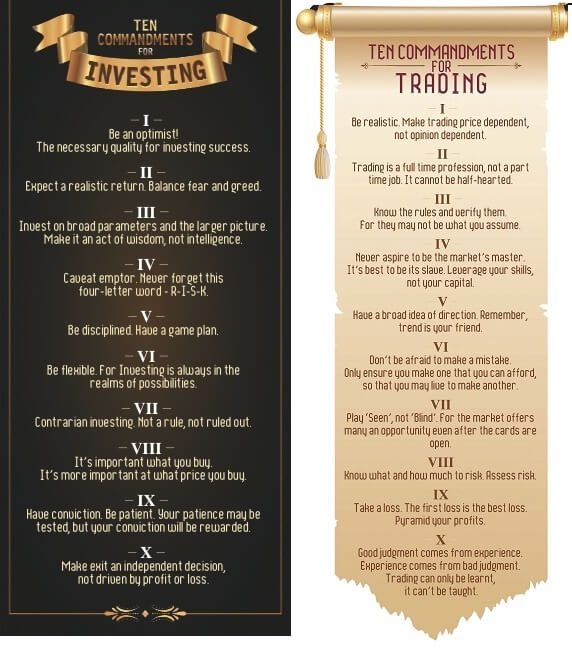

He is known by various names, the Big Bull, the Pied Piper of Indian stock market, the Warren Buffett of India, Rakesh Jhunjhunwala or RJ, born 5 July 1960, is one of the legendary and popular investor & trader of India. A chartered accountant by training, born in a middle-class family, Rakesh Jhunjhunwala started his investing journey in 1985 when the Sensex was at 150 with Rs 5000 and in 2020 his net worth is 2.7 billion dollars. In the Harshad Mehta scam of 1992 along with Radhakrishna Damani made a lot of money shorting stocks. In this article we will explore, What is the portfolio of Rakesh Jhunjhunwala? What are his investing principles? Is RJ an investor or a trader? Family of Rakesh Jhunjhunwala. The image below shows the investing and trading rules that Rakesh Jhunjhunwala follows and framed copies are on his office wall.

“Rakesh has brought a lot of positivity to stock trading. Before him, the markets were known for unsavoury characters who ended up in jail. He changed that by being transparent.”, Kalpraj Dharamsi,

Rakesh Jhunjhunwala Rules of Trading and Investing in his office

Table of Contents

The stock market journey of Rakesh Jhunjhunwala

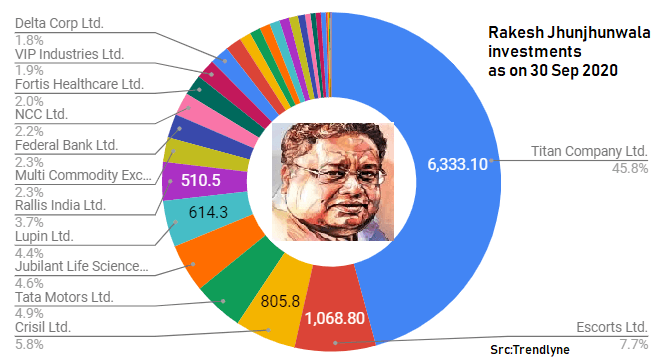

As per corporate shareholdings filed for September 30, 2020, Rakesh Jhunjhunwala publicly holds 34 stocks with a net worth of over Rs. 13,838.1 Cr. His holdings are given below.

Portofolio of Rajesh Jhunjhunwala

He was born in a middle-class family of income tax officer, Radheshyam Jhunjhunwala, in Mumbai. His mother was a housewife. He was the youngest of four children, with a brother Rajesh & sister Sudha. Rakesh Jhunjhunwala’s family hails from the Jhunjhunu district of Rajasthan.

Rakesh Jhunjhunwala’s passion for the stock market started from childhood as he heard his father discussing the stock market with his friends. He asked his father why the stock price fluctuates daily? His father suggested he read newspapers as the news that makes the price of stocks fluctuate. His father told him to check if there is news on a company called Gwalior Rayon in the newspaper, then Gwalior Rayon’s price would fluctuate the next day.

Like any middle-class parent, his father advised, “do whatever you want in life but at least get professionally qualified.” So, Rakesh completed graduation from Mumbai’s Sydenham College, took up chartered accountancy, and became a Chartered Accountant in 1985.

