Digital wallet company PayTm on 4 Sep 2018 launched Paytm Money app for mutual fund investments. Within a year of its launch, PayTm Money claims to have acquired a user base of over 30 lakh. How can one use PayTm Money App for Mutual Fund Investments? Is it is safe to use PayTm Money App? How does PayTM Money App earn money? What are the reviews? complaints? What are the alternatives of PayTm Money App?

Table of Contents

How to use PayTm Money App to invest in Direct Mutual Funds?

The Direct Plans of Mutual Funds were launched on January 1, 2013. If you want to invest in Mutual Funds Directly, without paying any trailing commissions then you need to look at the investment platforms like PayTm Money App, ET Money App, Zerodha Coin etc. By investing in Mutual Funds directly you save around 1% in Expense Ratio which over longer period of time can be a big amount. But remember there are more than 4000 mutual fund schemes so you need to be careful while investing Directly in Mutual Funds.

Unique features of PayTm Money App

- PayTm Money app has 4.3 ratings on Google PlayStore with more than 1 million downloads.

- Within a year of its launch(Sep 2018(, Paytm Money claims to have acquired a user base of over 30 lakh. The mutual fund industry is expected to grow exponentially and double its size within the next 4-5 years. In the direct MF segment, Paytm Money contribution is expected to reach around 50 per cent in 5-6 months from 40 per cent in Aug 2019.

- Support for all the Mutual Funds: Paytm Money App has mutual fund schemes from all 40 Asset Management Companies (AMCs) in India. There are no hidden charges, fees or commissions. The Paytm Money platform offers systematic investment plans (SIPs), Lump sump investments. (Many like Kuvera and Groww still don’t have all Mutual funds)

- Support for all banks

- Can invest on App or on their website

- Founders with deep pockets – PayTM Money app is backed by One Communications, the same company behind the popular PayTm app. So we expect it to be around for a long time. App will be upgraded, more features will be added. We have heard that soon direct stock investing, pension will be available on PayTM Money app.

- Comparison of PayTM Money app with other popular apps for investing in direct mutual funds is covered in detail in our article Compare Direct Mutual Funds Investing Platforms: ETMoney, PayTM Money, Zerodha Coin, Kuvera, Groww

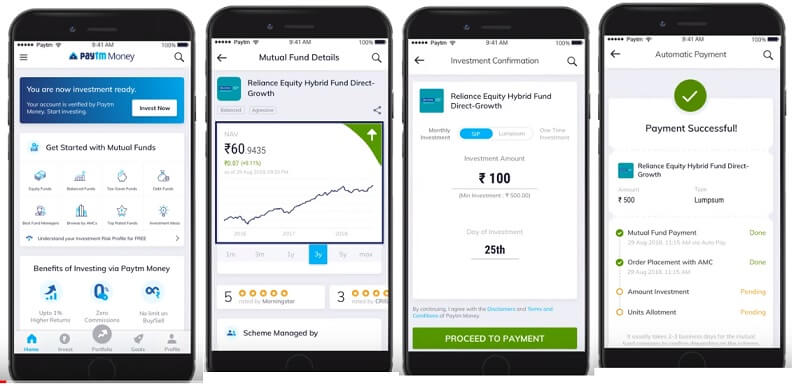

Investing in Mutual Funds through PayTm Money App is Simple.

- Login with your Paytm credentials i,e Mobile Number and password. Use your Paytm registered mobile number or email ID to sign in to Paytm Money account.

- Enter your PAN (Permanent Account Number) and check KYC status.

- Now, search mutual fund schemes by ratings, ideas, fund managers and more and make your first investment.

Note: The taxes,capital gains, on Mutual Funds are applicable on redeeming or selling the mutual funds are same irrespective of direct or regular plans.

Note: Switching from regular plan to direct plan also involves selling of old Funds and investing in new ones.

YouTube Video on How to Invest Through PayTm Money App

The 3-minute video shows the features of PayTm Money app. It allows easy discovery of funds (Top Rated Schemes, Funds with Highest Returns, India’s Trusted Fund Managers), Details about the Mutual Fund Scheme, Can invest in Lumpsum or start a SIP(as low as Rs 100), Easy payment. Experience seamless investments with Automated 1-tap payments.

Follow just a few simple steps for easy discovery of schemes to get started with investing on Paytm Money.

Alternatives to PayTm Money App

There are many Apps/Website available in which you can invest directly into Mutual Funds, other than investing through Mutual Fund websites. Some of them are given below(in no specific order). Comparison of PayTM Money app with other popular apps for investing in direct mutual funds is covered in detail in our article Compare Direct Mutual Funds Investing Platforms: ETMoney, PayTM Money, Zerodha Coin, Kuvera, Groww

1. Kuvera

2. Goalwise

3. CAMS & Karvy Website/Mobile App

4. Mutual Fund Utility(MF Utility)

5. PaisaBazaar

6. Zerodha Coin

7. PayTM Money

8. ETMoney

9. Groww

10. Clearfunds

Is it Safe to Invest through PayTm Money App?

Yes, It is safe to invest through any of the Mutual Fund providing apps, such as PayTm Money, ET Money, Kuvera, Groww, Zerodha coin. There are no charges or commissions.

When you invest through any of these Apps, your money goes to the mutual fund company. It is invested with them. When you redeem or withdraw, the money from the Mutual Fund and sent to your account.

If any of these Apps/Sites ceases to exist, you can always go to the mutual fund company’s website and redeem. All you need is Folio Number, PAN Number.

A folio number is a number given to a mutual fund investor by an asset management company when one invests in the fund. It is like bank account number you get when you open a bank account. Our article What is Folio Number in Mutual Funds? discusses it in detail.

