So, you have decided to invest in stocks. You can’t go to a stock exchange or stock market to buy or sell shares. You need to have a PAN Card and Open a demat and trading account with a broker. This article explains the process of opening a demat account. What is KYC and document checklist required? Why does one need to provide a Power of Attorney?

Table of Contents

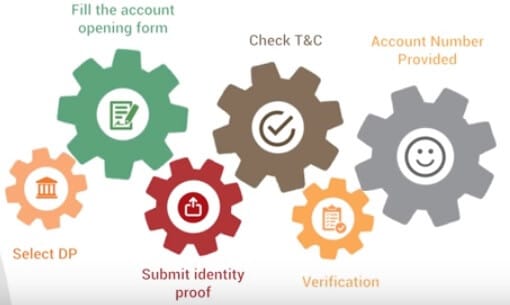

Overview of Process of Opening a Demat Account

The Demat opening process is shown in the image below. If you are not comfortable or don’t have time to research stocks, then we would recommend you invest in Mutual Funds. Please don’t keep all your eggs in one basket. Invest in stocks after proper Financial Planning.

Demat Account Opening Documents (Checklist)

Please check the following while opening a Demat account:

- Name, address, phone number and date of birth have been stated correctly.

- PAN has been mentioned correctly. Occupation, financial and bank details have been written.

- Signature on Know Your Client(KYC) form, NSE & BSE agreements (on all the pages of the agreement), Risk Disclosure document,

- You also need to sign Power of Attorney.

- Signature across the photographs.

- Introducer’s full details have been mentioned along with signature and seal.

- Name and signature of witnesses are present.

Let’s get through the list in detail.

PAN in Demat account opening process

From 1 Apr 2006, PAN or Permanent Account Number is required to open Demat account. For joint account holders PAN details are required for both.

PAN is issued by the Income Tax Department and it enables the department to link all financial transactions of the person with the department. PAN cards are issued by the I-T department, but the front-end of the process has been outsourced to UTI Technology Services Ltd and the National Securities Depository Ltd(NSDL) since July 2003.

PAN Card contains details such as PAN, Name, Date of Birth, Father’s Name, Photograph and Signature of PAN holder. It costs Rs 107.00 to get a PAN Card for Resident in India

One can apply for PAN either online i.e. through the internet or offline.

- The online application can be made either through the portal of NSDL (http://tin.tin.nsdl.com/pan/index.html) or portal of UTITSL (http://www.myutiitsl.com/PANONLINE/). In Online mode once the application and payment is accepted, the applicant is required to send the supporting documents through courier/post to NSDL/UTIITSL

- Offline PAN Card Application Form 49A for manual submission

Please select the name in PAN card carefully. Though you can change it later, try to stick to one name across all your official documents. If you have Aadhaar made, we will recommend you to stick to name in Aadhaar.

Our article What is PAN Card? covers PAN Card in detail.

What is Demat? What is Depository?

India adopted Demat System(Dematerialization)for electronic storing of stock certificates in 1996. In Demat System, the stocks owned by individuals, are stored in electronic format in central security depositories. When someone sells stocks, they are electronically removed from sellers Demat account and moved into buyers demat account.

A depository is an organization which holds securities (like shares, debentures, bonds, government securities, mutual fund units etc.) of investors in electronic form. There are two depositories in India and are registered with SEBI.

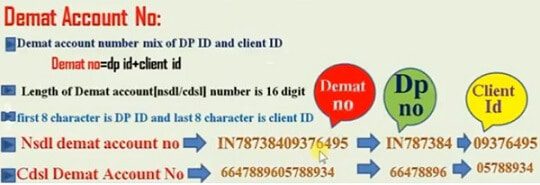

NSDL – National Securities Depository Limited (NSDL) was founded on 8 November 1996 was the first electronic securities depository in India. NSDL is promoted by NSE (National Stock Exchange) along with few major banks like Axis, State Bank of India, HDFC Bank and Citibank India (etc). DP ID for NSDL accounts of 8 characters and normally the first two characters are “IN”.

CDSL – Central Depository Services Limited (CDSL), is India’s second securities depository service. CSDL is promoted by BSE(Bombay stock exchange) along with few banks like ICICI, Bank of India, Union Bank of India and Standard Chartered Bank(etc). DP ID for CDSL accounts of 8 characters and all 8 characters are numerical.

