Now you can do EPF Withdrawal Online! On 1 May 2017, Labour Day, EPFO announced that all EPF Member’s who have activated their UAN and seeded their KYC (Aadhaar) with EPFO will be able to apply for PF Final Settlement (Form19), Pension Withdrawal Benefit (Form10-C) and PF Part Withdrawal (Form31) from the their UAN Interface directly. This will reduce the EPF Withdrawal time from 20 days to few hours. This article explains how to do EPF Withdrawal Online? What are the requisites, the procedure?

Table of Contents

Procedure for EPF Withdrawal Online

To claim your EPF Full Withdrawal or EPF Partial Withdrawal

- You should not be working at the time of submission of the claim in an establishment that is covered under the Employees’ Provident Fund and Miscellaneous Provisions Act, 1952.

- You have an option to withdraw 75%of your funds after one month of unemployment and keep their PF account with the body. Announced on 26 Jun 2018

- You would also have an option to withdraw the remaining 25% of your funds and go for final settlement of account after completion of two months of unemployment. Announced on 26 Jun 2018.

A claim for the purpose of final settlement can be submitted only after 2 months of the last date of employment.- Your Aadhaar and PAN Verified

- Your previous employer should have updated your Service History with Date of Exit(DOE) of EPF and EPS.

- Please verify your bank account number. As money is transferred to your bank account.

If you don’t meet these conditions then you have to go offline and submit the EPF withdrawal form to your previous organization. Our article EPF Withdrawal: How to withdraw from EPF and EPS explains the offline process through the previous employer and also without the employer.

Our article EPF Partial Withdrawal or Advance: Process, Form, How much explains how you can partially withdraw from you EPF while in service for repaying the housing loan, Marriage, Treatment, subject to prescribed conditions

Steps to do EPF Withdrawal online

- Step 1 is to log on to the UAN portal and enter your login details.

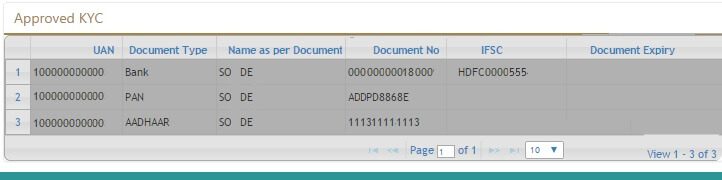

- Step 2 is to check whether the KYC details seeded are correct and verified or not. All your KYC should be approved by your employer/

- Aadhaar should be authenticated and verified.

- The date of joining and date of exit (last date of employment) should be available in the EPFO database.

- Bank Account details and the IFSC Code of the branch as the transfer would be online.

- Step 3: Keep a scanned copy

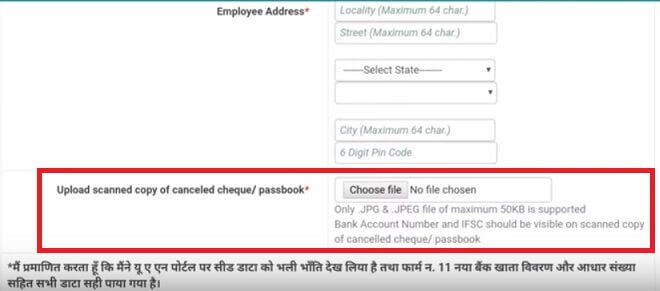

- Of cancelled cheque/front page of passbook with IFSC Code ready.

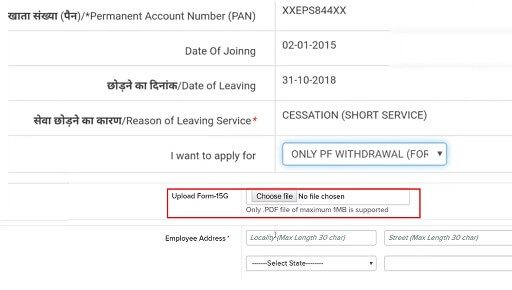

- Of filled Form 15G ready for upload to avoid TDS deduction. Especially if you are withdrawing within 5 years. Our article Submit Form 15G for EPF Withdrawal online, TDS, Sample Filled Form 15G discusses it detail.

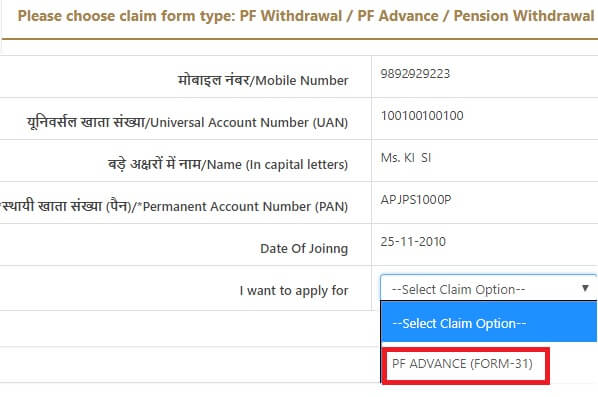

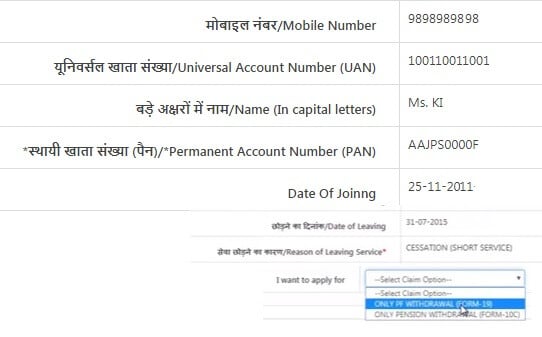

- Step 4 is to select the claim you require out of the 3 namely, full PF Settlement, PF Part withdrawal (loan / advance) or EPS withdrawal as shown in the image below.

- You need to fill Form 31 for EPF partial withdrawal i.e. loan/advance. one doesn’t need to submit any documents along with it.

- You need to fill Form 19 for EPF Withdrawal

- You need to fill Form 10C for EPF Withdrawal.

