The New Pension System has generated a lot of interest ever since Budget 2015 announced additional tax benefits for investments in the scheme. For someone in the 30 per cent tax bracket, this is a clear benefit of Rs 15,000 on investment of Rs 50,000 over and above the Rs 1.5 lakh allowed under Section 80 C. This article gives an overview of NPS, explains NPS Tax Benefits, answers frequently asked questions regarding NPS and tax.

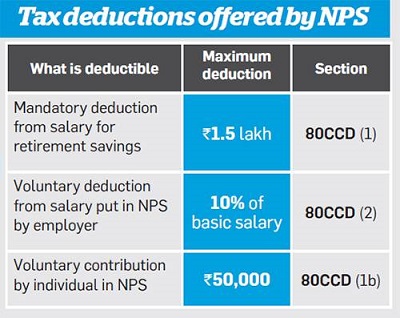

NPS Tax Benefits Sections

Table of Contents

Overview of NPS

National Pension Scheme is a government approved pension scheme for Indian citizens in the 18-60 age group.NPS is India’s answer to the US’ retirement scheme-401(K).

- Central and state government employees have to subscribe to NPS (it’s compulsory for them), it’s optional for others.

- NPS was introduced in 2004 for the new government employees but from 2009, it was extended to all on a voluntary basis.

- NPS is a defined contribution pension plan that needs you to keep contributing till the age of 60 years.

- The minimum annual contribution to the pension account (or Tier I account) is Rs. 6,000. The Tier II account in NPS works like a savings account to offer liquidity.

- Investments are market-linked and you can choose any of the three funds—government securities fund, fixed-income instruments other than government securities fund and equity fund but can’t put more than 50% of your money in the equity fund.

- Currently, fund management cost is fixed at 0.01%

- At 60, you can have up to 60% of this money in a lump sum, and buy an annuity product with the rest. So NPS is not a tax-saving scheme, it is a tax deferral scheme, that is your accumulation will be taxed at the time of withdrawal.

- Deferred exit options are available.

- Early exits are discouraged by mandating 80% of the accumulated corpus to buy an annuity. But the rules now allow for partial withdrawals up to 25% of the contributions for specific purposes.

The official site for NPS is npscra.nsdl.co.in and www.

NPS Tax Benefits

Tax benefits on NPS are available through 3 sections – 80CCD(1), 80CCD(2) and 80CCD(1B). All the tax benefits, annuity restrictions, exit and withdrawal rules are applicable to NPS Tier-I account only. NPS Tier-II account is open-ended ended mutual fund. You can take out the money at any time.

Only the NPS subscriber can claim tax benefits. If you invest in NPS which is in your spouse’s name then you cannot claim the tax deduction.

Your contribution to NPS can be claimed under Section 80CCD1(b)as well as Section 80C. So If you have can use other investments to claim 1.5 lakh deduction under 80C then you can claim your NPS contribution first under 80CCD1(b) for 50,000 then remaining along with other investments under 80C for 1.5 lakh. So the total deduction you can claim is 2 lakh.

For more information on NPS and Govt employee you can read our article NPS and Government Employees

Section 80CCD(1)

- Employee contribution up to 10% of basic salary and dearness allowance (DA) up to 1.5 lakh is eligible for tax deduction.

- This contribution along with Sec 80C has 1.5 Lakh investment limit for tax deduction.

- Self employed can also claim this tax benefit. However the limit is 10% of their annual income up to maximum of Rs 1.5 Lakhs.

Section 80CCD(2)

- Employer’s contribution up to 10% of basic plus DA is eligible for deduction under this section.

- Employer’s contribution is an additional deduction as it not part of Rs 1.5 lakh allowed under Section 80C.

- It is also beneficial for employer as it can claim tax benefit for its contribution by showing it as business expense in the profit and loss account.

- Self employed cannot claim this tax benefit.

Section 80CCD(1B) ,

- Additional exemption up to Rs 50,000 in NPS is eligible for income tax deduction.

- Introduced in Budget 2015, fro FY 2015-16

- Taxpayers in the highest tax bracket of 30 per cent can save Rs. 15,000 by investing Rs. 50,000 in the NPS. Those in the 20 per cent tax bracket can save around Rs. 10,000, while people in the 10 per cent tax bracket can save Rs. 5,000 per year by investing in the NPS.

- The additional tax benefit of 50000 is over and above the benefit of 1.5 Lakhs which can be claimed as a deduction under Section 80CCE.

- It is irrespective of the type of employment. So, a government employee, a private sector employee, self employed or an ordinary citizen can claim benefit of Rs 50,000 under Section 80CCD(1B).

Therefore, the total tax benefits that can be claimed for NPS under Section 80CCD(1) + Section 80CCD(1B) equals to 2 Lakhs for financial year.

If Employees have savings Rs. 1,50,000 under 80C excluding NPS Deductions, Then the Employee can show their NPS Deductions, under 80 CCD(1B), which is over the 1,50,000 Limit.

If the Employee have less than 1.5 Lakh savings in 80C and exceeds 50,000 towards NPS, then the Employee can split their NPS Amount to 80CCD(1) and 80CCD(IB).

