PPFAS Conservative Hybrid Fund is the first-ever offering by PPFAS Fund House in the Hybrid Mutual Fund space. It aims to replicate their flagship Mutual Fund PPFAS Flexicap Fund on the debt side. In this article, we shall explore the Features of the PPFAS Conservative Hybrid Mutual Fund, Understand What are Hybrid Funds? About PPFAS, the Mutual Fund Offerings of PPFAS and people behind PPFAS?

Table of Contents

Features of PPFAS Conservative Hybrid Mutual Fund

PPFAS, Parag Parikh Financial Advisory Services, is the only fund house that offers the least number of funds (3 currently, Parag Parikh Flexi Cap Fund, Parag Parikh Liquid Fund, Parag Parikh Tax Saver Fund). They believe that too many choices lead to decision paralysis and confuse investors. The fund house has funds in categories where they are excited to invest their own money or they have some form of differentiation. PPFAS Conservative Hybrid Fund is the first-ever offering by PPFAS Fund House in the hybrid Mutual Fund space.

Hybrid mutual funds are types of mutual funds that invest in more than one asset class. Most often, they are a combination of Equity and Debt, at times Gold or even Real estate. They are suitable for those who want to get slightly higher returns from fixed deposits and Post office saving deposits schemes. Hence those who want to invest in Debt Funds but with less volatility should look at such funds.

Parag Parikh Conservative Hybrid Fund will invest

- 10-25% of their assets in equity

- up to 10% of its corpus in units of Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InVITs)

- Rest in Debt: Predominantly in central and state government bonds and high-quality PSU debt as well as AAA-rated

The Investment Objective of Parag Parikh Conservative Hybrid Fund is To generate regular income through investments predominantly in debt and money market instruments. The Scheme also seeks to generate long-term capital appreciation from the equity investments under the scheme.

The New Fund Offer will be open from 7 May 2021 to 21 May 2021. After that, it will also be available for subscription as it is an open-ended fund.

- Plans: Growth, IDCW Monthly(Dividend)

- Expense ratio: 0.6%(regular plan) and 0.3% (Direct plan)

- Exit Load: For units in excess of 10% of the investment,1% will be charged for redemption within 365 days

