If you forget the password of your Income tax e-filing website, you cannot login and file your ITR. The income tax efiling website does not allow you to retrieve the old password but you can reset your password by clicking on the Forgot Password button. The reset password options are Answer Secret Question, Login through Net banking Upload DSC, Using e-Filing OTP, and Using Aadhaar OTP. You can choose any of the options to reset your password on the income tax website. Our article covers options on how to reset the password on income tax website in detail.

Table of Contents

Overview of the How to reset password if you forget the Password of Income tax e website

The reset password options are given below. You can choose any of these options.

- Answer Secret Question which you had selected and given an answer when you registered on the Income Tax website.

- Aadhaar OTP: if your Aadhaar number is linked to your PAN. And your mobile number is registered with Aadhaar

- eFiling Login through Net Banking: You can also login to Income Tax website through your Netbanking website if your PAN number is correctly updated in your bank account. Once you login you can change your password through Profile Settings > Change Password. More than 30 banks provide this facility which includes public sector banks like SBI, Central Bank, PNB etc and private banks like HDFC Bank, ICICI Bank, Yes Bank etc.

- e-Filing OTP :

- Using Registered Email Id and Mobile number: If your mobile number and email id are registered on the income tax site. You provide them while registering for the first time on income tax e website

- New Email Id and Mobile Number: You can register new Email id and Password at the income tax website. But you need to provide additional details of TDS or Bank account number.

- Upload DSC: If you have a digital signature

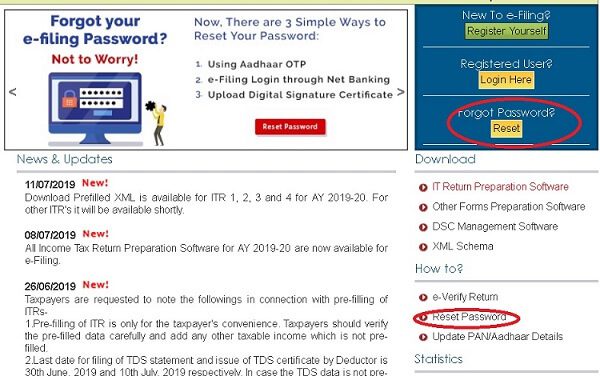

Forget Password page on Income Tax e filing website

To go to the income tax efiling website you can reach the Forget Password page by clicking on Forget Password button, Reset Password button, or click on Login Here button.

On the Login page click on the Forget Password button.

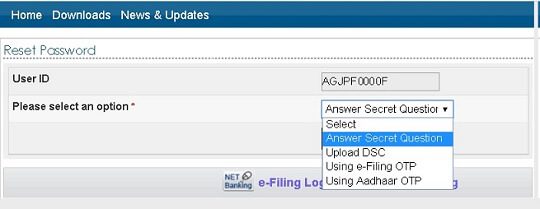

A new page as shown in the image below would appear. You need to enter your PAN Card no. in the User ID and select an appropriate option from the dropdown menu.

The reset password options in the dropdown menu include Answer Secret Question, Upload DSC, Using e-Filing OTP, and Using Aadhaar OTP.

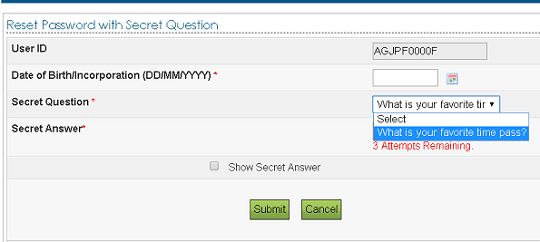

Forget Password on Income Tax Efiling website: Answer Secret Question

You can opt for this option if you remember the answer to the secret question that you had set up at the time of registration of your account. Once you select this option and click on the continue button, a new page would appear asking you to enter/select your User ID, Date of Birth, Secret Question, and Secret Answer.

