If there are no nominees then banks, Mutual funds, PPF account, Demat accounts, Insurance Policies require lots of additional documents such as a will, legal heir certificate, no-objection certificate from other legal heirs etc.

Note though a nominee is an important person, he or she has no rights over the money or assets unless that is specified under the will. So nominee is a mere custodian of the assets. (S)He is a contact point for the investments. So in the event of a person’s death, a bank/mutual fund could get in touch with the nominee for further instructions to act on the account. At the time of claiming the savings, the nominee will have to give a proof of his identity to the relevant authority.

Table of Contents

Wife struggles to get Husband’s money because of missing Nomination, Will

Delhi-based Padma Malhotra and her three children have been struggling to access what is rightfully theirs. They have been unable to lay hands on the financial assets of Malhotra’s husband, who passed away in January. The emotional trauma of losing him was followed by despair at not being able to withdraw the money lying in his bank account or access his other investments. “My husband didn’t leave a will and had not named a nominee,” she says ruefully. Her husband has a substantial amount of money in his bank account, but it cannot be withdrawn till the bank is satisfied that there are no other claimants to these funds.

“We have submitted copies of the death certificate and our ration card as well as a letter of indemnity, but the bank is demanding more documents. I don’t know how long it will be before we can use the money,” says the Padma. This upheaval has been sparked by an act of omission on the part of Padma’s husband – no Survivorship mandate, no Nominee, no Will. Options available for a smooth transition to your family are Survivorship, nomination and writing a will. Let’s go into detail as to what they mean

Who can operate the Joint Account in Investments

Investment can be made by an individual in his own name, single account or by two or more individuals jointly, called as the joint account. There are different types of joint account relationships such as:

- JOINT: In this type of account every transaction will need the signatures of all holders.

- EITHER OR SURVIVOR: In this type of joint account either of them can operate the account and in the case of the death of one of the depositors, the other can continue or the final balance in the account along with all interests (as applicable at the time of closure) will be paid to the survivor.

- ANYONE OR SURVIVOR: In This type of account is normally held when more than two individuals start an account jointly. Here, any of the depositors can operate the account at a time and in case if any of the depositors expire, the others can continue the account and if required, the final balance along with interest will be paid to any of the survivor/s as requested.

- FORMER OR SURVIVOR: In this type of joint account, only the first account holder can operate the account. The second depositor gets the right only on the death of the first after undergoing some basic formalities like submission of proof of death etc.

- LATTER OR SURVIVOR: This is similar to the former or survivor, but the difference is that, in this type of account, only the second account holder (latter) can operate the account. The survivor or the former account holder gets access to the fund only on the death of the latter and on producing the proof for the same.

This joint relationship is usually made while applying for the investment. Only in the case of bank accounts, one can add joint holders later. If not mentioned in an application for investments such as bank accounts, demat account, shares, bonds or mutual funds, the account may be marked as ‘joint‘ by default and you must make sure this is indeed the intention.

What is a Nomination?

A nomination is the process of appointing a person to take care of your assets in the event of your death. For all investments except company bonds and equity, nomination does not provide ownership of your assets. The nominee will only be the custodian of the asset till it is given to its beneficiary.

In a case that came up before the Supreme Court in 1983, a life insurance policyholder died without writing a will, leaving behind his mother, wife and son. His wife was the nominee of the insurance policy, but his mother and his son filed petitions, both demanding a one-third share in the insurance amount. The court ruled in their favour, stating that the nomination only indicates that the person is authorised to receive the amount but is not the sole owner of that sum.

What is Will?

A will is an official statement prepared by a person that describes how they want their assets to be divided among their heirs after their death. Preparing a clear will ensures that the heirs are left in no doubt about their inheritance. Quoting from jagoinvestor.com:How to make a will in India and its importance ? :

Ajay was 58 years old who died recently in an accident. As his children were settled, he wanted to make sure that his wife is the sole owner of all the monetary assets. This includes his insurance policy and mutual funds. So during his lifetime, he nominated his wife as a nominee in his term insurance policy and mutual funds investments. However, after Ajay’s death things didn’t turn up the way he wanted. The reason being Ajay did not leave a will. Though his wife was the nominee in all his movable assets, as per the law, his wife, along with children, were the legal heirs and all of them had equal right to Ajay’s assets.

One simple step which could have saved the situation was that Ajay should have made a will which clearly stated that only his wife was entitled to get all the money and not his children.

