Public Provident Fund (PPF) is a long-term, government-backed small savings scheme of the Central Government started with the objective of providing old-age income security to the workers in the unorganized sector and self-employed individuals as they do invest in Employee Provident Fund (EPF). Public Provident Fund is an ideal vehicle for long term investment in fixed-income/debt category, an important retirement saving tool for individuals, more so for those who are not salaried employees. This article covers the Public Provident Fund in detail, the investment amount, interest rate, power of compounding, who can open, where can one open and more.

Table of Contents

All about PPF, Public Provident Fund

When one invests in PPF one should be careful of following things

- Overview of PPF

- How to invest in PPF

- Interest Rate on PPF

- Dormant PPF

- Interest Rate on PPF

- Risk in PPF

- Show PPF Interest in Income Tax Return

- Withdrawal from PPF

- Premature closure of PPF

- Loan from PPF

- Nominee in PPF

- Duration of PPF account

Overview of PPF

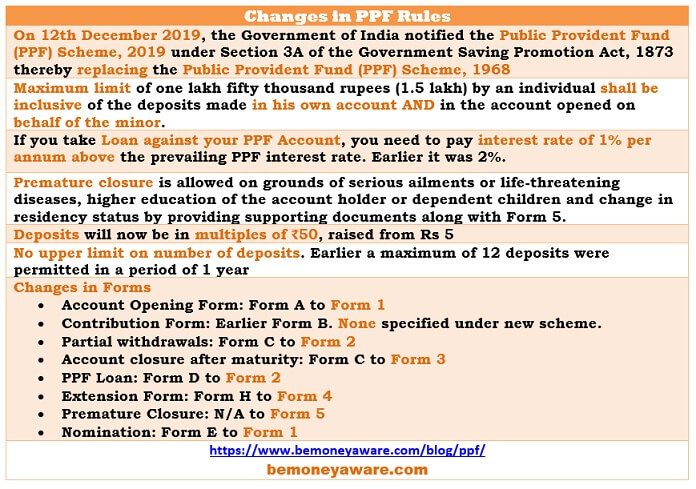

On 12th December 2019, the Government of India notified the Public Provident Fund (PPF) Scheme, 2019 under Section 3A of the Government Saving Promotion Act, 1873 thereby replacing the Public Provident Fund (PPF) Scheme, 1968.

PPF Scheme is one of the most tax-efficient instruments in India. It was launched to encourage savings among Indians in general, especially to encourage them to create a retirement corpus. It comes under EEE.

- Amount invested in PPF account can be claimed as tax deductions under section 80C upto limit of 1.5 lakhs.

- Interest earned on deposits in the PPF account is not taxable.

- PPF Withdrawal is tax free.

PPF comes under THE PUBLIC PROVIDENT FUND Scheme, 2019 which you can read here. Features of PPF are as follows:

- Indian Citizen who is a Resident Indian can open PPF account. Even if one has an Employee Provident Fund (EPF) account.

- PPF account can be opened with the State Bank Of India, or its associates , Post offices, or any other Certified Bank like ICICI Bank, HDFC Bank,Axis Bank.

- PPF account is opened for a minimum period of 15 years. This tenure can be further extended for a minimum term of 5 years.

- Premature closure of account is allowed in certain cases after completion of 5 years. It was introduced in the year 2016. One has to use Form 5(newly created)

- In a financial year, an investor can deposit a minimum of Rs. 500 and a maximum of Rs. 1,50,000 in their PPF account.

- Deduction U/s 80C of Income Tax is available for the amount invested in PPF.

- The government pays yearly interest on the balance in the PPF account.

- Interest earned in the PPF account can only be redeemed after maturity.

- Interest received from PPF investments is Tax-Free.

- Amount in PPF can be withdrawn from the 7th year onwards. This withdrawal amount is restricted to 50% of the previous years’ balance.

- Loan against the balance in PPF account can be availed after three years. Maximum of 25% of the balance in the PPF account is made available as the loan amount. The amount received at the time of maturity is completely tax-free.

- PPF account balance cannot be attached under circumstances of any order or decree of court against an individual’s debt or any other liability.

PPF works on a financial year basis (April 1st – March 31st). The interest on PPF changes and has been above 8%. The balance amount in PPF account is not subject to attachment under any order or decree of the court in respect of any debt or liability, but it can be attached by the Income Tax and Estate Duty authorities. Let us look at each of these features in detail, Links below expand on the sub-topic in detail.

- How to Deposit in PPF amount

- Filling ITR-1 : Bank Details, Exempt Income, TDS Details

- Transferring PPF account

- On Maturity of PPF account

- PPF Account for Minor and Self

- How to Close PPF account Before Maturity

- How to activate Dormant PPF account?

- PPF Partial Withdrawals

- Premature closure of PPF

- How to take Loan from PPF

- How to nominate: Demat Account and PPF

- Voluntary Provident Fund, Difference between EPF and PPF

- On Death of PPF account holder: How to Claim using Form G

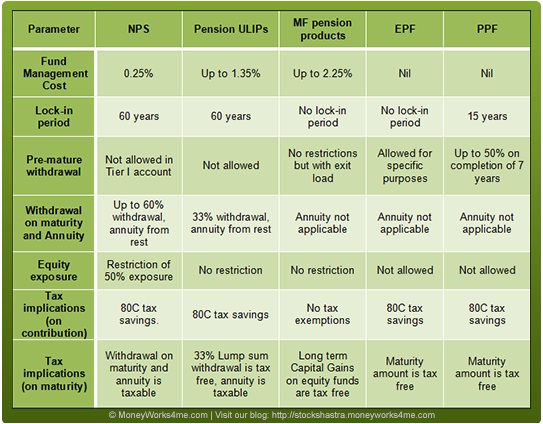

Comparison of PPF with other Retirement Options

Let’s look at the options for building a retirement kitty :

- Pure debt instruments such as the PPF, NSC and tax-saving FDs . They offer an assured return of around 8% in the long term.

- Mutual Fund Pension Plans

- Insurance Pension Plans

- National Pension Scheme

Comparison of PPF with other retirement Options is shown below

Investment Amount in PPF

- You need to deposit a minimum of Rs. 500 per year in a PPF account.

- The maximum amount which you can deposit in a PPF account is Rs. 150,000. The limit was increased to Rs. 1.50 lakhs in budget 2014-15. Before 1.12.2011 limit was Rs 70,000 it was increased to 1 lakh from 1.12.2011 .

- Deposit amounts should be in multiples of Rs. 50. (Before 12 Dec 2019, it was Rs 5)

- You can deposit lump sum or multiple instalments. The limit of the maximum number of instalments in a year can not be more than 12 was removed on 12 Dec 2019 in new PPF.

- Amount in each installment can be different. For example, in the month of May, you deposited 10,000 but in the month of Oct, you can deposit 500 only with no contribution in other months.

- Amount of investment in PPF in each financial year can be different. For example in FY 2014-15(from 1 Apr 2014 to 2015) you deposited Rs 50,000 but in FY 2015-16 you deposited 30,000 and in FY 2016-17 you deposited only 500 Rs.

- Amounts can be deposited through online, cash, cheque or via demand draft. Our article How to Deposit in PPF amount explains the process in detail.

- If you are depositing a cheque or demand draft, then the date of the deposit that will appear in your PPF account will be the date of cheque clearance and not the day you present the cheque. Say if you deposit the cheque on the 1st of the month but it fails to clear by the 5th for whatever reasons, you will lose out whole month’s interest!

- After investing please get the passbook updated.

Dormant PPF account

If you do not deposit the minimum amount, then account will be termed as discontinued account. Interest would, however, continue to accrue. You could regularize the account again by paying the penalty fee of Rs 50 for each year of the minimum amount has not been deposited along with subscription arrears of Rs 500 per Financial Year. For example, if you paid in Rs. 400 in year 1, Rs. 10,000 in year 2 and Rs. 0 in third year. You would need to pay into your PPF account fees of Rs. 50 per year where you did not pay the minimum Rs. 500. In the example, you would have to pay Rs. 100 as fees (50 for 1st year on 400 Rs investment, 50 for 3rd year on 0 investment). Additionally, you would have to deposit Rs. 100, Rs. 0 and Rs. 500 as arrears for year 1,2 & 3 as the amount deposited fell short of Rs. 500.

Our article How to activate Dormant PPF account? explains the process in detail.

Duration of PPF account

The duration for the investment is 15 years. However, the effective period works out to 16 years i.e., the year of opening the account and adding 15 years to it. The contribution made in the 16th financial year will not earn any interest but one can take advantage of the tax rebate. So if you were to open a PPF account on the 1st of April 2010, the counting actually begins from the end of the year, i.e. 31st March 2011. So your account will mature on 31st March 2026 and not 31st march 2025!

So add 15 years to 31 Mar of the financial year in which you opened the account. For account opened anytime between 1 Apr 2016 to 31 Mar 2017 date of maturity is 31 Mar 2032. (2017 + 15= 2032).