Once the secret answer is validated, a new page would allow you to reset your password and then you can log in to your e-filing account with your updated password.

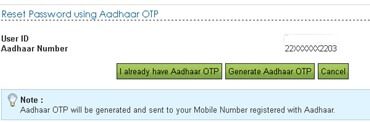

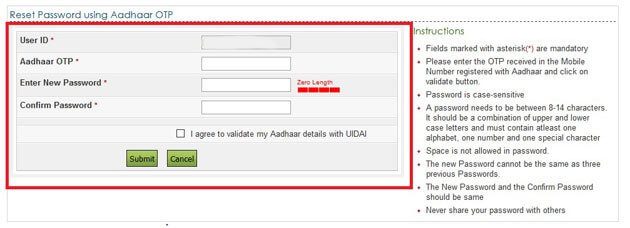

Forget Password on Income Tax Efiling website: Using Aadhaar OTP

Aadhaar OTP is the last option in the dropdown available to reset your password. For this your Aadhaar number should be linked to your PAN. When you select this option, your Aadhaar first and last few digits would appear on the screen. You click on the button Generate Aadhaar OTP . Enter the OTP sent to your mobile number registered with Aadhaar, Validate theYou will be able to reset your password.

Forget Password on Income Tax Efiling website: Using Net banking

If your PAN number is updated in your bank and you have net banking login details then you can use this option. There are more than 30 banks which provide facility to login to income tax efiling website through their net banking interface. These are the same banks which you can also use to generate EVM to e-verify your tax return as explained in our article E-verification of Income Tax Returns and Generating EVC through Aadhaar, Net Banking

Below is the list of banks:

