Income tax rules applying to non-residents are slightly different from those for residents. The income that NRI earns abroad is not taxable in India. But if an NRI earns income in India, in the form of interest from deposits, property rent, etc then it is taxable. This income, earned in India, has a basic limit of exemption. This article explains abut NRI and ITR,who is NRI,Tax and TDS on various kinds of income for NRI, example bank accounts,fixed deposits,mutual funds,stocks etc. How to use DTAA? When should NRI file Income Tax Return?

Table of Contents

NRI and ITR ,Income Tax Return

Who is NRI?

Non-Resident Indian or NRI under the Income Tax Act, 1961 (IT Act) is tied to number of days of an individual’s stay in India during a particular financial year. Residential status is determined for every year separately. India includes territorial waters of India and Employment includes self-employment

- A person is Non-Resident under IT Act if his stay in India does not exceed 181 days in a financial year or previous year( 1st April to 31st March of next year).

- If the person has not stayed in India for 182 days or more in the relevant year, he will still be resident if he has stayed here for a total of 365 days in the preceding four years and was in India for 60 days during the relevant year.

- For a Person of Indian Origin who comes to India for a visit, the period of stay in immediately previous year has to be 185 days or more to make him a resident in India

Please note: In computing the period of 180 days, the day of entry into India and the day of exit from India shall be included. Our article explains Non Resident Indian – NRI in detail.

Is NRI income earned abroad taxable?

An NRI’s income taxes in India will depend upon his residential status for the year.

- If your status is ‘resident’, your global income is taxable in India.

- If your status is ‘NRI’, your income which is earned or accrued in India is taxable in India.

Should NRI file Income Tax Return?

NRI or not, any individual whose income exceeds Rs.2,50,000 (for FY ending 31st March 2015) is required to file an income tax return in India. Note that for an NRI, income earned or accrued in India is taxable in India.

When does NRI have to file Income Tax Return?

If you are an NRI, you would have to file your income tax returns if you fulfil either of these conditions which fall under section 115G

- Your taxable income in India during the Financial yeas was above the basic exemption limit (which for FY 2013-14 is Rs 2 lakh)

- You have earned short-term or long-term capital gains from sale of any investments or assets, even if the gains are less than the basic exemption limit.

- You may also file a tax return if you have to claim a refund. Alternatively, you can submit Tax Exemption Certificate to all your deductors directing them to deduct less tax or nil tax, as applicable.

There are following exceptions:

- If your taxable income consisted only of investment income (interest) and/or capital gains income and if tax has been deducted at source from such income, you do not have to file your tax returns.

- If you earned long term capital gains from the sale of equity shares or equity mutual funds, you do not have to pay any tax .

- NRIs have a basic exemption limit like any resident Indvidual. For AY 2016-17(FY 2015-16) it’s 2.5 lakh. If NRI’s income exceed this limits, an NRI should file income tax returns in India.

- NRIs are taxed as per the tax rate and slabs prescribed for resident Indians below 60 years irrespective of whether he is a senior citizen or not.

- NRIs cannot adjust the taxable capital gains against the basic exemption limit. So if an NRI earns Rs 2.5 lakh capital gains, he will have to pay tax at applicable rates for the full amount even if he has no other income. Due to this, NRIs may have to claim tax refund if more is being deducted than is their tax liability.

Is it mandatory for NRI to e-file income tax return?

In the following cases the Income Tax Department has made it mandatory to e-file Income Tax Return. A significantly large number of returns are e-filed and gradually the income tax department is hoping to bring all returns online.

- you have to claim a refund

- Your gross total income is more than Rs 5,00,000

- You want to claim an income tax refund. Those who are over 80 years old and are filing ITR-1 or ITR-2 can still file a paper return to claim a refund.

- ITR-3, 4, 5, 6, 7 have to be mandatorily e-filed.

Which ITR should NRI file?