Therefore, an account opened on say 10th October 2010, will mature on 1st April 2026 (after the expiry of 15 years from the end of the financial year in which the account was opened i.e. 31.03.2011) and not on 10th October 2025 (after the expiry of 15 years from the date of opening of the account).

The account holder has an option to extend the PPF account for any period in a block of 5 years after the minimum duration elapses. The account holder can retain the account after maturity for any period without making any further deposits. The balance in the account will continue to earn interest at the normal rate as admissible on PPF account till the account is closed.

PPF works on a financial year basis (April 1st – March 31st) and interest is credited only at the end of the financial year.

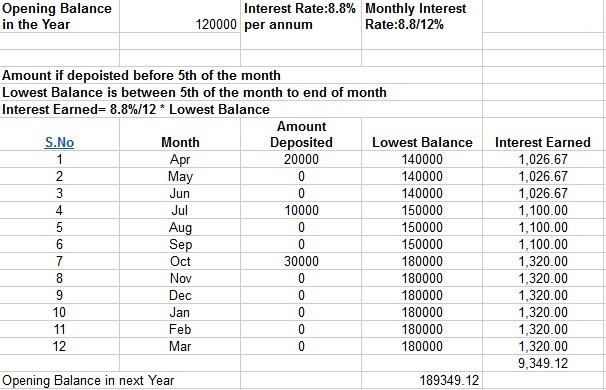

Interest earned on PPF account Detailed Calculation

PPF works on a financial year basis (April 1st – March 31st). The interest is paid as per the rates declared by the Government from time to time(quarterly now) , has been above 8% p.a. . PPF interest is calculated monthly on the lowest balance between the end of the 5th day and last day of the month, however, the total interest in the year is added back to PPF only at the year-end. So if you don’t deposit on/before the 5th of a month, you don’t earn interest for that month. The calculations are shown in picture below.

Note: For monthly calculation, one needs to use monthly interest which is (interest Per annum /12), which in above example is 8.8%/12.

So if you were planning on investing into it monthly, it is advisable you invest (i.e. your PPF account is credited with the investment amount) on or before the 5th of every month better still if you can invest the whole amount (Maximum 1 lakh (1,00,000) by April 5th.

History of Interest Rate of PPF

The interest on PPF is paid as per the rates declared by the Government from time to time. Earlier, the rate of interest was notified every year before the beginning of a new financial year. However, from 2016-17, the rate of interest has been fixed on a quarterly basis The government had moved to market-linked rates for small savings products, such as PPF, Kisan Vikas Patras and Senior Citizens Savings Scheme, to link the returns to government bonds so that these instruments do not eat into the bank deposit base. It is actually benchmarked to the 10-year government bond yield and will be 0.25% higher than the average government bond yield. The PPF interest Rates since 1st April 1986 are given below

| Period | Interest Rate p.a. |

| 01 April 1986 – 14 Jan 2000 | 12% |

| 15 Jan 2000 – 28 Feb 2001 | 11% |

| 01 March 2001 – 28 Feb 2002 | 9.50% |

| 01 March 2002 – 28 Feb 2003 | 9.00% |

| 01 March 2003 – 30 Nov 2011 | 8.00% |

| 01 Dec 2011 – 31 March 2012 | 8.60% |

| 01 April 2012 – 31 March 2013 | 8.80% |

| 01 April 2013 – 31 March 2016 | 8.70% |

| 01 April 2016 -31 Mar 2017 | 8.10% | 8.1% | 8.1% | 8% |

| 01 Apr 2017 -31 Mar 2018 | 7.9% | 7.8%| 7.8%|7.6% |

| 01 April 2018 -31 Mar 2019 | 7.6% | 7.6% | 8% | 8% |

| 01 April 2019 -31 Mar 2020 | 8%| 7.9%| 7.9% | |

Risk in PPF

An investment in the PPF is equivalent to the risk of lending to the government, and hence has the lowest level of default risk.

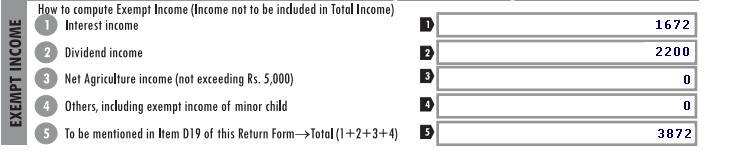

PPF and Income Tax Return

Though PPF falls under EET you need to show the amount invested in PFF under section 80C, if you are claiming 80C benefit, and show interest earned as exempt Income.

- The amount you invest is eligible for deduction under the Rs. 1, 50,000 limit of Section 80C. Remember benefits expenses like life insurance premiums, children’s school fees qualify under Section 80C as deductions in addition to other approved investment mediums like ELSS, 5 year FD’s, NSC etc. If you have exhausted your 80C contributions you can still deposit 1,50,000 without claiming 80C deductions.

- Interest earned on the investment is completely exempt from tax under Section 10 (11) of the Income Tax Act.. On maturity, the entire amount including the interest is non-taxable. One should show the interest income of PPF account in the section of exempt income as shown in our article Filling ITR-1 : Bank Details, Exempt Income, TDS Details

8% tax-free interest is effectively 12.85% pre-tax interest if you are in the 30% tax bracket and 11.25% if in the 20% tax bracket. It is difficult to find fixed-income instruments (at the same low-risk level) that can yield you comparable returns!

Liquidity of PPF

From liquidity point of view, your funds are locked in for 16 years. From From 1 Apr 2016 you can close your Public Provident Fund account under certain circumstances, provided the account has completed five years. Loan facility is available from the third year and Partial withdrawals are allowed only from the sixth year onwards.

Premature closure of PPF

Our article Premature closure of PPF explains the process in detail From 1 Apr 2016 you can close your Public Provident Fund, provided

- The account has completed five years.

- Premature closure of PPF accounts shall now be permitted in cases such as serious ailment, higher education of children, change in resident status of account holder.

- The person withdrawing will get 1 per cent less interest as a penalty for premature closure.

- One has to approach the bank/post office where one has PPF account. One has to submit the Account closure form. Excerpt Closure form of PPF from post office,Form SB-7A

Loan from PPF

Our article How to take Loan from PPF explains the process in detail with Loan Calculator.

- You can take a loan on the PPF from the third year of opening your account to the sixth year. So, if the account is opened during the financial year 2009-10, the first loan can be taken during financial year 2011-12.

- The loan amount will be up to a maximum of 25% of the balance in your account at the end of the first financial year. You can avail a loan amount of up to a maximum of 25% of the balance in your account at the end of the second year immediately preceding the year in which the loan is applied for.

- The loan must be repaid in a maximum of 36 EMIs.

- Interest payable on PPF Loan is 1% per annum above prevailing PPF rates(1% upto 2012, became 2% till Dec 2019). if the PPF interest rate is 8%, you would have to pay a rate of 9% if you take a loan against PPF. The interest is levied from the first day of the month in which the loan is taken to the last day of the month in which the last installment of the loan is paid.

- If the loan is not repaid back, the interest is charged at 6% per annum.

- You can take a second loan against your PPF account before the end of your sixth financial year, but your second loan can be taken only once your first loan is fully settled.

For example, Let’s suppose you opened your PPF account in December 2011 (in the FY 2011-12), you can avail a loan only in FY 2013-2014 (2012+2 = 2014) till FY 2016-2017 (2012+5=2017). If you apply for a loan in November 2013 (FY 2013-2014), you would get 25% of the amount that existed at the end of March 2012 (2014-2 = 2012).

For example, The first loan can be taken in the third year of opening the account i.e., if the account is opened during the year 2007-08, the first loan can be taken during the year 2009-2010. The loan amount will be restricted to 25% of the balance including interest for the year 2007-08 in the account as on 31/3/2008.

Withdrawal from PPF

Our article PPF Partial Withdrawals explains the partial withdrawal from PPF with calculator.

- You can make withdrawals from the sixth year i.e after expiry of 5 years full financial years from the end of the year in which your initial subscription was made. This means that from the day you open your account, you will need to complete 6 full financial years before you can make any withdrawal.

- You are allowed to withdraw 50% of the balance at the end of the fourth year, preceding the year in which the amount is withdrawn or the end of the preceding year whichever is lower.

- Not more than 1 withdrawal can be made in a year.

- The withdrawal amount is not repayable.

- After the expiry of 15 years duration when the PPF account gets matured and the entire funds can be withdrawn from the account.

For example, if the account was opened in 2000-01, and the first withdrawal was made during 2006-07, the amount you can withdraw is limited to 50% of the balance as on March 31, 2003, or March 31, 2006, whichever is lower.

For example, if you opened your PPF account on April 1st, 1993, you can make your first withdrawal after April 1st 1999, and the amount of withdrawal will be limited to 50% of the balance as 31st March, 1995, or the balance on 31st March 1999, whichever is lower.