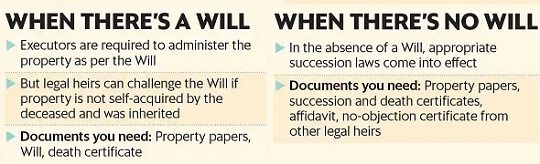

A will is a legal document that clearly demarcates what should go to whom and bypasses all succession laws. It reduces the chances of dispute and lessens emotional distress. The image below shows what documents you require when there is a will or there is no Will.

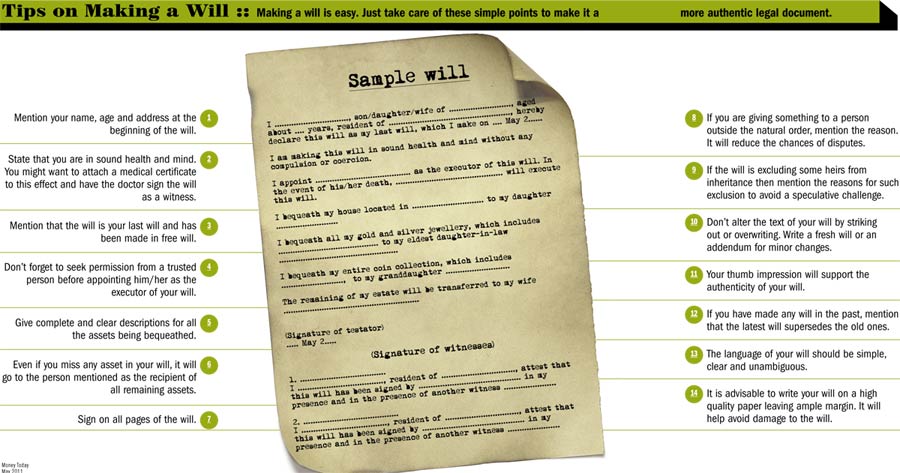

If you write your will on a piece of paper and get two witnesses to sign it, it is more than enough. A sample will from our article, Will: What is Will, is shown below.

Nomination in Shares/Stocks

But that is not the case in shares as Companies Act is applicable in those cases. Infact in the case of shares nomination always supersedes the will.

For instance, if you nominate your daughter as the nominee for the shares of a particular company held by you, your daughter will be the final beneficiary of the investment after your death. It does not matter even if the will states your son will be the beneficiary of all your investments.

OR

Harsha had married Nitin in December 2004 and Nitin passed away in 2007. A year later Harsha moved the HC seeking to sell the shares in Nitin’s demat account. It was found that a year before his death Nitin had nominated his nephew in respect of the shares. Harsha’s lawyers argued that she was entitled to the shares as she was her late husband’s heir and legal representative. The court said that Harsha Kokate would have no rights over the shares owned by her deceased husband. Justice Roshan Dalvi said ” The Companies Act sets out that the nomination has to be made during the lifetime of the holder, according to legal procedures. If that procedure is followed, the nominee would become entitled to all the rights in the shares to the exclusion of all other persons (following the death of the shareholder),”

Difference between Will and Nomination

The nominee has the right to receive and hold the money, ex: Amount of Insurance policy after death of the person, but he does not own the funds. If there is a will of a person who has died, the money/assets received will be distributed as per the will.

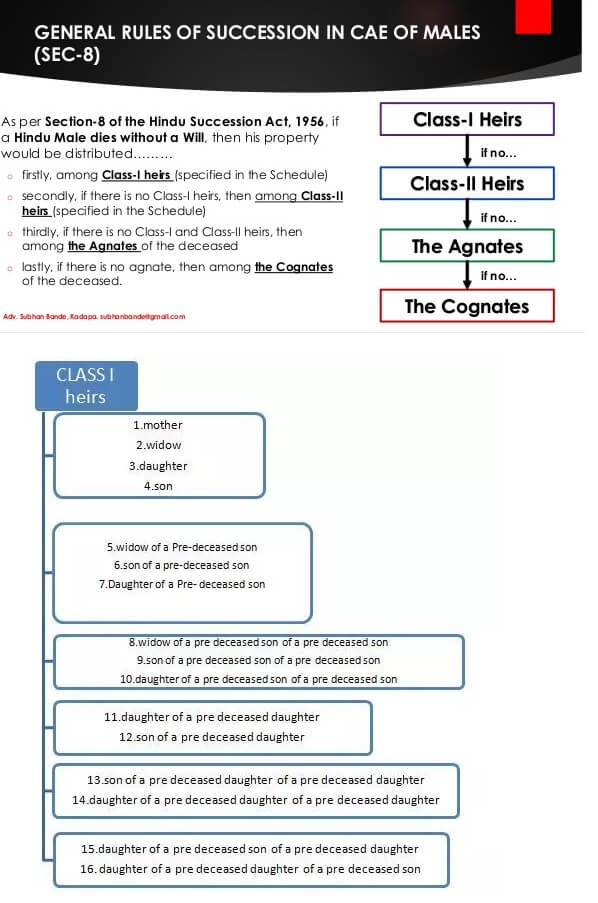

If the person has no Will, then money/ funds/assets will be distributed as per Indian Succession Acts which is based on the religion. Example of What happens when a Hindu Male dies without a will, from our article Inheritance Rights in India

