Almost every person in India wants to buy a house but he is at mercy of the builder.Project delays are a common characteristic of the real estate market. There are several cases where developers imposed random charges on the customers, Occupancy certificate etc . The much awaited Real Estate Bill, which aims to protect the interests of buyers and bring more transparency to the sector was passed in Mar 2016. This article looks at the Real Estate Bill in detail.

What is Real Estate Bill?

Home is where the heart is. “Beta Ghar to hona hi chahiye”(Son you should have a house). We have the builders and the housing loan providers to add to the agony. Infinite scam, no timely possession, the dilemma if the OC is cleared are some of the problems that the home buyer faces. While all financial investments such as mutual funds, stocks, and insurance investments are all regulated but not property purchases. So far, buyers aggrieved by delays, changes or unfair contracts on property purchases have been knocking at doors of the Competition Commission of India’s for bringing defaulters to book.

In July, 2011 Ministry of Law & Justice suggested a Central Law for regulation of real estate sector. The bill got approval of the Rajya Sabha on 10 March 2016 and by the Lok Sabha on 15 March 2016. This bill aims to establish Real Estate Regulatory Authority for regulation, promotion in the real estate sector. It will bring both clarity and trust between buyers and developers. This bill promises to secure the interests of home buyers and expunge corruption and inefficiency from the sector. It extends to the whole of India, except Jammu & Kashmir.

Time-line of Real Estate bill

Events that led to passing of Real Estate bill

- 2011, July- Ministry of Law and Justice suggested a Central Law for regulation of real estate sector.

- 2012 July, The Finance Ministry in 2012 paper on black money had pointed out that the real estate sector is vulnerable to black money because of under-reporting of transactions.

- 2013, June, Real Estate Regulatory Authority (RERA) Bill was introduced by the Indian National Congress government in 2013 and was approved by the Cabinet. Then, it was referred to the Standing committee in September, 2013

- 2014 , Submission of the report in Rajya and Lok Sabha in February,2014.

- 2015, December,The Union Cabinet of India approves 20 major amendments to the bill based on the recommendations of a Rajya Sabha committee that examined the bill. The Bill is referred to a select committee, which gave it report in July 2015. However, Congress and All India Anna Dravida Munnetra Kazhagam (AIADMK) had expressed their reservations on the report through dissent notes. The bill was listed for consideration but couldn’t be taken up.

- 2016, March- The Real Estate Regulation Bill, 2016 passed by Rajya and Lok Sabha

Overview of Changes suggested in the Real Estate Bill

State level Real- Estate Regulatory Authorities:

- This bill proposes to establish State Real Estate Regulatory Authority as government regulatory authority in state and union territory along with appellate tribunals where the customers can approach for redressing grievances against any builder. Respective states have power to govern land usage i.e they can bifurcate land into commercial or residential and have all rights for regulating any matters about it.

- In order to help the customers, the authority will grade the projects.

- The grievance of any consumer shall be fast-paced and will be resolved in 60 days. It will be faster as there are 644 consumer courts in our service. Civil courts are not allowed to hear the proceedings.

- If, any person is unsatisfied with the decision of the Appellate Tribunal, may file an appeal to the High Court, within a period of sixty days from the date of communication of the decision or order of the Appellate Tribunal

Registration of Real estate project

- The Real Estate Bill ensures there is 90% transparency in details and better governance for the buyers. It makes registration of real estate projects and real estate agents with the authority mandatory (for the ones whose land to be developed exceeds 500 sq. m or 8 apartments as the case may be). It mandates that builders should disclose details of all registered projects, including those about the promoters, project layout plan, land status, approvals, agreements along with details of real estate agents, contractors, architect, structural engineer etc. All these details should be uploaded on the website of the RERAs.

- For on-going projects which have not received completion certificate on the date of commencement of the Act, will have to seek registration within 3 months.

- Real estate agents also need to register with the RERAs. This will help the common man to assure himself that the builders and brokers are legit and the possibility of losing money due to frauds will decline to a great extent.

- Home owners can verify the quality of the builders since the bill now makes it mandatory for developers to provide details of projects launched in the past five years, both completed or under-construction. These will also be available on the regulator’s website.

- In case of non-registration with RERA the builder will be liable to pay 10% of the project cost as penalty. If he dodges order issued by the RERA, he faces imprisonment for up to three years, and/or an additional fine of 10% of the estimated cost of the project

- Meanwhile, the fine for the estate agents for any violation is Rs 10,000 per day during the period of violation of provisions.