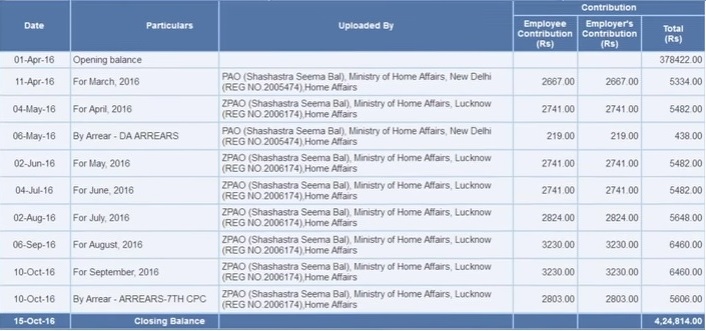

Proof for claiming Tax Benefits in NPS

The print out of the Transaction Statement could be used as a document for claiming tax benefit. For a Govt employee Transaction statement is similar to one shown in image

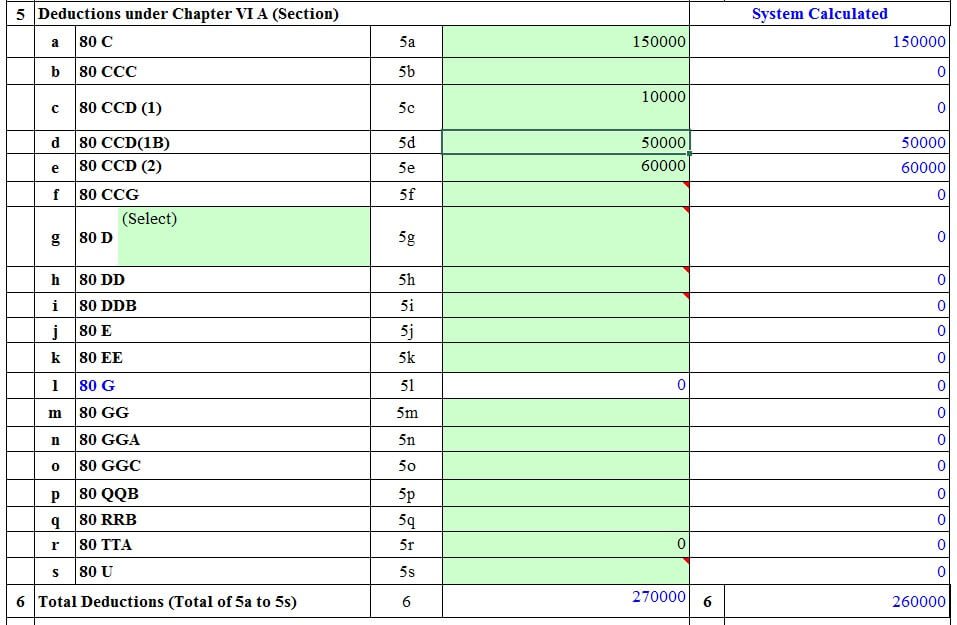

How to show NPS in ITR

Take the case when one has invested 1.5 lakh in PPF, Employer has invested 60,000 in NPS and Employee contribution is 60,000.

Section 80CCD(2)

- Employer’s contribution up to 10% of basic plus DA is eligible for deduction under this section.

- Employer’s contribution is an additional deduction as its not part of Rs 1.5 lakh allowed under Section 80C.

Section 80CCD(1B) ,

- Additional exemption up to Rs 50,000 in NPS is eligible for income tax deduction.

Section 80CCD(1)

- Employee contribution up to 10% of basic salary and dearness allowance (DA) up to 1.5 lakh is eligible for tax deduction.

- This contribution along with Sec 80C has 1.5 Lakh investment limit for tax deduction.

Should You invest in NPS: Word of Caution

NPS is drawing attention because of its tax benefit. However, one must remember that NPS falls under the EET (exempt-exempt-tax) regime. Hence, the benefit is just a tax deferral. Instead of paying tax on his income today, one defers the tax payment to a later date (when one turns 60) when he withdraws the money. Both the lump sum and the income from annuity will be taxed at one’s marginal tax rate. NPS might prove to be a better bet from the RoI perspective, if one can manage a lower marginal tax rate at the time of withdrawal. Buying an annuity may not be the optimal choice for returns when one retires. While NPS offers a tax break now, the benefits after retirement seem constrained. One must not base his decision purely on tax incentives on his current income. One should consider the taxation during withdrawal. One must decide by evaluating the product based on two key parameters: Does the product fulfil a need like no other product in the market. Will the post-tax return scenario be in his favour, compared with other EEE investments such as PPF, EPF and ELSS? One might be better off with the EEE choices. Our article Should you Invest in NPS the National Pension Scheme for additional 50,000 and save tax covers it in detail.

FAQ on Tax Benefits in NPS under sections 80CCD(1), 80CCD(2) and 80CCD(1B)

- A Govt employee/Corporate employee can claim a deduction of your employer’s contribution towards NPS under Section 80CCD (2), up to a limit of 10% of your salary (i.e. Basic Salary + Dearness Allowance). Employer’s contribution towards NPS or EPF (Employees’ provident fund) is not the part of your gross salary, but is added by your employer in your CTC (cost to company).

- A central government/state government officers/corporate employee are entitled deduction under section 80CCD (1B) on their own i.e employee contribution towards his NPS account

- You can claim a deduction of only your own contribution towards NPS under Section 80CC.

For more information on NPS and Govt employee you can read our article NPS and Government Employees

My salary (Basic + DA) is Rs 4 lakhs, so what are the tax benefits I can claim under NPS?

The total tax benefit, if you invest in NPS, is capped at Rs 1.3 lakh per annum.(40,000+40,000 + 50,000) You can claim the following deductions under NPS.

- As your salary (Basic + DA) is Rs 4 lakhs, the maximum tax benefit under Section 80CCD(1) is limited to Rs 40,000 per financial year.

- Contribution from your employer up to Rs 40,000 in a financial year will be exempt from tax.

- Over and above this You can also claim up to Rs 50,000 under Section 80CCD(1B).

- Even after these investments, you still have the option to invest up to Rs 1.1 lakhs for tax benefits under Section 80C (in products such as PPF, ELSS, Insurance premium etc). Benefit under Section 80CCD(1B) and Section 80CCD(2) is not included under Section 80C cap of Rs 1.5 lacs.

Amit is a government employee and his employer deducts Rs 62,000 per annum (which is 10% of basic + DA) from salary as employee’s contribution in NPS. It also deposits Rs 62,000 per annum as employer’s contribution in NPS. How and under which section should he claim tax benefit on NPS?

- Employer’s contribution in NPS would be eligible for tax deduction u/s 80CCD(2).