Ref: Nominee, not heir, to get shares after holder’s death: HC at economictimes.com

Let us again clarify, Though a nominee is an important person, he or she has no rights over the money or assets unless that is specified under the will or the nominee happens to inherit the money. So as such a nominee is a mere custodian of the assets. (S)He is a contact point for the investments. So in the event of a person’s death, a bank/mutual fund could get in touch with the nominee for further instructions to act on the account. At the time of claiming the savings, the nominee will have to give a proof of his identity to the relevant authority.

If nominees have been appointed, they can produce basic documents, such as a death certificate, to access the funds. A claimant who is not a nominee would have to produce a host of additional documents such as a will, legal heirship certificate, no-objection certificate from other legal heirs, among others. (which we will discuss in another post)

Do you need a Will or Nomination?

Do we need Nomination, can one just make a WILL as WILL super-cedes Nomination. Best is to have both Nomination and WILL for the smooth transfer of your Assets/Funds after death. Transferring of Funds/Assets is basically a 2 step process

Step 1: Nomination ensures a smooth transfer of funds from Bank or Financial Institution to the Nominee of the deceased person’s account.

Step 2: WILL ensures the smooth transfer of funds/assets to Legal Heir as per the wish of the person

The person can be both Nominee and also get money as per Will. Or Person can be only a Nominee.

When you nominate someone for your bank account, insurance policies, or shares held by you, it gives the bank/ insurer/company a convenient way to determine what to do with the balance in your account, the proceeds of your insurance policy and your shares upon your death. Remember nomination is introduced solely for the purpose of simplifying the procedure for settlement of claims of deceased depositors and nomination facility does not take away the rights of legal heirs on the estate of the deceased.

Will is not a substitute for nomination and neither is a nomination a substitute for making a Will. The ideal situation is where the name of the nominee and the beneficiary under the Will to whom you give the property as one and the same person.

Difference between NOMINEE and LEGAL HEIR

| Basis | NOMINEE | LEGAL HEIR |

|---|---|---|

| Meaning | Nominee is a person nominated to act as a custodian of the assets,

in the event of the death of the person who nominated |

Legal Heir refers to a successor,

who would be the final owner of assets. |

| Role | Trustee | Beneficiary |

| Indicates | one who is authorized to receive the amount or asset on the death of the person who nominated | Owns the amount or asset. |

| Determined by | Nomination | Will or Provisions of succession law |

Some points to remember about Nomination

Assigning the nominee in the beginning: During filling the form for investment/opening an account one can assign nominees. Usually, there is a column on the nomination in an application form for opening a bank account or starting an investment.

Our article How to Nominate in Bank Account, Mutual Funds covers Nomination details in Bank Accounts and Mutual Funds.

Missed it during applying – Can Do it Later: If you did not fill up the details in the application form while investing, you can still update the nominee details later by filling the appropriate form.

Minor: A minor can be a nominee provided the guardian is specified in the nomination form.

Multiple Nominees: Some investments allow more than one nominee and the percentage of share that each would be entitled to.

Joint Holder: The nomination form has to be filled up by all joint holders, irrespective of the mode of operation of the investment.

Can Change the Nominee: Nothing is fixed. You can change the nominee whenever you want. That too, any number of times. You don’t even have to inform the earlier nominee about the change.

Only a trustee: Nominee is a mere custodian of the assets except in case of stocks. To ensure the nominee becomes the final beneficiary, you have to ensure there is a will to bequeath your wealth in a hassle-free manner.

For more details one can read following articles:

Will your Nominee get the money on your death ? jagoivestor.com

Will your Nominee enjoy your investments after your life? at finvin.in

- How to Nominate in Bank Account, Mutual Funds

- Paper Work A Necessary Headache

- Inheritance Rights in India

It might seem morbid discussing things when we are no more but how many of us realize the importance of doing so? Have you done the right paperwork? What were your assumptions about how your investments would be passed on? Did you know about Survivorship Mandate/Nomination/Will, the difference between Will and nomination?

Trackbacks/Pingbacks