Many NRIs have given their house in India on rent. In this article , we will look at the various aspects involved with rental income when an NRI rents out a property in India. What should Person taking house on Rent from NRI do? Tax on Rental Income in India for NRI, Filing of Income Tax Return by NRI to show rental income.

Table of Contents

Overview of NRI giving his house on rent

Property is a favourite Indian asset class and one of the main reasons for this is its ability to generate regular cashflows through rent.

- An NRI can acquire an immovable property in India, other than agricultural land, plantation property or farm house under the general permission of the Reserve Bank of India.

- The property can be acquired from funds lying in the non-resident ordinary (NRO) and/or non-resident external (NRE) accounts. Alternatively, he can directly repatriate the funds through normal banking channels by way of inward remittance. He can’t, however, make the payment by way of travellers’ cheques and/or foreign currency notes or any other mode.

- If the house is acquired for Rs 50 lakh or more, you will need to withhold tax at source at 1% from the payment made to the seller and deposit it to the credit of the government on behalf of the seller. This provision was introduced with effect from 1 June 2013 and is applicable for both residents and NRI.

- NIR can let out the property

- Credit the rent received to his NRO/NRE account.

- The rent income is liable to income-tax as “income from house property”. He is entitled to a deduction of taxes levied by the local authority paid during the year and a further deduction of 30% thereafter.

- The tenant has to deduct TDS at the rate of 30.9%.

- The balance amount of rent is liable to tax as per the applicable slab rates after considering the threshold exemption.

- If more TDS has been deducted than due tax , NRI may file your return claiming the deduction of 30% and the benefit of threshold exemption and lower slab rates.

- Repatriation of rent income to NRI’s living country

- Can be done after payment of due tax by obtaining certificate of a chartered accountant in form 15CB, stating that the amount proposed to be remitted is eligible for remittance and that applicable taxes have been paid. From 1 Apr 2016 Changes have been made for Form 15CA and Form 15CB. Form 15CB and Form 15CA are now required only for any taxable payment exceeding Rs. 500,000 for which Assessment order or certificate is not obtained.

- The overall limit for remittance of funds from India is $1 million per financial year.

NRI and Rental Income

Residential status is determined on the basis of physical presence of an individual in India during the relevant FY and the last fewFYs. As per Income tax act an Indian resident for a financial year(From 1 Apr to 31 Mar of next year) is one

- who is in India for at least 182 days during the financial year

OR - who is India for 60 days for the year in the previous year AND have lived for one whole year (365 days) in the last four years.

You are an NRI if you do not meet any of these conditions. NRI or Non resident Indian. Further, in case of an Indian citizen, who is leaving India for the purposes of employment outside India; or who is based outside India during the entire financial year, and who comes to India only for visit purposes, the second ‘basic condition’ is not applicable. A resident may either qualify as a resident and ordinarily resident (ROR) or resident but not ordinarily resident (RNOR). Our article Non Resident Indian – NRI discusses it in detail.

Person taking house on Rent from NRI

When one takes a house on Rent From NRI one has to take care of following conditions

- No RBI permission is required by the NRI at the time of giving any residential or commercial property on Rent.

- The rent proceeds will have to be credited to the NRO Account of the NRI. It cannot be credited to the NRE account, unless the person crediting the account is also an NRI and is getting it debited from his NRE account. Our article Bank Accounts for NRI:NRO,NRE,FCNR discusses NRO account for NRI in detail.

- The amount of tax on such rental income must be deducted at source by the payer of the rent @ 30% and must be deposited in the account of government by tenant only.

- Education Cess and SHEC would also be levied and the effective rate of TDS in such cases would be 30.9%. While calculating TDS rates one needs to consider the provisions under Double Taxation Avoidance Agreement (DTAA) for the relevant country if any.

- For deducting TDS on rental income, tenant must have TAN number. One can apply for TAN online by filing Form 49B by going to https://tin.tin.nsdl.com/tan/. TAN Number is a 10 Digit Alphanumeric Number and is used as an abbreviation for Tax Deduction and Collection Account Number. Every Assessee liable to deduct TDS is required to apply for a TAN No. and shall quote this number in all TDS Returns, TDS Payments and any other communication regarding TDS with the Income Tax Department.

- Besides TAN,Tenant should have his own PAN and PAN of NRI Seller to deduct TDS under section 195.

