime or not in the previous year(AY 2021-22). Filled Form 10IE. Are you opting for a new regime this year? Remember those with an income from business or profession cannot opt in and opt out of the new tax regime every year. Once a non-salaried opts out of the new tax regime, they cannot opt in again for the new tax regime in the future. Form 10IE is a declaration made by the return filers for choosing the ‘New Tax Regime’

- ITR3: More Information is required if you are not opting for presumptive income under section 44AE/44B/44BB/44AD/44ADA/44BBA. Details about Presumptive Taxation are here.

Our Income Tax course will teach you everything you need to know about income tax in simple terms that are easy to understand. Learn Income Tax Course

We have come up with a workbook With Examples and Worksheets that explains what is Income, Income Tax slabs, Types of Income, how and when to pay self-assessment tax, how to pay the tax due, how to File ITR More details of the workbook here

Category of Pensioner: ITR1

In the old ITR forms, for Nature of Employment, an individual receiving pension had to choose the option of ‘Pensioners’.

In new ITR forms, the following options have been incorporated for pensioners:

- Pensioners – CG,

- Pensioners – SC,

- Pensioners – PSU and

- Pensioners – Others.

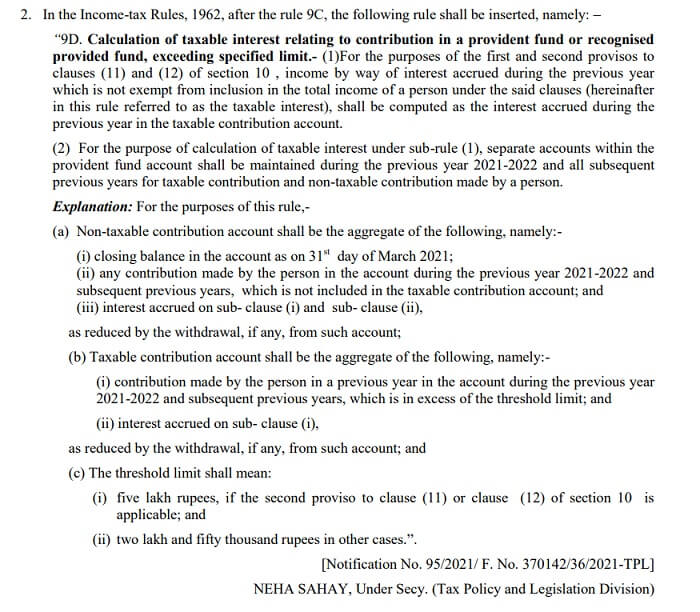

Tax on Provident Fund Interest

According to the new rules, any interest credited to the employee’s provident fund account is tax-free only for contributions up to 2.50 lakh every year and any interest on the employee’s contribution over 2.50 lakh is taxed. In case the employer does not contribute to the provident fund of the employee, then the limit applicable will be ₹5 lakh of the employee’s contribution.

This change is under Sections 10(11) and 10(12) of the Finance Act 2021. And Sections 10(11) and 10(12) define the exemption on the amount added to the provident fund. Still not clear if PPF is included along with EPF.

Reference: Notification No. 95/2021-Income Tax Dated: 31st August 2021 Calculation of taxable interest relating to contribution in a provident fund or recognized provided fund, exceeding specified limit which talks of RULE 9C. Calculation of taxable interest relating to contribution in a provident fund or recognized provided fund, exceeding the specified limit given below

Let’s see with an example, An employee has contributed Rs 4 Lakhs to the EPF account then the interest earned on Rs 1.50 Lacs (4 – 2.5 is taxable)

But only if life was so simple. One has to segregate of EPF account balance into taxable and non-taxable portions

Shailesh contributes Rs 31,000 per month to EPF for FY 2022-23 and his opening balance is Rs 1,11,063. In such a case his annual contribution will be Rs 3,72,000 (Rs 31,000 X 12) and interest will be taxable on Rs 1,22,000 (i.e 3.72 Lacs -2.50 Lacs) along with on opening balance of the taxable portion of PF

Details in our article Tax on EPF, VPF Contribution above 2.5 lakhs

At end of FY 2022-23 his taxable portion of PF will be as below:

| Particulars | Employee’s Taxable Portion of PF Balance |

| Opening Balance at beginning of the FY | 111,063 |

| Fresh contributions by the employee during the year | 122,000 |

| Interest on PF | 10,715 |

| Closing Balance at end of Financial Year | 243,778 |

So for FY 2022-23, taxable interest on PF would be Rs 10715, and the balance of the taxable portion of PF will be 2,43,778.