Your fund only for your project

- Builders have to keep 70% of funds collected from buyers like us in a separate account to cover the cost of construction including that of land. This ensures that the money is used only for the construction of a particular project and not for future investment. This will result to no delay in possession as the developers cannot utilize the money for any other purpose.

- In case of late possession of the property the builders are obliged to payback the buyer’s money inclusive of their Interests (paid as EMI). The bill proposes to levy same interest rate as builder levies on customers in case of any delay. Say, we pay 18% as late payment interest to the builder, they will be eligible for the same % of interest.

- One catch: the bill allows states to reduce the construction fund level below 70%, if they wish.

Pay Only for Carper- Area

- The Bill looks to clearly define the carpet area and states that this will form the basis for purchase of a house. It will, thus, eliminate the scope for malpractices in transactions. This means that we need to pay only for the carpet area of the house not for the super-built up area.

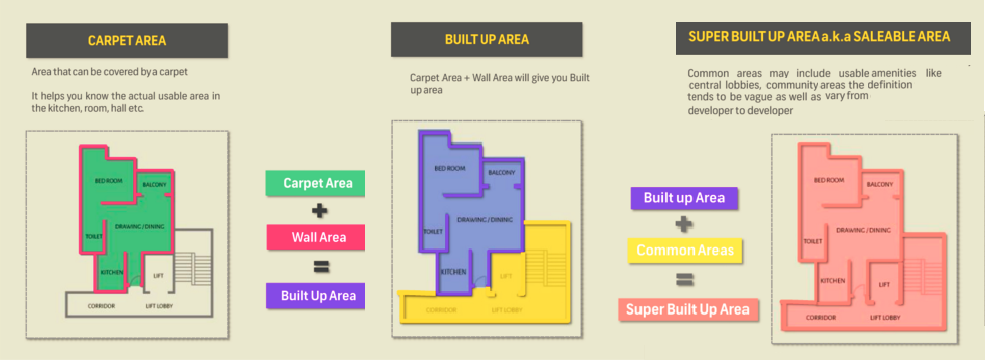

- Carpet area means the net usable floor area of an apartment, actual area to lay the carpet. This area does not include the thickness of the inner walls. It excludes the area covered by the external walls, areas under services shafts, exclusive balcony or verandah area and exclusive open terrace area, but includes the area covered by the internal partition walls of the apartment.

- Loading factor essentially creates a relationship between the super built-up area and the carpet area. The formula for calculating loading factor is: Super built-up area = Carpet area (1+ loading factor)

- Relation between Carpet Area, Built Up Area and Super Built Area is shown in image below. Click on image to enlarge

No False sample flat/advertisement

- We all have been through a common fraud wherein pictures of spacious rooms and mind-blowing amenities are displayed on various advertisements by innumerable builders. When we decide to see the actual site it turns up to be 30% of what is shown in the picture. No more fake expectations can be created in the minds of the investors.

- The developer cannot make any structural changes unless he gets consent of 2/3rd of the customers.

- In case of any mismatch, the entire money is to be refunded along with interest.

After-sales service

- Customers will now be the kings even in the real-estate market where they always received less than their expectations. Some builders provide low quality fittings and use cheap material to build the house as they know they will not be responsible once the allottee shifts. But now, we have a right to demand after-sale service from the builder in case of any structural deficiency/low quality fittings in the house. Within one year of possession. This ensures quality and justifies the price paid for the house.

- In case the builder violates any other provision of the act, he will have to pay up to 5 percent of the estimate cost of the project

No Discrimination

- Today, we see many societies dominated by majority of people belonging to the same caste. Minority castes such as Muslims and Christians face a tough time finding houses for themselves as societies do not permit sale to them. Unmarried couples or bachelors or single mothers are also face similar problems.

- To avoid any discrimination, any sale on basis of religion, region, caste, creed or sex and gender will not be permitted.

- All other punishments are mentioned in the official gazette: http://egazette.nic.in/WriteReadData/2016/168720.pdf

How will Real Estate Regulatory Bill make life simpler for buyers?

- A dedicated governing body conducting fast track dispute resolution mechanisms extending to maximum 60 days in case of any grievance.

- We can easily track the records of any new or existing builder and can decide to invest wisely. We as house-buyers will have legit builders and real estate agents and will be tension free.

- We will be able to invest our money somewhere else rather than blocking it with the builder for a very long time and also not receiving the possession of the same. If we have made payments and face untimely possession, we will be liable for interest from the builders

- We will now have accurate imagination of how our houses would actually look on completion and there will not be any surprises. We will also be assured of the quality.