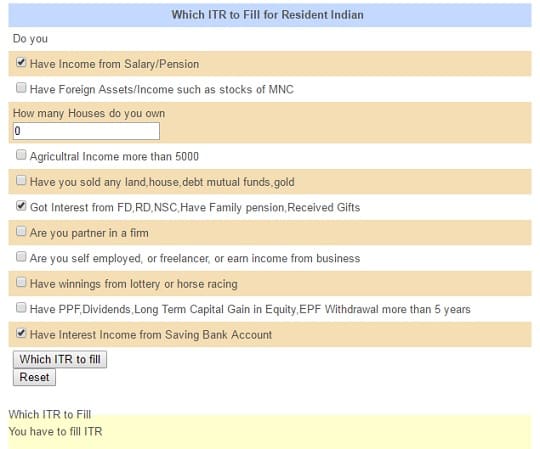

The ITR to be filed is same for NRI and Resident. It depends on type of Income earned. Our article Which ITR Form to Fill? provides overview and also suggests which ITR to fill.

Do NRIs have to pay advance tax?

Just like resident, If NRI’s tax liability exceeds Rs.10,000 in a financial year, he is required to pay advance tax . Interest under Section 234B and Section 234C is applicable when you don’t pay your advance tax.

How is NRI recognised in ITR?

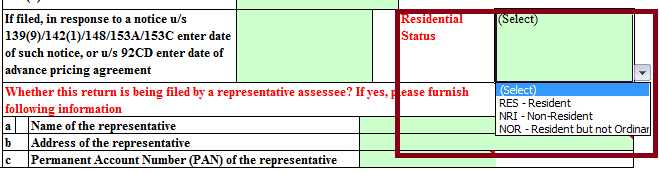

In Income Tax Return Form in the Residential Status one needs to select NRI as shown in image below(highlighted by box).

What is the last date for filing India tax returns for NRI?

The last date to file returns for NRI is same as that for the resident India. For the financial year 2015-2016 is July 31st 2016. Like resident Indians an NRI can delay filing his Income Tax returns.

- If you do not have any tax payable (that is all your tax has been deducted at source), you can still file your tax return by 31st March 2017 without any penalties

- If you do have tax payable, you can still file your returns by 31st March 2017 but you will be charged an interest of 1% per month for every month of delay starting from 31st July 2016 till the time you file your tax returns

NRI and Income

If your status is NRI, as per Income Tax Act, your income which is earned or accrued in India is taxable in India. Your global income is not taxed.

What kind of income is taxable for NRI?

Salary received in India or salary for service provided in India, income from a house property situated in India, capital gains on transfer of asset situated in India, income from Fixed Deposits or interest on savings bank account are all examples of income earned or accrued in India. These incomes are taxable for an NRI. Income which is earned outside India is not taxable in India.

Interest earned on a NRE account and FCNR account is tax free. Interest on NRO account is taxable for an NRI. Our article, Bank Accounts for NRI:NRO,NRE,FCNR, Their comparison, talks about it in detail.

Lets go over the different types of Income for NRI.

Income from salary

Your salary income is taxable when you receive your salary in India or someone does on your behalf. Therefore, if you are an NRI and you receive your salary directly to an Indian account it will be subject to Indian tax laws. This income is taxed at the slab rate you belong to.

Income from House Property

- Income from a property situated in India , whether rented out or lying vacant, is taxable for an NRI, just like a resident Indian. Income from House Property is taxed at slab rates applicable.

- An NRI is allowed to claim standard deduction of 30%, deduct property taxes and take benefit of a interest deduction if there is a home loan.

- The NRI is also allowed deduction for principal repayment under section 80C. Stamp duty and registration charges paid on purchase of a property can also be claimed under section 80C.

- A tenant who pays rent to an NRI owner must remember to deduct TDS at 30%. The income can be received to an account in India or the NRI’s account in the country he is currently residing. There is no separate rate prescribed for TDS on rent paid to NRIs. Just like in the case of capital gains on assets, the payer of the rent is responsible for deducting the tax at source. The same process of getting a TAN and issuing a TDS certificate applies in this case too.

- A person making payment to a Non Resident has to submit Form 15CA/Form 15CB. This form is submitted online.

Income from other sources

- Interest income from fixed deposits and savings accounts held in Indian bank accounts is taxable in India.