Net interest earnings from EPF will fall further if Public Provident Fund (PPF) contribution is also included in the Rs 2.5 lakh amount. Worth mentioning here is that the Budget papers mention interest under Section 10(11), which is the section that covers PPF interest. If PPF contribution is included in the Rs 2.5 lakh limit this will further reduce the weighted average returns from the provident fund investments. There is no clarity yet on whether the limit includes PPF contributions or not.

Here is how the new tax will impact provident fund earnings for individuals in each tax slab:

| Individual’s annual contribution to EPF | EPF returns (%) | Returns if PPF contribution added |

| Up to Rs 2.5 lakh | 8.5 | 7.1 |

| Rs 3 lakh | 8.0 | 7.0 |

| Rs 6 lakh | 6.9 | 6.5 |

| Rs 12 lakh | 6.4 | 6.2 |

| Rs 24 lakh | 6.1 | 6.0 |

| Rs 36 lakh | 5.7 | 5.7 |

| Rs 48 lakh | 5.7 | 5.7 |

| Rs 60 lakh | 5.5 | 5.5 |

| Rs 1.2 crore | 5.2 | 5.2 |

| Rs 2.5 crore | 4.9 | 4.9 |

Reporting of Foreign Assets in Calendar Year

The ITR Forms (except ITR 1 and ITR 4) require a resident taxpayer to disclose his foreign assets such as shares(ESOPs, RSUs), property in Schedule FA

In the old ITR Forms one had to report foreign assets in Schedule FA only if the person had held them at any time during the ‘relevant accounting period’. The ‘accounting period’ is not defined in the Income Tax Act. However, the instructions issued by the CBDT for filing of ITR Forms had provided the meaning of the term. For example, for AY 2021-22, the accounting period means from 1st January 2020 to 31st December 2020 in respect of foreign assets or accounts, etc., held in those jurisdictions where the calendar year is adopted as a basis for the closing of accounts and tax-filings.

The CBDT has clarified that a taxpayer shall be required to report foreign assets only if such assets have been held at any time during the “previous year” (of India) as also during the ‘relevant accounting period’ (on the foreign tax jurisdiction).

The new ITR Forms have replaced the expression “accounting period” with “calendar year ending as on 31st December 2021”. This change implies that the assessee shall furnish the details of all foreign assets held between 01-01-2021 and 31-12-2021 in return to be filed for the assessment year 2022-23.

Irrespective of the fiscal year followed in the foreign country (like, Australia follows July to June, Costa Rica follows October to September, etc.), the reporting is to be made if the specified foreign assets are held on 31-12-2021. This change removes all scope of misunderstanding or miscalculating the reporting period.

Example 1

| Relevant previous year | 01-04-2021 to 31-03-2022 |

| Relevant calendar year | 01-01-2021 to 31-12-2021 |

| Date of purchase of shares of Apple | January 2021 |

| Is the assessee required to furnish the details regarding the foreign assets acquired? | Yes |

The assessee is required to furnish the details of Apple’s share in ITR applicable for Assessment Year 2022-23 even if he has not held the foreign asset in the relevant previous year.

Example 2

| Relevant previous | 01-04-2021 to 31-03-2022 |

| Relevant calendar year | 01-01-2021 to 31-12-2021 |

| Date of purchase of shares of Apple | January 2022 |

| Is the assessee required to furnish the details regarding the foreign assets acquired? | No |

The shares of Apple were acquired within the previous year but after the end of the relevant calendar year. Thus, the assessee is not required to furnish the details of Apple’s share in ITR applicable for Assessment Year 2022-23. The disclosure requirement for such investment shall arise in the Assessment Year 2023-24 only.

Our Article RSU of MNC, perquisite, tax , Capital gains, ITR explains it in detail.