| Allahabad Bank | Equitas Small Finance Bank Ltd | Saraswat Co-op Bank |

| Andhra Bank | HDFC Bank | South Indian Bank |

| Axis Bank Ltd | ICICI Bank | State Bank of India |

| Bank of Baroda | IDBI Bank | Syndicate Bank |

| Bank of India | Indian Bank | The Federal Bank Limited |

| Bank of Maharashtra | Indian Overseas Bank | The Karur Vysya Bank Ltd |

| Canara Bank | IndusInd Bank Ltd | UCO Bank |

| Central Bank of India | Karnataka Bank | Union Bank of India |

| City Union Bank Ltd | Kotak Mahindra Bank | United Bank of India |

| Corporation Bank | Oriental Bank of Commerce | Vijaya Bank |

| Corporation Bank | Punjab National Bank | Yes Bank Ltd |

| Dena Bank | Punjab and Sind Bank |

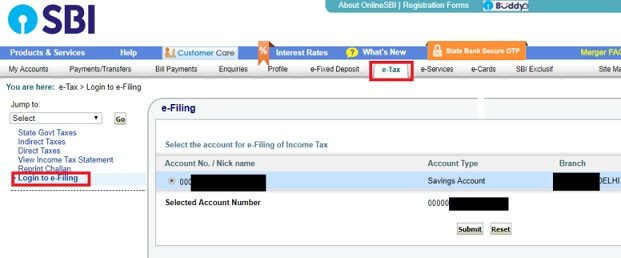

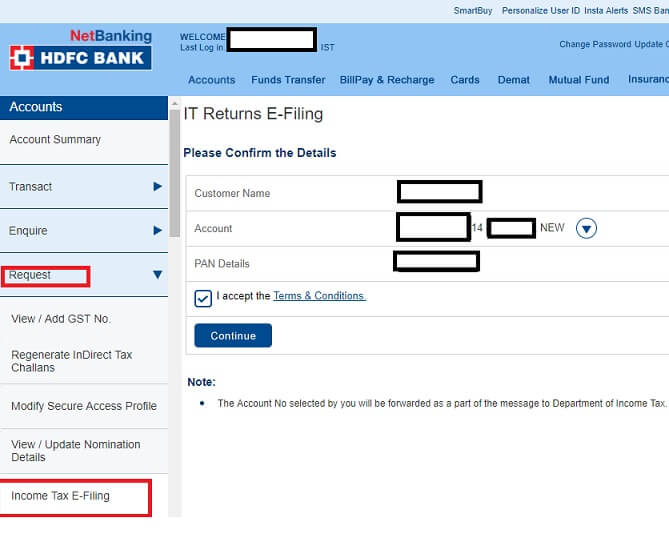

Login to your bank’s net banking interface and find links related to tax. In SBI it is under e-Tax menu. In HDFC Bank you can find it in Accounts-> Request->Income Tax E filing. The screenshots for State Bank of India and HDFC Bank are given below.

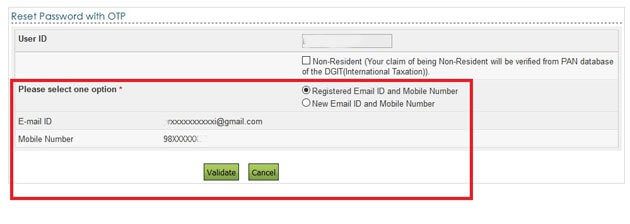

Forget Password on Income Tax Efiling website: Using e-filing OTP

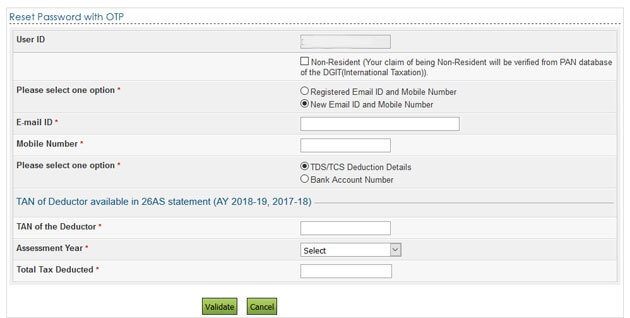

Another method to reset your password is by the use of e-filing OTP. After you select this option, you will be redirected to a new page. The new page will appear like the image shown below:

- Non-Resident: Select it if you are a Non-Resident Indian.

- Registered Email Id and Mobile Number: If your mobile number and email id is regestired on the income tax site. You provide them while regsitering for first time on income tax e website. You will receive OTPs on your Mobile Number and your Email Id. Once these are verified, you will be allowed to reset your password.

- New Email Id and Mobile Number: You need to select this option if you do not have access to the registered Email Id and Mobile Number. After you select this option, a page like the one shown below would appear: To complete the validation process, the Income Tax website gives you the following options:

- 26AS TAN: You can select this option if TDS has been deducted in the present or the previous financial year. After you select this option, you would be required to enter TAN of Deductor, Assessment year, and Total Tax Deducted.

- Bank Account No.: Here, you need to enter the bank account number that you had used previously to file the return.

- Once the details are validated, you would be allowed to reset your password. After this, you can access your account again.

Forget Password on Income Tax Efiling website: Upload Digital Signature (DSC)

A Digital Signature is an electronic form of a signature. Just as one authenticates a document with handwritten signature, a digital signature authenticates electronic documents. Authentic means that you know who created the document and you know that it has not been altered in any way since that person created it. A licensed certifying authority (CA) issues the digital signature.

Digital signatures rely on certain types of encryption to ensure authentication. Encryption is the process of taking all the data that one computer is sending to another and encoding it into a form that only the other computer will be able to decode.

You have to buy Digital Signature Certificate. Those who do following work buy Digital Signature.

- Filing Forms With ROC for Company and LLP Registration or for Filing Various forms Required to be filed under Companies Act and LLP Act

- Submitting Employee’s EPF to EPFO.

- Filing of E Tender

- For Applying Import Export Code

Digital Signature is the second reset option in the dropdown menu. . When you click on the Continue button after selecting DSC option in the dropdown menu, a new page will appear giving you two options, New DSC and Registered DSC.

