With innumerable direct and indirect taxes in the country, common man is certainly looking for ways to save tax. National Pension Scheme (NPS) regulated by the Pension Fund Regulatory and Development Authority that was restricted to only government employees has been to open to the entire nation since 2009. This article talks about NPS and Tax Benefits, and through examples shows how NPS Saves Tax under various 80C Sections using salary restructuring and additional investment. It also answers Can a government employee claim 50,000 Rs under section Section 80CCD(1B) from his employee contribution under 80CCD(1)?

Table of Contents

NPS and Tax Benefits

NPS is an investment product for retirement. Compulsory for central and state government employees while optional for others. Various types of accounts(Tier-1 and Tier-2), asset classes and fund managers are available under NPS scheme. Our article Understanding National Pension Scheme – NPS covers NPS in detail. The major attraction for investment in NPS in recent times is is tax benefits that NPS offers. Note Tax benefits can be availed for investments in NPS Tier-1 only.

The contribution for NPS and interest earned are eligible for deduction while withdrawals are taxable. NPS falls under exempt-exempt-tax bracket. For a detailed review on the total tax benefits and a better understanding of the section, refer to our article NPS Tax Benefits and sections 80CCD(1), 80CCD(2) and 80CCD(1B)

| Section | Deduction allowed | Maximum Limit | Can be claimed by |

| 80CCD(1) | Employee contribution up to 10% of basic salary and DA | Upto 1.5 Lakhs including 80C. | Employees. For self-employed 10% of their annual income up to a maximum of Rs 1.5 Lakhs. |

| 80CCD(2) | Employer’s contribution up to 10% is basic salary and DA. | Upto 10% of basic salary and DA. | Only employees. |

| 80CCD(1B) | Additional tax benefit up to Rs. 50000 over and above the benefit under 80CCD(1). | Upto Rs. 50000 | Employee( Government or private) or self-employed or ordinary citizen. |

How NPS Saves tax?

Tax Benefit Of NPS under Section 80CCD(2) to Employees and Employers

Employer’s contribution up to 10% of basic salary and DA reduces the tax of the employee but the employer can also claim the contribution made in NPS pension scheme as the business expense. For example, Rohit’s annual basic salary is Rs 180,000 i.e Rs 15,000 per month. If his employer contributes 10% of his basic salary in NPS then the employer will be eligible to get a tax deduction of Rs 18000 (10% of 18000 or 1500*12) as the business expense. But most of the employers do not allow tweaking of the pay structure.

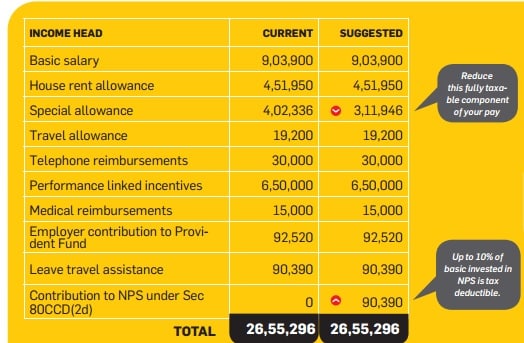

For example, If Sree could ask his company to restructure his salary to reduce his special allowance by Rs 90,390 and put that amount in the NPS under Section 80CCD(2d) it will reduce his tax as shown in image below.

Tax Benefit Of NPS under Section 80CCD(1) to Employees

Employee contribution up to 10% of basic salary and dearness allowance (DA) is eligible for tax deduction. The Tax benefit on NPS contribution on behalf of employee comes under Sec 80C which has a limit of 1.5 Lakh and includes PPF, Tuition fees, Life Insurance Premium etc.

Self-employed can also claim this tax benefit. However, the limit is 10% of their annual income up to a maximum of Rs 1.5 Lakhs.

The earlier pension structure was replaced by NPS in most central and state government jobs since 2004. So anyone who joined after that has a compulsory deduction for NPS. The deduction is 10% of basic salary and dearness allowance (DA) and the employer too contributes the matching amount

Let’s see how 80CCD (1B) and 80CCD (2) work to reduce tax

| Head | Particulars | Without NPS | With NPS |

|---|---|---|---|

| Salary | Basic (40% of Gross) | 4,000,000 | 4,000,000 |

| HRA (50% of Basic) | 2,000,000 | 2,000,000 | |

| Flexi / Professional Allowance | 3,327,600 | 2,927,600 | |

| Corporate Contribution – EPF | 480,000 | 480,000 | |

| Corporate Contribution – Gratuity | 192,400 | 192,400 | |

| Corporate Contribution – NPS (10% of Basic) | 0 | 400,000 | |

| Gross Salary | 10,000,000 | 10,000,000 | |

| Deductions | 80CCE | 1,50,000 | 1,50,000 |

| Corporate Contribution – PF | 480,000 | 480,000 | |

| Corporate Contribution – Gratuity | 192,400 | 192,400 | |

| Corporate Contribution – NPS (80CCD (2)) | 0 | 400,000 | |

| Gross Deductions | 672,400 | 10,72,400 | |

| Taxable Salary | 93,27,600 | 89,27,600 | |

| Change in Taxable Salary | 400,000 | ||

| Tax Saved @ 30% | 120,000 | ||

Tax Benefit On NPS under Section 80CCD(1B) to Individual

Investment up to Rs.50,000 is deductible from taxable income under section 80CCD (1B) of Income Tax Act, 1961. This was introduced in Budget 2015 and has been available since FY 2015-16. This has led to an increase in interest in NPS. Tax saved by investing 50,000 in NPS for one with 30% tax slab is 15,450 and Tax saved in 20% slab is Rs 14,832