- Riskometer: Moderately High

- Benchmark: CRISIL Hybrid 85+15 Conservative TRI

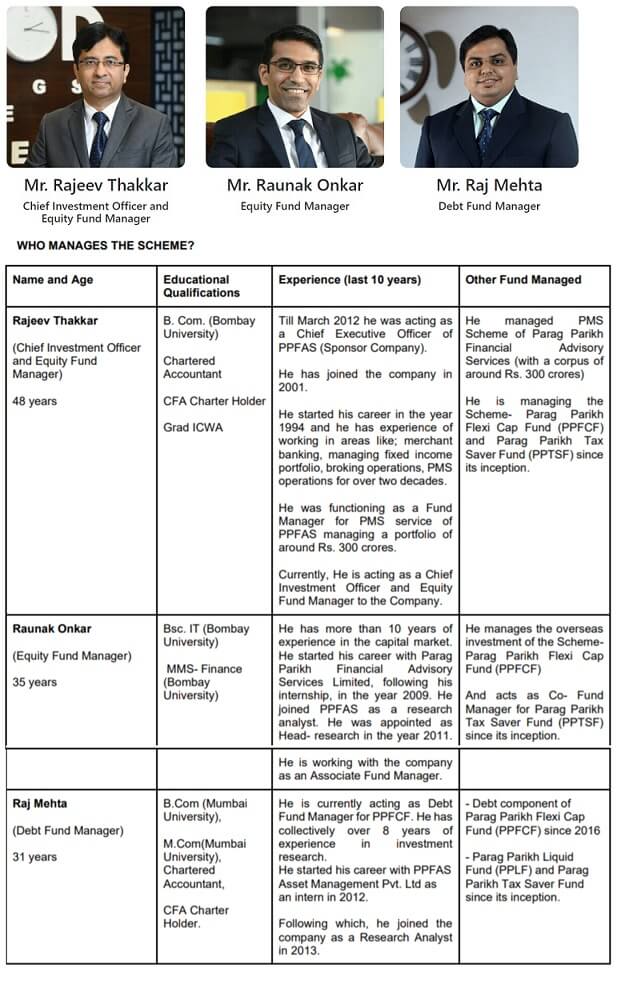

- Managers: jointly managed by Rajeev Thakkar and Rounak Onkar on the equity side and Raj Mehta for the debt portion

- Tax: Same as Debt Fund (explained later in the article)

What are Hybrid Funds?

Hybrid mutual funds are mutual funds that invest in more than one asset class. Mostly they are a combination of Equity and Debt assets, and can also include Gold or even Real estate through REITs

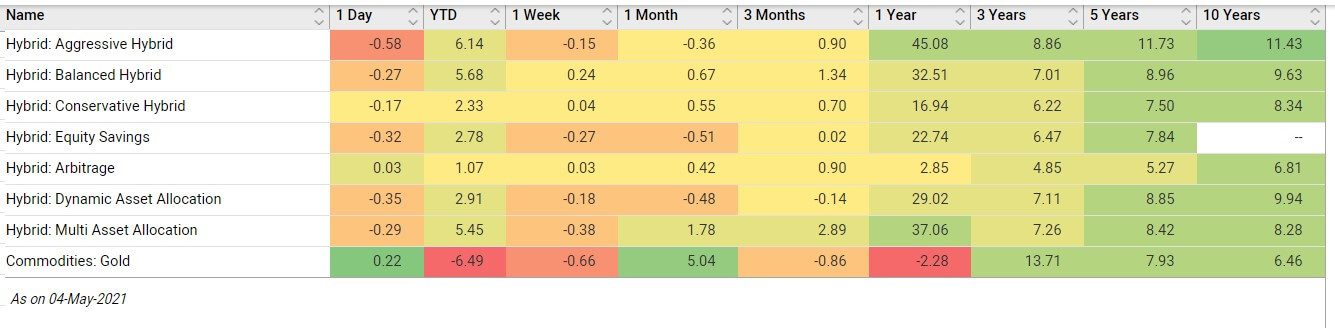

There are different types of Hybrid funds based on the levels of risk tolerance which ranges from conservative to moderate and aggressive. They achieve this through different percentages of investments in Equity, Debt, Gold, Derivatives, REITS. The Types of Hybrid funds available and their returns are given in the image below

SEBI has defined a set allocation for all types of Mutual Fund Schemes.

For example, Aggressive Hybrid Funds can invest a minimum of 65 percent and a maximum of 80 percent in the equity asset class and 20 to 35 percent in the debt asset class.

Conservative Hybrid Funds are required to invest 10 to 25 percent of their total assets in equity and equity-related instruments. The remaining 75 to 90 percent is to be invested in debt instruments.

| Category of Schemes | Scheme Features |

| Balanced Hybrid Fund | Invest between 40% and 60% of total assets in equity and its related securities; should invest between 40% and 60% of total assets in debt securities. No arbitrage will be allowed |

| Aggressive Hybrid Fund | Invest between 65% and 80% of total assets in equity and its related securities; should invest between 20% and 35% of total assets in debt securities |

| Conservative Hybrid Fund | Invest between 10% and 25% of total assets in equity and its related securities; should invest between 75% and 90% of total assets in debt securities |

| Dynamic Asset Allocation or Balanced Advantage Fund | Invest in dynamically-managed equity or debt securities |

| Multi-Asset Allocation Fund | Invest in a minimum of three asset classes with a minimum allocation of 10% in each asset class |

| Equity Savings |

Invest at least 65% of the total assets in equity and its related securities and at least 10% of total assets in debt securities |

| Arbitrage Fund | Should follow arbitrage strategy and invest at least 65% of total assets in equity and its related securities |

