Can an NRI open a PPF account? What if he opened a PPF account before he became NRI? What about Govt notification of NRI have to close their PPF account before maturity? The Public Provident Fund scheme is a tax saving cum investment instrument that offers decent interest rates and compounding benefits. This article covers NRI and PPF account

Table of Contents

NRI and PPF Account

From 23 Feb 2018, rules of PPF account for NRI are given below. These have been in force since 2003 except for a brief period between 3 Oct 2017 to 23 Feb 2018.

- An NRI cannot open a PPF Account.

- However, if a person has opened a PPF account while being the citizen of India, he can continue to invest in PPF till the end of the original term- 15 years from the start of the PPF account.

- He can contribute from Rs 500 to 1.5 lakhs to his account through NRE/NRO account.

- NRIs would receive the same PPF interest as the resident Indians and all PPF rules of partial withdrawal etc will apply.

- NRI’s cannot extend the PPF account after completing 15 years. While Resident Indians can extend their PPF accounts with/without contribution in the block of 5 years.

A person is considered a resident in India if he is in India for 182 days during the financial year OR If he is in India for at least 365 days during the 4 years preceding that year AND at least 60 days in that year. When a person doesn’t satisfy both these conditions, he is termed as NRI.

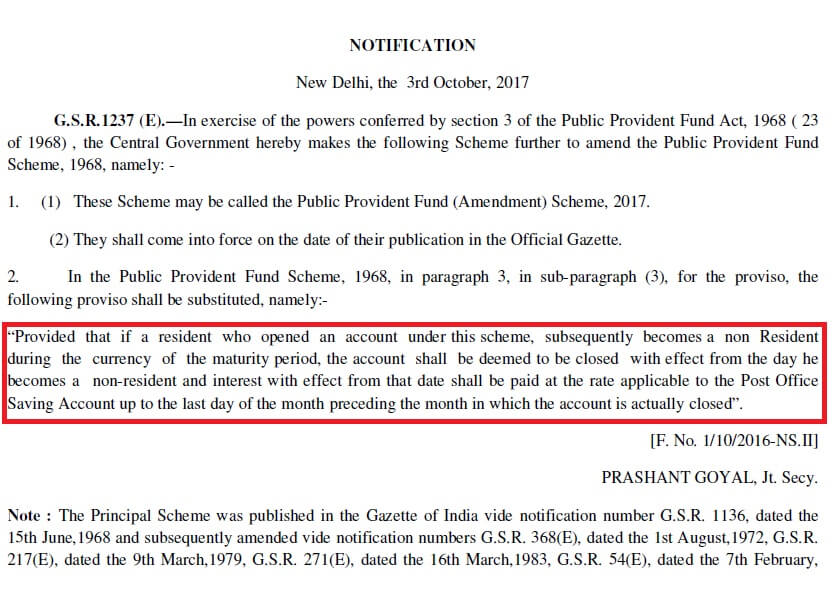

On 2 Oct 2017, the Department of Economic Affairs (DEA) had said that from 3 Oct 2017 if a resident, opened a PPF account and became a non-resident during the 15 years of PPF account, the account shall be deemed to be closed with effect from the day he becomes a non-resident.

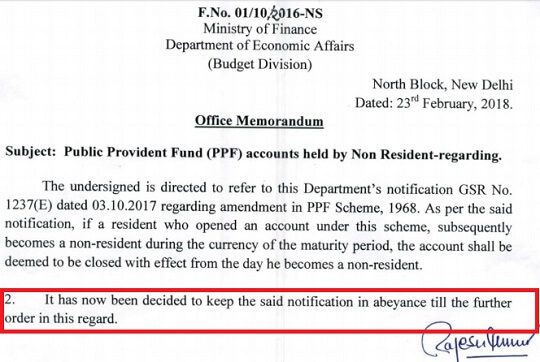

On February 23, 2018, the DEA released an office memo, which kept its earlier notification regarding the NRI’s PPF account released on October 2, 2017, in abeyance (or temporarily dismissed). The notification is shown in the image below.

There is no clarity on what happens for the PPF accounts of NRIs who closed their account between October’17 and February’18

Notification that NRI’s cannot continue PPF account

From 3 Oct 2017, these investments will be deemed to be closed on the day the investor becomes a non-resident. Subsequently, the investor will be paid interest at the much lower post office savings account rate at 4% p.a, the government said in a notification which is given below.

NRI cannot open a Public Provident Fund account. If an NRI opens a PPF account despite being an NRI (through inefficiencies in the system) it should be kept in mind that strict legal action can be taken against such an individual.

In 2003 PPF amendment said an NRI could not open the PPF account but they could contribute to their existing PPF accounts. This was for the PPF account they opened prior to becoming NRIs.

Questions that were raised were:

- What interest will you get for the period before 3 Oct 2017? Will you get the full interest for the period prior to October 3, 2017?

- What is counted as the day when one becomes NRI? The day one leaves India?

- How to close the PPF account? Will it be allowed online?