New DSC: New DSC option is selected if you are using an option of Digital Signature for the first time.

Registered DSC: This option is to be selected if you are resetting your account using the previously generated DSC.

After the selection of any of the above options, an option of attaching the Digital Signature will appear. You have to upload your Digital Signature and click on the Validate button to proceed to the next step of password reset.

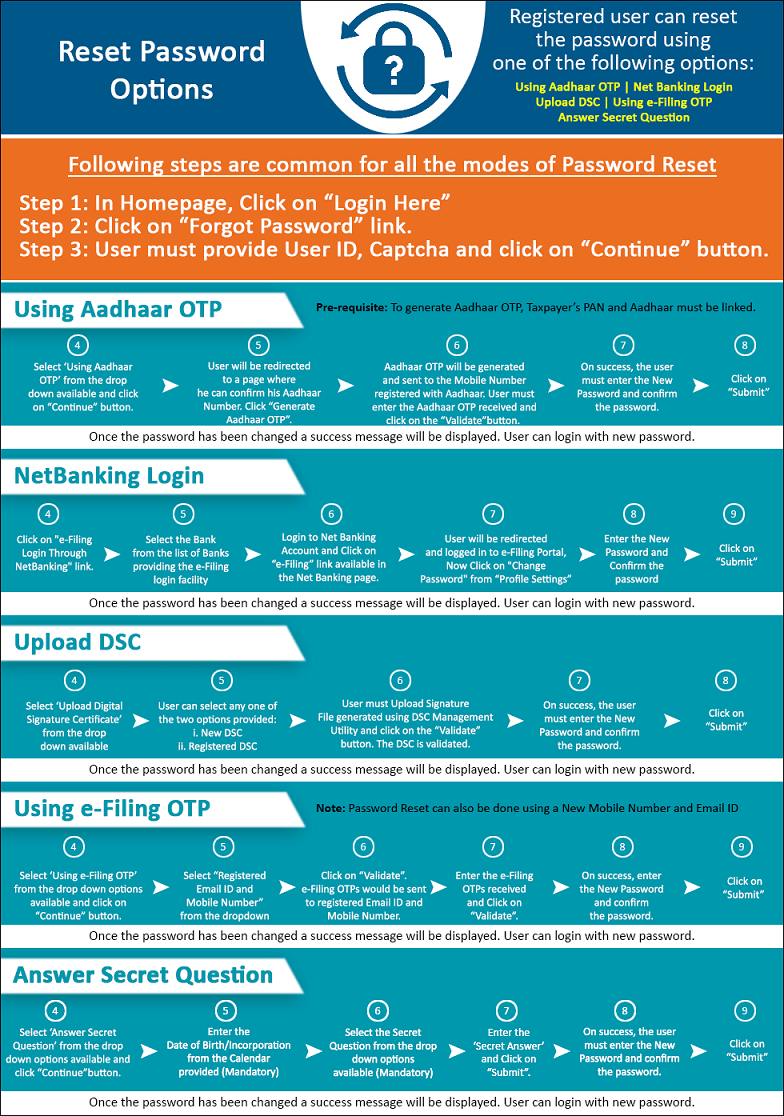

Infographic How to reset the password on Income Tax Website

The summary of all the options to reset password is shown in the image below.

Related articles:

Everything about Income Tax: Basics,How to fill ITR, Income Tax Notices

- Registering on Income Tax efiling Website

- Documents Required to file ITR, For All types of Income

- Mistakes while Filing ITR and CheckList before submitting ITR

- Which ITR Form to Fill?

- E-verification of Income Tax Returns and Generating EVC through Aadhaar, Net Banking

That’s all! You are done! You have successfully reset your Income Tax E-filing password. Now, you can access your account. 😊

Iam sandeep kumar singh mobile number 9958916823

UAN-100235091700

I forgotten my password