Life insurance is meant to offer financial protection to dependents in the unfortunate event of one’s death. With long-term capital gains (LTCG) from equity and equity mutual funds being taxed from 1 Apr 2018, the tax advantage has shifted towards unit-linked insurance plans ULIP of life insurance companies. Let’s relook at various types of life insurance such as Term Plan, Endowment Plan and Money Back Plans and ULIPS and ULIP Tax Advantage.

Table of Contents

Types of Life Insurance

Life Insurance provides financial protection against unexpected events and its purpose is to enable one’s dependents to maintain their current lifestyle and pursue their life goals. Just like Wearing a helmet while driving is inconvenient but covers one from damage in an accident.

Life Insurance Plans offered by insurers can be classified into following categories:

- Pure Insurance Products: Term Plans

- Investment cum Insurance: Endowment, Money Back, Whole Life, Unit Linked Plan.

Term plan, endowment and whole life insurance policies are the traditional insurance plans.

These are considered risk-free, as they provide fixed returns in case of death or at the maturity of the term.

Term Insurance

Term Insurance is for a specific period of time, one can select the length of the term for which one wants the coverage right from one year up to 35 years. Premiums of this policy are fixed and do not increase during the term period of one’s policy. In case of sudden death, dependents receive the Sum Assured, cover amount one got oneself insured for .In case the individual assured survives the term of the policy, no claim is paid to the assured.

Endowment and Money Back

An endowment plans if the policyholder dies during the policy term, nominee gets the sum assured plus some returns; if he survives the policy term, he gets back the sum assured and returns.

Money Back Plans: Similar to Endowment plan with the basic difference that unlike endowment plans where benefits are disbursed at end of policy term, money back policies pay out a fixed percentage at various interval. Some part of the sum assured, predefined earlier, is paid out at regular intervals. If the policyholder survives the term, he gets the balance sum assured. Money back plans guarantee a regular flow of income at fixed stages in our lives and are suggested for milestones like higher education of children.

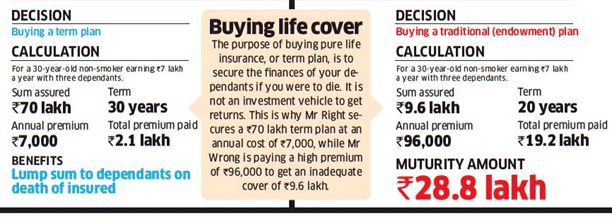

The image below shows the comparison of Term plan with endowment Plan, wherein Term plan one pays less premium 7,000 vs 96,000 in Endowment plan and gets higher coverage of 70 lakh vs 9.6 lakh.

Term Plan and Mutual Funds vs ULIPs

Financial planners suggest a combination of term plans and mutual funds, compared to ULIPs or traditional endowment and money back plans.

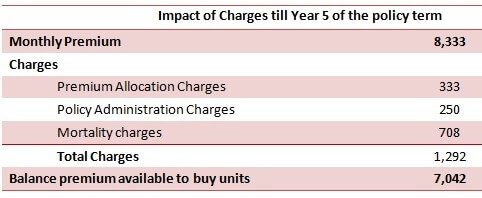

ULIP lags behind because of the various charges associated with it. For example in ULIP after deduction of all the charges including premium allocation charge in first five years, from a monthly premium of 8,3333 only Rs 7,042 is left to buy units.

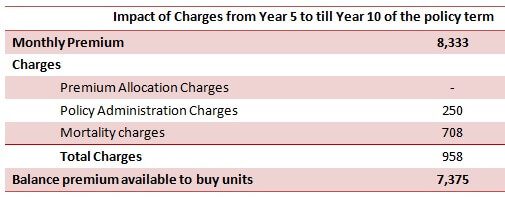

From sixth year onwards the premium allocation is nil but still some amount from premium is deducted.

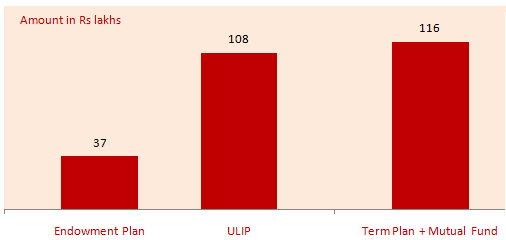

This is where ULIP puts you at a disadvantage compared to the combination of term plan and mutual fund. The chart below shows the maturity amounts for Rs 1 lakh annual investment over 20 years in endowment plan, ULIPS and term plan and mutual Funds, Term plan and mutual funds came out at the top due to the various charges in ULIP.

ULIP Tax advantage: Long-term capital gains on Equity

But From 1 Apr 2018 equity and equity mutual funds long term capital gains are taxed.

As there is no mention of Tax on ULIPS in the Finance Bill the maturity proceeds will remain tax-free.

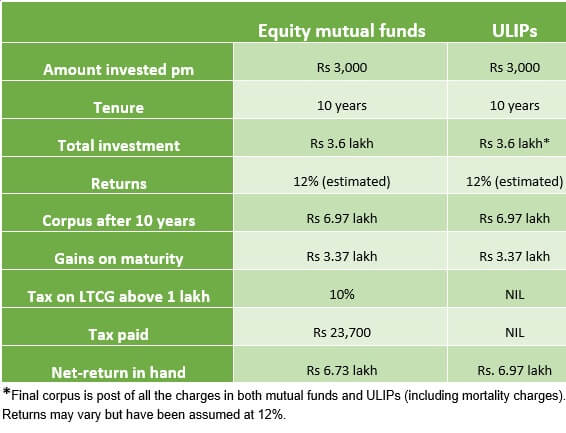

So now the tax advantage has shifted towards unit-linked insurance plans (Ulips) of life insurance companies. The comparison between mutual funds and ULIP investment over a same period is shown below

So ULIPs offer following tax benefits:

- 80C benefits on premiums paid,

- No tax on switching between different funds within the ULIP,

- Tax-free returns on maturity,

The table below shows the comparison of ULIPS, Traditional plans and Mutual Funds.

Those looking at better post-tax returns in equity schemes can consider investing in ULIPs since they offer the equity advantage without the clause of LTCG tax on the maturity amount.

Related Articles:

All About Insurance : Life Insurance, Health Insurance, Car Insurance, LIC

- Changes in Mutual funds in 2018

- Budget 2018:Long Term Capital Gain on Stocks & Equity Mutual Funds with Calculator

- All You Need to Know About Multiple Life Insurance Policies

rajendra place