After buying from the shop or online one needs to pay. The common payment methods are cash, debit cards, Credit cards, net banking, Digital wallets like PAYTM, Mobiqwik. When you have to pay to someone or some organization like a school, shop, you can pay using cash, cheque, demand drafts, Online banking, bank transfers like NEFT, IMPS, RTGS, phone and mobile payments. In this article we shall look Payment methods we use when we go shopping.

Table of Contents

Lets Go Shopping!

You went shopping with your parents. Your parents and you bought some things. Now to take these things home you need to pay. For example in the image below say you went to a toy shop and you bought the toy from the given ones below. How much was the bill? How will your parents or you pay?

Make bill for the toys you bought

Payment Method CASH

Cash remains the most commonly used payment type for everyday purchases and is simple to use, you hand over banknotes or coins. Cash is used every day for all types of transactions such as in shops, restaurants, coffee shops and pubs. It’s almost always used face-to-face and you can physically see the money being handed over.

Bank Notes are issued by the Central Bank of the country. In India, banknotes are issued by Reserve Bank of India or RBI.

RBI governor signature on the Indian note

Our articles

- What are Central Banks

, What is RBI? What do they do? discusses RBI in detail.

- About Rupee: Its name, Rupee Symbol, Countries discusses about Indian Rupee

- Coin: Anatomy, Indian coins, Motto, History, Mint Marks discusses coins of India

- Monuments on The Indian Notes: Konark Temple, Himalayas, Manglayan Mission discusses the Indian notes in detail.

Using cash avoids overspending. You can choose exactly how much you’re willing to spend and carry that amount with you, then stop spending when you are out of cash. But It’s not a good idea to carry large amounts of cash around.

Where does the Cash come from? You must have seen people withdrawing money from ATM using the bank debit card or going to the bank to withdraw money. But can you keep on withdrawing from the bank? Where does the money in the bank or ATM come from?

Payment method Debit and Credit Cards

You would have often seen people using cards in shops. They buy things, at the counter they give a card to the shopkeeper who swipes the card on a machine, gives a receipt and people walk off with their things without paying any money seemingly. These cards can be a debit card or credit card and are generally called plastic cards.

Credit means buying money, goods, and services at any given time but paying for it at a future date. Based on whether you are paying on credit or not there are two kinds of Plastic cards, which are used by the cardholder to buy goods and services.

- Debit Card: On using a debit card, the money is immediately deducted directly from the user’s account. The user can buy things as long as there is money in his account. A debit card is a way to “pay now.”

- Credit Card: Here, the person uses the card to buy and then pays back later. There is a limit to which one can buy on credit card.

Can you swipe the card as much as you want? If wishes were horses!

At the end of predefined time, the credit card company which issued the card would send the bill to the person who swiped the card. The due amount has to be paid by due date. One can pay the full amount by the due date(which is recommended) or pay at least the minimum amount.

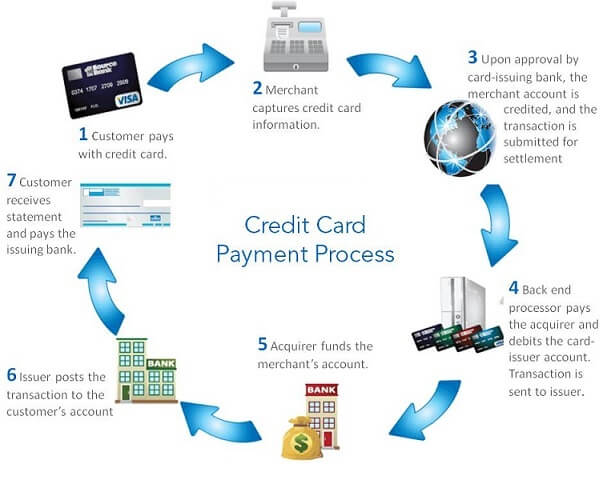

How is Credit Card Swipe Processed explains what happens when a credit card is swiped. The image below shows the steps.

How credit card transactions happen

How is a Debit Card different from a Credit Card?

Both debit and credit card look similar. Other than Debit/Credit word on the card there is no difference in the cards appearance wise. But they differ functionally.

Debit Card is a direct account access card i.e. the amount transacted gets debited immediately. The amount permitted to be transacted in the debit card is to the extent of the amount person’s savings account.

On the other hand, a credit card involves borrowing up to the limit sanctioned by the bank which is paid by the card user on receipt of the bill either in full or partially in instalments.

Payment Method Digital Wallets

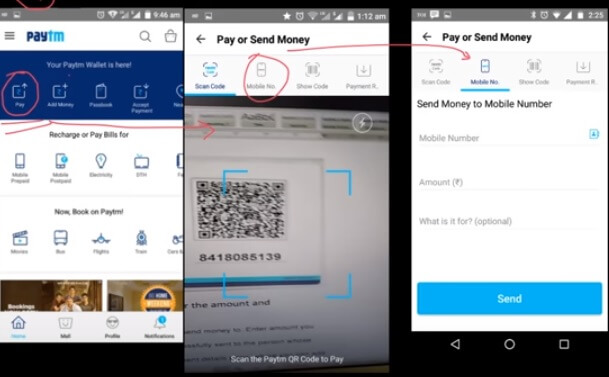

Electronic wallet, in reality, is virtual cash. E-wallets can be loaded with money using your debit/credit card or net banking. This money can then be used to make purchases at a vendor, to recharge your mobile/cable, to pay mobile/gas/electricity bills, book flight/railway tickets or even order food! Generally, e-wallets like Paytm, Freecharge and Mobikwik have promotional offers.

How mobile wallets work

The Indian economy has traditionally been dominated by cash. However, the increased adoption of smartphones together with a favourable regulatory environment is pushing the economy to a less usage of cash and promoting the usage of digital payments. Startups including Paytm, Oxigen Services and Mobikwik are helping Indians take small steps towards using digital money. They attract customers with cash back and discounts to make the transition from cash to digital.

The great moment for digital payments was the government’s move to remove high-value currency notes from circulation in November 2016. Demonetization of INR 500 and INR 1,000 currency notes, which accounted for over 80% of the bills in circulation, and the subsequent policy measures taken by the government of India (GOI) and the Reserve Bank of India (RBI) have provided further impetus to digital payments.

Which method do you or your parents use for shopping?