When Rakesh first started investing in 1985, he had no money. His father refused to finance him or borrow from his friends. He was able to borrow Rs 2.5 lakhs from a client of his brother by promising to give higher returns compared to the fixed deposits. And another client gave him 5 lakhs.

First big Win: Tata Tea

Rakesh Jhunjhunwala’s first big profit was Rs 5 lakh in 1986. He bought 5,000 shares of Tata Tea at Rs 43 and within 3 months share was trading at Rs 143. He was confident that the markets had under-estimated the potential of a company looking to grow at a time of rising yield production. “I was apprehensive, but if you don’t have confidence, you shouldn’t come to the stock market. You have to risk,” he recalls

After 1986, the market went into a big depression for two-three years but he had put that money in Tata Power and the Tata Power stocks became about 1100-1200. Between 1986 and 1989 Rakesh earned ₹20-25 lakhs through investments in stocks

1989 Budget

In 1989 when V P Singh was the prime minister and Madhu Dandavate was the finance minister, there were talks about the budget being socialist in nature and many were bearish about the stock market. But Rakesh Jhunjhunwala was of the view that Singh would never allow a budget that would hurt business.

“I thought the first part of the liberalisation programme in 1983 was launched by V P Singh and I always thought he is a ‘thakur’ who understands business. So I never thought he will present a budget that will hurt business. He was the PM who was giving broad directions to the budget (but) everybody was humongously bearish,” said Jhunjhunwala.

The budget was business-friendly and after five months of the budget, Rakesh networth increased from 2 Crores to 40-50 Crores.

His next big investment was Sesa Goa. He realised that Sesa Goa had a big fall because there was a depression in the iron ore industry and then prices for the next year had been considerably raised about 20-25%. The stock was available abysmally cheap around Rs. 25-26. There was a projection of very good growth in profitability in the next year but nobody seemed to believe it.

So He bought 4 lakh shares of Sesa Goa in forward trading, worth Rs 1 crore. He sold about 2-2.5 lakh shares at Rs 60-65 and another 1 lakh at Rs 150-175. The prices then went up to Rs 2200 and then he sold some shares. He did some other trading too.

He established Rakesh Jhunjhunwala company called Rare Enterprises, an asset management firm, named using his and his wife’s(Rekha) initials, which has a dozen or so employees whose sole job is to help him make his market bets. “This isn’t a fund. I have no money other than my own and my wife’s,” he says. “She’s my only client. I don’t manage anybody’s money except hers.“

In 2002-03, Rakesh Jhunjhunwala bought Titan Company Limited at an average price of Rs 3. The stock then rose to touch Rs 80 and later fell to Rs 30, but he did not sell a single share. “when it fell from Rs 80 to Rs 30, I lost Rs 300 crore of value in my portfolio. But I never sold as I thought that neither EPS (earnings per share) nor PE had peaked and there was a lot of growth still to come“

Over the years, he made some really profitable bets such as Lupin, Crisil, Praj Industries, Aurobindo Pharma, NCC, which catapulted his wealth.

In 2020 he earned Rs. 5.56 crores per day from just one company, Escorts Ltd.

How Networth of Rakesh Jhunjgunwala has increased over the years

Losses of Rakesh Jhunjhunwala

It is also important to understand that not every investment that Rakesh Jhunjhunwala made was successful. In fact, he has had losses in stocks such as Mandhana Retail Ventures, DHFL, Geojit Financial Services. He confesses that he is not as smart as people make him out to be. “My failures are far less known than my successes. Consistency, return on capital, corporate governance, payouts and such things are very important.”

Rakesh Jhunjhunwala faces massive losses from Mandhana Retail Venture, retail and trading business of the Salman Khan’s Being Human. Jhunjhunwala bought 12.7 per cent shares of the company in 2016 and still holds them as on (Nov 2020) when the price has gone down from high of 247 on debut in Dec 2016 to 5.10 on 23 Mar 2020. More details at Zee Business article Rakesh Jhunjhunwala lost hefty money in Being Human!

In Oct 2013 Rakesh Jhunjhunwala bought 25 lakh shares of the mortgage lender Dewan Housing Finance Corporation Ltd. (DHFL) for nearly Rs 34 crore at a price of Rs 135.32. When there was heavy selling in DHFL between September 2018 to October 2018 due to liquidity positions of the sector, the ace investor increased his holding in the company by another 0.43%. He increased his stake in DHFL to by 73 basis points (bps) to 3.19 per cent as at the end of the March 2019 quarter valued at Rs 150.25 crore. In 2019 DHFL’s stock plummeting from Rs 150 levels on March 29 to Rs 93 levels as on June 6. He then decreased his holdings in DHFL with holding going down to less than 1% in Dec 2019 and then 0.