Nominee in PPF

In case of death of the account holder, the balance amount in the account of the deceased account holder will be paid to his nominee or legal heir, as the case may be, even before expiry of 15 years. The nominee or legal heir cannot continue the account by making fresh subscriptions to it. If the balance in the amount is more than 1 lakh, then the legal heir or nominee has to prove identity and provide the relevant documentation to claim the amount in the PPF account.

On Maturity of PPF

A PPF account has a maturity of 15 years. After 15 years, you have the following options :

- Encash the total maturity proceeds of the PPF account which is exempt from tax.

- Within 1 year from date of expiry of 15 years, apply for extending the PPF block period of 5 years.

If one applies for an extension of your PPF account one again has two options:

- The account holder can retain the account after maturity for any period without making any further deposits. The balance in the account will continue to earn interest at normal rate as admissible on PPF account till the account is closed.

- The account holder can make deposits as earlier.

After the expiry of 5 years, you can continue to extend the duration of the PPF account by 5 years. There is no limit to the number of such extensions.

For example, if you opened a PPF account in the year 2000, then it would mature in the year 2015. In the year 2015 you would have an option to encash your PPF balance or to extend the maturity of PPF for 5 years upto 2020. This decision would have to be taken by you up to 2016 (within 1 year after maturity). After 2020, you can continue to extend your PPF account to years 2025, 2030 and so on.

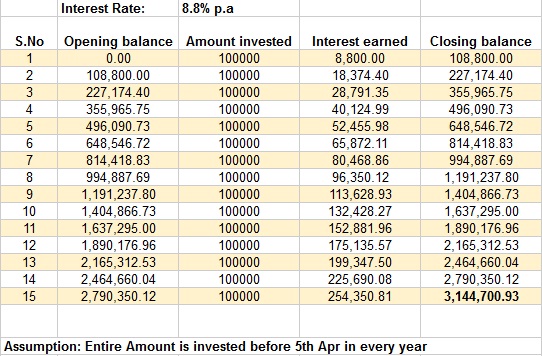

How much can one earn through PPF?

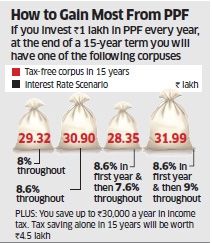

PPF is a long term investment and banks upon the Power of Compounding – the more the number of years for which you invest better the returns. If one invests Rs 1 lakh before 5th Apr every year in PPF, after 15 years he will earn 31.44 lakh assuming the interest rate is 8.8% throughout the tenure as shown in the picture below:

At different interest rates, the gains are as shown in the picture below.

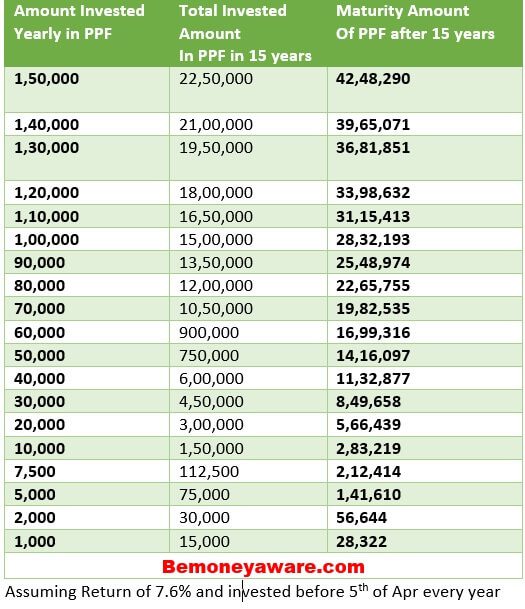

How much would one get on maturity in PPF, assuming the same amount invested yearly before 5th of every year and return of 7.6%

Who can Open a PPF Account

PPF is classified as a small saving scheme and can be opened by an individual (salaried or non-salaried). No Joint account can be opened.

- Individual: An individual can open only one PPF account to which he contributes. If you have a General provident Fund account(GPF), or an Employees Provident Fund(EPF) account, you can still have a PPF account A PPF account can also be opened in the name of your spouse or children. At any point in your life, you are allowed to have only 1 PPF account in your name. If at any time it is seen that you have more than 1 account in your own name, the second account will be deactivated, and only your principal will be returned to you.

- Minor: Account can also be opened in the name of minor through guardian who can be father or mother or a person appointed by court (if guardian is not there). However that will be the child’s account, the parent is simply the guardian.

- Grandfather or grandmother are not allowed to open an account in the name of Grandchildren.

- PPF rules limit the investment to a maximum of Rs 1,50,000 in the PPF accounts of self and minor child together in a financial year.

- If the account is opened in the name of the minor and the minor attains majority before the maturity of the account, then the ex-minor will himself continue the account thereafter. He will submit a revised application form for opening the account to the Accounts Office. His signature on the application form will be attested by the guardian who opened the account of the minor or by a respectable person is known to the Branch. Our article PPF Account for Minor and Self discusses it in detail.

- Hindu Undivided Family (HUF): Until 13 May 2005, HUFs could also invest into PPF. However subsequent to that date HUF can no longer open fresh PPF accounts. Existing PPF accounts of HUFs shall not be renewed after the expiry of the initial duration of the PPF.

- NRI: The PPF Scheme 2019 does not explicitly prohibit non-residents from opening a PPF Account and it is also silent on the question of whether someone who becomes non-resident subsequently can continue to contribute. However, it requires a declaration that the individual is a resident of India in the account opening form (Form 1). It also lays down change of residency as a ground on which a PPF account can be terminated prematurely, after a period of 5 years from opening

Where can one open PPF account?

The PPF scheme is operated through Post Office and Nationalized banks and private Banks like ICICI bank offers this account. It can be opened with a minimum deposit of Rs. 100 at any branch of the State Bank of India (SBI) or branches of it’s associated banks like the State Bank of Mysore or Hyderabad.A PPF account cannot be transferred from one person to another. Account is transferable between post offices or banks but this will involve some leg work. Our article Transferring PPF account explains the process in detail.

Many banks like SBI and ICICI offer online access to PPF accounts opened through them. You will be able to make subsequent deposits online if you choose this facility. PPF accounts opened at post offices do not have online access facility yet.

Documents Required to open PPF:To apply for the PPF Provident Fund ( PPF ) scheme, 1968, you have to fill Form A , photograph(s), PAN Number , proof of address.

Banks in which PPF account can be opened are:

- 1. SBI

- 2.SBI Subsidiaries (Patiala, Bikaner & Jaipur, Travancore, Hyderabad, Mysore)

- 3. ICICI (PPF Account ICICI Bank)

- 4. BOB – Bank of Baroda

- 5. Central Bank of India

- 6. BOI – Bank of India

- 7. Union Bank of India

- 8. IDBI

- 9. Vijaya Bank

- 10. Allahadbad Bank

- 11. Oriental Bank of Commerce

- 12. Bank of Maharasntra

- 13. Canara Bank

- 14. Central Bank of India

- 15. Corporation Bank

- 16. Dena Bank

- 17. Indian Bank

- 18. IOB – Indian Overseas Bank

- 19. PNB – Punjab National Bank

- 20. United Bank of India

- 21. IDBI Bank

- 22. Axis Bank

PPF online and State Bank of India

- The savings account can be in any bank, it is necessary for the PPF account to be at an SBI branch.

- You will need to link the PPF account to the savings account in the same branch.

- If your PPF account and savings account are in different SBI branches or even in a different bank. You can simply add the PPF account in your Net banking list of third party transfer and continue smoothly with the transaction.

- One can refer to Chartered Club PPF Account in SBI for more details.

PPF Online and ICICI Bank

- You need to have a ICICI Bank account before you open the PPF account in ICICI. However, the account can be in any branch of ICICI

- You can not open PPF account in any ICICI Branch. For each city, there are special designated branches for opening PPF account. List of PPF authorised branches at ICICI bank

- ICICI Bank offers an online account opening facility also.

- By default ICICI bank does not provide a PPF passbook when you open it. However, the Customer can view his/her transactions through his/her statement of accounts available online on the Website.If you really need it, you will have to give a written request and only after its processed it will be given

- ICICI bank webpage on PPF has more details.

On getting the PPF and bank account linked together, you can then check the status of you PPF account too. You get online transactional rights for your PPF account. Through this facility you can make PPF contributions online too. Jagoinvestor’s Online transfer to your Public Provident Fund (PPF) account explains the process with pictures.

New PPF Rules 2019

On 12th December 2019, the Government of India notified the Public Provident Fund (PPF) Scheme, 2019 under Section 3A of the Government Saving Promotion Act, 1873 thereby replacing the Public Provident Fund (PPF) Scheme, 1968.The new PPF rules as per the notification are in Public Provident Fund Scheme, 2019, New PPF Rules . The image below shows the difference between PPF 2019 and PPF 1968.The image below shows the difference between PPF 2019 and PPF 1968.