- Interest on NRE and FCNR account is tax free.

- Interest on NRO account is fully taxable.

Income from business and profession

Any income earned by an NRI from a business setup or controlled in India is taxable to the NRI.

Income from capital gains

Any capital gain on transfer of capital asset which is situated in India shall be taxable in India. Capital Gains on investments in India in shares, securities shall also be taxable in India.

If you sell a house property and have a long-term capital gain, the buyer shall deduct TDS at 20%. However, you are allowed to claim capital gains exemption by investing in a house property as per Section 54 or investing in Capital Gains Bonds as per Section 54EC.

TDS rates for NRI

Tax liabilities of an NRI investing in India are the same as that of a resident investor, but tax is deducted at source(TDS) in case of NRI. TDS is deducted for most of the investments at flat rate irrespective of income slab, unlike the resident Indians. Various investment options , tax rate applicable and TDS are explained below. Applicable tax on gains will be deducted at the time of redemption/maturity. In any of the cases if the tax liability on your investment is less than the amount of tax deducted at source then you can file your income tax refund to get refund from income tax department.

Please note that If NRI does not provide correct Permanent Account Number(PAN) TDS would be deducted at the rate 20% or at the rate specified whichever is higher.

Tax and TDS for NRI for Bank accounts, Fixed Deposits

An NRI can have Non Resident External (NRE) accounts, Foreign Currency Non Resident (FCNR) or Non-Resident Ordinary Rupee Account (NRO Account). Our article, Bank Accounts for NRI:NRO,NRE,FCNR, Their comparison, talks about it in detail.

Interest earned on Non Resident External (NRE) accounts and Foreign Currency Non Resident (FCNR) accounts are tax free in India. Hence, there would be no TDS.

NRO accounts may be opened in the form of current, savings, recurring or fixed deposit accounts. Interest earned on the Non Resident Ordinary Account (NRO) is taxable and will be subject to a TDS of 30%. This holds true for Post office also. There is no basic exemption limit. For example, interest earned by resident Indians from bank deposits is subject to TDS only over and above a limit of Rs 10,000. No such limit applies for NRIs.

TDS and Tax for Mutual Funds for NRI

For investing in Indian mutual funds, therefore, an NRI needs to open one of the three bank accounts-non-resident external rupee (NRE) account, non-resident ordinary rupee (NRO) account or foreign currency non-resident account (FCNR)-with an Indian bank.

| Category of Units | Tax Rates under the Act | TDS Rates under the Act |

|

Short Term Capital Gain |

||

| Units of Non-equity Oriented Scheme | Taxable at normal rates of taxes applicable to the assesse | 30% for Non Resident Individuals |

| Units of an Equity Oriented Scheme | 15% on redemption of units where STT is payable on redemption (u/s 111 A) | 15% |

|

Long Term Capital Gain |

||

| Listed Units of a Non-Equity Oriented Scheme | 10% without Indexation OR 20% with indexation, whichever is lower (u/s 112) | 20% for Non Resident Individuals (u/s 195) |

| Unlisted Units of a Non-Equity Oriented Scheme | 10% with no indexation | 10% for Non Resident Individuals (u/s 115E/112) |

| Units of an Equity Oriented Scheme | Exempt in case of redemption of units where STT is payable on redemption (u/s 10(38)) | Exempt in case of redemption of units where STT is payable on redemption (u/s 10(38)) |

Dividends for NRI

Dividends from equity shares, equity mutual funds and debt mutual funds are exempt in the hands of the share or unit holder.

Equity Investments and NRI

NRIs can invest in Indian stock markets under the Portfolio investment scheme (PIS) of the Reserve Bank of India (RBI). Under this scheme, an NRI has to open an NRE/NRO account with an RBI-authorised Indian bank. An individual open only one PIS account for buying and selling stocks. Each transaction through a PIS account is reported to the RBI. Aggregate investment by NRIs/PIOs cannot exceed 10% of the paid-up capital in an Indian company. An NRI cannot transact in India except through a stock broker so he needs to open a demat account and a trading account with a Sebi-registered brokerage firm.