Additional disclosures required for Capital Gains in ITR 2, 3, 5 & 6

New ITR Forms require the following additional disclosures in the Schedule CG (Capital Gains) both Long and Short

- Date of purchase and sale of land/building

- Country and Zip Code if the property is situated in a foreign country

- Disclosure of FMV of capital assets and consideration received in a slump sale transaction

- Year-wise details of the cost of improvement to land/building

- Separate disclosure of cost of acquisition and indexed cost of acquisition

Our article Capital Gain Calculator on Sale on Property, Mutual Funds, Gold, Stocks explains in detail

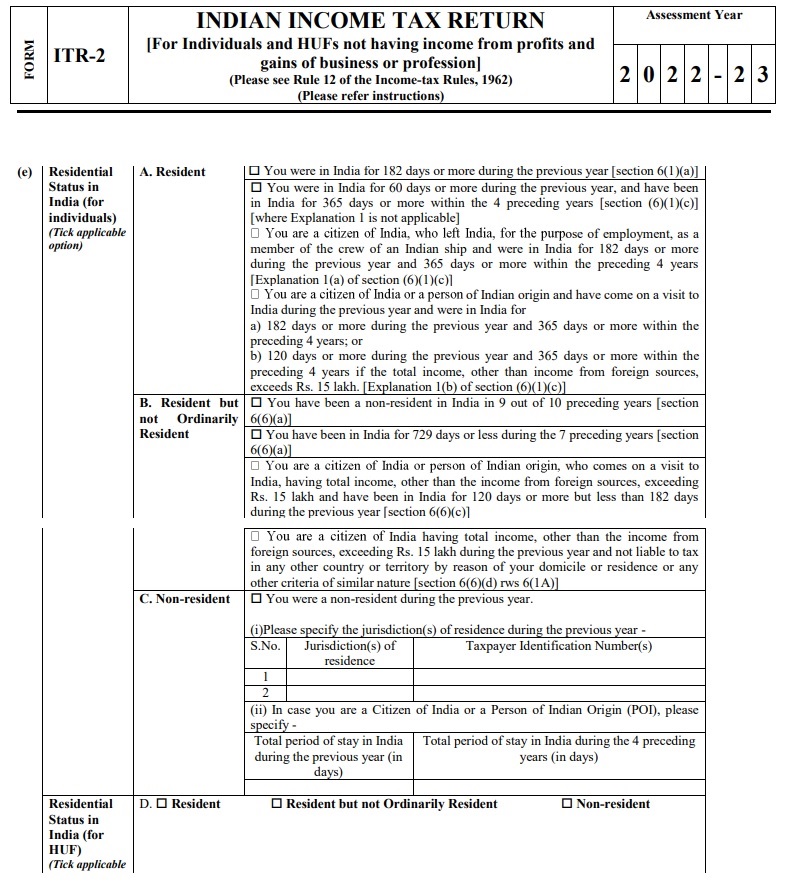

Residential status in India in ITR 2, 3

The income tax rules and perks of NRI are different from those applicable to resident Indians. For example, From the financial year 2017-18, ITR 1 is not available for non-residents. NRIs are supposed to file returns in ITR2 in all cases, except for business income. NRIs with business income are supposed to file returns in ITR 3.

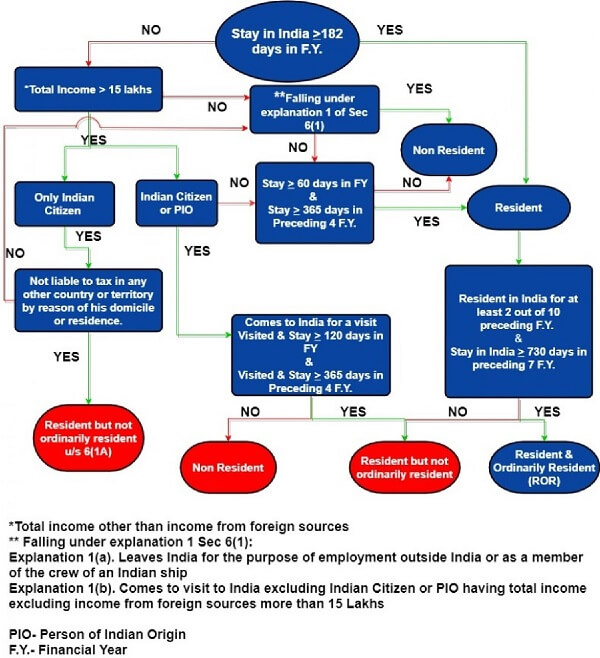

If you lived outside India in the last Financial year, Whether your income will be taxed in India or not depends upon your residential status.

Determining the residential status of an individual in India is quite a tedious exercise. The new ITR forms give a suitable description of different clauses due to which the residential status is determined. These options are self-explanatory. The assessee has to choose the relevant option in support of his selection of residential status.

For a resident, their Global income is taxable in India.