- The employee has a choice as to which section ,80CCD(1) or 80CCD(1B), he wants to show his contribution. Ideally he should show Rs 50,000 investment in NPS u/s 80CCD(1B). The tax deduction on rest Rs 12,000 can be claimed u/s 80CCD(1). The section 80CCD(1) along with Section 80C has investment limit eligible for tax deduction as Rs 1.5 lakhs. So he should make additional investment of Rs 1,38,000 in Section 80C to save maximum tax. In all he can save Rs 2 lakhs tax u/s 80C and 80CCD(1B).

I am a central government employee. I have invested Rs 1.5 lakh in Public Provident Fund (PPF). I also contribute around Rs 72,000 per year to National Pension System (NPS). The government, my employer, also contributes a matching amount. I want to know whether I can claim my PPF investment of Rs 1.5 lakh under Section 80C and the additional Rs 50,000 under Section 80CCD(1) on my contribution to NPS?

An employee’s contribution is eligible for tax deduction of up to 10 per cent of his salary (basic + DA) under Section 80CCD(1) within the overall ceiling of Rs 1.5 lakh under Section 80CCE. The employee is also eligible for tax deduction of up to 10 per cent of his salary (basic + DA) contributed by the employer under Section 80CCD(2) over and above the limit of Rs 1.5 lakh provided under Section 80CCE. As per the last Budget, an additional tax deduction of up to R50,000 can be claimed under Section 80CCD(1B) on investments in NPS. However, the aggregate amount of deduction under section 80C, 80CCC and 80CCD(1) cannot exceed R1.5 lakh.

That means you can claim a total tax deduction of Rs 2 lakh like this: Your contribution to NPS is Rs 72,000. You can claim a deduction of Rs 50,000 under section 80CCD(1B) and Rs 22,000 under section 80CCD(1). The remaining R1.28 lakh (R1.5 lakh – R22,000) can be claimed under section 80C on your investment in PPF.

I have invested Rs 1.5 lakh in PPF and Rs 62,000 in NPS. Am I still entitled to the employer’s contribution of NPS (62,000) under Section 80CCD(2)?

Yes, you can claim deduction if the contribution to the NPS has been made by the employer. This deduction can be claimed over and above Sec 80C and employee’s contribution to NPS. The deduction will depend on your basic salary. If your basic salary, excluding all allowances and perquisites except dearness allowance, is upwards of Rs 6.2 lakh, you can claim deduction of Rs 62,000 under Sec 80CCD(2). Else, the deduction will be capped at 10%.

Can I claim deduction Under 80CCD(1B) for in contributing in NPS account in the name of my wife or my minor child?

Only the NPS subscriber can claim tax benefits. If you invest in NPS which is in your spouse’s name or child then you cannot claim tax deduction.

Related Posts:

| What is NPS? | Income Tax for AY 2017-18 or FY 2016-17 | How NPS Helps to Save Tax |

| eNPs:How to open NPS account | Returns of NPS | Should you Invest 50,000 in NPS and save tax |

| Shifting NPS account: Sectors in NPS, Form ISS | Changes in NPS 2016 | Retirement:Pension Plans,NPS,EPF,PPF |

| How to do online Contribution to NPS using eNPS | NPS and Government Employees | Tax Planning Traps To Avoid |

Does PF deduction include employer and employee part both.

Can mandatory contribution to NPS be included for rebate under sec 80CCD(1)b

I have not claimed sec 80ccd (1b) in my previous returns as I had made only mandatory contribution and considered myself ineligible.I had used ELSS for availing sec 80 c benefits.But few days ago I came to know that I can avail Rs 50000 from my mandatory contribution in NPS.

Can I file revised returns for FY 2016-17 and 2017-18? Should I bother about sec 143 (1) and sec 143 (3)

?Will these be subjected to more severe scrutiny by AO?

It is a double-edged sword.

No one can predict how things would pan out?

Hey bemoneyaware,

A little clarity is required from you.

Suppose, A person is employed with a private organisation, where the deduction is made by employer under NPS scheme in which as per department of HR person has been informed that already 5% of his basic salary is being invested in NPS scheme.

Now the employee has already utilised full quota of 150K in 80c in various LICs, 5year Term FDs, PPF deposits and NSCs from self.

In Additional to this, the person wants to invest in NPS for investment as well as Tax saving, Both…

Now

Question 1. How much amount a person can invest in NPS after 150k of 80c to have maximum tax benefits.?

Question 2. Apart from tax benefits, whats the max investment can be done? Under what heads and Sections – Individually; eg 80c, 80ccd (1 & 1B), 80ccg & 80d

Question 3. Is section 80C and 80CCD-1, 80CCD-1B are linked or individual sections to invest for tax savings and How much in each? (Plz provide individual limits of investment and Tax saving amount for all 3 section)

Hi,

Thank you for a detailed post on NPS.

Request a clarification, if I am already a participant in NPS & have availed 80CCD2, how do I practically invest in 80CCD1(B) to claim tax benefit of Rs.50K?

Thanks in advance.

Hi Sir,

THIS IS PERUMAL

I am working as a Teacher (Govt. of Andhrapradesh).

I have a doubt on 80CCD(1)(B)

Let us take my salary as example.

My gross salary is Rs . 600000 (SIX LAKH)

My NPS contribution is Rs. 54000 p.a.

(THIS IS DEDUCTED FROM MY SALARY)

i.e. ((BASIC + DA) *10%)

I HAVE 1,40,000 Rs. EXEMPTION under 80C

(THIS IS MY PERSONAL LIC SAVINGS)

Now my doubt is

1) Can I Claim

10,000 under 80C and

44,000 under 80CCD(1B)?

LIKE THIS……

1,40,000 =80C (LIC SAVINGS)

10,000 =80CCD(1)

———————-

1,50,000 =MAX. LIMIT

44,000 =80CCD (1)(B)

———————

1,94,000 =80C + =80CCD (1)(B)

———————

2) Can I Claim

4,000 under 80C and

50,000 under 80CCD(1B)?