Existing Direct Hybrid Funds

Details of Existing Top Direct Hybrid Funds from Value Research Online are shown in the image below

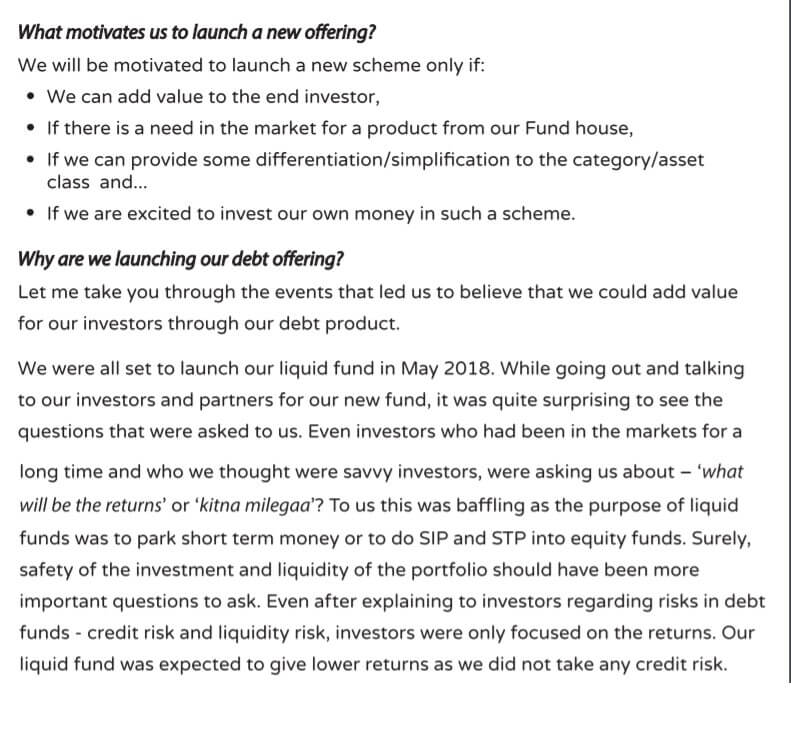

Why is PPFAS offering the Conservative Hybrid Funds?

Excerpt From the message of the CEO Neil Parag Parikh is given below, you can read the full here.

About PPFAS Mutual Funds

PPFAS Mutual Fund was established in 2013 by Mr. Parag Parikh.

Parag Parikh

Mr. Parag Parikh was known to be a research-driven, value investor. His was the first Indian brokerage house to set up formal equity research under his company, Parag Parikh Financial Advisory Services. Then he started a PMS (portfolio management service).

In May 2013 he started PPFAS Asset Management by launching PPFAS Long Term Value Fund, which we now know as Parag Parikh Flexi Cap.

He passed away in May 2015 in a car crash at age of 60 when he was in Omaha to attend Warren Buffett’s speech as part of Berkshire Hathaway’s annual meeting.

He was a great believer in value investing and behavioral finance. He wrote two books about how an investor should not only look at financial statements but also be aware of emotional biases. The two books are

- Stocks to Riches: Insights on Investor Behaviour

- Value Investing And Behavioral Finance: Insights into Indian Stock Markets Realities

PPFAS Funds

Unlike other Mutual Funds PPFAS are the only fund house that offers the least number of funds (3 currently, Parag Parikh Flexi Cap Fund, Parag Parikh Liquid Fund, Parag Parikh Tax Saver Fund). The information about their funds is given below.

They have a strong conviction in the principle of compounding, they offer our investors only the ‘Growth Option” and not the ‘Dividend Option’.

Parag Parikh Flexi Cap Fund (PPFCF) is a Local Fund with Global Focus. It is one of few Indian mutual fund schemes to invest in a basket of Indian and foreign stocks. Its investment universe is not restricted by any self-imposed limitations in terms of sector, market capitalization, geography, etc.