For NRIs, income earned within India is taxable income. If you earned interest on an NRE account and an FCNR account is non-taxable in India. But interest earned on an NRO account is taxable in India for an NRI. Income that is earned outside India is not taxable income in India

Examples of Income earned and are taxable income in India:

- Salary received in India

- Salary for service provided in India

- Income from Indian house property(Rental)

- Capital gains on transfer of Indian assets(sale of property etc)

- Income from Fixed Deposits

- Interest on the savings bank account

Details of NRI Income in our article Non-Resident Indian – NRI

If you are still confused then this image in flowchart form might be helpful

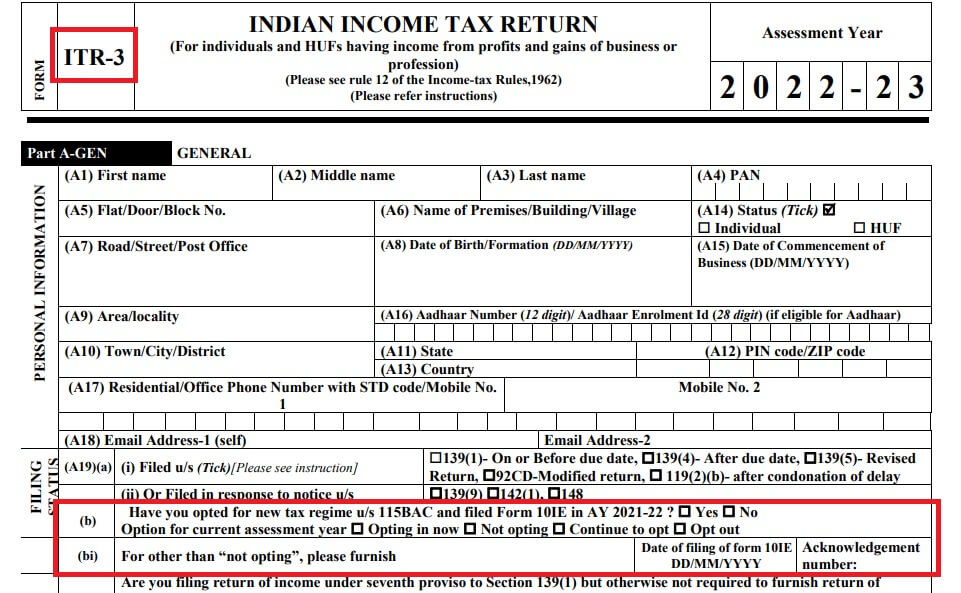

New tax regime opted under Section 115BAC for ITR3 and ITR4

Remember those with an income from business or profession cannot opt in and opt out of the new tax regime every year. Once a non-salaried opts out of the new tax regime, they cannot opt in again for the new tax regime in the future. Form 10IE is a declaration made by the return filers for choosing the ‘New Tax Regime’

For AY 2021-22 only information required was if one has opted for the new tax regime or not.

But For the AY 2022-23, you have to choose from the following options: Whether you have opted for the new tax regime under Section 115BAC and filed Form 10-IE in AY 2021-22

For the AY 2022-23, you have to choose from the following options as shown in the image below.

- Opting in now

- Not opting

- Continue to opt

- Opt out

Our article Old or New Tax Regime to choose with Calculator for Income Tax explains when to opt for New Tax Regime

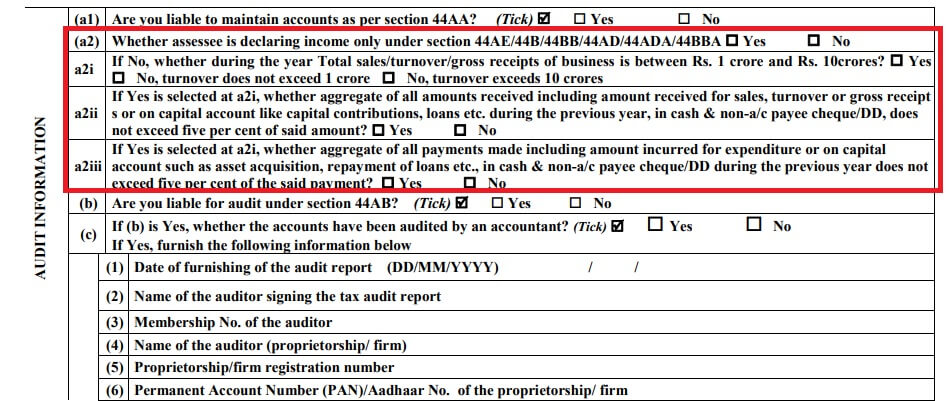

Additional information from the assessee not opting for the presumptive tax scheme ITR 3, 5 & 6