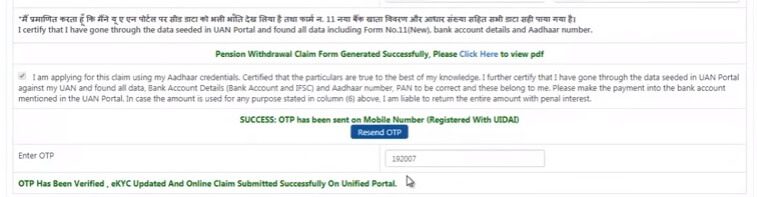

- Step 5 is to verify the online PF claim using One Time Password (OTP) that you will receive on your mobile number linked with your UAN.

- EPFO will obtain your KYC i.e. Aadhaar details from UIDAI and your online PF claim will be processed and your bank account will be credited with the amount of the claim.

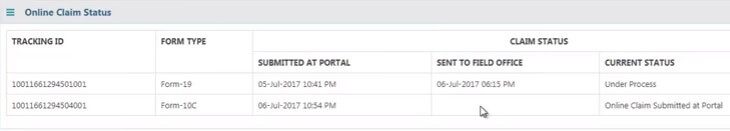

- Track your claim status from UAN Member portal itself.

Before EPF Withdrawal Online

Before you start the withdrawal process make sure all your previous PF accounts are merged into one. The total service in the present and previous organisations will be taken into account and therefore, it is advisable to merge your accounts.

One can do Full or Partial EPF Withdrawal online. One can complete the whole process online and one neither needs to interact with the employer and nor with EPFO field office to submit the online claim. The online claim submitted will be processed and the member’s bank account credited.

This will reduce the EPF Withdrawal time from 20 days to few hours. These are part of Government’s e-gov initiatives and the three forms collectively form more than 80% of EPFO’s claim workload.

For availing EPF Withdrawal facility, one should have

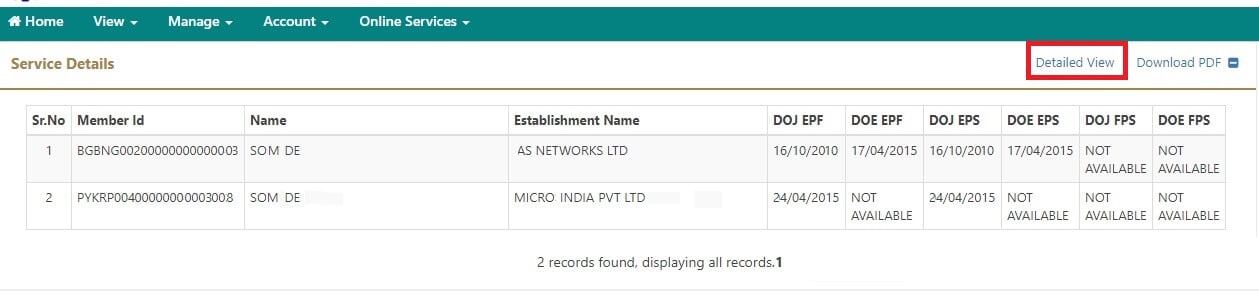

- The employer should have updated Date of Exit of EPF and EPS. Else you will not see the withdrawal option. Go to View->Service History and check that Date of Exit is mentioned as shown in the image here.

- Activated Universal Account Number

- The mobile number used for activating UAN should be in working condition.

- Aadhaar details should be seeded in EPFO database and he/she should avail OTP based facility for verifying eKYC from UIDAI while submitting the claim.

- The bank account along with IFSC code should be seeded in EPFO database.

- Permanent Account Number (PAN) should also be seeded in EPFO database for PF Final settlement claims in case his/her service is less than 5 years.

- Both Aadhaar and PAN should be verified

- Bank Number should be verified.

So if you Login to UAN Website and click on

View-> Service History and see an overview of the various companies you worked in with the date of joining and leaving as shown in the image below. If the last employer,MICRO INDIA PVT LTD, has not updated the Date of Exit (DOE) DOE EPF and DOE EPS then the employee will not be able to withdraw his EPF. There will be no Form 19/10C but only Form 31 as shown in the image here.

If Date of Exit is missing then there is no Withdrawal Form 19 and 10C. Only PF Advance form (Form 31) is available.

Manage->KYC in Approved KYC section you should see your PAN, Aadhaar, and Bank Details as shown in the image below and PAN and Aadhaar should be verified.

Our article How can an employee Verify PAN in UAN website explains it in detail.

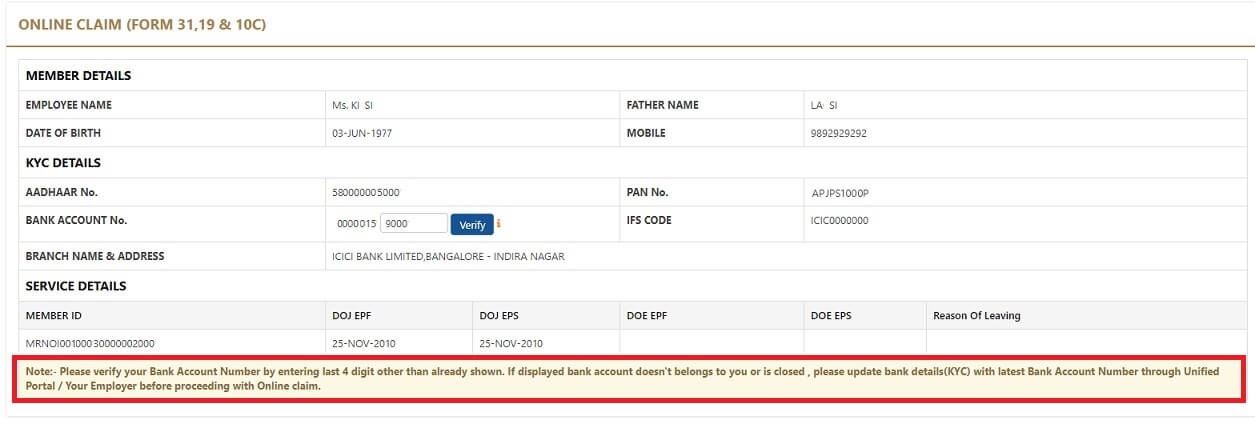

Verify Bank Details before EPF Withdrawal

On clicking Verify you see the following message

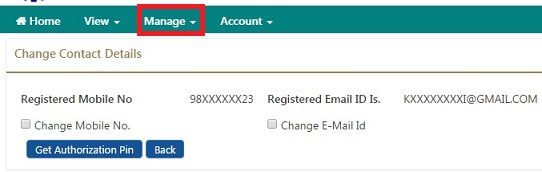

You can check the mobile number associated with your UAN by going to Manage->Change Contact Details or View->Profile

The article New UAN Unified Portal for Employees talks about the new UAN Unified Portal for Employees in detail.