LIKE THIS……

1,40,000 =80C (LIC SAVINGS)

4,000 =80CCD(1)

———————-

1,44,000

50,000 =80CCD (1)(B)

———————

1,94,000 =80C + =80CCD (1)(B)

———————

Both options are valid.

We have explained it in detail in our article NPS and Government Employees.

Quoting from it:

A Govt employee can claim a deduction of your employer’s contribution towards NPS under Section 80CCD (2), up to a limit of 10% of your salary (i.e. Basic Salary + Dearness Allowance). Employer’s contribution towards NPS or EPF (Employees’ provident fund) is not the part of your gross salary, but is added by your employer in your CTC (cost to company).

A central government/state government officers are entitled deduction under section 80CCD (1B) on their own i.e employee contribution towards his NPS account

You can claim a deduction of only your own contribution towards NPS under Section 80CC

I work in private sector. Does the additional 50,000 limit under 80CCD(1b) applicable if I am exhausting 80C limit on non-NPS products? For example, if I use up 80C 150k limit with ELSS and Home Loan Principal, can I invest another 50k for NPS?

I had a same issue and i searched a lot

i think you can cuse ELSS to claim 80 c

and you can use employee contibution for sec 80 ccd 1 b exemption

What is the upper side of 80 CCD(2)

Employer’s contribution up to 10% of basic plus DA is eligible for deduction under the section 80CCD(2).

Employer’s contribution is an additional deduction as it not part of Rs 1.5 lakh allowed under Section 80C.

there is NO MAXIMUM LIMIT for such a deduction. So higher your income, higher the deduction, higher the savings.

I am central school teacher. My form 16 has specified NPS OS for Rs. 60K as additional deduction apart from Rs. 1.5 lakh 80 C deduction made by me. Please help in understanding it we should go under which section of NPS -80CCD(1) or 80CCD(2) or 80CCD(1B). I have asked my office teams, but nobody has clarity what is this amount and under which category it should be specified. please help

Your own contribution of Rs. 60K in NPS shall be claimed under Section 80CCD1(b) as your Section 80C quota of Rs. 1.5 lakh is already full.

Contribution of 60K by your employer in NPS would go under Section 80CCD(2)

Alternative, you could claim deduction of Rs.50K under Section 80CCD1(b), Rs160K under Section 80C (inclusive of Rs.10K (balance NPS subscription of your under Section 80CCD(1))) which will ultimately get limited by Rs150K. In both the cases you will get maximum deduction of Rs.200K

Thanks

I am a central govt employee.For the FY 2016-17 (Asst year 2017-18)i had invested Rs 150000/- under PPF. Apart from this NPS(tier 1) amount of Rs 60000 was deducted from salary.

My employer has equally contributed an amount of Rs 60000/- under NPS.so please guide me for best filing of income tax of above amount as deduction under

Sec 80 CCD(1B), 80 C &

80 CCD (2)

We have updated the article with your case.

Check the section How to show NPS in ITR

Sir,

I am a PSU employee and my taxable income is Rs 664209/-.

My investment includes , Employee PF,Term Insurance,PPF,MF,HL PRINCIPAL(39000+9000+2000+30000=80000).Above that my investment in NPS is Rs 125683/-(my contribution Rs 62842 and Rs 62842 by employer).Now I want to avail the benefit of 80CCD 1B.So please guide me how much to be invested in 80c so that I can avail the 80CCD 1 B benefit.and also guide me that while filing ITR what should be the bifurcation of 80CCD1,80CCD2&80CCD(1B).

Plz Respond.

To avail benefit under Section 80CCD1(b), you would have invested additionally more than Rs.7158 under section 80C like in PPF, Tuition Fee, ELSS etc. With the present savings, the case fall in category of upto Rs.1, 50,000 saving under broad section 80C as your total savings (your own contribution) is Rs.1.42,842. Thus, any further saving (your additional own contribution) amount above Rs.7,158 upto Rs.57,158 can yield upto Rs.50,000 deduction under Section 80CCD1(b).

Your Employer’s Contribution of Rs.62,842 in NPS will be claimed under Section of 80CCD2

Claim Your own Contribution of Rs.62,842 in NPS into two parts i.e. (1) Rs.50,000 under Section of 80CCD1(b) and (2) your Balance own NPS Contributions of Rs. 12842 under Section 80CCD.

This will make Total of Rs. 92842 under broad Section 80C. Now, depending upon your saving capacity, you need to invest upto Rs. 57,158 to make use of full quota of Rs.1,50,000 under Section 80C (i.e. Rs.1,50,00 minus Rs.92842). Thus, if you additionally invest Rs. 57,158 then you can claim deduction of Rs.1,50,000 under Section 80C resulting in total benefit of deduction of Rs.2,00,000.

great article keep it up.

SIR I AM LOKENDRA A GOVT. EMPLOYEE….SIR MY ANNUAL CONTRIBUTION TO NPS is 124000(62000 govt. or employers contribution and 62000 is employee mandatory contribution)

my other saving include 1300000 approx in pf and lic and sip…

Sir i want to know can i show my 50,000 (that is my mendatory contribution toward nps not any extra investment toward nps) from that 62000 in 80ccd(1b) and include rest 12000 in 80C…

Or it need to contribute extra 50000 to claim 80ccd(1b)…

Can I claim deduction Under 80CCD(1B) for in contributing in NPS account in the name of my wife (she is house wife/ not in service) or my minor child.

only the NPS subscriber can claim tax benefits. If you invest in NPS which is in your spouse’s name or child’s name then you cannot claim tax deduction.

I work for Govt of Goa. I have been paid Rs. 64,650/- towards Seventh pay arrears during 2017-18 and instead of paying cash, Govt has transferred the said amount to my CPF (NPS) account. Is this amount eligible to claim for 80 CCD (1-B)? (additional maximum of Rs. 50000).

surely you can do under section 80ccd(1b) 0f rs 50,000 and rest in 80ccd(1)

Sir

I am a govt. Employee in haryana I have nps acount

Annual saving of nps is above 50000 and other saving Is also above 150000. So I want to know can I get the additional tax benifit of 50000

Yes you can.