Historical shareholding details of Jhunjhunwala Rakesh Radheshyam in Dewan Housing Finance Corporation Ltd. (DHFL)

| QUARTER | NAME | TOTAL NO. SHARES HELD | PERCENT HOLDING |

|---|---|---|---|

| Jun 2019 | Jhunjhunwala Rakesh Radheshyam | 7,720,000 | 2.46% |

| Mar 2019 | Jhunjhunwala Rakesh Radheshyam | 10,000,000 | 3.19% |

| Dec 2018 | Jhunjhunwala Rakesh Radheshyam | 7,728,500 | 2.46% |

| Sep 2018 | Jhunjhunwala Rakesh Radheshyam | 10,000,000 | 3.19% |

| Jun 2018 | Jhunjhunwala Rakesh Radheshyam | 8,665,264 | 2.76% |

| Mar 2018 | Jhunjhunwala Rakesh Radheshyam | 10,000,000 | 3.19% |

| Dec 2017 | Jhunjhunwala Rakesh Radheshyam | 10,000,000 | 3.19% |

| Sep 2017 | Jhunjhunwala Rakesh Radheshyam | 10,000,000 | 3.19% |

| Mar 2017 | Jhunjhunwala Rakesh Radheshyam | 10,000,000 | 3.19% |

| Dec 2016 | Jhunjhunwala Rakesh Radheshyam | 10,000,000 | 3.19% |

| Sep 2016 | Jhunjhunwala Rakesh Radheshyam | 10,000,000 | 3.19% |

| Jun 2016 | Jhunjhunwala Rakesh Radheshyam | 10,000,000 | 3.43% |

| Mar 2016 | Jhunjhunwala Rakesh Radheshyam | 10,000,000 | 3.43% |

| Dec 2015 | Jhunjhunwala Rakesh Radheshyam | 10,000,000 | 3.43% |

Is Rakesh Jhunjhunwala a trader or investor?

Rakesh Jhunjhunwala considers himself as both a trader and a long-term investor. He says what he has learnt in life is to try and earn money in trading and to invest it in stocks.

“No, I made a lot of money by short selling. Harshad Mehta was a dream. I made one of the biggest fortune of my life by short selling in ‘92. In fact, I will tell you an incident. We started short selling from 4200. So BSE CEO Mr Mayya would call me and say you are short selling, I will take your badge. Again he called me at 3,500, at 3,000 and then he called me when the index was 2,200”

From his interview with Economic times in 2009, The journey of Rakesh Jhunjhunwala

“Short-term trading is for short-term gain. Long-term trading is for long-term capital formation.

Trading is what gives you the capital to invest. My trading also helps my investing in the sense I use a lot of technical analysis for trading at times.

If the stock is overpriced, I should sell but my trading skills tell me that the stock can remain overvalued or get more overvalued. Hence, I hold on to my investments”

From EconomicTimes article, 98% money is made in the market by being a bull, on How he manages both trading and investing?

Well if you have a wife and a mistress and you manage both well, you can do both trading and investing well. And how do you manage that? You keep them apart. One should not know anything about the other.

Investment is a fall or rise in valuable investment unless it is extreme or it is some event laden which has significance. The daily values have no significance to me at all.

Trading is momentum. Trading is le fatafat, de fatafat. Maro aur bhago. (Trade and run). You have to follow the crowd in trading.

In investing you can be a bit contrarian, still make a lot of money.

Trading is my friend and trading the ROEs are highest. The cash flows are great.

I love trading. Given a choice, I would like to make all money out of trading. But that is not possible. You lose money also. I have lost money so many times.

In this Instagram video, Rakesh explains the difference between trading & investing. Click here to check

Rakesh Jhunjhunwala family

He was born in a middle-class family of income tax officer, Radheshyam Jhunjhunwala, in Mumbai. His mother was a housewife. He was the youngest child with a brother Rajesh & sister Sudha. Rakesh Jhunjhunwala’s family hails from the Jhunjhunu district of Rajasthan.

In 1987 he got married to Rekha from Andheri. Rakesh Jhunjhunwala’s RaRe Enterprises is named after the couple: ‘Ra’ for Rakesh, ‘Re’ for Rekha, who is touted as his lucky charm.

