Parents want to give the best, especially education to their children. Education costs, especially higher education costs are shooting up. If you don’t plan well, you could fall way short of the required amount when your kid is ready for college. How to invest for child’s college or higher education? Should parents go for Mutual funds, Fixed Deposit, insurance child plan, recurring deposit? Or Is ULIP the best child education plan? There are 3 key elements to saving for child higher education.

What will college cost?

How much you can save?

How many years you have?

Table of Contents

Options to Invest for College or higher education of the child

There are various ways through which one can save for a child’s education. These include SIPs, Life Insurance, Mutual Funds, Exchange Traded funds (ETFs), ULIPs, you need to build a portfolio with various investments designed to meet goals with the different time frame depending on your future needs, income, and requirements.

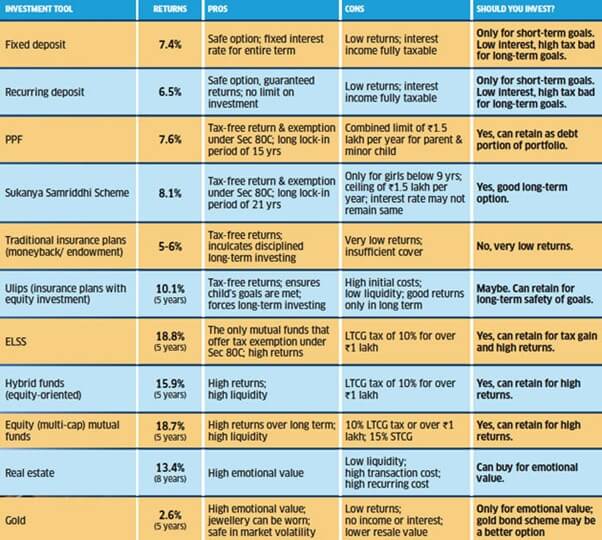

The image below lists the various investment options, their pros and cons.

How much does parent need to save for a child’s college education?

Let’s assume your child is of 2 years currently and you assume he/she will start their higher education at 23. Taking an average cost of Rs 15,00,000 for a master’s degree, you will be required to have a corpus of Rs 62,10,844 by the time your child starts thinking of colleges, keeping inflation of 7% in mind.

Cost of Undergraduate College Education

In Karnataka, the annual tuition fees for MBBS seats for the 2018-19 academic year, was for government medical colleges ₹50,000, for government quota in private medical colleges ₹97,350 and in institution quota seats in private medical colleges ₹6.83 lakh.

IIT fees range from Rs. 8 lakhs to Rs. 10 lakhs for general category students for the full course.

In Ashoka University the four-year degree course will cost over Rs 35 lakh. This is among the costliest undergraduate programmes in the liberal arts in India.

IIMs known for providing flagship Management courses in the country are hiking fees over 20% each year. IIM Ahmedabad is charging fees of 25 lakhs in 2019 compared to last year’s fees of 22 lakhs.

So, calculate your goal accordingly, and if you have more than one child, calculate for both. Make sure your investments project enough surplus to take care of your child’s education and your other needs in the future.

Start Early, Less Investment Amount for Child College

Starting early requires a smaller amount for investment and hence puts a lesser burden on your finances. For example, if you want to save Rs 25 lakh for your child education in 15 years. if you start now you need to save only Rs 5,004 a month. But the amount increases to 9,915/month if you start six years later. And if you start 12 years later, the required amount jumps to Rs 23,875/month, as shown in the image below

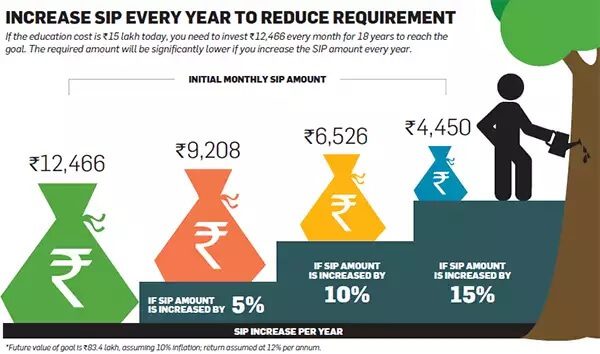

Also, plan to increase the investment amount over a period of time as it will help you to reach your goal faster.

Investing for child College/higher education depends on his age

The investment options before a parent depend on the age of the child. The investment choices and strategy will be different for a parent whose child is 3-4 years old, than for a parent whose child is 15-16 years old. The image below shows the options available for a parent.

One needs to have a portfolio which mix of investment options and invest as per the risk-reward profile. So, for short-term have more debt than equity, and for long-term, have a higher exposure to equity

For example, you can have three buckets based on risk.