PPF Forms

Form have changed:

| Old Form | Description | New Form |

| Form A | Application for opening a Public Provident Fund Account | Form 1 |

| Form B | Contribution Form | Not provided |

| Form C | Application for withdrawals | Form 2 |

| Form D | Application for a loan | Form 2 |

| Form E | Application for Nomination | Not provided |

| Form F | Application for cancellation/variation of nomination previously made | Not provided |

| Form G | Application for the closure of the PPF account | Form 3 |

| Form H | Application for continuance of account beyond 15 years/Extension Form | Form 4 |

| Application for premature closure of the account | Form 5 |

Video on PPF account

Public Provident Fund or PPF Account benefits are discussed in Hindi by Asset Yogi. How to open a PPF account online or in Post Office, PPF Calculator, Interest Rate and other PPF rules regarding withdrawal, eligibility, maturity period etc. are discussed in detail.

Related Articles:

- Taxation of investments : EEE, ETE, TEE..

- Beginner to Investing – Approaches, Plan, Psychology

- Investing:Think about Liquidity,Safety,Returns,Risk,Tax

- On Maturity of PPF account

- PPF Account for Minor and Self

- How to Deposit in PPF amount

- How to Close PPF account Before Maturity

- How to activate Dormant PPF account?

- Transferring PPF account

- PPF Partial Withdrawals

- Voluntary Provident Fund, Difference between EPF and PPF

Public Provident Fund (PPF) is one of the safest forms of investment. If you continue to invest into it for a long term and enjoy it’s tax free benefit which is largely dependent upon the power of compounding. Have you invested in PPF?

Very useful article. Please visit my article on “How inflation is beating income and what are the solutions?”

https://financefor9to5.com/242-2/

A platform for NRI who would like to Retire in India: Achieve Financial Freedom. Run by Hemant Beniwal a Certified Financial Planner with 15 years of experience in Personal Financial Planning & Retirement Planning in India for NRIs. Firm Ark is SEBI Registered Investment Advisor & Online Fee-Based NRI Financial Services.

read More -https://www.wisenri.com/”>investment options in india

Sir,

I opened a ppf account of 50,000 as initial amount through hdfc net banking. but in my account that much amount is not there. If i paid only 5000, and I want to invest 80,ooo after May 2020 what will happen as I selected as Initial pay 50k but paid only 5k in the present financial year

Sir of we deposit money in wrong account by mistake in PPF can it be reversed

Sir,

Till Oct,2017 I have invested in ppf Rs. 80,000 (from April,2017 to Oct,2017). I have invested the Rs. 80,000 amount in 12 investment from April,2017 to Oct,2017. Sir , my question now up-to March,2018 will I invest the rest amount i.e. Rs.(150000-80,000) = Rs. 70,000 ?

Sir You can deposit lump sum or multiple installments. However, maximum number of installments in a year can not be more than 12.

Sir, I want to ask a question. If I invest in scss and its interest in ppf, can I get tax benefits for both?

for eg. next financial year if I invest 15lakhs in sscs and invest 1.5 lakhs in ppf ( i.e. sum of my salary for next financial year and interest earned from sscs), will my taxable amount be nil?

I am an NRI. I had opened a PPF account in India long around 25 years back and had deposited money consistently for 15 years. When I moved abroad I had forgotten about it since my account had matured and I had never withdrawn any amount from it. Currently, my father reminded me about it as he had the passbook and all my other documents in India. I do not have any bank account in India apart from this and I want to give that money to my old parents. It must be around 18-20 lakhs by now. How can the money be withdrawn? Will the bank make a DD in my fathers’s name if I send an authorization letter of may be visit the bank myself.

The process for PPF withdrawal by NRI

Basically, the PSU bank can only process your PPF withdrawal request if your signature is attested by an authority, which can be the PSU bank itself (which will need your presence) or some other authority.

If an NRI has an NRE/NRO account in a bank (a good bank balance or relationship with bank will be a plus), then they can follow this process

Courier the documents to India in the city where you have the NRE/NRO account. Make sure you send these documents to a person (relative, parents, siblings etc or friends)

Give an authority letter mentioning that you are allowing the person to follow this process on your behalf

Ask the person to go to the bank where you have NRE/NRO account and ask them to attest these documents (mainly the signature part). At this step, you can expect the friction because this is not a standard process.

Once the attestation is done, then you can ask your person to visit the PSU bank for PPF withdrawal and they might accept these documents which are attested by your bank.

Sir pls suggest me how to get max interest in in ppf account. I want to deposit 85000 rs. In this financial year

Deposit it before 5 of June to get maximum interest this year

Dear sir , I open my my PPF account on 28 July 2016 by 5000. After that I deposit 5000 in 30 August 2016. Next 04 November 2016 deposit 10000. And after that 7 January 2017 deposit next 10000 rs. And at last in this month means 27 January 2017 i deposit 70000 rs. in my account . Total balance in ppf account is 100000 (one lakh ). I got 1901 rs. By interest. Sir pls. Reply me it’s correct or not. And how to calculate the interest in my balance.

PPF works on financial year basis (April 1st – March 31st). The interest is paid as per the rates declared by the Government from time to time(quarterly now) , has been around 8% p.a. .PPF interest is calculated monthly on the lowest balance between the end of the 5th day and last day of month, however the total interest in the year is added back to PPF only at the year-end. So if you don’t deposit on/before the 5th of a month, you don’t earn interest for that month. Note: In 2016 Interest rate for 8.1% till 30 Sep and became 8% from 1 Oct 2016.The image below shows the calculation for your deposit

Thank you so much sir. For your reply. Sir pls.suggest me how to get max. Interest in ppf. In this financial year . I want to deposit 85000 rs.

Thank you so much sir.

Hi All,

thanks for the article . was reading it whole night 🙂

just one question, I have taken a ppf account in march (after 5 th) 2017 by depositing 50k, now can you please confirm if I will get any interest of 16-17 on same, or will it be just good enough to show it while filing ITR in june when form 16 comes, & no interest could be earned on same.

second question, from april 17 – march 18, my planning is to deposit at least 1 lac in my account, but if I deposit same in either installments (2- 3) or in lumpsum along the year (whenever I will have) so the interest got on same will be different, more or less, from the interest which I would have got if I had deposited full amount in April 17 only (before 5th 🙂 and so on in future years?

third, if have taken policy in march, 17, when will it mature?

I know my question may sound completely senseless but please answer naa in your best possible ways ..

Hello Sir,

Sorry to keep you waking.

No questions are stupid only answers are :-), .

1. Your doubt is correct. You will NOT any interest for amount deposited after 5th Mar 2017.

The interest on balance in your PPF account is compounded annually and is credited at the end of the year.

But the point to remember is that the interest calculation is done every month: the interest is calculated on lowest balances in account between 5th and last day of the month.

So if you don’t deposit on/before the 5th of a month, you don’t earn interest for that month.

Q2.

PPF interest rate is 7.9%

Scenario 1:

Let’s take the case you deposit 50,000 in Apr after 5th.

Then say you deposit 50,000 in Aug before 5th

Your for the FY 2017-18 would be 10204.17

Scenario 2:

You deposit 1 lakh in Apr after 5th.

Then your interest for FY 2017-18 would be 11191.67

Difference of Rs 987.5

If you can plan and deposit before 5 Apr for the entire year is best for earning interest from PPF.

But my suggestion is that you deposit whenever you can.

A 3:

The duration for the investment is 15 years.

However, the effective period works out to 16 years i.e., the year of opening the account and adding 15 years to it

Your account will mature in FY 30-31 on 31 Mar 2032. (2017 + 15)

Nice article, EEE instrument. Could you please clarify these lines…..8% tax-free interest is effectively 12.85% pre-tax interest if you are in the 30% tax bracket and 11.25% if in the 20% tax bracket.

Hello,

Thanks for the informative post on PPF Account.

Very useful post for learning tips and guidelines on investing in PPF Scheme.

Regards.

Dear Sir,

I have opened a PPF account on Jan 2017 and deposited around 50k. I wish to contribute the remaining balance 1 lakh. Do I need to deposit it before 31-March-2017?

When will year 1 starts for me?

Could you please clarify?

Thanks in Advance.

Regards

Harish

Yes if you want the PPF contribution to be counted for this Financial year you have to deposit it today by 31 Mar. For next Financial Year which starts from 1 April you can deposit 1.5 lakh again.

My PPF account matured in April 2015

I did not renew it within 1 year in 2016

What are my options available now?

When did you take the PPF. The duration for the investment is 15 years. However, the effective period works out to 16 years i.e., the year of opening the account and adding 15 years to it. The contribution made in the 16th financial year will not earn any interest but one can take advantage of the tax rebate. So if you were to open a PPF account on the 1st of April 2010, the counting actually begins from the end of the year, i.e. 31st March 2011. So your account will mature on 31st March 2026 and not 31st march 2025!

Even if your PPF matured in 2015 Apr you can still extend it by 5 years with a contribution by submitting Form H. We have explained this in our article On Maturity of PPF account.