As explained in our article, NPS and Government Employees

A government employee can invest in NPS and get the additional benefit of Rs. 50,000 under section 80CCD (1B). This benefit is open for all, including central /state government employees irrespective of their joining date.

If you are an existing Government subscriber, you can approach any POP-SP or your Nodal Office or alternatively you can visit eNPS website (https://enps.nsdl.com) for making an additional contribution in your Tier I account.

The print out of the Transaction Statement could be used as a document for claiming tax benefit.

Can we subtract employer’s contribution in NPS as well from our total income to reach at Total Taxable Income.

I am Central government employee. I am a NPS Subcriber and my contributions is around 58,000. I have shown my HBA Principle amount and LIC policies and NPS subscrition in 80c. Now can show the part of my NPS Subscription and LIC policies and HBA prinicple to Make Rs 1.5 Lakh and show the balance in 80ccd (1B)?

I am a government employee. I have made compulsory contribution of 10% of my basic i.e. Rs.28366 towards nps. I have also made voluntary contribution of Rs. 20000 towards nps tier-1. Can i sum these contribution 28366+20000=48366 to get tax benefit under section 80ccd(1b)

sir i am bank employee since 1999 having pension option.now my query is that can i open NPS for which i can get income tax deduction under 80 cc(d). please clarify

Yes irrespective of what pension option you have you can enroll for NPS to claim the Additional exemption up to Rs 50,000 in NPS is eligible for income tax deduction under Section 80CCD(1B)

Yes you can open NPS.

If i claim employers contribution in NPS to 80CCD(2), do i need to include employers contribution in my gross salary also or gross salary will be excluding employers contribution.

example-(hypothetical)

my gross salary- 8lac(gross salary from my salary slips)

Employee contribution- 60K

Employer contribution-60K

Then can i claim 80 CCD(2) ,if

my gross salary will be 8lac or 8.6 lac????????

You have to include employer’s contribution in gross income to claim 80CCD(2)

Dear Sir,

I am working with a PSU bank. I havn’t opened a NPS account till date, however NPS amount is being added by my employer forming part of total pay (Gross pay) and then my contribution as well as employer contribution is deducted under recovery part.

As far as my Form 16 is concerned, my employer is not considering my contribution qualifying under 80CCD 1 (because I havn’t opened NPS) although showing under Section 80CCD 1 head. My employer is not showing any amount under 80CCD 2 (NPS Employer amount) in form 16.

Now my question is that whether I can claim tax rebate under 80CCD1 and 80CCD2 while filing ITR.

dear sir i am defence personal are we also eligible for deduction under 80CCD(1B). i have an onging pension plan of LIC. is this also covered under this section. regards

respected sir,

My salary (basic + da ) for the f.y. 2016-17 is rs. 900000/-. I contributed rs. 90000/- as employee share towards NPS. My employer contributed rs. 90000/-. I CLAIMED DEDUCTION OF RS. 150000/- u/s 80 c , and rs. 50000/- U/S 80CCD(1B).

CAN I CLAIM DEDUCTION OF EMPLOYER SHARE OF RS. 90000/- Towards NPS U/S 80CCD(2) IN ADDITION TO DEDUCTION CLAIMED OF RS.200,000/- U/S 80C AND 80CCD(1B) . Wheather this amount of rs. 90000/- is to be included in my TOTAL INCOME ALSO ?

Sir I m working in a PSU I have already invested RS.130,000 in Lic ppf etc and compulsory nps is around 48000 my taxable income is 515000. Totally investment under 80c is 130000+48000=178000 . can I show the remaining 28000 of NPS in additional investment under 80ccd or I need to invest additional 15000 for claiming under 80ccd

my savings in PPF IS 150000 Rs and also 60800 in nps tier 1 account ( Basic DA10%)

kya mai 50000Rs savings ka benefit le sakta hu please tell

sir i invested 150000in ppf.my emplyer contribution in nps is 117000.can i take benifit of 80ccd 1b.

Employer’s contribution up to 10% of basic plus DA is eligible for deduction under the section 80CCD(2)

Employer’s contribution is an additional deduction as its not part of Rs 1.5 lakh allowed under Section 80C.

Employee contribution up to 10% of basic salary and dearness allowance (DA) up to 1.5 lakh is eligible for tax deduction under section 80C.

If your amount is less than 1.5 lakh then you can claim the remaining amount invested in PPF under section 80C.

The additional tax benefit of 50000 is over and above the benefit of 1.5 Lakhs which can be claimed as a deduction under Section 80CCE.

Therefore, the total tax benefits that can be claimed for NPS under Section 80CCD(1) + Section 80CCD(1B) equa a s to 2 Lakhs for financial year.

I under stood that subscription under Option Tyre – 2 can not claim tax deduction under sec 80CCD (1B) amount of Rs.50,000/-. Is it right ?

U can go for 2 lac rebate

iam hp state govt. employee covered under contributory pension scheme. i haveinvestment under section 80c of rs 148000 in ppf , lic tution fee etc. also mandatory contribution towards cps/nps is 49877rs and equally same amount is being credited by employer/ himachal govt.into my cps/nps account in the FY 2016-17.what will be the deductions or tax liability.

You can claim your employer’s contribution(49877) towards NPS under Section 80CCD (2), up to a limit of 10% of your salary (i.e. Basic Salary + Dearness Allowance)

You can claim 148000(PPF LIC Tuition fee) under 80C + 2000 from your own contribution in NPS.