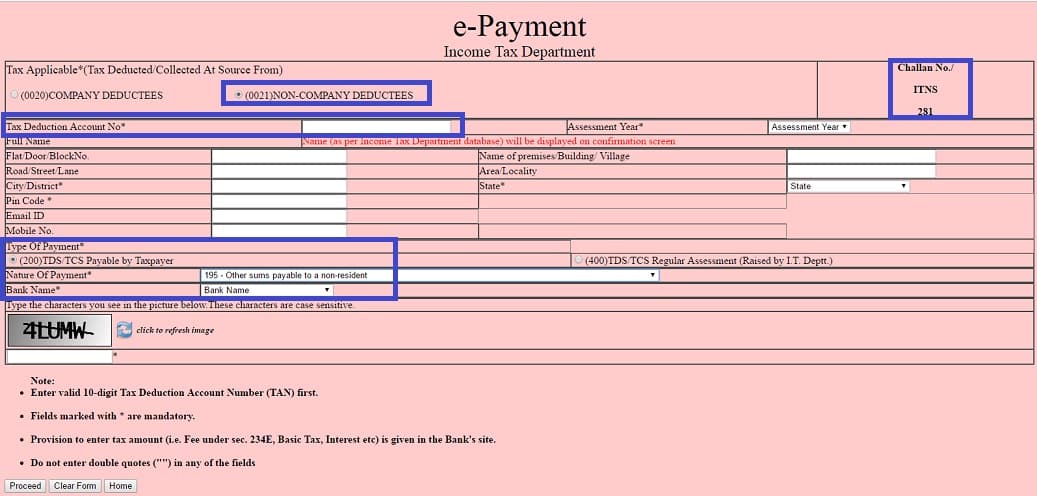

- TDS has to be deducted by filling Challan 281 as shown in image below.

- Tax applicable :0021 Non company Deductees

- Type of Payment : 200 TDS/TCS payable by taxPayer

- Nature of Payment: 195 : Other sums payable to non resident.

- Please be careful of Assessment Year. For Rent paid between 1 Apr 2016 to 31 Mar 2017, Assessment Year should be 2017-18

- After deducting TDS, tenant must provide TDS certificate to the NRI for Income Tax purpose. NRI can check TDS details from his Form 26AS..

Tax on Rental Income in India for NRI

Any income earned in the form of rent from property in India constitutes rental income and is taxable irrespective of residential status. The nature of taxability on the rental income will depend on how you rent the property out. Our article Tax and Income from Let out House Property discusses it in detail.

- Rental from both commercial and residential property is chargeable to tax under the head Income from House Property

- Rental income is considered as business income if it is used for purposes like home stay or service apartments. Though, a person could claim deductions under both the situations, the type and the quantum of expenses/payments will differ.

- Owner’s PAN details are to be furnished if the annual rental value exceeds Rs 1 lakh.

- Even vacant house property will be considered for tax as a deemed let out property. For example, if you have two houses and only one is self-occupied and the other kept vacant, even then one has to pay tax as the property will be considered ‘deemed to be let out’.

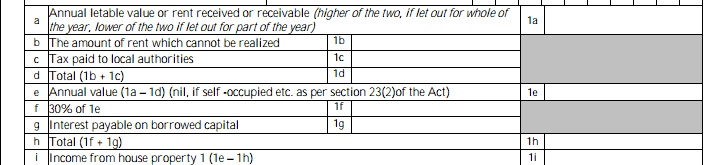

While showing rental income in Income Tax Return, it has to be shown in Income From House Property. While calculating the taxable value of rental income, various deductions are available. It includes:

- Standard deduction at 30% of the taxable value;

- Municipal taxes paid to the local authority;

- Interest paid on a loan taken for construction, repairs, acquisition, or renewal of the property;

- Pre-construction period interest deduction (available as deduction in five instalments from year subsequent to construction completion year).

- Additionally, any repayment of principal amount against housing loan taken for such property is also eligible for deduction under section 80C (maximum deduction under this section is Rs.1.5 lakh).

Show Rental Income in ITR

Rental Income and Country of Residence

As an NRI, you are a resident of another country and hence you will come under that country jurisdiction when it comes to tax matters. In most cases, countries levy tax on residents on their global income. Even if you are paying taxes on your Indian Rental Income (Or any other income for that matter) the same could be taxed in your country as well. In such cases, refer to the Double Taxation Avoidance Agreements that India has entered into with various countries.