After 15 years, you have the following two options:

Take out the maturity amount and close the account OR

Continue the existing PPF account for further block period of 5 years. After the expiry of 5 years, you can continue to extend the duration of the PPF account by 5 years. There is no limit to the number of such extensions.

Sir-I opened a PPF a/c on 29/03/2000. I contributed till 2003-04. Thereafter I stopped contributing. Now I want to get my money.

whether I will not get the interest after 31/03/2004. A/c has matured on 31/03/2015.

OR

I will get interest upto 31/03/2015 on the balance after 31/03/2004

OR

I will get interest upto 31/03/2017 ( in case I withdraw the amount in April 2017)

Please let me know my fate as big amount is involved.

Sir good news that you can withdraw from PPF as it is your money.

Bad news is that you would have to pay penalty and 500 Rs for the years you did not deposit.

If your PPF account has already matured, it will not earn any interest from the date of maturity.

But for all the years before you will be earning interest

Matured accounts cannot be revived, but penalty will be payable in order to claim the maturity proceeds.

You could regularize the account again by paying the penalty fee of Rs 50 for each year of the minimum amount has not been deposited along with subscription arrears of Rs 500 per Financial Year. For example, if you paid in Rs. 400 in year 1, Rs. 10,000 in year 2 and Rs. 0 in third year. You would need to pay into your PPF account fees of Rs. 50 per year where you did not pay the minimum Rs. 500. In the example, you would have to pay Rs. 100 as fees (50 for 1st year on 400 Rs investment, 50 for 3rd year on 0 investment). Additionally, you would have to deposit Rs. 100, Rs. 0 and Rs. 500 as arrears for year 1,2 & 3 as the amount deposited fell short of Rs. 500

Please go through our article on how to activate a dormant PPF account.

I want to open ppf account in feb 2017

Can i get benefit of 80c for tax of 2016-17

Yes you can claim 80C deductions for FY 2016-17 for payment made from 1 Apr 2016 to 31 Mar 2017.

Don’t wait for last moment.

Please understand that in making investments in PPF you are locking your investment for 15 years

I have two kids – age 5 yrs and 3 yrs

I had opened PPF account 4 yrs back for my elder son and maintaining since then.

Question 1 – Can I open second PPF account in younger child name???

Question 2 – Can i deposit MORE then Rs 150000 in both the accounts in one year ??? (I know that i will get Tax rebate only on Rs 150000)

Question 3 – Supposing that I can deposit MORE THEN Rs 150000 in both the accounts, Will the Total mature amount be treated non taxable ???

Hi Sir

I have opened a PPF account in 19th Jan, 2016.

So could tell me how many installments are allowed from 19th Jan, 2016 to 31st March, 2017.

Is it 12 or more?

Max number of installments in a financial year, from 1 Apr to next Mar, are 12.

It is not necessary of have 12 installments in a year.

The number of times you invest in PPF, Amount you invest in PPF in one investment or multiple investments are not fixed.

Thanks a lot.

I invest 3 times from 19th Jan, 2016 to 31st March, 2016 & 9 times from 1st april 2016 to Jan 2017.

It is total 12 times.

Do I invest more in the financial year 2016-2017?

If I can only able to deposit for 3 years in PPF account. What should happen ?? after?

Start PPF only if you are in for 15 years.

Remember min investment is Rs 500 a year.

If you miss for a year or so you can pay penalty of Rs 50 per missed year + Rs 500 for that year and make your PPF account active.

I want to open ppf account on December 26 2016.is it wise to open now or to wait till beginning of the next financial year?? please reply

If you are sure that you want to invest for 15 years in PPF then the right time to start is now. You can claim 80C deductions for this financial year also.

Hi Sir, I have a PPF account in post office and i have invested some amount in the last year. Can I show this same amount for the current financial year or only the amount deposited during the current financial year that needs to be declared?

You can claim only the amount under 80C in this financial that you have invested in this financial year between 1 Apr 2016 to 31 Mar 2017

sir i have a ppf aacount linked to my savings account with monthly deduction of 3000, making it 12 installments per year which is limit, now i want to add some lump some amount around 30k to my ppf account. how can i add this amount, as i have 12 automatic monthly deductions? thanks

Do I have to really claim it under 80C? Basically I don’t care about 80C here but no tax on interest earned is fascinating (I am meeting 1.5L contributions by other means and I can’t stop those contributions). I see that you said in this case I can invest only 1L in PPF. Why not 1.5L? most other places I see maximum limit is 1.5L and it’s upto me whether I claim it under 80C or not. Or Can I claim 1.5L PPF amount under 80C and leave my other 80C contributions unclaimed?

You have a good point Sir. It’s not important to take claim for 80C contribution.

Personally my EPF covers most of 1.5 lakh 80C. But I still invest in PPF for reasons you mentioned. Tax is like cherry on the cake but I am more interested in the cake 🙂

Hi TEAM,

IF I OPEN A PPF ACCOUNT IN THIS MONTH (WHICH MEANS 1 SEPTEMBER), WILL I GET THE TAX BENEFIT 80 C FOR THIS YEAR (2016-17)?

OR FOR WHICH YEAR I WILL GET THE BENEFIT?

PLEASE HELP ME ON IT..

Yes you will get benefit for investing in PPF for the amount you have invested under 80C this year.

Infact every year whatever amount you put in PPF you can claim under 80C upto 1.5 lakh. Note this 1.5 lakh includes EPF,LIC premium etc.

I am planning to open a ppf account as a monthly deposit basis. Can i deposit different amount monthly as per my income?

You can deposit lump sum or multiple installments. However, maximum number of installments in a year can not be more than 12.

Amount in each installment can be different. For example in month of May you deposited 10,000 but in month of Oct you can deposit 500 only with no contribution in other months.

Amount of investment in PPF in each financial year can be be different. For example in FY 2014-15(from 1 Apr 2014 to 2015) you deposited Rs 50,000 but in FY 2015-16 you deposited 30,000 and in FY 2016-17 you deposited only 500 Rs.

Deposit amounts should be in multiple of Rs. 5.

Sir, I have open PPF account and there after settled abroad. My present status us OCI and NRI. My querry is on maturity how do I withdraw money staying abroad. My bank account in India is operative. Pl guide with all options.

If you are an NRI at the time the deposit matures, you would need to withdraw the balance. An NRI is not eligible for extension on the PPF account. What happens if you leave the account unattended past the maturity date? “In such cases the account will be considered ‘extended without contribution’ in blocks of 5 years for an unlimited period of time. Extended without contribution means that the NRI will not have to make the minimum yearly investment of Rs 500. His account will continue to earn interest at the prevailing rate. According to the rule book the extension can be made for an unlimited period of time.”

Can PPF withdrawals be repatriated?

When NRIs were permitted to continue investing in existing PPF accounts in 2003, the permission was on non-repatriable basis, that is, NRIs could not remit proceeds of PPF withdrawal out of the country. Subsequently the RBI announced a Liberalized remittance scheme in 2004 according to which NRIs could remit up to USD 1 million per financial year from the NRO account. Therefore, as of today, you can credit the withdrawal proceeds of your PPF account into the NRO account. And balance in the NRO account can be repatriated abroad up to a limit of USD 1 million per financial year. Of course, you would need to follow certain procedure for such repatriation.

In the country of residence

You would need to look at the tax rules that apply in the country of your residence. In countries like the US, the interest earned on the PPF will be taxable. PPF does not qualify as a retirement account under the US tax laws and therefore the interest will be taxable in the US. Now, the question is whether you should pay tax every year on the accrued interest or on the entire interest at the time of withdrawal. While there is no rule on this, a taxpayer can take a view depending on what is beneficial to him. For instance, if you expect to be in the high tax bracket when you withdraw, then you might pay higher tax at that time. In such case you might want to pay tax every year on accrued interest. But whatever method you choose, ensure that it is followed consistently.

I am NRE, but not NRI, can I open ppf account?

Short Ans:No you can’t open PPF account as you are NON resident of India

Long Ans: An Indian abroad , popularly known as an NRI – has two important definitions determining his residential status – one coined under the Foreign Exchange Management Act (FEMA) 1999 – and the other coined under the Income Tax Act,1961

NRI as defined under Foreign Exchange Management Act (FEMA), 1999 is based on permanent residence of an Overseas Indian who may be an Indian citizen or Person of Indian Origin permanently settled and residing outside India for purpose of employment, profession, vocation, business or having a permanent home and family ties abroad.

Non-Resident’s definition under the Income Tax Act, 1961 (IT Act) is tied to number of days of an individual’s stay in India during a particular financial year. A person is Non-Resident under IT Act if his stay in India does not exceed 181 days in a financial year( 1st April to 31st March of next year).

PPF account is for Residents of India as per Income Tax Act.

As you are not a resident of India you cannot open PPF account

is it possible to change PAN number in the PPF A/C

Why would change the PAN number in PPF account? PAN number in PPF account is for an individual.