You can claim 47877 (49877 – 2000 which you used in 80C) for 80CCD(1B)

You can invest 2123 in Tier 1 account independently to claim full 50,000 deduction under 80CCD(1B)

or you can invest 2000 for 80C and 123 in NPS to claim under 80CCD(1B)

Our article NPS and Government Employees discusses it in detail

I am state govt. employees in H.P. education department sir our govt . contribution 10% is also included in our total income as other income sources U/S 80CCD(2) OR PLEASE TELL ME WHAT TYPES OF INCOME IS INCLUDED IN OUR TOTAL INCOME AS OTHER INCOME

I work for a private IT firm my yearly salary is 13L

I have hosing loan

interest 250000 , and principal amount 150000

Insurance premium 40000

Children schoolfees : 20000

House rent : 120000

Medical insurance : 5000

PF : 10000

my question is what else I can invest to reduce tax ?

If employer does not provide the facilities of NPS contribution from employer us 80ccd(2) as it is not mandatory/statutory compulsion, what should do employee for getting this benefits?

Investment in NPS up to Rs. 50000/ is eligible for additional EXEMPTION or DEDUCTION? I think it is additional deduction and not exemption as mentioned in original article.

sir,I am state govt employee,my 80cc deduction is 100000 &employee NPS deduction 75000 ..sir I want 150000(100000 under80c+50000 under 80ccd(1)&remaing 25000 under 80ccd(1b) kya this is right? or I do not want any other investment under 80c ..plz sir answer as soon as possible

sir how many 80ccd max deducation

Sir, i am a central govt employee under nps. My yearly contribution is around 100000rs under NPS, in PLI 60000rs, in PPF 35000rs lic 20000rs ie total 215000rs. Please tell me can I make deduction 150000 in 80C, 50000 IN 80CCD(1B), out of this total saving of 215000 rs. Thanks

Can I open eNPS in the name of my wife who is a homemaker. Whether the contribution made on her name would help me for tax rebate.

Is the additional 50000 in NPS for tax advantage is still valid for Financial year 2016-17. Is there any circular from Govt regarding clarification on 80CCD1, 80CCD2 and 80CCD1b. There is still confusion among people regarding employee contribution (they say that employee contribution will be considered only in 80CCD1 and not in 80CCD1b even if you have investment of 1.5lakh in 80CCD1).

Yes additional tax deduction of 50,000 Section 80CCD(1B is available for FY 2016-17.

There is no clarification from Govt regarding 80CCD1, 80CCD2 and 80CCD1b.

Yes not only people but experts also differ. You can read article Experts differ on how to claim additional NPS tax benefit under Sec 80CCD (1b)

But many are using what is described in following ex:

Amit is a government employee and his employer deducts Rs 62,000 per annum (which is 10% of basic + DA) from salary as employee’s contribution in NPS. It also deposits Rs 62,000 per annum as employer’s contribution in NPS. How and under which section should he claim tax benefit on NPS?

Let’s take the easy part first. Employer’s contribution in NPS would be eligible for tax deduction u/s 80CCD(1).

The employee has a choice as to which section [80CCD(1) or 80CCD(1B)] he wants to show his contribution. Ideally he should show Rs 50,000 investment in NPS u/s 80CCD(1B). The tax deduction on rest Rs 12,000 can be claimed u/s 80CCD(1). The section 80CCD(1) along with Section 80C has investment limit eligible for tax deduction as Rs 1.5 lakhs. So he should make additional investment of Rs 1,38,000 in Section 80C to save maximum tax. In all he can save Rs 2 lakhs tax u/s 80C and 80CCD(1B).

Hope it helps

sir i have got an RTI rely copy which can add clarification to this.It can be attached but no attachment options here.I have even clarified it..

Please drop an email to bemoneyaware@gmail.com

Thanks a lot.

I work in psu bank. My gross earnings are Rs.862000/-. My NPS Investment is Rs.71974/- and my 80c investments are Rs.80250/-. My employer already invested the same amount of Rs.71974/- as his contribution.

My doubt is that, whether to claim employer contribution u/s 80CCD(2) do we need to add the employer contribution to the Gross salary or not..??

Please clarify the same

Employer’s contribution towards NPS or EPF (Employees’ provident fund) will not be part of your gross salary, but generally, will be added by your employer towards your CTC (cost to company).

Your gross salary is as per your Form 16.

Thanks for reply.

If suppose my employer didn’t show his contribution in my Gross salary..!! Then Still can I claim the employer’s contribution in 80CCD(2)..?!?!

Please clarify the same.

i am 59 years old. i would like to invest in nps. i wish to save rs.50000 each for next two years. what is the benifit under nps? when i can withdraw from nps? at the time of withdraw should i take entire amount withdrawn for computation of tax? kindly clarify.

Please explain NPS Tax Benefits and sections 80CCD(1), 80CCD(2) and 80CCD(1B)

This article tried to explain that.

What clarification do you need?

can both benifit be applicable 80ccd(2) and 80ccd(ib) means 150000+ 58000 (employer contribution) + 50000 (80cc ib) max 250000 please explain

Yes You can claim all the three tax deductions

dear sir

I am a government empoyee joined govt service after 2004.Rs 6700

pm deducted from my salary every month for pension fund and same

amount is contributed by govt for my pension fund.I am investing rs

150000 in my PPF account seperately.can I take benefit of Rs 50000

under sec 80ccd1b

Yes you can claim benefit under 80CCD(1b)

I have already reached my maximum limit of Rs 1.5 Lacs savings as per section 80c and have also done Rs 50,000 self contribution under NPS Sec 80CCD (1B).

Can I still ask my employer to deduct 10% from my basic plus DA and deposit in my NPS account to benefit from Sec 80CCD(2) as well despite of me exhausting the above 2 limits and save tax 30% tax slab on 10% from basic + DA component?

In summary, I am trying to understand if there is a way to save more tax by making additional investment through employers contribution over and above the 2 Lacs which I have already saved.

Or is the NPS benefit capped to Rs 50000 irrespective of contribution coming from employer (under section 80 CCD(2)) or employee( under section 80CCD(1B)).

Please clarify the above. Thanks in advance

My gross salary of the year includes 51500 govt contribution as well 51500 my contribution towards NPS. How & under which I.T. sections I can claim these deductions? Please guide.