Long term capital gains, profits made on sale after 1 year from date of purchase, on equity shares (like in equity mutual funds) are exempt from tax. There will be no TDS applicable.

Short term capital gains, profits on sale within one year of date of purchase, are subject to a TDS of 15%.

Capital Gains on Gold , House Property and NRI

For Capital gains on other assets like house property, gold

- Long term capital gains are subject to a TDS of 20 per cent.

- Short term capital gains are subject to a TDS of 30 per cent.

The payer of the sale proceeds, even if he is an individual is responsible for deducting tax at source and paying it to the Government. He must get a Tax Deduction Account number (TAN) and issue a TDS certificate for the same. The onus of deducting tax is on the payer

Professional services and royalty

If an NRI receives a payment from a company in India for providing professional services, his income would be subject to TDS. The rates are as follows.

- If your agreement is dated between 1st June 1997 and 30th May 2005, you would be subject to a TDS rate of 20 per cent.

- If your agreement is dated on or after 1st June 2005, you would be subject to a TDS rate of 10 per cent

- The same applies to royalty. For definitions of professional service and royalty, please refer to section 115 of the Income Tax Act.

Interest on all other investments

Interest earned on all other investments like corporate deposits and bonds will be subject to TDS at 20 per cent. In all these cases, the company or party making the payment will deduct this tax

All other income

All other income that an NRI earns and which are liable for tax as per Indian laws, will be subject to a TDS of 30 per cent.

Double Taxation and NRI

Are NRI subjected to double taxation-once in India and again in the country of their residence? It depends on the country of residence. If the Indian government has a avoidance of double taxation treaty (ADTT) with that country, the NRI will be spared from paying tax twice. Many countries have an ADTT with India. For example, India has an ADTT with the US. If an NRI based in the US makes short-term capital gains from equity investments in India, he pays 15% tax. However, the rate for such gains is 30% in the US. The investor will need to pay tax only for the difference in rate. This means he gets a deduction on the tax paid in India from his tax payable in the US.

For availing the benefit of Double Tax Avoidance Agreement(DTAA), beneficiary of Double Tax Treaty is require to submit Tax Residency Certificate issued by Government of NRI’s residence. For example To obtain U.S Residency Certificate, also known as IRS Form 6166 you will have to fill out ans submit IRS Form 8802. If you need the certification for the next calendar year the earliest you may apply is December 1 of the current year. IRS Information on Completing the Form 8802, Application for United States Residency Certification explains how to get Tax Residency Certificate.

Related Articles:

- List of Articles to Understand Income Tax, How to Fill ITR,Income Tax Notice…

- Bank Accounts for NRI:NRO,NRE,FCNR, Their comparison

- NRI : Fixed Deposits, DTAA

- How to report Incomes from India while filing US tax returns

Very informative Blog,

Check our blog on Ways To Claim Nil Or Lower TDS On Sale Of Property (Know many interesting and unknown facts)

https://aktassociates.com/blog/lower-tds-on-sale-of-property/

If you are a Non-Resident Indian and having a property in India and wants to sell it but confuse about the procedure, then you are at the correct place visit our site for full infpormation.

Dear Team,

Kindly provide under which section the NRI is charged with TDS on redemption from non equity oriented schemes and at what rate plus what is the threshold for TDS in Mutual Fund

Section 195 of the Income Tax Act is a section that covers the TDS on Non-resident payments.

Short-term capital gains from stocks are subject to 15% TDS,

while those from debt funds and debentures, gold and property are slapped a higher rate of 30%.

Even long-term gains from property and gold are subject to 20% TDS.

The TDS on the interest on bank deposits is only 10% for resident Indians, but NRIs have to cough up 30%.

Hi Anand ,

I need advice on my case .

I am NRI and working in Netherlands and receiving part of my salary into my Indian account as I am still on Indian payroll. My company has revise my IT returns of last year and has applied for tax refund under DTAA. I have received the refund amount to my Indian bank account but my company is asking to put back the money(which includes the tax I paid as part of my salary and from my personal savings) into company’s account as they are paying my taxes in Netherlands. My question is should I put the refund money that I received as part of my personal savings too ?