My father don’t have ppf account but if he invest in SCSS and again invest the interest of scss in my ppf account. Then what will be the scene of tax for both? I am adult.

Interest from Your father SCSS is taxable as per his income slab.

What he does with interest from SCSS is his choice. As you are adult he can gift any amount to you,

you can invest amount in your PPF or spend it or invest anywhere.

Are you asking if your father can invest in your PPF and claim 80C deduction for himself?

Yes

I have two ppf account. One my daughters name and one on my name.

1. I have extended my account for 5 years in 2012. It will expire on 2017. Can i extend it further? I pay my yearly subscription in june.

2. If yes when i have to apply for extension i.e 2017 june or 2018 june

3. My daughter will turn major in 2017. Then i cannot avail tax deductions fm that account ? Do she need to apply to bank anyway

1. Yes Sir you can extend it as many times as you want. My friend just extended it for second time.

2. The choice to extend the PPF account with subscription has to be made within one year from the date of maturity of the account by Filling Form H. So if your account is expiring on 2017. You can submit Form H anytime after maturity. PPF matures on 31 Mar of FY. So your investment in June 2016 would be FY 2016-17 and in June 2017 would be in extended account for FY 2017-18.

3. Good question. If the maturity of the PPF account is after the minor turns 18 years old, then the account becomes operational by the applicant. The guardian or the parent will no longer be in-charge. The child will become the heir to the money and can choose his or her decision. So he/she becomes the sole Account Holder of the PPF account and can either withdraw the amount or extend the PPF account.

After 18 your daughter becomes major and you can invest (and teach her) in her name and she can avail the tax benefits. So as a family there would be tax saving!

I want to invest in PPF yearly but now i fail to deposit the amount before 5th April so, i want to invest monthly 0n from 1 to 5th May 2016, can i get interest for 11 months for the finacial year 2016-17 and than i want to deposit 1.5 lakh yearly for 2017-18 before 5th april and not to deposit monthly . and when it will be matured.

A little too much is made of the importance of investing in PPF before the 5th of the month.

Yes you will get interest for remaining 11 months. As PPF interest is calculated monthly on the lowest balance between the end of the 5th day and last day of month, however the total interest in the year is added back to PPF only at the year-end.

Lets take a case of comparing how much difference is there if you invest in PPF before and after 5th

Assumptions:

Annual investment limit: Rs. 1,50,000

Interest rate fixed for the entire tenure: 8.7%

Fixed Monthly Investment: Rs. 12,500 or

Fixed Annual Investment: Rs. 1,50,000

Final Maturity value if all the monthly investments are made before the 5th of the month: Rs. 45, 04, 384

Final Maturity value if all the monthly investments are made after the 5th of the month: Rs. 44, 73, 197

Difference: Rs. 31, 187

Forget about the ‘before 5th’ vs. ‘after 5th’ nonsense. Invest what you can, when you can.

Excellent goods from you, man. I’ve remember your stuff previous to and you’re just extremely fantastic. I actually like what you’ve bought here, really like what you’re saying and the way in which wherein you are saying it. You make it enjoyable and you still take care of to keep it smart. I can’t wait to read much more from you. This is actually a terrific website.

I want to invest in PPF yearly but now i fail to deposit the amount before 5th April so, i want to invest monthly 0n from 1 to 5th May 2016, can i get interest for 11months for the finacial year 2016-17 and than i want to deposit 1.5 lakh yearly for 2017-18 before 5th april and not to deposit monthly . and when it will be maturity.

News of Premature closure of one’s PPF account is making rounds on social media and all major financial articles/ new websites.

I needed amount in my PPF account to cover my expanses while my studies in Canada. I have been in regular touch with SBI and PNB bank (even inquired there customer care for the same), and they informed that govt. hasn’t notified anything like that as such.

Does anybody know what’s the whole scenario?

It ha s been declared but not implemented yet.

Soon, customers have the option of closing the deposit scheme after completing five years for reasons such as children’s higher education or expenditure towards medical treatment.

How soon the premature closure will be implemented? how do we know that this has been implemented across the banks. Today I went to bank (SBT) to close my PPF account opened six years back, but the bank person says he has not heard about it. Regards Sudhakar

You can now close your Public Provident Fund (PPF) account and withdraw the entire accumulated amount under certain circumstances, provided the account has completed five years. The new rule came into effect from April 1, 2016. We are trying to dig up the notification. We checked with the bank where we have PPF account and they also don’t have any information regarding it.

Earlier, one could withdraw the entire amount only at the time of maturity after the completion of 15 years. Premature closure of the account was possible only in case of death of the person.

Premature closure of PPF accounts shall now be permitted in cases such as serious ailment and higher education of children. However, the person withdrawing has to forgo 1 per cent of the interest earned on deposits as a penalty for premature closure.

Partial withdrawals from PPF account are allowed once a year from the seventh year. The maximum amount that one can withdraw is 50 per cent of the amount retained in the account at the end of fourth year preceding the year in which the amount is withdrawn or 50 per cent of the balance at the end of the immediate preceding year, whichever is lower.

My PPF account is 10years old. I have never withdrawn from this account. If I want to make a withdrawal in May 2016, will I get 50% of balance as on 31/03/2013 or 31/03/2012. The balance as on 31/03/2016 is higher than the previous balances.

Also, if I withdraw in May 2016, will I get interest for the months of April 2016 on the amount withdrawn ?

Thanks

The amount of withdrawal is restricted to 50% of the credit balance at the end of the fourth year immediately preceding the year of withdrawal or the year immediately preceding the year of withdrawal, whichever is lower.

So if you are withdrawing in FY 2016-17

Lower of these 2 balances will be taken.

Balance of the Account as on 31.03.2016

Balance of the Account as on 31.03.2013

Usually balance in earlier year for ex 31.03.2013 will be lower than balance in 31.03.2016.

Yes you will get interest for month of Apr 2016 on balance amount in Apr 2016, because PPF interest is calculated monthly on the lowest balance between the end of the 5th day and last day of month, however the total interest in the year is added back to PPF only at the year-end

If a PPF account in one bank is transferred to another bank in between the financial year, who will pay the interest on the the PPF amount ?

Its the Govt who pays the interest on PPF. While transferring though one has to close an existing PPF account and open a new one, the PPF account will be considered as a continuing account and one should not loose out any interest Our article Transferring PPF account discusses it in detail.

My mother died in march 2016. She had her PPF account where in me and my sister are nominee. I need some clarifications regarding her PPF account.

1.0] Can we continue her PPF account

2.0] If yes should we deposit the money in her name

3.0] when can we inform the bank regarding her death.

pl guide

Sad to hear about your mother, our condolences are with the family.

Even during a situation wherein the nominees would like to continue with the PPF account of the deceased, the account could not be further operated, extended or transferred. In all possibilities, the account has to be closed

On the death of a subscriber, the balance in the PPF account is paid on demand to his nominee or successor. However, the balance, if not withdrawn, continues to earn tax-free interest. No partial withdrawals are permitted. It is risky for the nominee to continue the account because the nominee cannot appoint a nominee.

Thanks for the comment and information

Thanks for appreciating us. You are welcome.

Just spread the word around about bemoneyaware.com

MY MOTHER DIED RECENTLY. ME AND MY SISTER ARE NOMINEE. CAN WE CONTINUE MY MOTHERS PPF ACCOUNT? IF YES SHOULD I DEPOSIT MONEY IN HER PPF ACCOUNT.

I have ppf account linked with ICICI savings account with zero balance service.

I was having standing instruction given on every 4th.

But in First month I had two transaction made into ppf account resulting into total 13 transactions per year.

I already received confirmation SMS about money transfer.

I want to know about my 13th transaction happened recently.

Will it allow me to have 13 transactions in a year? what will happen with that deposited money?

As per union budget announced on 29th February, there is introduction of tax on EPF and NPS accruals on withdrawals. I have few queries how it would work for PPF as below,

1. Would this be applicable for PPF as well?

2. Also, as per the budget the tax would be levied on contributions done after 01-April-2016. Would interest accruals for contributions before that date will also be taxable? For Ex. if my PPF or EPF account balance as of 31st March 2016 is 1 lack rupees. And my retirement is 20 years away which means interest would be accrued over next 20 years. Would that interest be taxable on withdrawals?

if i have opened ppf account in 5th feb 2001 the maturity of the ppf will be in 1st april 2016 or 1st april 2017 which one is correct .

I have my first name only in all documents. I went to bank, They told to open a account as “bhawna .” keeping “.” as my last name. Will it create any problem while doing withdrawal of the amount. If any one have faced this problem please help

If bank has said that then it should be OK wrt to Bank.

You would not face any problem in any documents in India except if you go to USA where Last name is compulsory. So people in suchsituation usually resort to putting the first-name ain the surname section of this form. As a consequence, you will be issued a VISA with it’s first name field as FNU ( First Name Unknown )

In PAN Out of the three names, surname is the mandatory

Hi,

If an employed wife deposits amount in an employed husband’s ppf account, will the wife be able to claim for the amount?