- Will the Withdrawn amount be taxable? What would be the tax liability?

- How to show the PPF withdrawn amount in ITR?

- Would Interest at the saving account rate be taxable? (yes we think so)

- Will any TDS be deducted? If yes at what rate?

How can NRI close his PPF account?

Procedure to close PPF account is the same for NRI as for the resident Indian.

To withdraw PPF corpus after the maturity, one has to visit the branch of the PPF account. One has to submit a PPF withdrawal form along with the passbook. Money from PPF account will be credited to your NRO/NRE account.

Difference between NRE and NRO account?

NRE Account: In an NRE account, your funds in foreign currency are converted into Indian rupees, at the rate prevailing at the time of transferring the funds from the account. The principal as well as the interest is freely repatriable or can be transferred to the foreign country. Funds in the NRE account can be freely repatriated.

NRO Account: If you want an account to transfer Indian earnings, an NRO account is suitable for you. Foreign funds can also be deposited into this account. The interest income earned on in this account is subject to tax in India. The interest is subject to income tax deduction at source @ 30% plus applicable surcharge plus education cess. Funds in the NRO account cannot be repatriated abroad.

Who is NRI?

A person is considered a resident in India if

- When he is in India for 182 days during the financial year

- OR

- If he is in India for at least 365 days during the 4 years preceding that year AND at least 60 days in that year.

When a person doesn’t satisfy both these conditions, he is termed as NRI.

Manav left India on 3rd July 2018 and came back to India on 15th March 2019. Therefore in the financial year, FY 2018-19(AY 2019-20), Manav has spent less than 182 days in India. So Manav is an NRI for the purpose of income tax in India.

NRI and taxes

An NRI’s income taxes in India will depend upon his residential status for the year.

- If the status is resident, NRI global income is taxable in India.

- If the status is NRI, the income which is earned or accrued in India is taxable in India.

- Salary received in India or salary for service provided in India, income from a house property situated in India, capital gains on transfer of asset situated in India, income from fixed deposits or interest on savings bank account are all examples of income earned or accrued in India.

- A tenant who pays rent to an NRI owner must remember to deduct TDS at 30%. The income can be received to an account in India or the NRI’s account in the country he is currently residing.

- Income which is earned outside India is not taxable in India.

- Interest earned on an NRE account and FCNR account is tax-free.

- Interest on NRO account is taxable for an NRI.

Where can NRI invest in India?

If the NRI plans to come back to India in the future he/she can opt for non-repatriable products whereas if that’s not the case only repatriable investment options should be considered. Then the investor should analyse the risk tolerance and opt for products that suit his/her needs.

Fixed Deposits: An NRI can open a term deposit through 3 different types of accounts in India i.e. NRE, NRO and FCNR accounts. Banks usually provide attractive and high-interest rates on NRI Fixed Deposits.

Mutual Funds: NRIs can invest in Indian mutual funds, but have to get their KYC updated.

The payment can be made from any of NRE/NRO/FCNR accounts.

The compliance requirement is the US and Canada are more stringent as compared to other nations. According to FATCA guidelines, all financial institutions must share the details of financial transactions involving a US person with the US Government.

The tax liabilities for NRIs are the same as that of a Resident, the only difference being that in case of NRIs, tax is deducted at source(TDS).

Stock Market: NRIs are also eligible to invest directly in the stock market under the Portfolio Investment scheme(PIS) of RBI

Real Estate: an NRI, can purchase both residential and commercial properties. There is no restriction on the no. of properties owned. But, an NRI cannot buy agricultural lands, farmhouse or plantations. Although, NRI can have ownership of agricultural land through inheritance or gift.

However, selling of property comes with some restrictions by FEMA (Foreign Exchange Management Act), especially in case of repatriation transactions. So, you need to plan things well in advance by hiring a professional who will guide you with all the legal documentation and procedures at the time of purchase/sale.

If an NRI has plans to return to India and wants to have a retirement corpus back home, then they may consider investing in the National Pension System (NPS). Our article All About NPS, National Pension Scheme covers NPS in detail

- If an NRI in the US is unsure of future plans and could settle down there after retirement, NPS will not make sense. They will have to disclose the investment and the annuity under FATCA.

- NRIs in Gulf countries don’t have great option to settle in those countries after retirement. Since they will come back to India after 25-30 years of working life, they can use NPS to build a solid retirement corpus through a combination of equity and debt

Related Articles:

- Understanding Public Provident Fund, PPF

- Non Resident Indian – NRI

- NRI and ITR :TDS,Tax and Income Tax Return

- Bank Accounts for NRI:NRO,NRE,FCNR

- Rental Income and NRI: When House of NRI is on Rent

- NRI : Fixed Deposits, DTAA

- On Becoming NRI: What to do when you leave India to settle abroad

Thanks for raising important questions regarding the ppf nri notification. Any answers to the questions? Please update. There is a lot of confusion. Will the 4% interest be tax free or taxable?