How to do EPF Withdrawal online in Detail

Steps to Withdraw EPF Online are as follows

- Login to the member interface using UAN credentials.

- Check that KYC and service shown against his UAN are correct.

- Select Online Services. Select the claim(Form 31, 19 & 10C).

- If you are withdrawing EPF then submit both the Forms, Form 19 and 10C.(You would have to repeat the process twice)

- You would see all your details such as Member Details, KYC Details, Aadhaar Details. Click on Proceed for Online Claim

- Choose the claim.

- Enter your Address details

- Upload the scanned copy of filled Form 15G to avoid TDS deduction. Especially if you are withdrawing within 5 years. Our article Submit Form 15G for EPF Withdrawal online, TDS, Sample Filled Form 15G discusses it detail.

- Upload the scanned copy of Cancelled Cheque or Bank passbook.

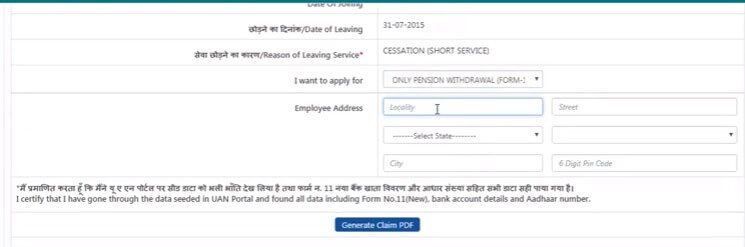

- Click Generate Claim Form as shown in the image below

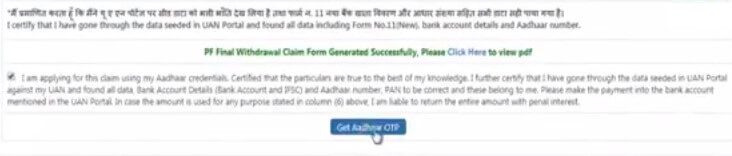

- Check the certification. You will see a message saying PF Withdrawal Form Generated Successfully. You can view the Form also.

- Click on Get Aadhaar OTP.

- Check the box that says I am applying for the claim using my Aadhaar credentials.

- Authenticate using Aadhaar credentials.

Track EPF Claim

You can track your EPF Claim submitted online by clicking on Online Services -> Track Claim Status. You will see a window similar to shown in the image below

EPF Partial Withdrawal Online

One is not required to give any supporting document while preferring online PF Part Withdrawal case. Member’s applying online will be taken as his self-declaration for preferring the advance claim. A

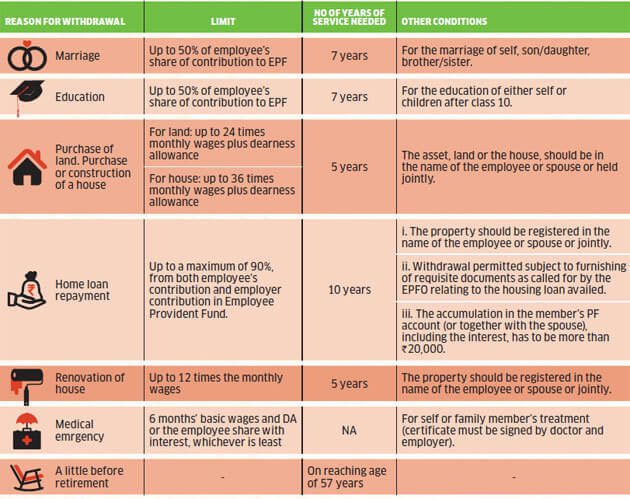

dvance or Withdrawals may be availed for the following purposes after putting in at least 5 years of service. The amount that can be withdrawn depends on the purpose, depends on the number of years of service. How many times can one withdraw for the same reason depends on purpose, for example, one can withdraw for the marriage of self, son or daughter, brother or sister 3 times after one has completed 7 years of service. For marriage purpose, one can withdraw 50% of employee share but for treatment, one can withdraw up to 6 times of Wages. Our article EPF Partial Withdrawal or Advance covers it in detail.

Video on How to do Full or Partial EPF Withdrawal online

The video below shows the process of how to do EPF Withdrawal online

When to do EPF Withdrawal offline

No Aadhaar linked: The online claim process is not available to those who do not have Aadhaar or Aadhaar is not linked. Link and Authenticate Aadhar . The non-Aadhaar composite claim form needs more details like date of birth, father’s name and bank account details. Apart from your signature, it has to be certified by your employer.

Bank Detail different from that on UAN site: you can get the payment from EPFO for your claim only into the bank account registered with it and which is shown in your UAN member interface If, for some reason, you want to use some other bank account to get the claim, do not submit the claim online; use the physical process instead, or get the bank account details changed through your current employer. . If you are making the claim offline, fill the form and submit it along with a cancelled cheque.

TDS deducted for EPF less than 5 years: Do remember that if you have been an EPF member for less than 5 continuous years, the maturity corpus is taxable and you will also need to furnish proof of PAN. You cannot submit Form 15G/H.

Related Articles:

- EPF Withdrawal:How to withdraw from EPF and EPS

- EPF Partial Withdrawal or Advance

- New UAN Unified Portal for Employees

- EPF Withdrawal before 5 years,TDS,Form 15G,Tax and ITR

Hope it helped you to do EPF Withdrawal. Where did you find problem while filing ITR?