- Innumerable penalties are imposed on the builders in case of any default and there is money-back guarantee in case of any such circumstances. This will boost genuine buyers and will assist them in investing in their authentic dream homes without hesitation.

- Savings once the bill is implemented: For instance, at the latest February-March 2016 rates in Mumbai (according to Makaan.com and Knight Frank) home buyers will end up saving the following(Rates in the first table are calculated by PSF*Built up, while in the second chart: PSF*Carpet) Ref

| Before the RERA Bill | After the RERA Bill | ||

| Area | PSF (Feb-March 2016) | 600 sq ft Super Built-up area

(avg 35% loading) |

Carpet 390 sq ft |

| Colaba | Rs 42,000-46,000 | Rs 2.52 crore – 2.76 crore | Rs 1.63 crore – Rs 1.79 crore |

| Bandra (W) | Rs 40,000-60,000 | Rs 2.40 crore – Rs 3.60 crore | Rs 1.56 crore – Rs 2.34 crore |

| Borivili | Rs 11,000-15,000 | Rs 66 lakh – 90 lakh | Rs 43 lakh – Rs 58 lakh |

How does Real Estate Bill benefit the builders

- At present, a slowing down home sales is taking a toll on the economic revival. According to consultancy firm Knight Frank, home sales have declined 4 percent in 2015, with an unsold inventory of about 7 lakh units. Naidu said about 10 lakh people buy houses every year with an investment of about Rs 3.5 lakh crore. As per available information for 27 major cities including 15 capitals, 2,349 to 4,488 new housing projects were launched every year between 2011 and 2015. “Thus in these 27 cities during these last five years, a total of 17,526 projects were launched with a total investment value of Rs 13,69,820 crore.

- Now that the bill is passed and the consumers are assured with transparency, this will revive the faith in builder irrespective of the fact if they are new or old as consolidate data about builders will be available. This will shoot up the sales as consumers will be ready to invest in the real-estate market.

- Also, NRIs or foreign investments in real estate will increase due to authenticate regulations.

- New/old players might refrain from coming up with new projects due to 70% investment in single project only and there will be hardly any scope for pre-investing in upcoming projects. Thus, the cost of developing a project will rise further and builders are going to pass on that cost to customers. This mean further rising of prices. Builders will of course enjoy the new pricing.

- Builders do not actually lose much on carpet area pricing as they might increase per sq.ft rate.

Will the builders comply to Real Estate Bill?

- Majorly, every builder will comply as it will benefit them, and the conmen will have to involuntarily comply or there is even a possibility for their license to be cancelled and project will be demolished other than rigorous penalties.

- It bans advertisements or brochures inviting advances or deposits. This poses to be a potential problem for developers as they cannot garner eyeballs for their projects, they could witness a decline in the pre-launch sales. So they might still try to come up with some substitute plan.

- In the case of developers who operate in regions with low land prices, a 70 per cent rule will not be very difficult to manage. But other mature real estate markets, especially hubs within cities that have high land prices, will make a project unfeasible with a 70 per cent escrow. For example, if the land price per square foot in South Delhi is Rs 30,000 and the selling price is at Rs 50,000, keeping 70 per cent of the project value will put a huge burden on the developer. Ideally, the escrow stipulation should have been linked to market prices and should have been made region-specific. So, this is one aspect where major builders might face a problem. Owing to the clause in the bill about 70% fund to be kept away in escrow accounts, the cost of developing a project will rise further and builders are going to pass on that cost to customers. This mean further rising of prices.

- But to sum up, the regulations covers every portion of the loophole and the developer has no escape to it.

How long will it take For Real Estate Bill to be implemented?

So, to sum up this bill is in interest of both buyers and builders. Fair developers will benefit while scamsters will be eventually eliminated from the market. The real estate bill ensures transparency but will not affect the roaring prices in the market. However, a lot will depend on the effective and timely implementation of this bill in each and every state. Although the Bill is still at least 9-24 months away from implementation. It is a ray of hope for home buyers who are frequently cheated by builders. This bill can single-handedly make the real estate sector evolved and mature in terms of investments and buyers’ trust. The real estate bill is definitely going to be a boon for buyer, but the onus still lies on buyer to do a diligent research about the project.

[poll id=”81″]

Related Articles:

- Index for Real Estate : NHB Residex

- Joint Home Loan and Tax

- Terms associated with Home Loan

- Is Real Estate the best Investment Option?

- Income from House Property and Income Tax Return

What do you think about the Real Estate Bill? Do you think it would help the buyers? Do you think it will help the builders?

Real Estate Regulatory bill hurts for real estate developers in short term, but in long term its good for everyone.