I am under statutory pension scheme and if I volunterely started NPS whether I could get 50000 deduction under 80ccd(b1).I have already 80 c contribution of more than 1.5 lakhs

Hi, i want to know that, is this additional 50,000/- tax exemption over and above 1,50,000/- limit can be availed by saving in nps tier-1 account. As when asked, i was informed that additional 50,000/- saving benefit will be applicable for tier-II contribution only.

Regards.

I HAVE AN EMPLOYEE OF GOVERNMENT ORGANISATION. RS. 50000/- DEDUCTED FROM MY SALARY AS PART OF NPS CONTRIBUTION. RS. 50000 ALSO CONTRIBUTED BY MY EMPLOYER.

2. I HAVE INVESTED RS. 50000/- IN PPF. NOW I WANT TO AVAIL THE TAX BENEFIT OF RS. 50000/- WHICH IS UNDER 80.CCD(1B).

3. CAN I INVEST THE RS. 50000/- IN PPF OR ELSE I HAVE TO INVEST IN NPS ? CAN MY MANDATORY PART OF NPS AUTOMATICALLY ADJUSTED TO 80.CCD(1B)

iam nageswara rao dama from ongole.

i am state government employee.

2016-2017 my deductions under 80c

apgli 30000

gis 720

lic 25000

children tution fee 10000

total 65720.

my nps(cps) contribution 2016-2017:60000, government contribution 60000.

in this part which amount 80C, which amount 80CCD(1B)

I am a state government employee.gross salary:₹700000,basic+da:₹636000,cpsded:₹59000, govt matching Grant into my cps acc:₹59000,

80c:₹100000.can i get tax exemption on govt matching grant? how much?should I show it in my gross salary? Please clarify.

I am Central Gov Employee. My taxable income is 687540 I invest 150000 inPPF & LIC under80c also 39000 in NPS what will be Incom TAX for year 2016 _17 I have to paid Please guide me.

please confirm whether a central govt. employee who is in old pension system can contribute to the sec. 80ccb(1b) of rs. 50000/- and get tax benefit

A central government employee can contribute to NPS for additional 50000 under 80CCC(1B)

My basic+DA= 1500000, Employees contribution 80CCD(1) = 150000 (10% of Basic+DA), Employers contribution 80CCD(2) = 150000 (10% of Basic+DA), I voluntarily invested 80CCD(1B)= 50000, What is my total Chapter VI-A dedution? is it 150000+150000+50000= 450000 ?

150000 80C

50000 80CCD(1B) EMPLOYEE CONTRIBUTION

50000 80CCD(2)EMPLOYER CONTRIBUTION

I am a state govt employee with Old pension scheme. I want to take benefit by investing in NPS under section 80 ccd1(b) only. Can I open a account for this purpose and invest?

Yes you can open account in NPS and claim tax benefit under section 80CCD1(b)

Section 80CCD(1B) ,

Additional exemption up to Rs 50,000 in NPS is eligible for income tax deduction.

Introduced in Budget 2015, fro FY 2015-16

Taxpayers in the highest tax bracket of 30 per cent can save Rs. 15,000 by investing Rs. 50,000 in the NPS. Those in the 20 per cent tax bracket can save aroundRs. 10,000, while people in the 10 per cent tax bracket can save Rs. 5,000 per year by investing in the NPS.

The additional tax benefit of 50000 is over and above the benefit of 1.5 Lakhs which can be claimed as a deduction under Section 80CCE.

It is irrespective of the type of employment. So, a government employee, a private sector employee, self employed or an ordinary citizen can claim benefit of Rs 50,000 under Section 80CCD(1B).

my uncle is central govt employee who is eligible for old pension scheme…is he eligible for nps deduction if he invest in nps scheme??

i am a private employee..my gross income is around 8 lakhs.i have 2 questions

1.can i withdraw my NPS before 10 yrs? if yes how much?partial or completely?

2.if i withdraw my money before or after 10 yrs , will tax applicable only on returns earned or total fund value?

I am 64 yrs my wife is 54 yrs she has no income can I invest in nps for tax benefit?

You cannot invest in NPS as you are more than 60 years. But you can invest in name of your wife

The minimum age is 18 years. One can stay invested up to the age of 70 years. Anybody who joins NPS cannot withdraw his savings before the age of 60. This means those joining the scheme at the age of 60 will have the choice to stay invested for another 10 years.

what if the person who invested in NPS dies.?

Your employer contribution will not be added in your salary. Also it will be shown in seprate head in itr which is already exempted from income tax. It cant be shown in 80ccd 1b. For this you have to invest additinal 50 thousand

I want to contribute to NPS from my savings account in the name of my son. Can I claim deduction under sec 80ccd(1B)?

Is your son an adult or a minor?

I work in Central Government and my contribution u/s 80C is Rs 150000/-. Further I want to claim deduction u/s CCD (1B) by investing Rs 50000/- more in NPS. How to go about it? By online or by deduction through my office and under which TIER (I or II) it should be deposited. Pl guide me.

You may invest online directly in your nps account or may invest throudh your office as well. This amount will be only invested in tier I and not tier Ii. All rules will of tier I will be applicable. This is just a tax deffring plan you will have to pay tax at existing rate at time of maturity ie retirement

For claiming exemption under Section 80 CCD(2), do I need to add that amount in my gross salary or I can claim without adding?

Hi, If i claim employers contribution in NPS to 80CCD(2), do i need to include employers contribution in my gross salary also or gross salary will be excluding employers contribution.

example-(hypothetical)

my gross salary- 8lac(gross salary from my salary slips)

my NPS contribution- 60K

Government NPS contribution-60K

Than i claim 80 CCD(2)

my gross salary will be 8lac or 8.6 lac????????

Gross Salary = 800000

80CCD(2) = 60000

————————–

=740000

————————–

80CCD(1) = 10000

80CCD(1b)= 50000

———————-

net taxable income = 680000

Your gross will remain 8 lakhs but you will show rs 60000 against the head 80ccd(1b). Tax will be calculated on the remainiing income. Rs 50000 can be the rebate amount on this head. This will be in excess of your saving upto 1.5 laks

I am a self employed person with gross income of rs.8lakh.