Each Demat account has a unique identification number which is DP Id + Client Id

Broker or Depository Participant

You cannot open an account in a depository yourself. You need to open a demat account and trading account through a broker. Example of brokers are Geojit, ICICI Direct, Kotak Securities, Zerodha etc. A broker can be a company or an individual registered and licensed by Securities and Exchanges Board of India (SEBI).

For purpose of buying or selling shares, you need a trading account. Trading account is an interface between your Bank account and your Demat account used during buying and selling.

Every broker charges certain commission and fees for processing investor’s order. These charges can vary from broker to broker. Some give discounts on the basis of the amount of trades conducted, annual maintenance charges etc. Do check the quality of support and platforms before being sold by the price offering.

Account opening fee: Fee for opening the demat and trading account or 3-in-1 account. Depending on the DP, account opening charges range between Rs. 500 to Rs. 700. Some broker even offer zero opening account fee

Annual maintenance fee: The fee required to maintain the account charged annually and in advance

Transaction fee or Brokerage: Fee charged for buying or selling securities. While some DP charge a flat fee per transaction, some peg the fee to the transaction value, which is subject to a minimum amount. The fee also differs based on the kind of transaction (buying or selling) also for different types of transactions – intraday, delivery, F&O etc. Other than Brokerage GST and Securities Transaction Tax (STT), Stamp Duty, Exchange Levy etc are also charged by DP.

Demat Account opening process

The account opening process is now paper paperless.

For example, for Geojit You need to login to the website or mobile app using your email id or Social media details (like Facebook, Google, LinkedIn)

Enter the PAN number or Aadhaar number which checks your KYC compliance.

Upload the soft copy of the cheque leaf of the bank account with your name printed on it.

Complete the profile

In case of any issues, Individual may connect with the regional office who will assist in the completion of the entire process.

We liked the Geojit feature where the benefit of the Investors, Geojit provides a demo trading platform enabling Individuals to understand the process of executing trade, interaction with the comprehensive and highly customized Selfie Trade Platform.

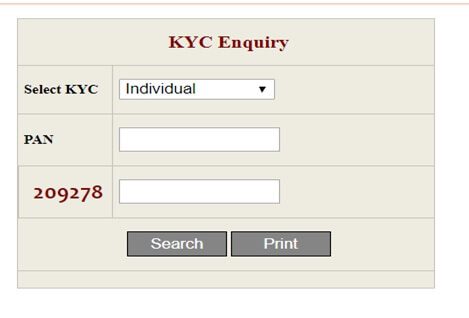

KYC in Opening a Demat account

KYC or “Know your Client”, a term commonly used for Client Identification Process. SEBI has prescribed certain requirements relating to KYC norms for Financial Institutions and Financial Intermediaries including Mutual Funds to ‘know’ their Clients. This would be in the form of verification of identity and address, providing information of financial status, occupation and such other demographic information. Applicant must be KYC compliant while investing with any SEBI registered Mutual Fund.

Account Opening process is one of the main aspects of opening an account is filling out the Know Your Client (KYC) form as stipulated by SEBI.

KYC is one-time exercise. once KYC is done through a SEa BI registered intermediary (broker,DP,Mutual Fund etc), you need not undergo the same process again when you approach another intermediary.

You can check your KYC status at https://www.nsekra.com/ as shown in the image below

If you don’t have KYC done, then you need to submit the form.

Why Power of Attorney is required to open a Demat account?

A power of attorney or POA is an authorization given by you to your broker to transfer securities to a stock exchange when you sell shares or pledge the securities with the broker for a limited time.

When you take delivery of your share it goes to your Demat account. When you sell your shares the POA is required as it gives the broker the authority access your Demat account and release the shares being sold.

Related Articles

All About Stocks, Equities,Stock Market, Investing in Stock Market

- How to start investing in Stock Market?

- Investing in Stock Market: Open Demat account and Trading account

- Technical Analysis and Fundamental Analysis of Stocks

Now you are all set to buy and sell shares. You need to understand yourself and decide whether you want to be an investor or trader.

Thanks For Sharing Information about Investing Stock Market. Following these blogs helps in Knowing the secret of success. In this trending era where people are seeking marketing experts guidance for stock market training .