Namaste,

My claim has been rejected because of below reason. Can you guide me on this to get resolved?

Your Claim [ Claim Id – BGBNXXXXXXXXXXXX ] has been rejected due to : 1) EMPLOYER TO SUBMIT DECLARATION U/P 26(6) & CONFIRMATION OF ADM. CHARGES ON HIGHER WAGE TO PF 2) PHOTOCOPY OF BANK PASSBOOK NOT ATTESTED BY THE AUTHORIZED SIGNATORY

Great post keep posting thank you

Great Article. It’s really informative and useful. keep posting with the latest updates. Thanks for sharing.

Is it possible to claim the tax deducted under EPF withdrawal as I don’t have any other source of income?

You can claim TDS deducted by filing ITR and asking for a refund.

If you have withdrawn before 5 years of contributing to EPF(total) then technically you are required to pay tax on it.

Hi sir, I applied for form 19 claim on 30th June, it’s still under process, how much time does it take to get settled.

Great Blog I really inspired .

Hi,

How and where will I get form 15G

Thank you for sharing this valuable information with us! Looking ahead for more content.

I had submitted form 19 and form 10C bu the claim is rejected and the following reply came

Your Claim [ Claim Id – GNGGN200250023372 ] has been rejected due to : 1) PLEASE UPDATE 11 DIGIT BANK A/C NO NOT ACCEPT BY SYSTEM YOUR BANK A/C NO 00000020234556473 2) INCOMPLETE BANK DETAILS

What does it mean? I applied with six zeros before my SBI account no. Do I need to claim with the 11 digit SBI account number. I have seen in some YouTube videos that one should add six zeroes before SBI account no as the epfo system does not accept 11 digit account number. I want to know if the epfo resolved the issue and now there is no need of adding zeroes before SBI account number?

My pf advance was settled but not credited to my account it was settled few days back

My pf advance was settled but not credited to my account it was settled few days back

Reply

My pf balance not receive my bank account

How many days since withdrawal?

Ultimately, after spending many hours on the internet at last we’ve uncovered somebody that surely does know what they are. Thank you for sharing wonderful article. Great post. I will be your regular visitor.

I have applied for final settlement last 28 November 2019 and UAN No: 100525158041 & PF Account number : MHBAN01283270000018646 but still showing under process for PF status kindly clear as soon as possible do the needful

Unable to with draw PF times it has got rejected have again applied for the same, can i get some number to whim it can be escalated

as per PF Office my name does not match where in my Aadhar and Pan has been verified by them

The PF accounts have been transferred and your latest passbook shows the transfer details as shown in the image in the article How to Transfer EPF Online on changing jobs

Online pf claim not successful

Only rejected

Please send the details of the passbook to our email id and why was claim rejected?

Hello Sir,

i have 3 pf accounts under one UAN .

1) 2nd Pf amount claim settled

2) after settled the 2nd pf amount, 1st pf amount transferred to 2nd pf account & it is showing in passbook.

3) 3rd pf amount also settled

now whenever i am going for submit form 19 & 10C the 3rd pf account is showing for claim which is already settled.

then how could be possible to claim for the 1st account transferred amount which is showing in 2nd pf account passbook ?

Pls help me to call : 7980812589

Hi sir, I applied for form 19 claim on 30th June, it’s still under process, how much time does it take to get settled.

Is partial epf withdrawl possible?

PF withdrawal balance date 15.07.2019 – BGBNG – 190650034562 approved amount Rs.45486/- & BGBNG 190650035141 approved amount Rs. 99680/- but amount received on 24.07.2019 SHORTAGE AMT Rs.9968 /- against BGBNG-190650035141.

I need my remaining balance Rs.9968/- urgent basis in my axis bank account -915010046448967

Thanks for sharing this post,

Keep posting like this that is very helpful For us

I have found something new in this Article.

Please help i want to apply for online clam as i have my UAN no. also, but i can because the company where i had work before does not submit the digital signature and as well my bank account also they had not submit.

Hi Basavaraj,

Does PF full-withdrawal need continuous 5 years or can

be discontinued 5 years.

i have discontinued 5 years. (5 yrs 5 months) but while withdrawing its showing only the last company’s service detail alone where i worked for 4 months.

All the PF transfer from previous employment has been done and reflecting in passbook.

Please do the needful.

Logs (while withdrawing)

======================

Date Of Joinng

01-04-2018

छोड़ने का दिनांक/Date of Leaving

17-08-2018

सेवा छोड़ने का कारण/Reason of Leaving Service*

CESSATION (SHORT SERVICE)

Regards,

Babu

when i am trying to apply form 19 it shows error as (As your establishment is exempted in PF, please submit your withdrawal case to concerned Trust)

Please explain why this type of error getting.

hello sir I am satish my uan# # 100687488200 Feb I applied on line claim it shows settled I waited one month it’s not credited in my account after o realize my accout # wrong I sended the mail I got reply to send the ASR FORM AND CANCELLED CHEQUE I sended by courier its reached March 29 still I am not received my amount how many days it will take please send me reply sir

I have claimed my PF on 20th Feb 2019 and after that mar 8th it is showing your claim is settled but money not credited in my account my UAN no is 101294961661

I am unable to apply and i am getting the below error message. So please help me.

“OTP verified but the data available against the UAN in system is not matching with the data available with UIDAI(AADHAAR).”

Verify that data in UAN matches that in Aadhaar.

I am also getting the below error message

”OTP verified but the data available against the UAN in system is not matching with the data available with UIDAI(AADHAAR).” but my question is that when UAN and UIDAI are both places data is same then how can you say that data mismatch??

I am also getting the same error. can you please help me, what u did to get it resolved.

I am also getting the similar message. Name, date of birth etc are matching in both EPFO and Adhar. Can someone explain why?