Thanks in advance

Regards,

Sujith

Sir if the day of entry and exit is same (Came out of India and catch another flight to leave in two three hours) is that day count as day in India or not for a seamen while calculating his total number of days out of India.Thanks In advance.

Hi, I am an NRI and holding SB accounts and also NRE account, but is it necessary to convert to NRO account from SB? I am planning for tax filing this time to claim TDS on my SB accounts. Please reply.

Sir my self nri I have a property in india holding more than 3 yrs what is the procedure to repatriation and what is the tax implication of I don’t have other income in india

Hi,

I am an NRI and I have NRE account.

I have made few FD in my NRE account, is interest earn on these FD is taxable?

How income tax department track NRE account without PAN CARD number?

Hello,

I have a query on Surcharge and other cesses on the Tax quantum.

If the IT dept. has ordered a fixed quantum basis section 197 for the tds for nri – say 16%, what should be the surcharge and cesses levied on this tds?

Thanks for the above article.

I have a question suppose rent of ₹120000 pa is paid to a non resident, and such non resident has no other income charegable to tax in india.

Now deductor has to deduct tax @30℅ on above amount, and can he (deductor) make an application to AO where he consider that the whole of such sum would not be income charegable in the hands of receipent and ao by general or specific order determine the appropriate amt to charge (sec 195(2)), if yes then what is the procedure to make application?

Another ques whether the benefit of sec 197 (certificte for deduction at tax at a lower rate or no deduction) is available to above such non resident.

Another ques if such tds is deducted @30℅ then whether non resident will get refund after filing of IT return or not..or will deductor get the refund of such tds?

Thanking youu

A tenant who pays rent to an NRI owner must remember to deduct TDS at 30%. The income can be received to an account in India or the NRI’s account in the country he is currently residing.

if NRI would like Nil/ lower tax deduction on such transaction. Under Section 197 of the Act, NRIs can obtain Tax Exemption Certificate on the basis of estimated capital gains tax computation and submission of relevant documents. After going through the information furnished by the NRI, the jurisdictional Assessing Officer/ Tax Officer may issue a certificate authorising the buyer of property to deduct tax at a lower rate or nil rate as the case may be.

Any person residing abroad and expecting to receive any income on which tax is likely to be deducted at source in India can apply for exemption certificate. In order to assist in above mentioned situation, the Act has provided procedure u/s 197 whereby an NRI can apply to his Jurisdictional Assessing Officer (in prescribed form) at the Income Tax Department to issue specific certificate authorizing the payer of income (who deducts tax at highest prescribed rate) to deduct tax at a lower rate or nil rate as the case may be. The NRI should estimate his income, tax liability and likely TDS and then apply for partial or complete TEC. The payer is mandatorily required to deduct tax in accordance with the TEC of the Assessing Officer. Such a certificate is binding on the payer.

The application has to be filed with the assessing officer in Form 13 for obtaining a certificate authorizing the payer of income to deduct tax at a lower rate or nil rate as the case may be. The validity of such certificate is prospective from the date of issue and normally extends up to the end of the financial year for which it has been issued.

If such certificate has not (or Cannot) be obtained, refund can be claimed by filing return of income on the basis of certificate received for tax deduction at source.

i am an NRI and recently purchased an underconstrucion property….registered the agreement..paid stamp duty and registration…i am paying TDS of 1% on the amount that has to be paid slabwise as the consideration amount is above 50 lakhs.

how can i get a refund/credit of this amount from the I.T dept. as the builder is not going to pay it…can u pls clarify..thanks

Hello,

I put money from the sale of a property in a Capital Gains Account NRO.

I now do not want to roll over into another property, but want to put into NRO Savings Account.

I have paid ALL taxes due. My Bank says a FORM G has to be filled. Which I did. However there is a section that requires the INCOME TAX officer to sign off on. The Officer is giving me the run around and I do not want to PAY a single Rupee of a bribe.

What should I do next?

Hi

First of all. tanks for creating such an informative forum.