After six cycles of IVF and complicated pregnancy, a daughter Nishtha was born on 30 June 2004, 17 years after their marriage. She went through three cycles of IVF again before she was conceived. She was 45 years old and twin sons, Aryaman & Aryavir Jhunjhunwala were born on 2 Mar 2009. They’re seemingly completely different yet alike in many ways. She’s low-key and nurturing, while he’s loud, jocular even, but so self-assured he could get into an argument to prove his point. But the determination with which he built his company meets its match in the focus she applies to her personal life.

His office is strewn with memorabilia given by his friends and family along with framed copies of Jhunjhunwala’s 10 Commandments for Investing and 10 Commandments for Trading

Rajesh Jhunjhunwala family

1992 Scam, Harshad Mehta & Rakesh Jhunjhunwala

The 1992 Financial & Securities Scam is one of India’s Biggest Financial Fiasco. Rakesh Jhunjhunwala made a lot of money during the Harshad Mehta phase by shorting the stocks as he was part of the bear cartel.

In 1990’s the market was dominated by established cartels. One such bear cartel was led by Manu Manek, known as the Black Cobra. He had a group of followers such as Radha Krishan Damani, Rakesh Jhunjhunwala, Ajay Kayan etc. The 1990s was a fierce battle between Black Cobra cartel & Harshad Mehta. Harshad Mehta was predominantly a Bull who believed in the positive rationale of the Market.

Cartel shorted many shares, like Indrol, convinced that the exuberance in the stock market was not supported by fundamentals and that the rally would not sustain. The Bear Cartel was initially clueless about HM’s never-ending funds. With a huge reservoir of bank funds at his disposal, though through illegal means, Mehta absorbed deliveries with ease, and squeezed the bears out of the market. The continuous rise in prices bled Harshad’s rivals financially. To square up their short positions, they had to buy shares in the open market, which further fuelled the rally, and cost them more money. As a last resort, the Cobra spread a rumour that Mehta had lost an amount of Rs. 1 crore in the stock market. This was done to attack the Mehta’s credibility. But Harshad Mehta cleared all his dues and emerged as victorious in the battle. It is said, Harshad Mehta celebrated his victory over the bears by feeding peanuts to a ‘Bear’ in the Zoo!

The bull run ended when Sucheta Dalal broke the scam on Times of India, the stock market crashed. Harshad Mehta’s stocks fell heavily and the bears Radhakishan Damani and Rakesh Jhunjhunwala made huge money.

In Radhakishan Damani’s own words, “Agar Harshad saat din aur apni position hold kar leta, toh mujhe kathora leke road par utarna padta.” (Had Harshad Mehta held his position for seven more days, I’d have taken a begging bowl and walked on the road).

There is a scene in ‘Scam 1992’ where Damani says he wants to quit trading and become a long-term value investor.

Jhunjhunwala too agreed with Damani and said the Sensex would touch 40,000 one day. In his last scene in the series, he says “who knows, I could be the next big bull”. And that’s exactly what he went on to become.

1992 Harshad Mehta scam and Bear Cartel

Rakesh Jhunjhunwala On Radhakrishna Damani

“I learnt trading from him … He has wisdom, extreme patience and humility … The patience he has to hear the other person’s point of view is unbelievable … He taught me life and shaped my nature. If he and my father had not been there to guide me, I would not have achieved such success”

Comparison of Rakesh Jhunjhunwala with Warren Buffett

Rakesh Jhunjhunwala protests loudly when he is compared to billionaire investor Warren Buffett. He says “It’s not a fitting comparison. In terms of wealth and success and maturity, he’s far, far ahead,”

“I hope I am not compared to him. I am a very poor comparison. I don’t have the knowledge, ability, and performance he has.”

Rakesh Jhunjhunwala a producer

Rakesh Jhunjhunwala has produced several Bollywood films as well, such as Ki & Ka, English Vinglish with Radhakrishna Damani and also Shamitabh.

He is also media savvy and can be seen regularly on major business channels.

Video on Rakesh Jhunjhunwala

Watch this video to learn how he started his journey into the stock market & became the king of Dalal Street.

Video of Interview of Rakesh Jhunjhunwala

In an interview to ET NOW’s Nikunj Dalmia, the titan of Dalal Street says India is on the verge of a secular, structural bull market and that golden year are ahead- not just for the markets but for India as well. What is making RJ optimistic? What is his investment mantra and which sectors will rally the most in a post-COVID world? Checkout this ET NOW blockbuster with the Big Bull.

Trackbacks/Pingbacks