Please guide

Yes. As mentioned in our article 80C Income Tax Deductions can be claimed in whose name

For resident individual, can be in the name of self/spouse, any child & for HUF, it can be in the name of any member of the family. Hence, the deduction could be claimed in respect of contributions made in his own PPF account or in the account of spouse or any child. Accordingly, your wife would be eligible to claim deduction in respect of contributions made by her in her husband’s or child PPF account.

i m government employee but not getting any pf account as i m join After 2005 Am i able to open ppf account

Yes you can open PPF account. It can be opened by anyone including govt. employees whether one has EPF or not.

Hi

I have a query on PPF Penalty payment. I have an account since 2007, I have paid amount in financial year 2007-08, 2008-09, 2009-10, & 2010-11. I subsequently missed making investment in SBI in subsequent years 2011-12, 2012-13,2013-14 & 2014-15.

Basis the information available in various websites & SBI site, I have the impression that I am required to pay fine of 50/- for each year missed and minimum payment required for each year i.e 500 /- for each year.

From my understanding the penalty should be 50*4 = 200 Rs at the govt account and 500*4 in my PPF account for reactivation

I visited SBI Bank branch, where they advised me that I would be required to pay penality of 950 Rs in the govt account and deposit 500*4 in my account for reactivation.

I was told it is cumulative…

Even if cumulative

Year 2011-12 : 50

year 2012-13 : 100

year 2013-14 : 150

year 2014-15 : 200

Even in this case this sums up to 500 … I wanted to understand what should be the penality, where it need to be deposited.

In this case, Is it possible to make the payment online to SBI PPF account, Given the operating style of SBI, I would prefer adding PPF account as payee in ICICI or other branch, and transfer funds, Would the account get automatically activated in this case with deduction of appropriate fees.

In order to revive the account,you must give a request in writing to the bank or post office where the account is held. Since the PPF account has been declared inactive, reactivating it will require a personal visit and verification by the bank.

A penalty of Rs 50 for each year of default is also payable along with the arrears. So if you have missed contributing in PPF for 2 years then you have to pay Rs 50 *2 = Rs 100 as penalty.

In your cae you have to pay 50 * 4=200 Rs as penalty. You have to fill the form https://www.sbi.co.in/portal/documents/21386/22045/FORM-B+(PPF+DEPOSIT+SLIP).pdf/30fba742-33c8-4688-bcc9-d1818c3edacd

For other years minimum you can pay Rs 500 and max 1 lakh from FY 2011-12 and 1.5 lakh from FY year 2014-15

From the FAQ on SBI website https://www.sbi.co.in/portal/web/customer-care/faq-public-provident-fund

A penalty of Rs. 50 will be levied per year of default, if the customer doesn’t deposit the minimum deposit amount of Rs. 500 on the completion of the financial year.

Please follow http://dalmiaadvisory.com/ppf-interest-rate-and-rules/ it has all the FQ about the PPF which is really appreciable.I found all most all queries solution here.

Can i deposit 60Rs Per Month Which Make 720/- per year in PPF A/c.

Hi,

I have a query on the number of transactions that I can make in PPF account.

I hold PPF account for myself in post office and also opened a PPF account in ICICI bank on my kids behalf.

I want to give standing instructions to deduct money every month from the account directly. ICICI bank reps told me that I can do only 12 transactions in a year.

Is this a limit for both the accounts together or for each account.

Appreciate your response on this.

Thanks,

– Krishna

Number of transactions are 12 for each account. Your kid PPF account has a different PPF number.

The only restriction(debatable) is that together you should not put more than 1.5 lakh per year in your and kids together. our article PPF Account for Minor and Self discusses it in detail

How to claim the deposit in PPF a/c of a deceased person where there is no nomination and balance lying in credit is around 6 Lakhs. The Bank is insisting on Succession Certificate or legal heir certificate from court. Please advise.

i read this Somewhere

Only the person actually depositing the amount gets section 80C benefit This means if your spouse deposits any amount into your PPF account, you will not be able to claim the deduction benefits under section 80C. Infact, your spouse will be able to (rightfully) claim section 80C deductions on his/her income

means if a open a ppf account in name of my mom and My Dad depositing Money in My Account So He can Claim 80C Deduction In his name ?

Correction Money in Her* Account

i read this Somewhere

Only the person actually depositing the amount gets section 80C benefit This means if your spouse deposits any amount into your PPF account, you will not be able to claim the deduction benefits under section 80C. Infact, your spouse will be able to (rightfully) claim section 80C deductions on his/her income

means if a open a ppf account in name of my mom and My Dad depositing Money in My Account So He can Claim 80C Deduction In his name ?

Correction Money in Her* Account

Dear sir,

I opened ppf account inpost office, on19/04/2000. It maturied on 31/03/15. But ppf calculate maturity period in financial year only. ie March 2016. From 1/4/2015/ to 31/03/16 any subcription may pay or not.

I already paid 180 months(15*12)

Sir

A Public Provident Fund (PPF) account has a maturity of 15 years but calculation of 15 years start from the end of financial year in which the account was opened. For example, If you have opened the PPF account on 9 Apr 2000, then 15 years tenure will start from the end of FY 2000-2001 i.e. 31st march 2001. The lock is till 31 Mar 2015 and so you can withdraw only after be 1st Apr 2016.

You please verify with your Post office. You can also check the PPF book on which maturity date should be mentioned.

Dear sir,

I opened ppf account inpost office, on19/04/2000. It maturied on 31/03/15. But ppf calculate maturity period in financial year only. ie March 2016. From 1/4/2015/ to 31/03/16 any subcription may pay or not.

I already paid 180 months(15*12)

Sir

A Public Provident Fund (PPF) account has a maturity of 15 years but calculation of 15 years start from the end of financial year in which the account was opened. For example, If you have opened the PPF account on 9 Apr 2000, then 15 years tenure will start from the end of FY 2000-2001 i.e. 31st march 2001. The lock is till 31 Mar 2015 and so you can withdraw only after be 1st Apr 2016.

You please verify with your Post office. You can also check the PPF book on which maturity date should be mentioned.

I missed to invest in my ppf a/c in 2014-15. I have invested Rs 600 on 09.4.15. I want to know whether the fine of Rs 50 will be deducted automatically or I have to apply specifically. Currently the transactions show no deduction of fine from total balance.

In case you fail to deposit the minimum amount of Rs 500/ in a financial year, your PPF account is marked as de-activated account. It can be again activated by paying a small penalty. Thus to re-active your account, you need to pay a fine of Rs.50 for each year that you have not made any subscription, and also make a minimum subscription of Rs. 500 for each year you have missed. Then your account will be reactivated and you will re-start earning interest. The account will only be closed after maturity and will continue to earn interest till it is closed. The facility of loan or withdrawal will not be allowed from such account.

So the 600 Rs you deposited – 500 Rs will be for last year 50 would be penalty and 50 Rs would be for this year

I missed to invest in my ppf a/c in 2014-15. I have invested Rs 600 on 09.4.15. I want to know whether the fine of Rs 50 will be deducted automatically or I have to apply specifically. Currently the transactions show no deduction of fine from total balance.

In case you fail to deposit the minimum amount of Rs 500/ in a financial year, your PPF account is marked as de-activated account. It can be again activated by paying a small penalty. Thus to re-active your account, you need to pay a fine of Rs.50 for each year that you have not made any subscription, and also make a minimum subscription of Rs. 500 for each year you have missed. Then your account will be reactivated and you will re-start earning interest. The account will only be closed after maturity and will continue to earn interest till it is closed. The facility of loan or withdrawal will not be allowed from such account.

So the 600 Rs you deposited – 500 Rs will be for last year 50 would be penalty and 50 Rs would be for this year

So does it means that i will not receive interest of the period during which my account was deactivated..??

whether the interest on the same deactivated period will be credited after i pay penalty and minimum amount..?

The amount in your account will continue to earn/accrue interest even though the account is deactivated.

you can revive your PPF account by paying a fee of Rs. 50/- for each year that you defaulted, along with subscription arrears of Rs. 500/- for each such year.

Since the PPF account would have been declared ‘inactive’ by the bank, reactivating it will require a personal visit and verification by the bank.

Hi All,

Question – My PPF account has matured this March. I would like to renew it for another 5 years, BUT, would like to withdraw 90% of the maturity amount and renew with only 10%. Is this possible.Appreciate a feedback from the forum.. thanks.