- Low risk: fixed deposits, PF, gold and Sukanya Samriddhi Scheme,

- Medium risk: mutual funds

- High-risk: direct investing in stocks

- Emotional: Real estate and gold should also be picked only for emotional value. Many people choose Real estate for their retirement

If your child is 3-4 years old, you have 13-14 years to save and you can take a calculated risk to tide over the volatility of the stock market. You can have a higher percentage in equity by investing in Index Funds or ETF or Mutual Funds through SIPs. For debt part, you can invest in Sukanya Samridhi account for the girl child or PPF

When a child is 8-12 years old, since you have only 5-9 years to save, the risk will have to be lowered. Many prefer to have 50% in stocks and 50% in debt at this stage. Instead of equity funds that invest the entire corpus in stocks, one can go for balanced funds that invest in a mix of stocks and bonds.

Monthly income plans (MIPs) from mutual funds can be a good alternative If your risk appetite is lower. These funds put only 15-20% of their corpus in equities and are therefore less volatile than equity or balanced funds but the returns are lower than those of equity funds

For parents of teen-aged children, the goal is near only 1-4 years away, so you cannot afford to take risks with the money accumulated for your child’s education. The investment strategy should focus on capital protection, the higher returns from equity is not worth the risk. A sudden collapse in the equity markets can upset your plans. The equity exposure at this stage should preferably be not more than 25%. For example, you started investing in a mix of mutual funds and bank deposits for your daughter college education almost 12 years ago. But now that the goal is just one year away, it is advisable to shift 85% to Fixed Deposits or Debt funds.

If you face a shortfall, don’t be tempted to dip into your retirement money to fill the gap. This could be a HUGE mistake. Your retirement has to be given priority over your child’s education. For your child can get an education loan but no one will give a loan for your retirement. You can take an education loan with the child as a co-borrower.

Insurance, Endowment/MoneyBack Child Plans

But what if something untoward happens to you? The dreams will be ruined, and the entire plan can crash. Life Insurance plan would help you to combat the difficult times by helping you to safeguard from the unforeseen situations.

Child plans are often suggested. As these plans are prefixed with ‘child’ it is tied to goal of parent i.e save for their children. It also acts as a psychological barrier for parents to redeem, sell or dip into these during the investing tenure. Insurance plans designed for the child do not usually insure the child but the parent who has a minor child to provide for.

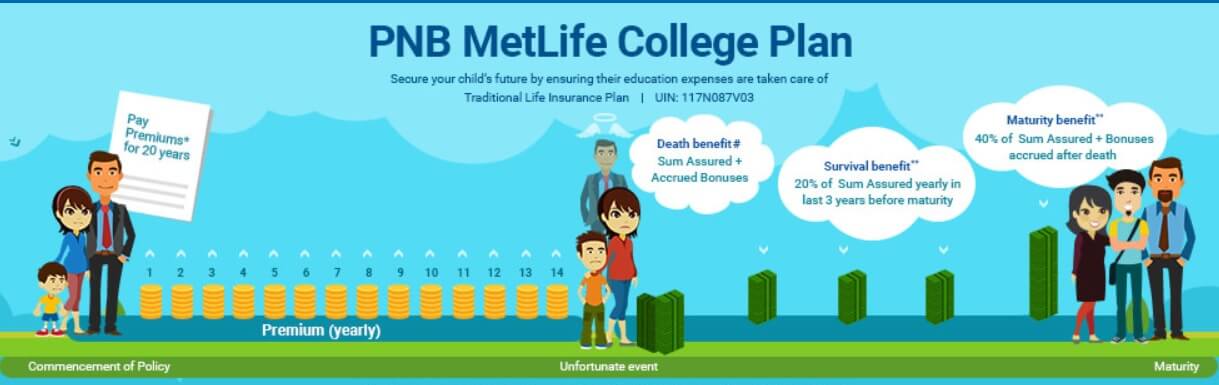

Child plans typically fall into three categories: traditional insurance plans (Endowment /Moneyback plan), Ulips and hybrid mutual funds.

Endowment/Moneyback plan is a life insurance policy which provides you with a combination of both i.e.: an insurance cover, as well as a savings plan. One pays a premium over a specific period of time.

- In the endowment plan, one gets a lump sum amount on policy maturity, if the policyholder survives the policy term.

- In Moneyback policies one gets the predefined amount in the last few years of the policy.

Endowment/Moneyback Child Plans plans work like regular endowment plans but are specifically tailored for a child’s future. Example of Endowment Plan is shown in the image below.

Just because the plan entails insurance in the event of death, make sure that the amount assured is sufficient and the premium is also manageable. It is better to have an alternate term plan to take care of higher insurance, so the money from this investment is used for the child’s education.

Review your Plan

It is also important to review the progress of your investment plan and make any changes. You should check every year if you need to step up your contribution towards the higher education kitty.

This article is not to frighten but to make parents aware of rising education cost. Start planning from today so that your child may not get deprived of the education which would eventually make his/her future. How are you preparing for your child’s education?

missed debt funds

A great post. Many of us do not have an idea about financial planning. This post may serve as a great tip.

Sir my DOB is 02/03/1957 I HAVE joined the bata India Ltd on 21/12/1980 and retired on 02/03/2017 my Basic salary was at the Time of Retirement RS 10000.00 per month please calculate my pension I have completed 58 years on 02/03/2015 please reply

With regards thinking you