I have rented an apartment in pune which is jointly owned by me and my wife.

the monthly rent is 19000.we pay muncipal taxes of 26000 per annum. we have taken a joint home loan where we pay 42000/m emi with 28000 interest component. I have following questions.

1. seeing above whats the final taxable rent for each of us?

2. for taxation purpose is the tenant supposed to split the rent in half and pay to both of us separately?

3.if we have a joint savings NRE account can the total rent be taken in single name and while filing returns shown as 50% for each.

4. 50% is 114000 rent for each of us which after all deductions will come down even more. I had read somewhere that if the taxable rent is less than 1.8lakhs then no need to deduct TDS of 30%. whats the rule here? is it 1.8 lakhs on total rent or 1.8 lakhs for each of the receiver?

It would be nice if you can shed light as many will be having similar case as above.looking forward to youradvice on same

Splitting of rental income for tax payer in India:

If you have a jointly held property, the rent received from it will be taxable in the hands of each co-owner based on the respective shareholding. The rental income will be distributed among the owners based on the proportion mentioned in the purchase deed or agreement.

Further, if there is a housing loan, the proportion in which the loan has been taken should be the same as the proportion in which the property is jointly owned. Once this ratio is decided, it cannot be changed during the period the property is held

In case the rental income of the NRI is also taxable in the country where he resides, Double Taxation Avoidance Agreements come into picture. For example, there is DTAA agreement between India and USA which states that rent from any immovable property shall be taxed in the country in which such property is situated. So, the NRIs who live in US but have property in India shall be taxed in India and not in US.

Rental from both commercial and residential property is chargeable to tax under the head Income from House Property. Add this rental income to any other income the NRI earns in India. If the total Income earned in India is more than the minimum exemption limit, tax is payable based on the tax slabs for the financial year. In such a case a return must be filed by the NRI.

Under the head Income from House Property, certain deductions are allowed to be claimed and those are also available to an NRI.

TDS on Rental Income

The tenant is required to deduct TDS before making a payment to the NRI, on rent payments to NRIs TDS is deducted @ 30%.

Now there can be two situations :

When the total Income of the NRI is less than the minimum exemption limit – If TDS has been deducted on rental income, a refund may be due to the NRI. The only way to claim a refund is to file an Income Tax Return. All TDS deductions are linked to the PAN and the NRI can check these details from his Form 26AS.

When the total income of the NRI is more than the minimum exemption limit – In such a case whether or not TDS has been deducted the NRI must file a return and pay the tax which is due. In case TDS has been deducted it is adjusted against his final tax liability. Since TDS is deducted at 30% and this rate of tax is applicable in the highest tax slab of income more than Rs 10lakhs, a refund situation may arise if the total income of the NRI is in a lower tax slab.

Thanks a lot for such a detailed reply.

can you please answer the following doubts that I still have.

1. my wife is a house wife and has not contributed to the Apartment purchase or the loan. We never thought of proportion and cant see any proportion mentioned on the registration or the loan documents. if there is nothing mentioned is it default 50% in that case?

2. for taxation purpose is the tenant supposed to split the rent in the said proportion and pay to both of us separately including deduction of TDS? I am sure none of the tenants would like to go through all these hassles.

3.if we have a joint savings NRE account can the total rent be taken in either of our single name and while filing returns shown as 50% for each or the agreed proportion.

Please share your advice on the above 3 scenarios.

Best Wishes

Peeyush

I understand that in case of NRI in USA, pension (other than government pension) is taxable ONLY in USA. Hence it is not taxable in India (as provided in clause 20 of DTAA with USA). In that case, when filing ITR, must one exclude the pension or show it under exempted income? Your advice would be appreceiated. Thanks.

If we do payment to a NRI and he will not provide to us his PAN then in that situation, how to show that payment in TDS return without PAN?

Sorry we don’t have information about it.

You can contact TIN NSDL, contact number from TIN NSDL webpage

Tel 020 – 2721 8080

Fax 020 – 2721 8081

Email tininfo@nsdl.co.in

Which ITR form to be use for capital gain tax on Debt Mutual Fund & Interest income on Bank FD Income. No other income. Total Income 293000/- Can I get refund?

Please guide?