The audit under Section 44AB is mandatory if the total sales, turnover, or gross receipt from the business during the previous year exceeds Rs. 1 crore. However, if the cash receipt and cash payment do not exceed 5%, the audit shall be mandatory if the turnover of the business assessee exceeds Rs. 10 crores during the financial year. For the purpose of computing the limit of 5%, payment or receipt by cheque drawn on a bank or by a bank draft, which is not an account payee, shall be deemed to be the payment or receipt in cash only. The old ITR Forms required the assessee to furnish the response regarding cash receipts and payments only, and it did not consider the receipt or payment through a non-account payee cheque or DD.

Change in New ITR Form

The following additional disclosures are required regarding Audit Information:

- Whether total sales, turnover or gross receipt is between Rs. 1 crore and Rs. 10 crores. If not, is it below Rs. 1 crore or exceeds Rs. 10 crores?

- The new ITR forms require aggregation of receipts and payment in cash and non-account payee cheque or DD while computing the limit of 5% as mentioned above.

For details about Presumptive Taxation details here.

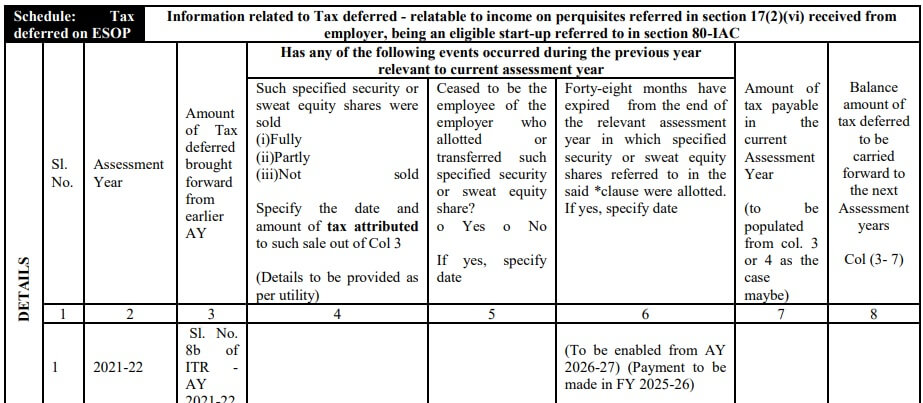

Reporting of tax deferred on ESOP has a new Schedule

An employee can defer the payment or deduction of tax in respect of shares allotted under ESOP (specified securities) by an eligible start-up referred under Section 80-IAC. The tax is paid or deducted in respect of such ESOPs within 14 days from the earliest of the following period:

- After the expiry of 48 months from the end of assessment year relevant to the financial year in which ESOPs are allottewed;

- From the date the assessee ceases to be an employee of the organisation; or

- From the date of sale of shares allotted under ESOP.

The Part B of Schedule TTI (Computation of tax liability on total income) in ITR Forms of AY 2021-22 shows the disclosure of the tax amount deferred in this respect.

Change in New ITR Form

The New ITR Forms have inserted a “Schedule: Tax Deferred on ESOP”. The Schedule seeks the following disclosures:

- Amount of tax deferred in ITR filed for AY 2021-22;

- Date of sale of specified securities and amount of tax attributable to such sale;

- Date on which he ceased to be an employee of the organisation;

- Amount of tax payable in current assessment year;

- Balance amount of tax deferred to be carried forward to next assessment years.

As the outer limitation period of 48 months from the end of assessment year relevant to the financial year in which ESOPs are allotted is not yet over, the employee shall be liable to pay tax deferred in the assessment year 2021-22 in the previous year 2025-26.

The new Schedule has been inserted to keep track of the amount of tax deferred by the employee and the year it should be taxed. The tax payable in the current assessment year is exported in a new row introduced in Schedule Part B – TTI (Computation of tax liability on total income).