Currently I am investing rs.1.5lakhs

Per year in ELSS(for 80C) and rs.50000 in NPS.

Can I additionally invest 10% of my income in NPS. Will I get tax benefit on this additional investment of 10% in NPS

No sir. Only 50000 is permissible above rs 1.5 laks saving.you canot go beyond that

I am a Central Govt. employee my Investment for FY 2015-16 are as follows:

LIC : 19222

Home Loan Principal : 47578

Bank PPF : 54000

Sukanya Samridhi : 23000

TOTAL of above : 143800

Over and above my NPS contribution ( Employee’s contribution) : 82000

How I can do the 80 C, 80ccd etc.for tax calculations.

Can I take 50000 benefit for NPS and remaining of 1.5 lacs for 80C

Experts are divided over how taxpayers can claim the additional tax deduction for NPS contributions. Quoting from article Experts differ on how to claim additional NPS tax benefit under Sec 80CCD (1b)

An employee’s mandatory contribution to NPS is eligible for deduction under Section 80CCD (1b)

This means taxpayers covered by NPS will not have to make additional investments to claim the new deduction. Other tax-saving investments and expenses, such as home loan principal, children’s tuition fees, life insurance premium, NSCs and ELSS funds, can be claimed under Section 80C while the mandatory contribution to NPS can be claimed u ..

Another interpretation says that the mandatory contribution can be claimed under the new section only if it exceeds the Rs 1.5 lakh limit under Section 80CCD(1). High income earners covered by NPS stand to benefit from this interpretation. If the taxpayer contributes more than Rs 1.5 lakh to the NPS in a year, the amount in excess of Rs 1.5 lakh can be treated as voluntary investment and claimed as a deduction under the new Section 80CCD(1b).

However, others believe that the mandatory contribution to retirement savings made by an individual will not make him eligible for the new deduction. For that, the taxpayer must make an additional ‘voluntary’ or ‘self’ contribution to the NPS.

Your all saving amount like lic etc will be calculated in 1.5 lakhs. Also your contribution to nps of rs 82000 will be clubbed in 1.5 laks. Your home loan priciple will be reduced from your income. Intrest paid on home loan will be addtionaly calculated seprately under diffrent head and will be reduced from your texable income. Also addtional 50000 can be invested which will get tax benefit upto two laks of saving.

I am a Central Govt. employee my Investment for FY 2015-16 are as follows:

LIC : 19222

Home Loan Principal : 47578

Bank PPF : 54000

Sukanya Samridhi : 23000

TOTAL of above : 143800

Over and above my NPS contribution ( Employee’s contribution) : 82000

How I can do the 80 C, 80ccd etc.for tax calculations.

Can I take 50000 benefit for NPS and remaining of 1.5 lacs for 80C

Experts are divided over how taxpayers can claim the additional tax deduction for NPS contributions. Quoting from article Experts differ on how to claim additional NPS tax benefit under Sec 80CCD (1b)

An employee’s mandatory contribution to NPS is eligible for deduction under Section 80CCD (1b)

This means taxpayers covered by NPS will not have to make additional investments to claim the new deduction. Other tax-saving investments and expenses, such as home loan principal, children’s tuition fees, life insurance premium, NSCs and ELSS funds, can be claimed under Section 80C while the mandatory contribution to NPS can be claimed u ..

Another interpretation says that the mandatory contribution can be claimed under the new section only if it exceeds the Rs 1.5 lakh limit under Section 80CCD(1). High income earners covered by NPS stand to benefit from this interpretation. If the taxpayer contributes more than Rs 1.5 lakh to the NPS in a year, the amount in excess of Rs 1.5 lakh can be treated as voluntary investment and claimed as a deduction under the new Section 80CCD(1b).

However, others believe that the mandatory contribution to retirement savings made by an individual will not make him eligible for the new deduction. For that, the taxpayer must make an additional ‘voluntary’ or ‘self’ contribution to the NPS.

I work for a PSU Bank.For the FY 2015-16 i had invested Rs 128254/- under LIC and PPF. Apart from this NPS(tier 1) amount of Rs 46613 was deducted from salary.So can i show Rs 21746/- under Sec 80 CCD(1) and remaining Rs 24867/- under sec 80 CCD(2)?

My employer has equally contributed an amount of Rs 46613/- under NPS.So can i show this amount as deduction under Sec 80 CCD(1B)?

I work for a PSU Bank.For the FY 2015-16 i had invested Rs 128254/- under LIC and PPF. Apart from this NPS(tier 1) amount of Rs 46613 was deducted from salary.So can i show Rs 21746/- under Sec 80 CCD(1) and remaining Rs 24867/- under sec 80 CCD(2)?

My employer has equally contributed an amount of Rs 46613/- under NPS.So can i show this amount as deduction under Sec 80 CCD(1B)?

No you will have to invest in 80ccd 1b seprately for this saving of addtional 50000 thousand rs. Your employers contribution is not taxable already

I work for a PSU bank and 10% of my salary(Basic +DA) goes into the NPS.

My employer, also contributes a matching amount into NPS. But this contribution is

not added in the salary slip. By NPS statement this matching contribution can be confirmed.

I want to know whether for claiming deduction under 80ccd (2), first I have to add this contribution to my salary and then take deduction or directly without adding I can claim this deduction.

I work for a PSU bank and 10% of my salary(Basic +DA) goes into the NPS.

My employer, also contributes a matching amount into NPS. But this contribution is

not added in the salary slip. By NPS statement this matching contribution can be confirmed.

I want to know whether for claiming deduction under 80ccd (2), first I have to add this contribution to my salary and then take deduction or directly without adding I can claim this deduction.

For claiming deduction under 80 CCD 2 first we have to add the employers contribution in the Gross amt. Salary software in most of the Govt departments add the employers contribution in the Gross salary