Outlook money May edition 2018 cover story is about Teaching the Kids about Money or as they say Catch Them Young. For Rs 50 only you would get some great information on how parents are imparting money lessons to their kids, the importance of teaching money to kids, great articles by experts, also about Bank account for children and Child-specific Mutual Funds and Life Insurance Plans.

Table of Contents

What does Outlook Money Teach Them Young cover

- Editorial by Malini Bhupta on the relationship of Money with kids and how Parents play a role in it.

- Priya Nair’s cover story, Catch them Young, which covers how different parents are imparting money lessons to their kids and How to teach Children Good money habits.

- Saving for your Child’s future, as Education costs are rising and Planning Early is the key.

- Bank Account for Juniors: Banks offer special saving accounts for kids which give them a headstart on the concept of saving, managing money and banking

- Children specific Mutual Funds, Life Insurance Plans

- Gaurav Mashruwala, financial advisor and author of Yogic Wealth, how he raised his 16-year-old daughter Sanaa as a money savvy kid.

- Deepali Sen, author of the book Why Greed is Great, on Teaching Kids how to Spend and save effectively, article here.

- Lata Dyaram, Department of Management Studies IIT Chennai, on Shaping the Right attitude towards money. As she says we can’t ignore the fact that we are a product of parents approach to money, in either embracing it or rejecting it.

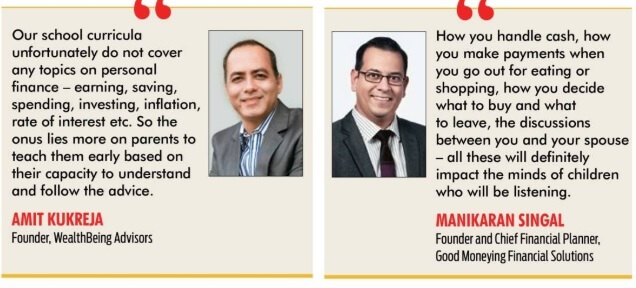

Outlook money Teach them Young Quotes

Editorial in Outlook Money Teach Them Young

From the Editorial page of the Magazine by Malini Bhupta,

As the editor of the Magazine said, “Money is a complex subject and so are is our relationship with it”. For some, money is merely means to an end, while for others it is often an end in itself. A couple of months ago, I was sitting with Gaurav Mashruwala, financial advisor and author of Yogic Wealth, and discussing how our behaviour and biases impact our financial health. What Mashruwala said was very interesting. He believes that our relationship with money is determined at a very early age. Just as children tend to learn from their parents – all things good and bad – they also tend to pick up money habits from them. And habits formed back in our childhood are hard to break as adults.

Interestingly, parents believe that children are too young to discuss or learn money management. In fact. a former landlord of mine kept his assets and investments a secret from his son because he believed his son did not have any ‘money sense’ and would spend it all on frivolous things if he knew just how rich his father was. Someday these ‘children will inherit their parents’ money and then they will find it challenging to deal with the inherited wealth.

Even today, most people don’t believe in paying for professional guidance and prefer to rely on friends and family for advice. It is for this reason that our cover story for this month addresses the importance of financial literacy among children. By exposing kids to the purchasing power of money, we are leaving them with half-knowledge, which can be very dangerous. It is essential for children to learn the importance of saving, earning, and spending. And this can be done in fun ways too, say the experts. We also have interesting case studies of parents and the money lessons they give their children.

Priya Nair, who put the cover story together, says. “While it’s important to teach children about saving and spending money wisely, there are no fixed rules or methods. However, parents should follow a balanced and systematic approach: Some parents feel that instead of giving money to children, setting an example by leading a disciplined and frugal life is the right way to teach them the value of money. Yet other parents reward their children with cash or treats for good behaviour to teach them concepts like earning and saving. Indeed, such life lessons have to be taught. What route parents choose to follow would depend on their comfort levels and individual preferences.

Outlook Money cover story on how to teach kids about money

Deepali Sen on Teaching Kids how to Spend and Save Effectively

Outlook Money Children Save and Spend

Cover Story: How are parents teaching their children about money?

Old habits die hard. And when it comes to money, what we learn about it in childhood has a deep bearing on our relationship with it in our adult life. Most parents today unflinchingly expose their children to the power of spending but keep other important aspects of earning and saving for adulthood. This creates an unrealistic impression in the minds of young children, who believe that money is something that magically comes out of ATMs.