Verify your UAN and pan data, i.e., Name in the UAN site and Name in aadhar data base. It may be slite different, like “SUbham tiwari” in UAN and “tiwari Subham” in Aadhar. Names in all the proofs should be same with each letter matching, irrespective of first name and last name. I’ve faced this type of problem. In attaching pan also, this error may occur.

Sir ,

My pf no. Claim show that”status is not available “.but the pf amount debited my pf passbook but can not revive in my account. Please

help me.

My uan no. 101218925183

I actually added your blog to my favourite and will look forward for more updates. Great Job, Keep it up. First of all let me tell you, you have got a great blog .I am interested in looking for more of such topics and would like to have further information. Hope to see the next blog soon.

Number of Online apply is exceeded for me. How can i apply PF advance through Offline? Please guide.

HI Sir

My fother name is mismatch how to change

pls tell

mismatch is putting my brother name

Sir,

when i am trying to apply form 19 it shows-(As your establishment is exempted in PF, please submit your withdrawal case to concerned Trust.)

I can understand what to do.

Dear Sir,

In my case i’ve two EPF account under single UAN, lets assume X (left in April’2017) and Y(Left in Dec’2017) and now i am no more under EPF clause due to nature of work. I’vent transfer balance from X to Y, hence it shows two separate passbook with balance.

Now, i want to withdraw both account today completely (ie in Nov’2018).

I’ve full eKYC done along with my Aadhar, Mobile, Joining Date and End date done.

My question is can i make withdrawal in two step or i’ve to first transfer X to Y then withdraw Y in full. Since i need money on very urgent basis i need the faster option.

Thanks.

Saurabh Singh

I had submitted my form 19 online for full PF withdrawal. Claim was “under process” for 21 days, post which it got rejected. all details (bank/PAN/aadhar) are correct. no email no sms was ever received even though phone and email details are correct. what to do? to whom can i complain?

hi sir

sir maine online epf withdrawal advance kiya hai lekin bank AC NO galat ho gaya hai sir aaj hi apply kiya hai please sir reply

what wrong?

account no wrong mean ,claim will be rejected

sir actually mera b same problem hua h but my claim settled krke show ho rha h but paisa cradit ni hua hua.

please suggest me what i am do.

As per new rule how can i get epf smount after one month

Hi Sir,

This is regarding the withdraw options. I quit my job in Mar 2018 and joined new organisation in the same month. Now, I want to withdraw full PF amount of previous employer. While I claim amount from my PF account, it shows only form 31 (PF advance) option. Rest of the options (form 10c and 19) are missing. Employer has already updated DOE for EPF and EPS. This might be because of condition of 02 months of unemployment (which is not here). If so, can offline application can be the alternative option?

Till you transfer your old PF account the options will be for the new employer only.

You can either transfer your PF account(which is recommended as EPF is for retirement)

or

You can withdraw offline your EPF of the previous employer. You need to submit your application physically.

To know about regional EPF office you can go through our article here.

Hi Sir,

I have applied pf partiall withdrawal form 31. As per the passbook employee share is 150993, therefore I claimed rs 150000 but I only received 65200. Reason for withdrawal is illness and my service period is more than 6 years.

Can you please let me know why I didn’t receive the full amount.

Maximum Admissible Amount: 6 times of Wages OR Full of Employee share (whichever is less).

Wages here mean Basic + Dearness Allowance, not your Take Home salary.

Get well soon

old pf account balance has to be transferred to new account through form 13

You can do it online as explained in the article How to Transfer EPF Online on changing jobs

Hi Sir, please answer on my queries.

-My passbook shows 162999/- Employee cont. and employer cont. but when I applied for PF settment (form 19) then I got only 146999/- means 16000 less.. so my equery is that Did they deducted 10% of TDS? or I will get the amount letter. FYI- my contribution was started from Sep’ 13 and ended on july’ 18. So my query is why did I get only 146999 instead of 162999.

– In my passbook it shows 162999/- withdrawal.

– I did apply for transferring the PF from last two employer to current employer and amount of only employee and employer was transferred. So please let me know how can I withdraw this amount.. pls tell me the process.

– I applied for form 10c but it got rejected even after I have got the PF amount as I mentioned about? Regards, BHARAT

Check your Form 26AS, if TDS is deducted then it should show up in Form 26AS.

-So your passbook does not show withdrawal from one employer. Is that employer linked to your UAN? You can try withdrawing offline

-How many years did you work in total including that of old employer(s)? What was the reason for rejection given? If its more than 9.6 years you cannot withdraw EPS.

You can send details of your UAN service history, passbook to our email id bemoneyaware@gmail.com for us to look into details.

I have already left my job on 14th June 2018.

I have taken withdrawal of employee share through Form 31.

I want to withdraw employer share and pension part also but I am unable to do so because my account is not showing Date Of Exit and that’s why only Form 31 option is available. I have requested several time to my organisation for updating the records but still its not getting updated.

I am in urgent need of funds. Please help me in suggesting what to do in this scenario (Online/Offline) and how to get my money asap ?

Regards

Anil Sehrawat

8826898100

Just view your passbook,which is last month contribution is consider date of exit ,go for offline process

Hi

I have resigned my job, i would like claim my PF and Pension amount, what is the procedure, i should claim both amount at a time pls advice.

myself total experience 3 years and total PF amount is 45k +Pension Amount 15k total 60k. is it must to update the PAN Card on cliam process?

pls advice one

Regards

prakash.

Sir i submit PF withdrawal by online but settlement is reject due to “PL SUBMIT 15G AS 10% TDS DEDUCTED, OR SUBMIT PHYSICAL FORM WITH PROOF/OK”

and than i submit again without 15G submit on dated 22/08/2018

So i just confirming with you, now amount will be settle and not…..???? its already take 12 days.