You should get Mutual Fund Statement, NSDL CAS statement. You can contact RTA like CAMs, Karvy to send your statement. You can even continue to invest in the same fund using the mutual Fund company website.

How does PayTm Money App earn? What is it’s business model?

Nothing in this world comes for free & Data is the new Oil.

Always remember “if you’re not paying for the product, you are the product”.

PayTM is not taking any charges neither they will get any commission from AMCs as it is offering Direct Plans and (not Regular Plans)

But they get your information, your data spending/investing, your risk taking ability. They will use it to offer you products or sell your information to companies. It may push financial products ex loans, insurances for you or give you special recommendations.

This is what Google, Facebook and other companies have been doing for a long time.

Features of PayTm Money App

The features of PayTm Money App are given below.

- Simple Discovery of Mutual Funds

- Top Rated Schemes

- Funds with Highest Returns

- India’s Trusted Fund Managers

- Minimum Investment Amount

- Smart & Powerful Search

- Leading Mutual Fund Companies

- Instant Redemption Funds

- Investment Ideas

Top funds across popular categories, grouped by fund returns and investment period, for your ease of selectio

- Detailed Tracking of all your Investments

- View Updated Portfolio

- Simplified Investment Insights

- Request Statements Anytime

- Easy SIP Management

- Step by Step Tracking of Transactions

- Goal-Based Tracking

- Detailed Mutual Fund Information

- Latest NAV of all Schemes

- Historical Scheme Performance

- Category Performance

- Riskometer for all Schemes

- Mutual Fund Holdings

- Suggested days for SIP Make the best outcome for your investments with our suggested SIP dates for optimized returns

- Convenient Payment Options for Investing: Experience seamless investments with Automated 1-tap payments

- Net Banking All major banks supported

- Auto-Pay with Physical Mandates : 190+ Banks supported

- Pay through UPI

Review of PayTm App

Please check PlayStore for all the reviews of PayTm App.

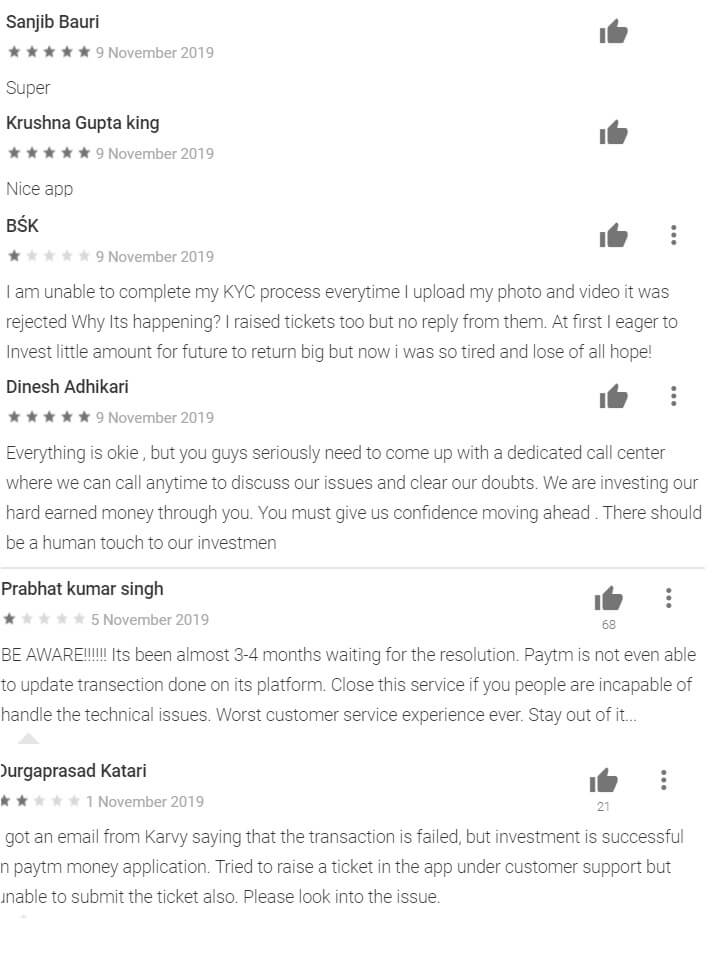

The image below shows some of the reviews.

A common complaint that we noticed is that PayTm Money does not provide customer support on phone. PayTm Money has 4 levels of grievance redressal

Customer Support of PayTm Money App

They provide 4 level of customer supprt but sadly you cannot speak to anyone, as it is through App or sending emails. The first 2 levels of customer support are given below.

Level 1: If a Customer has any grievances / complaints, the Customer can approach Customer Support help desk via the “customer support” tab in the app or via www.paytmmoney.com.

Level 2: If the customer’s issue is unresolved after a period of 15 days from the date of first raising the issue at Level 1 or if the customer is not satisfied with the response provided at Level 1, the Customer may, post completion of a 15 day period from the date of first raising the issue at Level 1, write to the Compliance Officer at:

The Compliance Officer

Paytm Money Limited,

Vaishnavi Summit, 80 Feet Road,

3rd Block Koramangala, Bangalore-560095

Email: complianceofficer@paytmmoney.com

Related Articles:

- All About Mutual Funds : Basics, Choosing, Paperwork, Direct Investing

- Direct Investing in Mutual Funds

- ETMoney

- Switching of Mutual Funds

- Redeeming Mutual Funds : Check Exit Load,Taxes

- Investing in Equities: Stocks vs Mutual Funds

Have you used PayTM Money App? Did you find it good? Do you invest directly in Mutual Funds? Which platform do you use?

thank you for sharing valuable paytm information