From Apr 1 2015, one can do additional saving of Rs 50,000 under section 80 CCD(1B). This would lead to additional saving as shown in the table below.

| Description | Without NPS | With NPS |

| Salary | 25,00,000 | 25,00,000 |

| Basic (40% of Salary) | 10,00,000 | 10,00,000 |

| NPS Contribution | 0 | 0 |

| Deductions | ||

| Under section 80C | 1,50,000 | 1,50,000 |

| Under section 80CCD(2) | 0 | 0 |

| Under section 80CCD(1B) | 0 | 50,000 |

| Total taxable income | 23,50,000 | 23,00,000 |

| Tax (at 30%) without Edu cess | 5,30,000 | 5,15,000 |

| Tax with Edu cess at 3% | 5,45,900 | 5,30,450 |

| Additional Tax saved | 15450 |

Can a government employee claim 50,000 Rs under section Section 80CCD(1B) from his employee contribution under 80CCD(1)?

There is confusion regarding whether a government employee claim 50,000 Rs under section Section 80CCD(1B) from his employee contribution under 80CCD(1)?

This is about additional Rs.50,000 under 80CCD (1B). I already save Rs.1.50 lakh in Public Provident Fund (PPF) account. I am a government employee and they are deducting 10% every month from my salary under CPF and depositing in National Pension System (NPS), which comes to Rs.70,000 p.a. Now my doubt is, can I show Rs. 50,000 (from this Rs.70,000) under 80CCD (1B). i.e total saving is Rs.150,000 (PPF) + Rs.50,000 (NPS) = Rs.200,000. Kindly clarify my doubt.

Experts are divided over how taxpayers can claim the additional tax deduction for NPS contributions announced from 1 Apr 2015.

- Some tax experts claim that employees covered by NPS can claim deduction for their mandatory contributions under the new Sec 80CCD(1b) This means taxpayers covered by NPS will not have to make additional investments to claim the new deduction. Other tax-saving investments and expenses, such as home loan principal, children’s tuition fees, life insurance premium, NSCs and ELSS funds, can be claimed under Section 80C while the mandatory contribution to NPS can be claimed under Section 80CCD (1b).

- Others believe that the mandatory contribution to retirement savings made by an individual will not make him eligible for the new deduction. For that, the taxpayer must make an additional ‘voluntary’ or ‘self’ contribution to the NPS.

The income tax return forms have done little to dispel the confusion. While the deductions under different sub-sections of 80CCD have to be shown separately in the forms, there is no clarity regarding whether employee contributions can be treated as self-contribution

My investments in Section 80C barring NPS amount to Rs.1 lakh. However, I have deposited Rs. 1 lakh towards NPS through salary. How much total deduction in Section 80C will be available – Rs.1.50 lakh or Rs.2 lakh i.e. can I claim Rs.50,000 of my NPS contribution additionally under Section 80CCD (1B)?

A: As per section 80CCE of the Income Tax Act, the aggregate amount of deductions under section 80C, section 80CCC and section 80CCD (1) shall not exceed Rs.1.50 lakh.

The contribution towards NPS from your salary is covered under Section 80CCD (1), which states you will be allowed a deduction towards NPS contribution upto a limit of 10% of your salary (i.e. Basic Salary + Dearness Allowance). Hence, in your case, if your contribution towards NPS is within this limit, then you can claim a total of Rs.1.50 lakh (i.e. Rs. 1 lakh of other Section 80C investments plus Rs.50,000 out of your NPS contribution under Section 80CCD (1).

In addition to that, Section 80CCD (1B) allows an additional deduction of Rs.50,000 towards NPS contribution, provided you have not claimed deduction for such amount under Section 80CCD (1). Accordingly, you can claim the remaining Rs.50,000 of NPS contribution under Section 80CCD (1B).

Summing up, you can claim a deduction of Rs.1.50 lakh under Section 80C & Section 80CCD (1) put together and another Rs.50,000 under Section 80CCD (1B), making it a total deduction of Rs.2 lakh.

Related Articles:

To get the most benefit out of NPS, ask your employer to invest his part in NPS by rejiggling your salary structure. Claim benefit under section 80CCD (2) along with 80C/80CCD (1) for contribution made under NPS and try to not invest more than Rs. 50000 under NPS to gain the maximum with minimal money leakage.

Dear sir,

I open an Atal Pension Yojana (APY) and contribute regularly. But I unable to track my contribution. So, While I trying to create IPIN, system shows an error massage ‘PRAN not found in database’. Please resolve the issue as early as possible or send my IPIN password to my Mobile No. or email id.

Name: V CHANDRA BABU

PRAN:500028927298

Mobile No.8682903998

email id: vchandrababu82@gmail.com

Thanking You

V CHANDRA BABU

i have a pran no. but when i set password it shows PRAN not found in database . what can i do