Hi All,

Question – My PPF account has matured this March. I would like to renew it for another 5 years, BUT, would like to withdraw 90% of the maturity amount and renew with only 10%. Is this possible.Appreciate a feedback from the forum.. thanks.

i received maturity of ppf on 31.3.2015. interest for the month of march 2015 was not given .post office says that minimum amount for the month of march 2015 was nil as payment was made on 31 march 2015 (as a/c matured on that date).is it true? this means that every body will recieve interest payment for 11 months only in the year of maturity as all accounts will mature on 31 march.

i received maturity of ppf on 31.3.2015. interest for the month of march 2015 was not given .post office says that minimum amount for the month of march 2015 was nil as payment was made on 31 march 2015 (as a/c matured on that date).is it true? this means that every body will recieve interest payment for 11 months only in the year of maturity as all accounts will mature on 31 march.

I got interest on PPF acount credited in my account on 31 March 2013(from my Account statement), So i will declare it in ITR of Assessment year 2013-2014, given the fact that Previous year in which this interest was credited is 2012-2013(1 April 2012-31March 2013) ?

As the interest is credited on 31 Mar 2013 it has to be accounted in the FY 2012-12 or AY 2013-14.

Show it under exempt Income in Interest income as explained in our article Exempt Income and Income Tax Return

I got interest on PPF acount credited in my account on 31 March 2013(from my Account statement), So i will declare it in ITR of Assessment year 2013-2014, given the fact that Previous year in which this interest was credited is 2012-2013(1 April 2012-31March 2013) ?

As the interest is credited on 31 Mar 2013 it has to be accounted in the FY 2012-12 or AY 2013-14.

Show it under exempt Income in Interest income as explained in our article Exempt Income and Income Tax Return

Where from the combined limit of Rs. 1 lakh for being stated? How the rules are being interpreted and quoted on several PPF investment related sites? I have PPF account in my name and another in my Kid’s name. The combined investment per year is more than 1.00 lakh. I get interest amount in both these.

Arv Raj I personally had the same confusion (the Chartered Accountants I contacted gave me separate version). Lot of people have the confusion ex

economictimes

From the Indiapost ‘s PPF rules(pdf format)

3. Limit of subscription:- (1) Any individual may, on his own behalf or on behalf of a minor of whom he is the guardian, subscribe to the Public Provident

Fund (thereafter referred to as the fund) any amount not less than Rs. 500 and not more than Rs. 70,000 in a year.

This limit has been revised to 1 lakh now.

Yes at times due to ignorance (of bank/postoffice/subscriber) the ppf account of minor and parent gets interest for amount invested more than 1 lakh but it is not legal.

If the issuing authority (bank or post office) detects two accounts during the tenure of the scheme, you will get back only the principal you put into the account, sans any interest.

Thanks Kirti for answering promptly.

My PPF accounts are with SBI and I have asked the dealing people specifically regarding this, highlighting my case. The didn’t see any problem with the case.

Even the portion of rules you highlight doesn’t specifically deny the possibility of my case. One may think the statements to be applicable to individual accounts (i.e. kid’s account and own account separately).

Please cross-check and clarify, because I am relying on this mode of investment for my kid’s education. It will be disastrous if I get no interest later on one of the accounts.

Yes as you said, rule is not explicit. I had same doubt and even bank officials were not clear about the investment limit. They were okay if I put more than a lakh in both the accounts(parent and kid), But I played safer. Together in my and my child’s account I put 1 lakh.

I have asked CA Karan Batra for the answer. Let’s see what he says!

BTW you can put money in your wife’s name(if she is not working) and as interest from PPF is tax free there there will not be clubbing of income!

The PPF Laws state that:-

“Any individual may,on his own behalf or on behalf of a minor of whom he is the guardian, subscribe to the Public Provident Fund (thereafter referred to as the fund) any amount not less than Rs. 500 and not more than Rs. 1,00,000 in a year.”

If you carefully analyse the law, the maximum limit has been placed on the “Person making the Investment” and “Not on the Person in whose name the Investment has been made.”

So irrespective of whether you invest in your name or your child’s name- your limit is Rs. 1,00,000 only.

Moreover, practically speaking if what you are saying was allowed, every person would have been allowed a limit of Rs. 3,00,000 (assuming 2 minor children)

Thanks Karan, I get your point.

But may I then say that even for minimum amount (Rs. 500) this kind of distribution will be applicable (e.g Rs. 250 in each)? That doesn’t seem to be true.

May be I am extending the logic to my favour, as I have already done investment and still bank has not stopped me from doing so.

Please think it over again and kindly respond.

Thanks

AR

Forget the Bank and its employees… More than half of the Bank & Post Office Employees dont know about the PPF Norms…

The above analysis is only my interpretation of the law as the law does not very specifically state about your query…

So if you think your interpretation is correct, you surely can take the risk but I personally wont advise you to invest more than Rs. 1,00,000

Thanks Karan for speedy reply. I agree with you about the bank and Post office employees not being aware of the norms. When I opened account for my child, bank employee said I can deposit but at my own responsibility

Ignorance is bliss in some cases. Arv it’s a call you have to take – you can continue investing in name of your kid and yours for more than 1 lakh but be prepared just in case they roll it back.

I personally is investing to max of 1 lakh in child and parent’s account together till my child is a minor.

Once my child becomes attains 18 year of age I plan to invest in each of the account individually!

Thanks Karan and Kirti for the earnestness in helping.

I don’t wish to take chances in this matter. May be I will switch over to some other investment mode if this issue remains a mystry.

Regards

Arv

Glad we could be of help. Don’t know whether it is right or wrong. So be aware of what you are doing and why.

How old is your child?

You can invested atleast 15,000 in a fixed deposit Quoting from Economic Times Seven ways to earn tax-free income

if a parent invests in a minor child’s name, the income is clubbed with that of the parent who earns more. In some cases, a minor child may have a personal income, such as a cash prize in a competition or payments for commercials and events. However, this is rare and mostly it’s the parent who invests on behalf of the child. There is a small Rs 1,500 exemption per child per year for the income earned by such investments.

You can avail of this for a maximum of two children. This means, you can safely invest Rs 15,000 in a fixed deposit in your child’s name. If you have two children, that’s Rs 30,000 earning tax-free income every year. Opt for the annual payout option because the cumulative option will push up the earning beyond the tax-free limit in a couple of years as the compounding effect comes into play. Tax experts feel the Rs 1,500 exemption per child is too low and should be raised, but there are others who think this should be removed. A simpler tax structure will encourage greater compliance. The original DTC had proposed the removal of nearly all exemptions and deductions, but raised the basic exemption limit and tax slabs.

If your child is above 8 years then you can gift him bonds ex: NABARD bonds which mature after 10 years when your child will be a major and clubbing of income will not apply

Where from the combined limit of Rs. 1 lakh for being stated? How the rules are being interpreted and quoted on several PPF investment related sites? I have PPF account in my name and another in my Kid’s name. The combined investment per year is more than 1.00 lakh. I get interest amount in both these.

Arv Raj I personally had the same confusion (the Chartered Accountants I contacted gave me separate version). Lot of people have the confusion ex

economictimes

From the Indiapost ‘s PPF rules(pdf format)

3. Limit of subscription:- (1) Any individual may, on his own behalf or on behalf of a minor of whom he is the guardian, subscribe to the Public Provident

Fund (thereafter referred to as the fund) any amount not less than Rs. 500 and not more than Rs. 70,000 in a year.

This limit has been revised to 1 lakh now.

Yes at times due to ignorance (of bank/postoffice/subscriber) the ppf account of minor and parent gets interest for amount invested more than 1 lakh but it is not legal.

If the issuing authority (bank or post office) detects two accounts during the tenure of the scheme, you will get back only the principal you put into the account, sans any interest.

Thanks Kirti for answering promptly.

My PPF accounts are with SBI and I have asked the dealing people specifically regarding this, highlighting my case. The didn’t see any problem with the case.

Even the portion of rules you highlight doesn’t specifically deny the possibility of my case. One may think the statements to be applicable to individual accounts (i.e. kid’s account and own account separately).

Please cross-check and clarify, because I am relying on this mode of investment for my kid’s education. It will be disastrous if I get no interest later on one of the accounts.

Yes as you said, rule is not explicit. I had same doubt and even bank officials were not clear about the investment limit. They were okay if I put more than a lakh in both the accounts(parent and kid), But I played safer. Together in my and my child’s account I put 1 lakh.

I have asked CA Karan Batra for the answer. Let’s see what he says!

BTW you can put money in your wife’s name(if she is not working) and as interest from PPF is tax free there there will not be clubbing of income!

The PPF Laws state that:-

“Any individual may,on his own behalf or on behalf of a minor of whom he is the guardian, subscribe to the Public Provident Fund (thereafter referred to as the fund) any amount not less than Rs. 500 and not more than Rs. 1,00,000 in a year.”

If you carefully analyse the law, the maximum limit has been placed on the “Person making the Investment” and “Not on the Person in whose name the Investment has been made.”

So irrespective of whether you invest in your name or your child’s name- your limit is Rs. 1,00,000 only.

Moreover, practically speaking if what you are saying was allowed, every person would have been allowed a limit of Rs. 3,00,000 (assuming 2 minor children)

Thanks Karan, I get your point.