For Ex: India and USA has DTAA Agreement. According to it , Rent from immovable property will be taxed in the country in which the property is situated. So NRIs who are residents of US would have to pay tax on rental income in India. They would still have to declare that income while filing their tax returns in the US, they would get a credit for taxes paid in India.

So, it is best if you check the tax laws of the country where you are a resident or consult a tax expert in that country to avoid tax evasion issues there.

Filing of Income Tax Return by NRI

For an NRI Indian income in the form of interest on deposits, rental income on property in India etc. are taxed in India (as per domestic tax laws) and the exemptions available such as such as Section 80C with respect to certain investments, payment of principal on housing loan etc., can be availed by them . For the purpose of calculating tax on rent received by NRI in India, the NRI needs to add his rental income to any other income earned by him from India such as income from interest, deposits etc. chargeable under other heads of income. Thus, this total amount shall be his income taxable in India. All TDS deductions are linked to the PAN and the Resident/NRI can check these details from his Form 26AS

Further, a non-resident individual, whose income during the tax year comprises only of investment income or income by way of long-term capital gains or both, does not necessarily need to file an income tax return in India. Also, a return is not required if the necessary tax has already been deducted at source from such income. But it’s recommended you file ITR to keep your finances in order. If his total income is less than minimum exemption limit chargeable to tax (Rs. 2.5 lakhs), he isn’t liable to pay any taxes on such income. The normal slab rates apply on incomes above that.

- If TDS is deducted and total Income of the NRI is less than the minimum exemption limit,refund is due :: If TDS has been deducted on rental income, a refund may be due to the NRI. The only way to claim a refund is to file an Income Tax Return. Since TDS is deducted at 30% and this rate of tax is applicable in the highest tax slab of income more than Rs 10lakhs, a refund situation may arise if the total income of the NRI is in a lower tax slab.

- When the total income of the NRI is more than the minimum exemption limit – In such a case whether or not TDS has been deducted the NRI must file a return and pay the tax which is due. In case TDS deducted is adjusted against his final tax liability.

Please remember

- As rental income is earned in India, tax liability arises in India and hence NRI has to pay income tax in India (.

- In case the tenant has not deducted TDS on the rent to be paid by him to an NRI, he is liable to pay fines for not complying with the provisions.

- If the rental income of the NRI is also taxable in the country where he resides, Double Taxation Avoidance Agreements(DTAA) come into picture. They clearly define the place and provisions of taxation in such cases of double taxation of income. For example, there is DTAA agreement between India and USA which states that rent from any immovable property shall be taxed in the country in which such property is situated. So, the NRIs who live in US but have property in India shall be taxed in India and not in US.

80C Deductions not allowed to NRIs

Remember Some Investments under Section 80C are not allowed for NRI:

- Investment in PPF are not allowed. (NRIs are not allowed to open new PPF accounts, however PPF accounts which are opened while they are a Resident are allowed to be maintained. After completion of 15 years NRIs can extend their PPF without contribution)

- Investments in NSCs

- Post Office 5 Year Deposit Scheme

- Senior Citizen Savings Scheme.

Related Articles

- Non Resident Indian – NRI

- Bank Accounts for NRI:NRO,NRE,FCNR

- Tax and Income from Let out House Property

- On Becoming NRI: What to do when you leave India to settle abroad

- NRI and ITR :TDS,Tax and Income Tax Return

- How to report Income From India while filing US Returns

- Double Taxation and Double Taxation Avoidance Agreement

The question is whether Actual Rent received or Rental amount received that is Taxable after deductions. In Tax Matters when we talk of income, it should be the income that is taxable after legitimate deductions as per law. Someone who is a professional should authenticate this view.

Hi – Thanks for this article, has been very informative for me, I am looking for an example, could you help me on the following case::

For rental property in India, this article mentions that I need to pay tax on rental income(3.6L) in India(So as per the tax slabs, I need to pay tax for any income above 2.5L. Rental income has a direct deduction of 30% and also deductions in form of loan interest(3L) payments). Considering these, if the taxable income is below 2.5L and would not be eligible for Indian tax.

Question is as per the DTAA with UK(exactly similar to US in this case), would I need to add 3.6L INR to my UK income and pay tax on the entire amount at 40%(UK tax slab) and claim credit as per DTAA(which is zero credit)?