Please reply…..

you left the job so only 19 & 10 c is availble

for further help

Santosh kumar

Provident fund consultant

M-7430074346

W-8250489980

Sir, I submit our PF withdrawal amount but settlement is reject reason is “PLEASE SUBMIT 15G AS 10% TDS DEDUCTED, OR SUBMIT PHYSICAL FORM WITH PROOF/OK”

and I submit PF withdrawal again on dated 22/08/2018 without 15G submit because i don’t know how to fill.

so now it will be settled and not…..???? its already take 12 days

if you claim online tds will be deducted without asking 15G/H ,but if you do offline it is needed to submit 15G/H if balance is more than 50k with working period less than 5 yrs,

If you again not submitted 15 G it may rejected again

for further help

Santosh kumar

Provident fund consultant

M-7430074346

W-8250489980

sir, on my epfo account only form 10c & 19 is available. there is no option for form 31 what can i do?

please help

Form 31 is for the advance of EPF which is available if you are still working and contributing to unexempted EPF.

Can you send the picture of your UAN->Online services to bemoneyaware@gmail.com

Are you working and contributing to EPF?

Are you contributing your EPF to exempted trust?

no i am not working but i already applied for form 19 and 10c it was failed for unknown reason please help

Hello,

Can i apply for advance pf second time if earliear i was apply and got settle too?

How many time we can raise cliam for advance pf for illness purpose?

For illness purpose you can take advance(partial withdrawal) from EPF Whenever required for treatment

Hello Sir,

I’ve quit my job and it’s been over two months since I’m not employed. I applied for PF withdrawal, my aadhaar ,pan, bank account and exit date everything is there in the portal but still my claim was rejected reason mentioned is “PL FURNISH FORM 15G H FOR TDS PURPOSE/K”.

Do I need to submit 15G?If yes then can i do it online? if no, then how can my claim be accepted?

Regards,

Arastu

HII SIR PLZ HELP

SIR MY PROBLEM IS EPF ADVANCE REQUEST 14/07/2018 PORTAL BUT NOT CLEAR ADVANCE EPF BALENCE PLZ MY UAN NUMBER IS 100751860031 AND THE ERROR THIS EPF UNDER PROCESS MY NAME IS VIPIN KUMAR MY ADD. WARD NO 4 DINESHPUR UDHAM SINGH NAGAR UTTARAKHAND

Sorry to hear about it. Typically EPFO requests are to be handled with 3-20 days.

You can raise the issue with EPFO social platforms: twitter.com/socialepfo facebook.com/socialepfo

You can raise the complaint with EPFO

Our article How to register EPF complaint at EPF Grievance website online explains the process in detail.

Wait for a week for a reply.

If that doesn’t work then

You can visit the Regional EPFO office and talk to them.

Our article How to find your employer’s EPFO office and EPFO office Phone Numbers explains it in detail.

My pf advance was settled but not credited to my account it was settled few days back

Reply

Can you tell me how much amount I can take as pf advance/loan?

Depends on reason for withdrawal. You can check our article EPF Partial Withdrawal or Advance: Process, Form, How much for more details.

Thanks for the reply. I have withdrawn epf advance. Can I return it after 2 or 3 months? Is it possible?

Hello Sir,

I’ve quit my job and it’s been over two months since I’m not employed. I applied for PF withdrawal, my aadhaar ,pan, bank account and exit date everything is there in the portal but still my claim was rejected reason mentioned is “SUBMIT 15G/OK”.

Do I need to submit 15G?If yes then can i do it online? if no, then how can my claim be accepted?

Regards,

Shubham

Hi Sir,

Greetings!!!

I have some queries related to EPF withdrawal. Looking forward for your support on the same.

I am currently employed in abroad.

I worked for less than 5 years in the last company and its been more than 60 days since I resigned from the company in India.

In total I have worked for 10 years in India i.e., did PF contribution for 10 years.

But I have breaks in between where there was no PF contribution done from my side.

Due to the breaks I couldn’t do PF contribution ‘continuously’ for 5 years.

1) Income tax on PF withdrawal is applicable for me (due to breaks)?

If yes, what will be the income tax percentage(10% or 20% or 30%)?

2) After how many months of resigning(no PF contribution) EPF interest calculation will be stopped?

Appreciate your response in this subject.

Hello Viki,

You should be having UAN.

Did you transfer old EPF account to new one?

Does it show up in your View->Service Details (Can you send snapshot of UAN and passbook to our email id)

if you have transferred then your total contribution would be more than 5 years so you can happily withdraw without paying any tax.

EPF interest will not stop.

But if you are not contributing then EPF interest will be taxable.

Hi,

I have put a part PF withdrawal request last week from 31 (construction of house as only visible at the time of submission).There was no any kind of eligibility OR proofs asked, will they come up with the same post withdrawal?

Also i had withdrawn PF last year April 2017 for renovation of house so will my current request be considered?

Regards,

Sachin.

No EPFO has done away with the proofs.

They trust you to use your own money judiciously.

But you can withdraw Only Once for either the construction or purchase of house or repayment of housing loan

Thanks for ur valuable reply. I had withdrawn for home renovation last year so i guess it was different category than what you specified (construction or purchase of house or repayment of housing loan)

Can u clarify ?

It seems for the house so it depends on interpretation and Regional EPFO.

Sir why don’t you apply.

Let’s see what happens.

If it gets accepted well and good.

Thank you so much for ur reply!

Hi,

My request has been accepted & disbursed, however they did not release 90% of total (employee & employer).

Can i go again & submit request for another reason? will it be accepted as i am applying second time within a year.

Regards,

Sachin.

Partial withdrawal is always on the employee’s contribution, Never on employer’s.

For what did you raise the request?

I had raised for construction of house & got approved, they disbursed 75%(employee+employer) of total contribution.

As said earlier, can i submit request for another reason now, will they consider as i am applying for the second time within a year.

Sachin.

Hi,

I have put a request for PF withdrawal online form 31 (construction of house as only visible while submitting claim) this month, there was no documentation required. Will they ask in future for any proof of construction?

Also i had made withdrawal from PF for renovation of house last year April 2017, will they consider my current request.

Regards,

Sachin.

Hi , I have completed 5 years and 11 months in the same company. I want to withdraw PF Partially due to some reasons . Please confirm if any proofs need to be submitted on the site and Am I eligible for the Partial withdrawal of PF online. However I am in urgent need of funds. Please confirm.