Reporting Deferred Tax on ESOP

ITR Forms for Individual’s Assessment year 2022-23

| Nature of income | ITR 1* | ITR 2 | ITR 3 | ITR 4 * | ||||

| Salary Income | ||||||||

| Income from salary/pension (for ordinarily resident person) | ✓ | ✓ | ✓ | ✓ | ||||

| Income from salary/pension (for not ordinarily resident and non-resident person) | ✓ | ✓ | ||||||

| Any individual who is a Director in any company | ✓ | ✓ | ||||||

| If payment of tax in respect of ESOPs allotted by an eligible start-up has been deferred | ✓ | ✓ | ||||||

| Income from House Property | ||||||||

| Income or loss from one house property (excluding brought forward losses and losses to be carried forward) | ✓ | ✓ | ✓ | ✓ | ||||

| Individual has brought forward loss or losses to be carried forward under the head House Property | ✓ | ✓ | ||||||

| Income or loss from more than one house property | ✓ | ✓ | ||||||

| Income from Business or Profession | ||||||||

| Income from business or profession | ✓ | |||||||

| Income from presumptive business or profession covered under section 44AD, 44ADA and 44AE (for person resident in India) | ✓ | |||||||

| Income from presumptive business or profession covered under section 44AD, 44ADA and 44AE (for not ordinarily resident and non-resident person) | ✓ | |||||||

| Interest, salary, bonus, commission or share of profit received by a partner from a partnership firm | ✓ | |||||||

| Capital Gains | ||||||||

| Taxpayer has held unlisted equity shares at any time during the previous year | ✓ | ✓ | ||||||

| Capital gains/loss on sale of investments/property | ✓ | ✓ | ||||||

| Income from Other Sources | ||||||||

| Family Pension (for ordinarily resident person) | ✓ | ✓ | ✓ | ✓ | ||||

| Family Pension (for not ordinarily resident and non-resident person) | ✓ | ✓ | ||||||

| Income from other sources (other than income chargeable to tax at special rates including winnings from lottery and race horses or losses under this head) | ✓ | ✓ | ✓ | ✓ | ||||

| Income from other sources (including income chargeable to tax at special rates including winnings from lottery and race horses or losses under this head) | ✓ | ✓ | ||||||

| Dividend income exceeding Rs. 10 lakhs taxable under Section 115BBDA | ✓ | ✓ | ||||||

| Unexplained income (i.e., cash credit, unexplained investment, etc.) taxable at 60% under Section 115BBE | ✓ | ✓ | ||||||

| Person claiming deduction under Section 57 from income taxable under the head ‘Other Sources’ (other than deduction allowed from family pension) | ✓ | ✓ | ||||||

| Deductions | ||||||||

| Person claiming deduction under Section 80QQB or 80RRB in respect of royalty from patent or books | ✓ | ✓ | ||||||

| Person claiming deduction under section 10AA or Part-C of Chapter VI-A | ✓ | |||||||

| Total Income | ||||||||

| Agricultural income exceeding Rs. 5,000 | ✓ | ✓ | ||||||

| Total income exceeding Rs. 50 lakhs | ✓ | ✓ | ||||||

| Assessee has any brought forward losses or losses to be carried forward under any head of income | ✓ | ✓ | ||||||

| Computation of Tax liability | ||||||||

| If an individual is taxable in respect of an income but TDS in respect of such income has been deducted in hands of any other person (i.e., clubbing of income, Portuguese Civil Code, etc.) | ✓ | ✓ | ||||||

| Claiming relief of tax under sections 90, 90A or 91 | ✓ | ✓ | ||||||

| Others | ||||||||

Assessee has:

|

✓ | ✓ | ||||||

| Income has to be apportioned in accordance with Section 5A | ✓ | ✓ | ||||||

| If the tax has been deducted on cash withdrawal under Section 194N | ✓ | ✓ | ✓ | |||||

| * ITR-1 can be filed by an Individual only who is ordinarily resident in India. ITR-4 can be filed only by an Individual or HUF who is ordinarily resident in India and by a firm (other than LLP) resident in India. | ||||||||

ITR Forms for AY 2022-23

To Recap Changes in ITR Forms for AY 2022-23 with changes are given below

Related Articles

Income Tax workbook With Examples and Worksheets here

- RSU of MNC, perquisite, tax , Capital gains, ITR

- Tax on EPF, VPF Contribution above 2.5 lakhs

- Non-Resident Indian – NRI

- Capital Gain Calculator on Sale on Property, Mutual Funds, Gold, Stocks

- Old or New Tax Regime to choose with Calculator for Income Tax

Hope this explains What are the changes in ITR for AY 2022-23? What additional details are required? Which change did you like which you didn’t

Very Nice described.

Thanks a lot for commenting & sharing.

Appreciate it