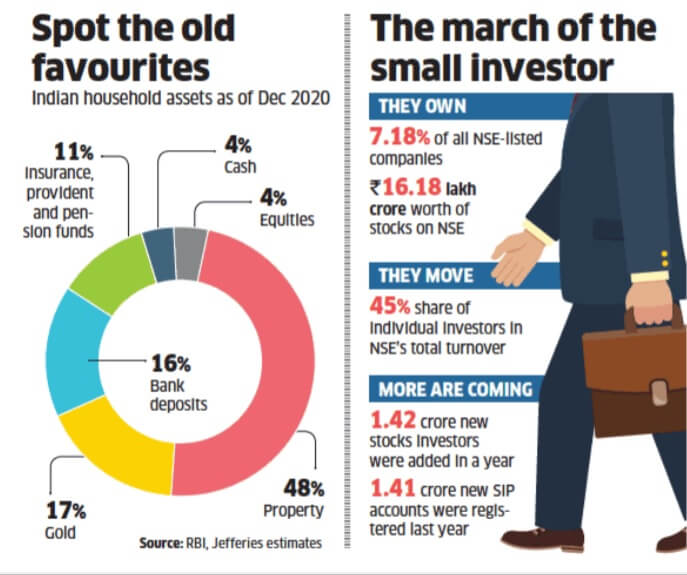

If you’re thinking about investing in real estate with a goal to put your money to work for you now so you have more in the future, it might seem a bit complex but it’s really quite simple once you understand the basics.Most of Indians invest in property as shown in the image below. And that is true for America as well. There is a reason surveys like a 2019 survey from Bankrate have found nearly a third of Americans believe real estate is the best way to invest their money, while only a fifth chose stocks.

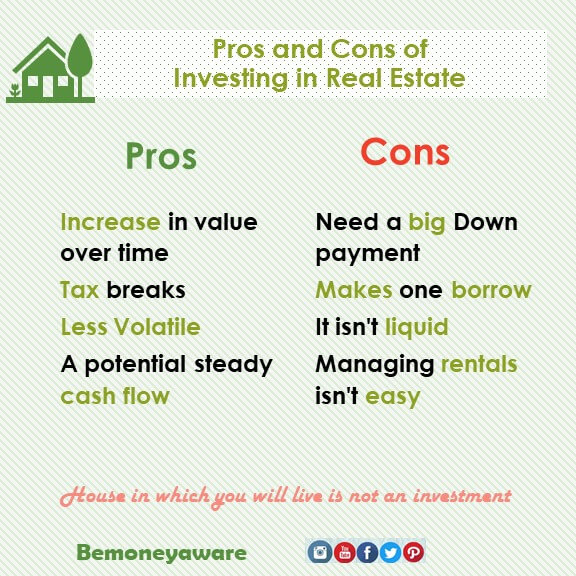

When done wrong the consequences can range from minor inconveniences to major financial disasters. But when done right, it can be very lucrative. Of course, getting it right requires an understanding of the basics. So where should you start? Lets look at Real Investing 101 Begin with the pros and cons. If you still want to move forward, read on.

The Pros of Investing in Real Estate

A potential steady flow of cash. If you have enough rental properties with tenants paying the rent on time, you can count on a stable revenue stream.

An increase in value over time. With real estate, your long-term returns will usually be positive as most properties increase in value over time.

Lower risk than stocks. Real estate investment typically comes at a lower risk than the stock market as the housing market doesn’t experience that volatility. You won’t have as much earning potential but there’s a good chance you’ll be able to steadily increase your income.

Tax breaks. You’ll be able to deduct many expenses from your taxes like mortgage interest, property taxes, and depreciation.

The Cons of Investing in Real Estate

It takes money to make money. In order to get a steady stream of income, you’ll need to have some cash to get started. As the saying goes, it often does take money to make money. The better news is that there may be options for financing for at least some aspects such as doing a remodel or making other home improvements.

Managing property rentals isn’t easy. If you plan to invest in real estate through rental properties, understand that it can be a big challenge. There are a lot of things that can go wrong, from bad tenants who are often late on rent or don’t pay at all, to a home that sits empty for months while you try to find the right tenants, to having to pay for unexpected expenses like replacing a broken water heater or a leaking roof.

Real estate isn’t liquid. If you find yourself in need of cash quickly, you won’t be able to get it fast like you would by selling a stock.

Ways to Invest

There are multiple ways to make money in real estate, with these some of the best options for getting started.

Rent a room. If you’re concerned about risk and want to just dip your toe in real estate, consider fixing up a room or another space in your own home and renting it out. You could rent it on your own to get a taste of what it would be like to find a long-term tenant, or consider Airbnb as your potential renters will be at least semi-prescreened and the company has a guarantee for hosts to protect against damages. These days there are options to rent for just a short term or for a longer period of 30+ days. This requires little investment, but to make the most profit, you’ll want the space to be as appealing as possible. Don’t have enough cash for the upgrade? Looking into a home owner grant to get the funds you need.

Buy an investment rental property. This is one of the most common ways to invest in real estate. You’ll need to find a place with combined expenses that are lower than what you’ll be able to get in monthly rent. You can manage it yourself to learn more about the industry which can be a big help when buying future properties or pay a property manager.

Flip Properties. Reality shows have made house flipping popular although it’s a little harder than they make it look on TV. Basically, you invest in a home that’s underpriced and in need of some love. You’ll renovate it for as inexpensively as possible and then resell it to make a profit. You’ll want the most accurate estimate of how much the repairs will cost before buying, which is risky as that’s very difficult to do. Estimate wrong and you could lose a lot of money.

REIT: REITs, or real estate investment trusts, are companies that own or finance income-producing real estate across a range of property sectors. REITs are similar to Mutual Funds as they allow multiple investors to pool their investments and in both cases, the assets are professionally managed by a designated Manager. But, while the underlying asset of Mutual Funds is usually Equity, Debt, Gold, or a combination of these, the underlying asset in the case of REITs is primarily Real Estate Holdings or loans secured by Real Estate. There are currently only 3 REITs available for investment in India – Embassy Office Parks REIT, Mindspace Business Parks REIT, and Brookfield India Real Estate Trust

Real estate investing is a big monetary decision.It is no stroll in the park. There are some risk factors you ought to know before you invest. So when did you buy your first property? Why? Were you happy with it?