No proof need to be submitted.

you can partially withdraw from you EPF while in service for repaying the housing loan, Marriage, Treatment, subject to prescribed conditions.

Please try it and see if it works for you.

Hi Seema, were u able to apply for the partial withdrawal? My question is when you submit your request online using portal do you still need to send “Composite form to EPFO office via courier?”

Please reply

Thanks,

Vivek

No Vivek, you DON’T need to send the composite form to EPFO via courier.

Online application is good enough.

my pf setall amount 81551.00rs

show in pf portal but account me 73399.00rsaaya hai jab no pan update hai luv me ye no 8000 kis ka kata hai ye kaise milega aur 15G online kaise submit karu offline knha submit hoga

10% TDS has been deducted.

Did you work for less than 5 years and then withdrew the EPF.

Please check your Form 26AS?

Can you send snapshot of your Form 26AS to bemoneyaware@gmail.com?

CAN I FILL BOTH FORM 19 & 10C AT A TIME OF EPFO PORTAL AND WITHDRAWAL THE BOTH AMOUNT AFTER THE RESIGNED WHEN I COMPLETED MY JOB 4 YEARS AFTER.

Yes you can withdraw online if you meet following conditions

You should not be working at the time of submission of the claim in an establishment that is covered under the Employees’ Provident Fund and Miscellaneous Provisions Act, 1952.

A claim for the purpose of final settlement can be submitted only after 2 months of the last date of employment.

Your Aadhaar and PAN Verified

Your previous employer should have updated your Service History with Date of Exit(DOE) of EPF and EPS.

Please verify your bank account number. As money is transferred to your bank account.

informative post!

Hi Bemoneyaware,

1. I have worked for 2 companies. The passbook has all the PF contributions from both the companies. However, only the latest company’s details are shown in the “Service History”. All details (DOJ/DOE) related to that are correct.

How can i add the details of my previous company as well?

2. Its been more than 2 months since i left my company. I want to withdraw full PF amount. I filled the online form (19), but it got rejected. i called the helpline, they said form 15G has to be filled and submitted (offline).

However, It seems that form 15G can not be submitted if the total interest income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2016-17. in my case, my total interest income exceeds Rs 2.5L, so i cannot fill form 15G.

How do i then completely withdraw my PF balance

Request your solution on the same.

Thank you.

Max you have 2 PF accounts, 2 passbooks or 1 passbook?

Did you not transfer your old PF account?

It is difficult to say without digging a little

Can you send snapshots/pictures of your UAN account the Service History and passbooks to our email id bemoneyaware@gmail.com?

Coming to withdrawal, Have you worked more than 5 years? PF withdrawal before 5 years is taxable.

EPFO is asking for FOrm 15G anyways. One should not fill the form 15G but well if you want to withdraw then there is no way out.

You would have to submit Form 15G which cannot be done online. You would have to go offline mode.

Hi dude,

This is regarding the withdraw options. I quit my job one year back. While I claim amount from my PF account, it shows only form 31 (PF advance) option. Rest of the options (form 10c and 19) are missing. Pls help me out.

Please check that employer has entered Date of Exit.

If he hasn’t then as per EPFO you are still working and hence cannot withdraw.

We have updated the article with Date of Exit, Bank details option.

Hi Bemoneyaware,

I’m Sathish from Bangalore. Please advise on the below,

I have 3 PF accounts linked to 1 UAN.

1. My first PF details : 2002 TO 2015 – 13 yrs

Here, I have withdrawn my PF and Pension fund is still unclaimed (was not allowed to withdrawn coz i have completed 9.6 yrs).

2. My second PF details : March 2015 to Aug 2017

Here, I have not withdrawn my EPF as well as EPS.

3. My third PF details: Aug 2017 to November 2017.

Here, I have not withdrawn my EPF as well as EPS.

The above first and second PF accounts are transferred to my third PF account currently. There is no even a single day gap in service.

My questions are :

1. Will my First PF account’s pension fund will be transferred to my Third PF account or Should I approach PF department for Scheme certificate.

2. Since I have worked for less 6 months in my recent company (third pf account), will I be able to withdraw pension fund transferred from my Second PF account ?

3. Since I have not completed 5 yrs in recent company, there will be 10% TDS on PF withdrawal, but can I claim it back by any means ? someone TDS is not deducted if Form 15G/Form 15H is submitted. How to file this.

Request your solution on the same.

Thank you.

Hello,

The PF accounts have been transferred and your latest passbook shows the transfer details as shown in the image in the article How to Transfer EPF Online on changing jobs

if all your PF accounts are merged then

1. You can withdraw your EPF without paying any TDS or tax as you have contributed for more than 5 years.

2. You cannot withdraw from EPS as total number of years of contribution to EPF is more than 9.6 years.

You can get the pension after the age of 58. Reduced pension can be withdrawn after the age of 50

You can also defer your pension till the age of 60. If you opt for deferment, the pension would increase by 4% for every deferred year.

Hi,

I want to know if i can withdraw the pension funds as well from my EPF balance as advance withdrawal, with my share and employer share?

Can I withdraw complete amount?

No EPF Withdrawal is from employee share only.

Hello,

I worked in previous company for 2 years 6 months and I’m unemployed from past 4 months. I’m thinking to withdraw my money. I have linked aadhar, bank account but I’m unable to link pan. Because of the initial expansion in my name. I heard that in pf office. You can withdraw pf online. Since your pf balance is less than 50000. No pan is required for this. My employee contribution is 26k, employer contribution is 8k and pension contribution is 17k. 26k+8k =34k. They also said that pension contribution is a non taxable amount as well.

Still in confusion. Please help me to withdraw balance online.

Try withdrawing online. If it goes through nothing like it.

Dear sir I have applied partial pf from online portal but I have not submitted pan card it’s taxable amount

I want to apply for partial PF withdrawal , I’ve got pf transfer request online and now how can I go ahead with PF withdrawal online ?

Partial PF withdrawal is possible for a reason and depends on the number of years you have worked.