Financially savvy parents tend to teach their children important aspects of money -including earning and saving from an early age – using innovative techniques. For instance, renowned financial advisor Gaurav Mashruwala started inculcating financial awareness in his daughter Sanaa when she was very young. He helped her understand the power of saving and building a corpus through a transparent chocolate bank – each time Sanaa took chocolates out of the ‘bank’, she saw the stock deplete. Today, as a 16-year-old, she’s the family bookkeeper when they travel. She maintains an expense diary that helps her track her outflows and inflows (pocket money).

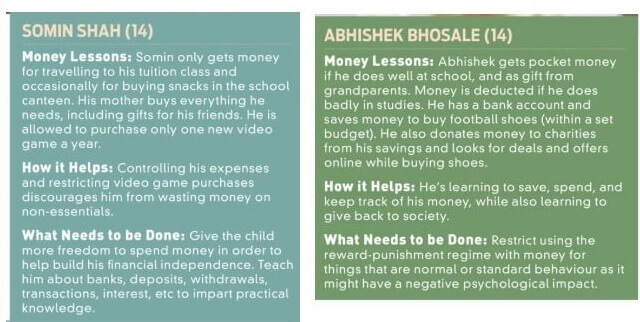

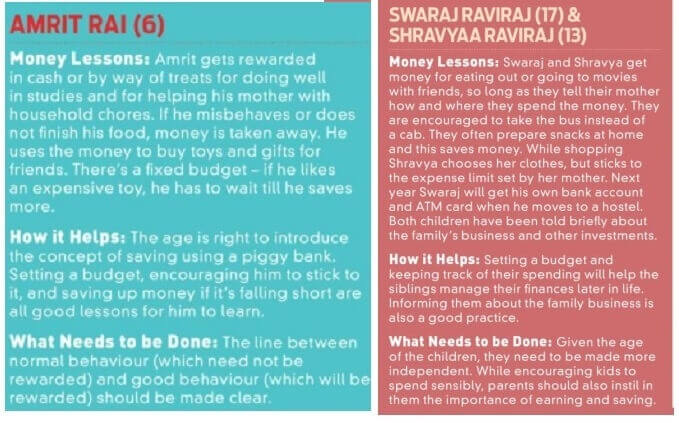

Most of us had a piggy bank while growing up and the financial discipline (or the lack of it) that we displayed then shows up even in our adult life. It is for this reason that some people like to live on borrowed money while others are more prudent. Outlook Money spoke to some families to see what they are doing right and what they can do differently.

Some parents feel that instead of giving money to children, setting an example by leading a disciplined and frugal life is the right way to teach them the value of money.

Some parents reward children with cash or treats for good behaviour to teach them concepts like earning and saving.

However, as the psychologist we spoke to says, there is no one right or wrong. These life lessons have to be taught. what route parents choose to follow would depend on their comfort and individual preferences.

While it’s important to teach children about saving and spending money wisely, there are fixed rules or methods. However, parents should follow a balanced and systematic approach, says Priya Nair

How are parents teaching their children about Money

How are parents teaching their children about Money

How to teach Children Good money habits

How to teach Children Good money habits

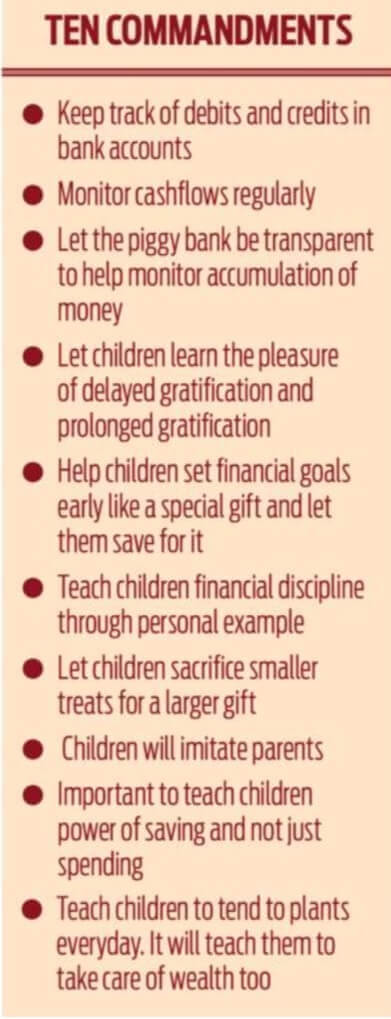

Ten Commandments to teach children about money

Gaurav Mashruwala, financial advisor and author of Yogic Wealth, how he raised his 16-year-old daughter Sanaa as a money savvy kid. As per him, the 10 commandments to teach kids about money are as follows.

Ten Commandments to teach children about money

So how are you raising your kids? What Good or Bad Money lessons you learnt from your parents? What Good or Bad money lessons are you giving to your children.