Parag Parikh Liquid Fund (PPLF) is an open-ended liquid scheme with the primary investment objective of delivering reasonable (non-guaranteed) market-related returns with lower risk and high liquidity through judicious investments in money market and debt instruments. It is a good alternative to bank fixed deposits, enabling one to invest to deploy money for short periods.

Parag Parikh Tax Saver Fund is An open-ended equity-linked saving scheme with a statutory lock-in of 3 years and tax benefit. It Invests in Stocks of small, medium and large-sized Companies based in India

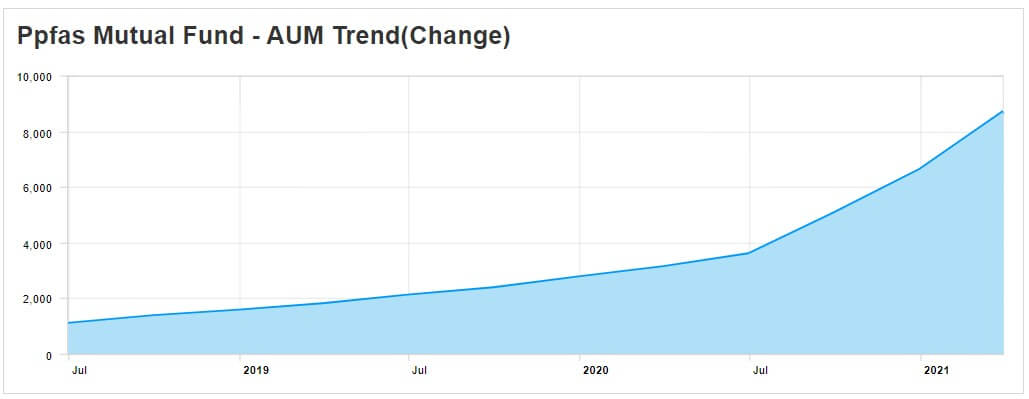

Their assets under Management are steadily increasing as shown in the images below.

PPFAS Managers

PPFAS Fund managers are Rajeev Thakkar and Rounak Onkar on the equity side and Raj Mehta for the debt portion. The information about the managers is given below

Tax on Conservative Hybrid Mutual Funds

They are Debt funds.

Tax on Dividend of Conservative Hybrid Fund

If you go for Dividend Option, now called Income Distribution cum Capital Withdrawal(IDCW), then Dividends are added to the income of the investors and taxed according to their respective tax slabs.

TDS: If an investor’s dividend income exceeds Rs. 5,000 in a financial year, the fund house will deduct a TDS of 10% before distributing the dividend. But one would still have to pay tax as per the tax slabs. One can claim TDS deducted while filing ITR.

Capital Gains on Selling the Mutual Funds

If the mutual fund units are sold within 3 years from the date of investment, the entire amount of gain is added to the investors’ income and taxed according to the applicable slab rate.

No tax is to be paid as long as you continue to hold the units. This is explained in our article Short Term Capital Gains of Debt Mutual Funds, Tax, ITR

If the mutual fund units are sold after 3 years from the date of investment, gains are taxed at the rate of 20% after providing the benefit of inflation indexation. This is explained in our article Long term Capital Gains of Debt Mutual Funds: Tax and ITR

Video on PPFAS Con

In this video, CA Rohit Gyanchandani along with Raj Mehta who is the Fund Manager of PPFAS gives a detailed analysis of Parag Parikh Conservative Hybrid Fund

Related Articles:

- All About Mutual Funds

- Direct Investing in Mutual Funds

- Short Term Capital Gains of Debt Mutual Funds,Tax, ITR

- Long term Capital Gains of Debt Mutual Funds: Tax and ITR

What do you think of Debt Mutual Funds? Have you invested in PPFAS funds? Are you considering investing in PPFAS Conservative Hybrid Fund?