Ex:

EPF advance for treatment of illness

An employee can withdraw up to 6 months of his basic and DA or his/her entire contribution, whichever is least for treatment of his/her own illness or treatment of family members. No specific membership period is required for this purpose.

EPF advance for marriage

For purpose of marriage of self/ daughter/son/ brother/sister an EPFO member can withdraw 50 percent of his share with interest. He/she must be an EPFO member for at least 7 years to apply for this advance.

Please help me .before I have 2 UAN and 2 PF account ,I transferred to one account and one UAN only. i joined at 5/10/2011 and leave at 31/11/2015 and new one is 1/11/2015 but same company only before ASSYSTEM INDIA PVT LTD and now ASSYSTEM TECHNOLOGIES ..but showing 1/11/2015 ,I want partial withdraw ,am not able to do in online showing (not 5years ).

in form 31 date of joining showing recent that is 1/11/2015 ,

for housing construction service is 5 years but my service more than a 6years ..please help me out

Sir, I want withdrawal pf according to form 31 and after two months after completing five years of service,I want apply pf for home renovation . Is it possible???

Sir,

I want to draw your attention that presently I am searching a job. I joined the EPFO in the year 2010 & continue Jan’2018. Presently I resigned my current job and searching the new job. I want to withdraw full amount of PF along with my Employer contribution of pension fund. Is it possible to withdraw the full amount at present. I have the UAN No & KYC is linked with PF. Please suggest what is the procedure.

Best wishes for the new job.

If you are planning to join a new company we would recommend you not to withdraw EPFO.

If you still want to withdraw then you should be unemployed for 2 months

If you have UAN and Aadhaar and PAN are verified you can withdraw online.

If you have any questions do let us know.

Very useful information.I have resigned my job.Shall I partially withdraw my PF using form 19.Is it possible?If it is partially withdrawn when can i do my next withdrawal?

You can partially withdraw from you EPF while in service for repaying the housing loan, Marriage, Treatment, subject to prescribed conditions.

EPF is meant for your retirement So, EPF Withdrawals should be your last resort. In earlier Hindi movies people used to withdraw money from EPF for marriage of daughter . In movie Ferrari ki saawari (2012), where Sharman Joshi wanted to apply to EPF to send his son to a cricket coaching camp at Lords, London but now there are other options.

You can withdraw from EPF if you are not employed after 2 months of leaving your job.

If you are planning to join a new job then you should get it transferred.

Check that all details in UAN website are correct and there are no missing details. Your Father’s name, Relationship, Gender

Your PAN and Aadhaar are verfied.

I am trying for Full PF settlement through online Form 19. On selecting the option, it only asks me to fill the address on the form and then on the same form there is a small box to check for OTP generation but nothing for ‘Claim form PDF generation’. Should it not show me ‘Generate Claim PDF’ option to generate ‘Claim form’ first for my review before I allow for OTP generation or will i get the claim form generation option after OTP is authenticated?

Also I completed more than 10 years of service and am under 50 years of age. Is it right that i can not withdraw EPS online for that reason? If yes, then what is the process to get ‘Scheme certificate’ ? Where should the form, if any, be submitted? Will my employer have a role to play in getting Scheme certificate?

I ALREADY APPLY FORM NO 19 I GOT THE HALF AMOUNT AND I WENT TO MY OFFICE AND THEY TOLD ME THAT THE REMAINING BALANCE IS YOUR PENSION ACCOUNT HOW TO WITHDRAWAL MY PENSION AMOUNT

How many years have you contributed to PF.

If its less than 10 years then you can withdraw the Pension or EPS amount.

To withdraw EPS you need to submit Form 10C

i want to claim my pf with final settlement but form 19 not showing only form 31 option available what to do

Its because you are still working. If there is no DOE in EPF and EPS you cannot withdraw your epf as shown in the image below.

The same is happening with me I have left my company on may 2017 but while I do claim online only one option is appearing form no 31 for pf advanced

But I want to full settlement what should I do

all my kyc have been verified my doe epf is not showing ( blank) my ex employer is delaying in filling the doe epf date what shall i do please suggest

If service is less than 5 years then how much tax is deducted at the time of pf settlement?

The epfo is not showing that aadhar is linked and after writing to grievance, they r saying no info.

We have the UAN and completed all link with aadhar , currently not with employer, left job 7 months ago.

Employer says they have deposited PF to EPFO

What should i do?

Please visit the regional EPFO and submit the details. If you can mail your PF number we can help you in finding your EPFO office.

Or you can find the Regional EPFO office by clicking on appropriate Zonal EPFO Office under Contact us on EPFO website or click here

Can you login to your UAN account? Is your UAN activated? Can you check the Passbook?

Do you have proof in terms of payslip from your employer?

There is no option online for partial withdrawal or advance using form 31 against “repayment of home loan”? Does this mean form 31 need to be submitted manually in pf office?

hi bemoneyaware,

my previous company maintains the pf in a trust,even then can i apply for pf withdrawal online through the above procedure.

thanks,

Sriram V

No, you have to submit it to the EPF Trust of your company.

Pan not verified. but all details are correct and it is linked with aadhar. please let me how can i fix it.

online pf kaise nikale

If you have activated your UAN and seeded KYC (Aadhaar) with EPFO you will be able to apply for PF Final Settlement.

Steps, as explained in the article are

Login to the member interface using UAN credentials.

Check that KYC and service shown against his UAN are correct.

Select Online Services. Select the claim(Form 31, 19 & 10C).

If you are withdrawing EPF then submit both the Forms, Form 19 and 10C.(You would have to repeat the process twice)

My query is relating to my moms eps withdrawal.My mom & dad are staying separately & we don’t know about his whereabouts.My mom is retired and now we are trying for her employees pension fund withdrawal…In form 10d,they have asked to submit age proofs and photos of family members(including spouse).We can submit just a copy of marriage certificate where age of my dad is mentioned apart from that we don’t have his photos or any other id proofs,will this be sufficient for eps withdrawal form?Will the form be accepted? Please guide.

Wonderful post!

Thanks a lot for sharing this information..

Wonderful post! We are linking to this great post on our website. Keep up the great writing.|

New account